Xiamen's newly emerged power semiconductor dark horse, Xiamen XINERGY Microelectronics Co., Ltd. (referred to as "XINERGY"), has emerged as a strong player in the third-generation semiconductor market. Their 1200V IGBT devices and modules are selling like hotcakes, and they have already achieved mass production of 1200V, 16mΩ silicon carbide MOS devices, with 13mΩ silicon carbide MOS devices soon to enter mass production. Their performance is on par with the industry leader, Infineon. In the increasingly competitive Chinese power semiconductor market, how does XINERGY manage to make significant investments and innovate? China Semiconductor Network recently conducted a special interview with XINERGY's CTO, Cai Mingjin.

Figure 1: Cai Mingjin, CTO of Xiamen XINERGY Microelectronics Co., Ltd., MIT Ph.D.

Cai stated, "After five years of research and development, production improvement, and market validation, we have introduced isolated gate driver ICs, IGBT devices/modules, SiC SBD/MOSFET devices, and other products to the market. Our annual shipment of IGBT devices has exceeded tens of millions, and they are widely used in motor control, inverters, UPS systems, new energy vehicles, photovoltaic inverters, energy storage, household appliances, and other markets." XINERGY, a third-generation semiconductor design company, was founded in 2018 with investment from Xiamen Tungsten Industry. They focus on developing IGBT devices/modules, silicon carbide MOSFETs, and gallium nitride power semiconductor chips. Despite being only five years old, they have gained recognition and adoption from major customers such as CHANGHONG, SKYWORTH, SUNGROW Power, TECO, GEELY, KELONG, TOBTAK, and EVADA.

Figure 2: Key customers and application scenarios of XINERGY Microelectronics

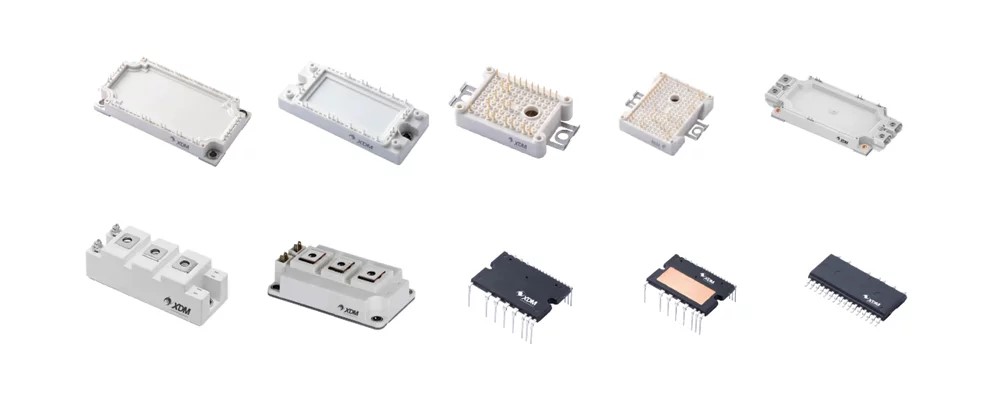

XINERGY achieved mass production of IGBT devices/modules in 2020. Currently, their IGBT devices cover mainly 650V/1200V with a current range of 5-100A. The IGBT module products focus on 1200V with a current range of 15-600A. They can provide different packaging forms to customers based on specific scenarios and requirements.

According to authoritative market research data, the industrial market's IGBT application scale is expected to reach 25 billion RMB by 2025, with an average annual growth rate of around 10%. Cai introduced that XINERGY's independently developed IGBT series products combine high performance and high reliability. The 650V IGBT series devices adopt an advanced trench structure and field stop technology, achieving an optimal balance between chip power density, switch frequency, and switching losses. The 1200V IGBT series devices feature a special design with wafer cell area and terminal field plate, providing high reliability and consistent electrical parameters. They are suitable for industrial inverters, servo motors, UPS systems, and other fields. Currently, XINERGY's monthly shipment of IGBT devices can reach 300,000 units, and the shipment of IGBT modules has reached 600,000 units.

In addition to IGBT devices, XINERGY has also developed IPM (Intelligent Power Module) products to meet different customer needs. By integrating IGBT devices, FRDs (Fast Recovery Diodes), driving circuits, protection circuits, and detection circuits into one module, IPMs offer advantages such as compact packaging, strong anti-interference capability, and convenient application. They are currently highly favored by customers. Furthermore, in the field of variable frequency home appliances, air conditioners, refrigerators, washing machines, and other high-power-consuming products require frequency modulation, energy efficiency, and noise reduction. The demand for high-power IPM modules in these products is also growing. XINERGY's IPM modules have been implemented in batch applications in industrial fields such as inverters, fans, and water pumps.

