Recently, major research institutions have successively released reports on global smartphone shipments in the second quarter of 2024. Although the data varies slightly from agency to institution, they are generally consistent. After sorting and summarizing, China Exportsemi Web will present a real industry situation for readers and friends, and analyze and deconstruct the top 5 global smartphone shipments in Q2 2024.

First, let's take a look at the top 5 rankings given by three major research institutions: Counterpoint Research from Hong Kong, China, which focuses on the mobile, semiconductor, software and services markets, and is known for its detailed smartphone market analysis; IDC from United States, specializing in the information technology, telecommunications and consumer technology markets, providing global market forecasting and consulting services, known for accurate market forecasting and in-depth analysis, and Canalys from the United Kingdom, focusing on the technology industry, including smartphones, PCs, servers and networking equipment, with fast, in-depth market reports and analysis that provide businesses with insights into market trends and competitive dynamics.

Counterpoint Research:

Figure: Top 5 global smartphone sales from 2021Q1 to 2024Q2(Source: Counterpoint Research)

1. Samsung: 20% market share, up 5% year-on-year.

2. Apple: 16% market share, down 1% year-on-year.

3. Xiaomi: 14% market share, up 22% year-on-year.

4. vivo: 8% market share, up 9% year-on-year.

5. OPPO: 8% market share, down 16% year-on-year.

IDC:

Figure: Top 5 global smartphone shipments in 2024Q2, data from IDC

1. Samsung: shipped 53.9 million units, 18.9% market share, up 0.7% year-on-year.

2. Apple: shipped 45.2 million units, 15.8% market share, up 1.5% year-on-year.

3. Xiaomi: shipped 42.3 million units, 14.8% market share, a year-on-year increase of 27.4%.

4. vivo: Shipped 25.9 million units, 9.1% market share, up 21.9% year-on-year.

5. OPPO: Shipped 25.8 million units, 9.0% market share, up 1.8% year-on-year.

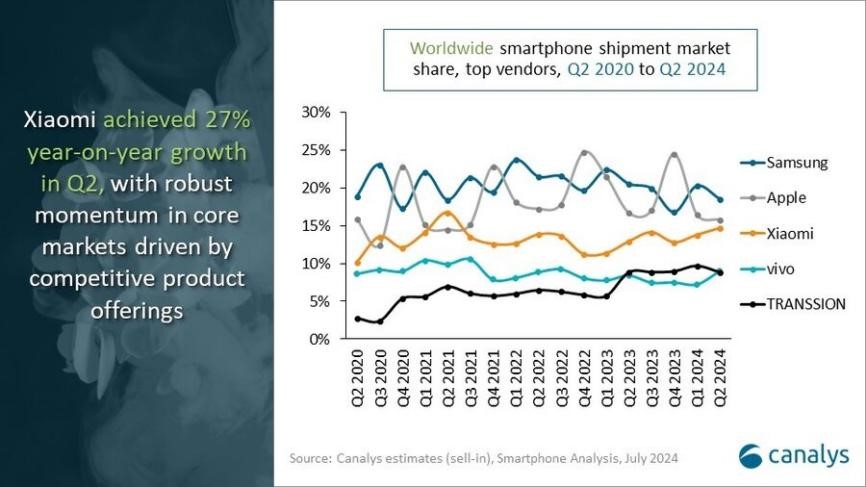

Canalys:

Figure: Top 5 global smartphone sales from 2020Q2 to 2024Q2, data source canalys

1. Samsung: Shipped 53.5 million units, with a market share of 19%, up 1% year-on-year.

2. Apple: 45.6 million units shipped, with a market share of 16%, up 6% year-on-year.

3. Xiaomi: Shipments reached 42.3 million units, with a market share of 15%, a year-on-year increase of 27%.

4. vivo: Shipments of 25.9 million units, with a market share of 9%, growing simultaneously.

5. Transsion: With shipments of 25.5 million units and a market share of 9%, it ranks fifth.

From this data, we can see several key points. First of all, in the days when Huawei was suppressed, Samsung and Apple still occupied the top two positions in the global smartphone market, but Xiaomi's rapid growth in Q2 cannot be ignored, and its year-on-year growth rate far exceeded that of other brands. In addition, vivo and OPPO, although they have similar shares in the global market, differ in their respective strategies and market positioning, which is also reflected in their growth or downward trends. Finally, Transsion's inclusion in the list shows the competitiveness and influence of Chinese brands in the global smartphone market.

Behind these rankings, each brand has its own growth story, which also points out the direction for the development of the industry

Samsung has occupied the first place for a long time, and the main reason why it maintains its leading position is its high-end product line and the 5G differentiation of the A series of products, especially in the field of AI mobile phones, Samsung has shown its innovation ability, its Galaxy S24 series is equipped with deeply empowered Galaxy AI technology, which not only promotes the popularization of mobile phone AI, but also brings users a safe and high-quality generative AI application experience, from communication, Productivity and imaging are reshaping smartphones.

While Apple faces challenges in some markets, particularly in China, where it is being competed by local brands such as Huawei, its strong performance in North America and Asia-Pacific has helped it maintain its second position in the market. In the first fiscal quarter of 2024, Apple achieved revenue of $119.6 billion, a year-on-year increase of 2%, and net profit increased by 13%, of which iPhone revenue was $69.7 billion, a year-on-year increase of nearly 6%. In addition, Apple has also invested heavily in the field of AI, and plans to announce the details of its development in the field of artificial intelligence later that year.

Xiaomi is growing rapidly through a competitive product portfolio, especially in emerging markets. Its shipments reached 42.3 million units, with a market share of 15%, ranking third in the global smartphone market. Xiaomi's growth is due to its continuous efforts and product innovation in the mid-to-high-end market.

vivo and OPPO have a strong presence in the Chinese market and are actively expanding internationally. Vivo ranked fourth with 25.9 million units shipped and a 9% market share, while OPPO is aligning its premiumization strategy by releasing more products in the mid-to-high-end price segment and striving to improve profitability.

Transsion, on the other hand, ranked fifth with 25.5 million units shipped and a 9% market share, continuing to succeed in specific market segments. TRANSSION's success reflects the effectiveness of its deep cultivation and localization strategy in emerging markets such as Africa.

To sum up, major brands have achieved their own achievements in the global smartphone market through continuous product innovation, market expansion, and localization strategies. With the further development and application of AI technology, the competition in the smartphone market will become more fierce in the future, and it will also bring more innovation and value to consumers.

To sum up, the competitive landscape of the global smartphone market is changing, and every brand is looking for growth and breakthrough in its own way. With the continuous advancement of technology and the continuous optimization of market strategies, we have reason to believe that the smartphone market will be more diversified and competitive in the future.