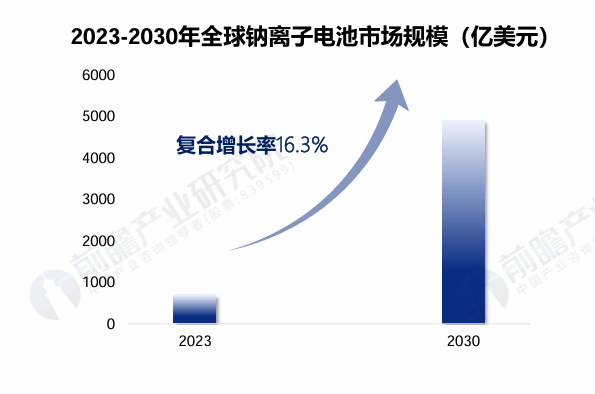

At present, sodium-ion batteries have been produced on a small scale and used in specific scenarios around the world. According to market research, the global sodium-ion battery market size reached $320 million in 2023 and is expected to reach nearly $1 billion in 2030. According to BIS Research, the global sodium-ion battery market revenue size was about $523 million in 2021 and is expected to reach $4.36 billion in 2031, with a compound annual growth rate of 23.5% from 2022 to 2031. In addition, the global sodium-ion battery market size is expected to exceed $2.3 billion by 2028.

The global sodium-ion battery market mainly covers North America, Europe, and Asia-Pacific, and specific countries include United States, United Kingdom, France, China, Japan, Sweden, and Australia, among others. At present, representative companies in the market have preliminarily clarified their product routes, and are actively promoting the production capacity construction and commercial application of sodium-ion batteries. For example, United Kingdom's Faradion has been deployed in the field of sodium-ion battery photovoltaic energy storage since 2022, and Sweden's ALTRIS has further expanded its application in the application of low-voltage power supply for sodium-ion battery vehicles. On the whole, the world's major companies are stepping up their efforts to explore the commercial application of sodium-ion batteries in different segments to promote the marketization of this technology.

Figure: Global sodium-ion battery market size 2023-2030 (USD billion)

China's sodium-ion battery market is in a stage of rapid development, thanks to the support of national policies, technological progress and cost advantages, the application of sodium-ion batteries in China has broad prospects. With the transformation of the global energy structure and the continuous progress of new energy technology, sodium-ion battery technology has shown strong development potential in China. According to the International Energy Agency, the world needs to add more than 300GW of energy storage capacity by 2050 to achieve global carbon neutrality, and sodium-ion batteries are expected to be an important driver of this growth trend. In 2023, China will sign more than 30 new sodium-ion battery-related projects, with a planned production capacity of more than 260GWh and a total investment of more than 114 billion yuan. In 2024, more than 20 sodium power projects will be signed, recorded, and started, involving multiple subdivisions such as battery cells, positive and negative electrode materials, and the total project investment will be nearly 40 billion yuan. At present, a number of companies have preliminarily developed related products, and have been small-scale demonstration applications in some fields such as power base station energy storage, electric bicycles, data centers and low-energy industrial forklifts. Sodium-ion battery technology is developing rapidly, and many companies have initially developed related products, and have been small-scale demonstration applications in some fields such as power base station energy storage, electric bicycles, data centers and low-energy industrial forklifts. Since 2018, the sodium-ion battery industry has gradually become a hot spot in China's capital market, and venture capital and financing activities have remained active. The number of investment and financing events has increased from 3 in 2018 to 56 in 2023, among which manufacturers such as Zhongke Haina, Lingyixi and Jiana Energy have become key investment targets in the capital market.

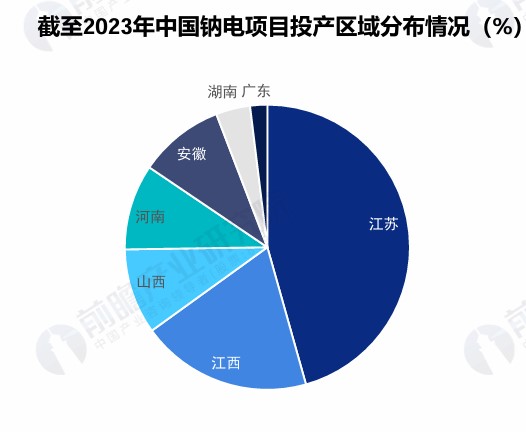

Figure: Regional distribution of sodium power projects in China as of 2023 (%)

As of the end of June 2023, the special production capacity of sodium-ion batteries that has been put into operation in China has reached 10GWh, and it is expected that by the end of 2025, the production capacity of China's sodium-ion battery special production line will reach 275.8GWh. In addition, a number of companies have made layouts in the field of sodium-ion batteries, and promoted the construction of sodium-ion battery production capacity and the transformation of commercial application results. For example, Guanghua Technology has launched high-purity sodium carbonate, battery-grade sodium fluoride, sodium oxalate and other products for the electrolyte, cathode and cathode sodium supplement of sodium-ion batteries. According to the analysis of the key investment points of the sodium-ion battery industry chain, 59% of the invested projects focus on key materials such as cathode and anode materials and electrolytes for upstream sodium-ion batteries; 24% of the invested projects focus on the R&D and production of midstream sodium-ion batteries, and 14% of the invested projects focus on sodium-ion battery solutions.

The sodium-ion battery industry in China has shown a positive growth trend in technology investment, and the sodium-ion battery industry is developing rapidly towards industrialization and commercial application under the dual promotion of government support and enterprise R&D.

Related: