Since the industrial age, greenhouse gas emissions caused by human activities have been increasing, which has had a profound impact on the climate, and extreme weather caused by climate change has posed a serious threat to human survival. In this context, the concept of "carbon neutrality" has been put forward around the world, aiming to curb global warming. China has also set the "3060" carbon neutrality goal, which has promoted the vigorous development of new energy industries such as new energy vehicles and electrochemical energy storage, and lithium battery technology has been widely used and matured. This time we will bring you the "2024 China Nano Ion Battery Report" by the Prospective Research Institute. It is divided into four aspects: the development background of sodium-ion batteries, the development status of sodium-ion batteries, the challenges and strategies of industrialization development, and the development trend of sodium-ion battery industry.

Lithium resource shortage and sodium ion substitution

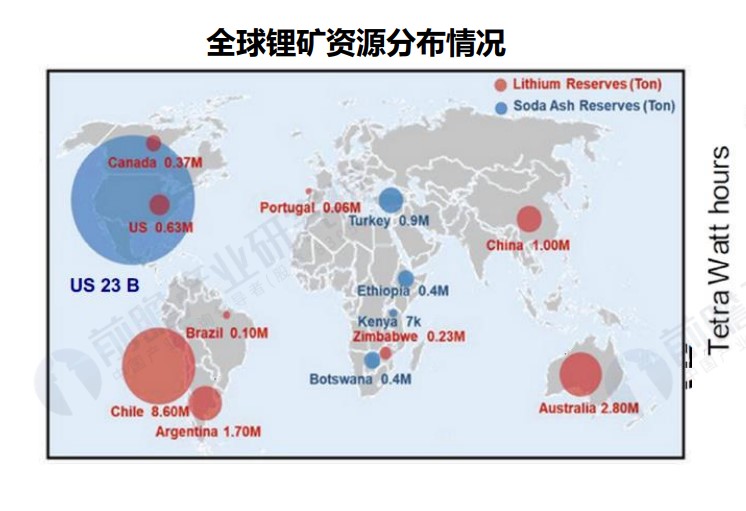

At present, in the context of the rapid development of new energy vehicles and the continuous expansion of energy storage demand in the world, the production and manufacturing scale of lithium-ion batteries has grown significantly. According to BMI's forecast, the world may face a shortage of lithium supply by 2025 as China's demand for lithium grows faster than supply. China is the world's third-largest producer of lithium, and demand for lithium is growing rapidly, especially in the field of electric vehicles. From 2023 to 2032, China's demand for lithium for electric vehicles will grow at an average annual rate of 20.4%, while China's lithium supply growth will only be 6% over the same period, far from meeting the forecasted demand. In addition, the distribution of global lithium resources is highly concentrated, with about 73% of lithium resources distributed in North and South America, while relatively small distribution of lithium resources in the Pacific, Asia, Europe and Africa.

Figure: Distribution of global lithium resources (Source: Qianzhan Research Institute)

Lithium resources are mainly found in the South American region known as the "lithium triangle" (Bolivia, Chile and Argentina), United States, Australia and China. According to the World Economic Forum, global demand for lithium will exceed 3 million tons by 2030, while the average global lithium production in recent years will not exceed 100 tons, which shows a sharp increase in demand for lithium resources in the future, as well as possible supply challenges. There are also analyses pointing out that although there will not be a serious shortage of lithium resources in the short term, there may even be a surplus of resources. But in the long run, supply growth may not be able to keep up with demand growth, especially after 2028, when the shortage of lithium resources could impact the supply chain.

Chart: Forecast of global lithium resource supply and demand trends

In the context of the shortage of lithium resources, due to the abundant reserves of sodium resources in the world, the substitution of sodium-ion batteries for lithium-ion batteries has gradually become the focus of research in the new energy industry. As an emerging battery technology, nano battery has many significant advantages, such as more abundant sodium resources than lithium resources, which is also conducive to reducing the cost of batteries and improving the stability of the supply chain. In addition, sodium batteries are chemically lower than lithium, so sodium batteries perform better in safety and are non-flammable and explosive.

In terms of performance, sodium batteries outperform lithium batteries in low-temperature environments, and can maintain a discharge rate of more than 90% at minus 20°C. Sodium batteries have good resistance to over-discharge, can operate in a wider temperature range, and are suitable for a variety of environmental conditions. According to market research, the industrialization process of sodium batteries is accelerating, and the industrial chain of sodium batteries is gradually forming, and it is expected that the demand for anode materials will reach 75,000 tons by 2025, with broad market prospects. With the further development of technology and the maturity of the industrial chain, the market share and application of sodium batteries are expected to further expand.