Figure 3: XINERGY IGBT module

In addition to the IGBT field, XINERGY has made breakthrough progress in the field of silicon carbide MOSFETs. They have developed a series of SiC SBD and SiC MOSFET products, with small-scale shipments achieved in DC-DC converters, motor drives, and charging modules. Proudly, Cai said, "We have achieved an RDS(ON) as low as 16mΩ for our 1200V silicon carbide MOSFETs. In February or March 2024, we will soon launch 13mΩ silicon carbide MOSFETs with performance close to major manufacturers like Infineon."

Figure 4: XINERGY SiC MOSFET series products

Compared to silicon-based IGBTs, silicon carbide MOSFETs have several advantages, including lower conduction and switching losses, higher efficiency, and better thermal performance. They are suitable for high-frequency and high-temperature applications, such as electric vehicles, renewable energy systems, and industrial motor drives.

Cai also mentioned XINERGY's focus on gallium nitride (GaN) power semiconductor chips. GaN devices have gained attention in recent years due to their high breakdown voltage, low on-resistance, and fast switching speed. They are particularly suitable for applications that require high-frequency operation, such as wireless power transfer, data centers, and telecommunications.

Regarding XINERGY's future plans, Cai emphasized their commitment to continuous innovation and product development. They aim to expand their product portfolio to meet the diverse needs of their customers. In addition, they plan to enhance their manufacturing capabilities, improve product quality, and strengthen their supply chain management.

Cai also highlighted XINERGY's dedication to research and development collaborations. They actively cooperate with universities, research institutes, and other industry players to stay at the forefront of technology advancements and foster industry growth.

In conclusion, Xiamen XINERGY Microelectronics Co., Ltd. has quickly emerged as a competitive player in the power semiconductor market, with their IGBT devices/modules, silicon carbide MOSFETs, and gallium nitride power semiconductor chips gaining recognition and adoption from major customers. Through their commitment to innovation, product development, and collaborations, XINERGY aims to continue providing high-performance and reliable solutions to meet the evolving needs of the power semiconductor industry. And China's only NEXPERIA ranks among the top ten, with a relatively small overall market share.

Looking at the current development status of the power semiconductor industry, Mr. Cai stated, "Currently, international giants such as Infineon, Mitsubishi Electric, and Fuji Electric have technological and production advantages in the power semiconductor field, occupying the global high-end market. Although China has achieved localization in low-end power devices such as diodes, transistors, and thyristors, it still heavily relies on imports for devices like IGBTs and SiC MOSFETs, which have higher technological and process complexity requirements."

The global semiconductor market has entered a downward cycle of inventory adjustment since Q3 of last year due to factors such as wars, economic downturn, rising inflation, and weak demand. However, due to the strong demand for third-generation semiconductor devices like IGBTs and silicon carbide in downstream sectors such as photovoltaics, energy storage, new energy vehicles, and industrial applications, the overall impact of the downward trend on the industry is very limited.

Specifically, according to the latest data, leading power device manufacturers such as Infineon, ON Semiconductor, and STMicroelectronics have a lead time of around 39-52 weeks for IGBTs in Q2 2023, and the delivery time and prices have remained relatively stable compared to 2022. The lead time for wide-bandgap MOSFETs is currently around 42-52 weeks, indicating a situation of supply shortage.

Looking at the development trends in China and globally, new energy vehicles will undoubtedly remain mainstream. Therefore, XINERGY's future focus on research and development and market expansion will gradually shift from the industrial market to the new energy vehicle market.

China currently has the world's largest market for new energy vehicles. In recent years, as the sales of new energy vehicles have significantly increased, the value of power semiconductors per vehicle has risen from $71 for traditional fuel vehicles to $550, presenting new opportunities for power semiconductor manufacturers. However, this market has been predominantly dominated by international giants, and the domestic self-sufficiency rate is relatively low, resulting in a significant supply-demand gap.

Currently, in the automotive field, Mr. Cai revealed that we are intensifying our research and development of 600A-800A/1200V IGBT modules and 13mΩ/1200V silicon carbide devices. We expect to start mass production and enter the market in the first quarter of next year. Additionally, to improve product iteration speed and address the shortcomings of the outsourced manufacturing model, we have also initiated the construction of a high-power module packaging production line, further empowering XINERGY’s sustained and stable growth in performance.