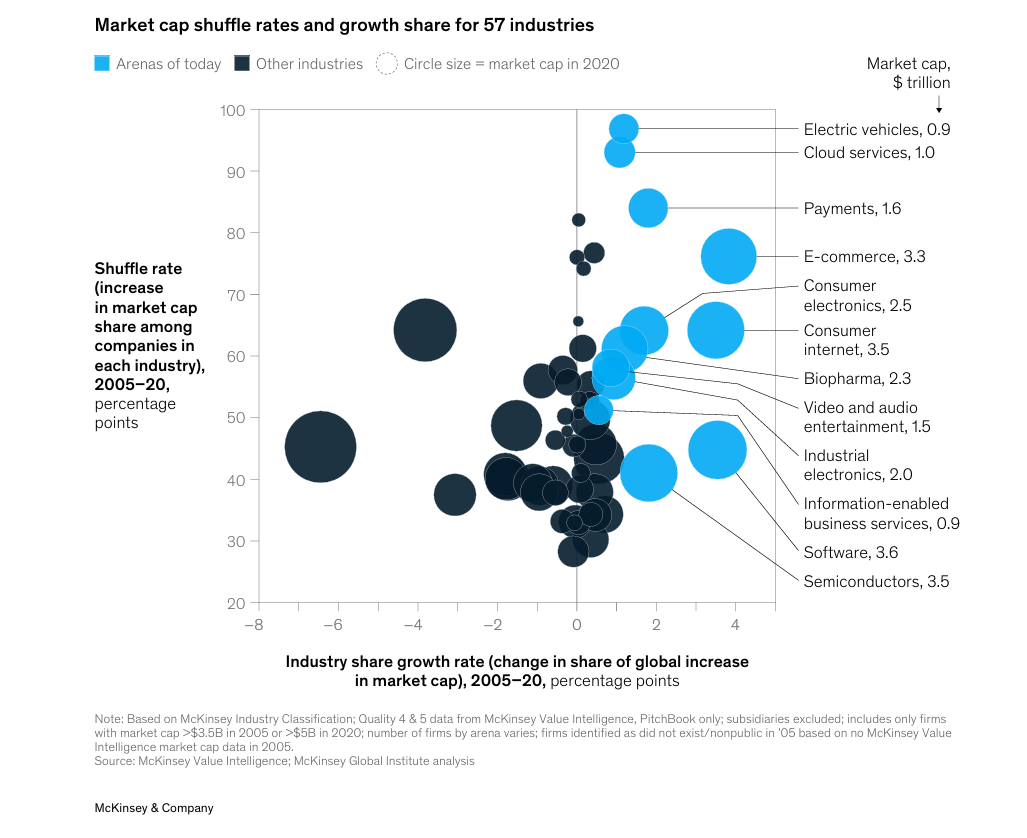

The report identifies 12 competitive sectors (including software, semiconductors, consumer internet, e-commerce, consumer electronics, biopharmaceuticals, industrial electronics, delivery technology, video and audio entertainment, cloud services, electric vehicles, and information-enabled business services) that emerged from 2005 to 2020. ) shows a significant rate of change, while these sectors have also seen a significant increase in their share of the total market capitalization, indicating their growing influence in the market.

According to the report, there are currently 12 competitive areas that differ significantly from other industries in six areas:

First, the competitive sector accounts for an increasing share of economic profits

In 2005, arenas generated $55 billion, or 9% of the total global economy's profits, and other industries generated $549 billion, or about 90% of the total. And in 2019, the arena generated a total revenue of $250 billion, accounting for half of the total profits of the global economy. Comparing the 2005 economic profit rankings with the 2019 and 2020 economic profit rankings, the economic profit rankings rose in all sectors except industrial electronics.

Second, the arena has attracted a lot of investment in innovation

As early as 2005, the share of R&D investment in the arena was already high, and it has been maintained for 15 years. It is reported that in 2005, 62% of commercial R&D spending in the United States went to arenas and arena-related industries; In 2020, this number increased to 65%. Among these segments, semiconductors and electronic components account for the largest share, followed by biopharmaceuticals and software.

Third, the field of competition promotes the development of start-ups

By 2020, 33% of the total market capitalization of these competitive sectors belonged to companies that were considered "outsiders" in 2005 – companies that either didn't exist at all, had a market capitalization of less than $3.5 billion, or did exist but were not yet a real competitive player in these areas. In contrast, in the non-competitive sector, new entrants account for only 15% of the total market capitalization. New players often enter the competitive arena in the early stages, when competitors see innovations that meet customer needs as investment targets. This kind of competition has created a unique dynamism in the field of competition.

Figure: Industry share growth rate from 2005 to 2020

Fourth, the arena has given birth to industry giants

The report notes that arenas are more likely than non-arenas to spawn the world's largest companies. In 2020, 74% of the Arena's total market capitalization was held by companies with a market capitalization of more than $50 billion, compared to 47% in other industries. 50% of the total market capitalization of the arena is held by companies with a market capitalization of more than $200 billion, compared to only 15% in other industries.

Some large companies are also more likely to enter the arena. More than half of the companies with a market capitalization of more than $200 billion are in the arena sector, although arenas only account for one-fifth of the total sample of companies. In 2005, only one of the top ten companies was on the stage of the future, Microsoft, with a market capitalization of $278 billion at the time. In 2020, 8 of these 10 companies were on the playing field, with market capitalizations ranging from $511 billion to $1.7 trillion.

Fifth, the competitive field often shows a high degree of concentration

The report points out that in the sample of the survey, in 2020, the top 10 companies accounted for at least 90% of the total market value and revenue in the five fields of cloud services, consumer electronics, consumer Internet, new energy vehicles and payments. At the same time, the competitive pressure to innovate remains. Investments that enhance products or take advantage of network effects tend to yield incremental returns, requiring leaders to constantly innovate to maintain their edge. The structure of the competitive industry rarely remains static or stable in the long run. Escalating investments and their superior returns can spark fierce competition in an already highly innovative market, triggering leapfrog changes in technology and business models that disrupt established winners.

Sixth, the field of competition has a stronger global character

On average, 50% of the revenue of companies in the competitive sector comes from outside their home markets, compared to only 42% of non-competitive companies. In addition, companies in the competitive sector are more likely to develop into multinationals. Among them, 68% of the companies in the competitive field have more than 20% of their revenue from overseas markets, while only about half of the companies in the non-competitive field meet this standard. The software industry is particularly global. In terms of 2020 revenue, nearly 60% of the top four software companies – Microsoft, IBM, Oracle and SAP – came from overseas markets.

Related:

18 Potential Arenas of the Future That Could Reshape the Global Economy (1)

18 Potential Arenas of the Future That Could Reshape the Global Economy (2)

18 Potential Arenas of the Future That Could Reshape the Global Economy (3)

18 Potential Arenas of the Future That Could Reshape the Global Economy (4)

18 Potential Arenas of the Future That Could Reshape the Global Economy (5)

18 Potential Arenas of the Future That Could Reshape the Global Economy (6)

18 Potential Arenas of the Future That Could Reshape the Global Economy (7)

18 Potential Arenas of the Future That Could Reshape the Global Economy (8)

18 Potential Arenas of the Future That Could Reshape the Global Economy (9)