With the dawn of the era of intelligent connected cars, autonomous driving technology has become the focus of the industry. In autonomous driving technology, the chip plays a "central hub" role, controlling the operation of autonomous vehicles through the autonomous driving platform. Driven by the international situation, national policies, and market demand, the automotive chip track is bustling with activity. Among them, autonomous driving chips have a representative significance.

Currently, two international manufacturers, Nvidia and Mobileye, occupy the main seats in the autonomous driving SoC chip market. Among them, Nvidia is the "king of large computing chips" and has continuously refreshed the "ceiling" of computing power since entering the field of autonomous driving in 2015; Mobileye has been deeply involved in the field of assisted driving and has long-term expertise in the field of L2 and below autonomous driving. Leading share. Qualcomm, which has already achieved a leading position in the field of smart cockpit chips, has now begun to enter the autonomous driving track and has quickly won the appointment of many leading customers such as BMW and Volkswagen.

At the same time, domestic companies are also expanding in this field. In recent years, domestic chip manufacturers such as Horizon, Black Sesame Intelligence, Xinchi Technology, and Cambrian Song have successively emerged. There are also traditional ICT companies Huawei and new car-making force Leapmotor, which are developing autonomous driving SoC chips. The ban on AI chips issued by the U.S. government a few months ago has spread the trend of local chip substitution to the automotive field, bringing more opportunities to domestically produced self-driving SoC chips.

So, what is the current development level of domestic autonomous driving SoC chips? Is it capable of "replacing" the current international mainstream high-power computing chips? What are the competitive advantages and product positioning of each local domestic manufacturer? What kind of chips will car companies really choose?

Six major hurdles faced by domestic chips

It is understood that among domestic chip manufacturers, Horizon, established in 2015, and Black Sesame, established in 2016, have launched single chips that can achieve L2~L4 levels of autonomous driving. Xinchi will also launch its V9 series of autonomous driving chip products this year. The coverage is expanded to L4/L5 level. Xinchi revealed that L2 smart driving is still the feature that car companies and the market are paying most attention to and has the most implementation.

For high-level intelligent driving systems, the increase in the number of sensors and the improvement in resolution have brought about massive data processing requirements, and the complexity of algorithm models has also increased significantly. Under the trend of E/E architecture centralization, the computing power of smart cars will be mainly realized by a few domain controllers or central computing platforms, which also places higher requirements on the computing power of a single vehicle chip.

According to Horizon Data, with each additional level of autonomous driving, the required chip computing power will increase dozens of times. Among them, the computing power requirement for L2-level autonomous driving is 2-2.5TOPS, the computing power for L3-level autonomous driving needs to reach 20-30TOPS, the computing power requirement for L4-level autonomous driving is more than 200TOPS, and the computing power requirement for L5-level autonomous driving is more than 2,000TOPS.

However, large computing power also means higher costs. Therefore, autonomous driving SoC chips with medium computing power will actually be more favored by car companies, which also provides opportunities for local manufacturers that are starting to develop.

Among these products launched closely by chip companies, everyone often only focuses on computing power data. But in fact, in the process of developing mass-produced models, in addition to computing power, OEMs will also comprehensively consider the energy efficiency ratio, algorithm efficiency, software and hardware adaptability, processor architecture, IP configuration and development difficulty of the autonomous driving chip. , based on the price and positioning of benchmark models.

Energy efficiency ratio control

Currently, the industry generally uses "TOPS" as the unit to evaluate the theoretical peak computing power of autonomous driving chips. However, in actual scenarios, it is unlikely that the theoretical peak computing power of autonomous driving chips will be fully released. This is because of the computing power. The effective utilization rate is also affected by the chip's power consumption performance and energy efficiency ratio control.

Comparing the above data, Auto Byte found that energy efficiency ratio control is an advantage of many domestic autonomous driving chip manufacturers. The high energy efficiency ratio can not only save a lot of electricity for the car, but also generate less heat energy, which helps the chip's heat dissipation and high-performance stable operation.

Algorithm efficiency

The peak computing power of the chip is high and it is effectively released. Will it be able to truly improve the overall processing power of the autonomous driving system? The answer is, unknown. If the chip architecture and algorithm are not matched well enough, the operation efficiency of the autonomous driving algorithm will be extremely low. A large number of transistors in the entire chip are actually idling. No matter how powerful the computing power is, the actual processing power is not optimal.

"The current artificial intelligence software algorithms are far from reaching the level of L5. If the computing power that can support L5 is used to match the L2 algorithm, the room acquisition rate will definitely be low." Horizon believes that computing power and algorithm efficiency should be developed in a matching manner, providing algorithms Just eat up the computing power.

Previously, Horizon CTO Huang Chang gave an example: the peak computing power of a chip is equivalent to the horsepower of a car. What the driver or passenger can truly experience is the acceleration of 100 kilometers, and a car with high horsepower does not necessarily accelerate faster. For chips, what users can feel is the processing power and efficiency of the system, and large computing power does not necessarily mean fast.

Horizon has always been more committed to the calculation method of FPS (Frames PerSecond), which accurately identifies the frame rate per second. According to reports, the Horizon Journey 5 chip can reach 1531FPS, Huawei Ascend can reach 829FPS, and Nvidia Orin can only reach 208FPS.

"Computing power is only a theoretical upper limit. The ultimate efficiency of the chip also depends on many factors such as software algorithm cooperation. During the vehicle life cycle and product sales process, the chip computing power is often not fully utilized, and may even be You can’t even perform half of it.” Xinchi also conveyed a similar point of view to Auto Byte.

Based on this problem, Corechip has done two things: First, it provides SDNN tools that can assign different algorithms to the most suitable IP for operation, such as CPU or GPU; second, it develops its own UniLink bus technology to achieve an efficient data distribution mechanism at the hardware level and reduce the time consumption of data transmission between heterogeneous cores.

In addition, Black Sesame also talked about a phenomenon that restricts the efficiency of chip algorithms. Most AI hardware acceleration units on the market now use a single acceleration unit. Models of different sizes cannot receive corresponding acceleration at the same time, which can easily lead to long inference times for large models and low utilization of small models. In response to this problem, Black Sesame developed its own NPU with medium to large computing power and a multi-dimensional heterogeneous architecture, so that different models have corresponding hardware acceleration units for acceleration and higher computing efficiency.

Processor architecture solution

In terms of architecture, there are currently three mainstream autonomous driving chip SoC architecture solutions on the market: (1) CPU+GPU+ASIC, such as NVIDIA and Tesla; (2) CPU+ASIC, such as Mobieye and Horizon; (3) CPU+FPGA, such as Waymo and Baidu Kunlun Core.

It is generally believed in the industry that from the perspective of development trends, autonomous driving SoC chips will develop towards a "CPU+XPU" heterogeneous architecture; in the long run, before the autonomous driving algorithm is mature and fixed, the CPU+GPU+ASIC architecture will still be It is the mainstream. When mature, customized mass-produced low-power, low-cost dedicated autonomous driving AI chips (ASICs) will gradually replace high-power GPUs, and the CPU+ASIC solution will be the mainstream architecture in the future.

Horizon adopts the "CPU+ASIC" architecture and independently designed and developed the AI-specific processor architecture Brain Processing Unit (BPU). On this basis, customers can develop autonomous driving software and hardware systems and complete vehicles. According to reports, BPU uses technologies such as large-scale heterogeneous computing, highly flexible large-concurrency data bridges, and systolic tensor computing cores to create matrix operations that adapt to the needs of end-side autonomous driving. Currently, five third-generation AI architectures have been launched: Gaussian architecture , Bernoulli 1.0 architecture, Bernoulli 2.0 architecture, Bayesian architecture, the next generation Journey 6 chip will integrate the fourth generation BPU architecture: Nash architecture.

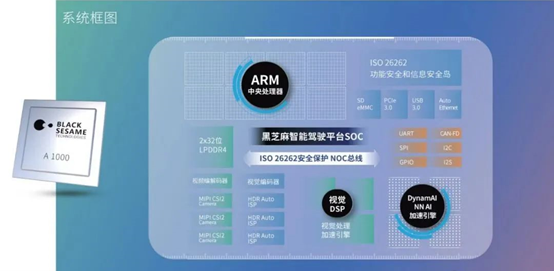

Currently, Black Sesame adopts a multi-core heterogeneous computing architecture. Its comprehensive computing power, power consumption and functional integrity require the use of an 8-core A55 solution on the chip processor, and the internal integration of self-developed ISP and NPU, as well as GPU, DSP, and functional safety and information security MCUs not only provide powerful computing power, but also ensure that different types of calculations have corresponding optimal computing units for acceleration, so that the chip can undertake image splicing rendering, sensor fusion, functional safety, etc. Complex functions can use a single-core solution to undertake driving and parking functions.

Xinchi, which also adopts a multi-core heterogeneous architecture, told Auto Byte that this design is more balanced, taking into account the computing power requirements and capabilities of the CPU, NPU, GPU, and MCU, and can handle the complete process of autonomous driving/ADAS from perception to planning control. . At present, autonomous driving systems mainly rely on the CPU for route planning and decision-making, and the execution of these decisions requires real-time/reliable control capabilities, that is, MCU computing power.

Heterogeneous IP configuration

Since current autonomous driving chips mostly use multi-core heterogeneous architecture, different types of computing IP are required, including GPU, NPU and CPU, etc. Heterogeneous IP configuration is particularly important in chip design.

However, configuring IP does not mean that the higher the computing power, the better. It involves the design and verification of the entire chip, and needs to take into account bandwidth, peripherals, memory and other aspects. Moreover, in the process of designing the chip, it is necessary to help customers optimize the hardware in each operation step based on the processing data flow inside the chip.

Among domestic manufacturers, Black Sesame has established certain advantages through self-development of two independently controllable core IPs, including the NeuralIQ ISP image signal processor and the high-performance deep neural network algorithm platform DynamAI NN engine. Among them, NeurallQ ISP can support up to 16 channels of high-definition camera access. In harsh autonomous driving environments (rain, snow, fog, etc.), it can still achieve high dynamic exposure, low-light noise reduction, LED flicker suppression, etc. Quality automotive image processing requirements; while the DynamAI NN engine can achieve simultaneous optimization of software and hardware, balance computing power and power consumption, has the advantages of supporting sparse acceleration and equipped with automated development tools, and can process more image data efficiently and quickly.

Software and hardware compatibility

Smart cars continue to develop, and the sensors and other hardware devices and software operating systems they carry are constantly updated. The adaptability of autonomous driving SoC chips is an unavoidable topic. "Intelligent automobile driving is a complex industrial chain, involving chips, algorithms, software, systems, hardware, protocol stacks, cloud and other levels. Each field needs to take into account the need for rapid iteration and upgrade." Xinchi said.

According to reports, Xinchi’s autonomous driving platform UniDrive uses general-purpose computing hardware acceleration and is compatible with different autonomous driving algorithm routes. Moreover, UniDrive is very open from algorithms to hardware and does not limit the OEM’s definition of autonomous driving. L1 to L4 can be designed accordingly based on this framework. At the bottom level, UniDrive supports mainstream automotive OSs such as QNX and RTOS, as well as Linux; at the module level, UniDrive is compatible with frameworks such as Adaptive AutoSAR, ROS, and Cyber.

Black Sesame has also established an open chip product ecosystem, which not only supports Black Sesame’s self-developed OS/middleware/visual perception algorithms, but also supports third-party software transplantation without binding sensors/software/MCU, etc. In addition, Black Sesame provides ISP (camera) debugging and adaptation services, which can perform early adaptation with mainstream OS/middleware/visual perception algorithm third-party suppliers.

Horizon is improving the adaptability of its chip products from three levels. At the media communication meeting in December last year, Huang Chang introduced in detail that first of all, the Horizon chip itself has a variety of high- and low-speed interfaces, which can adapt to peripheral key devices such as sensors, Cameras, LiDAR, Radar, PMICs, different Tier2s, and MCUs. ; Secondly, in terms of underlying software, Horizon has opened up the drivers for related peripheral devices, and customers can complete the adaptation to peripheral hardware at the software and hardware level; Finally, in terms of algorithm application development, Horizon has improved the algorithm tool chain to allow ecological cooperation Partners can jointly complete algorithm and application development and system integration adaptation work under relatively open conditions.

Unlike domestic chip manufacturers, Nvidia's autonomous driving SoC chips are developed based on its own GPU and are strongly bound to the CUDA operating system. Car companies need to develop autonomous driving software and hardware systems on this basis.

Development convenience

As a computing power infrastructure, chips must serve customers in algorithm development, and a good chip must be a "easy-to-use" chip. Currently, NVIDIA not only sells the complete autonomous driving system it has developed, but also allows car companies to purchase autonomous driving SoC chips separately, and provides them with a variety of mature algorithms, basic software stacks, and DRIVE Hyperion Developer Kit for autonomous driving development. kit.

Mobileye has gradually shifted from a closed black box solution to an open model. In July last year, it released the EyeQ Kit, a software development toolkit that allows partner car companies to independently develop EyeQ 6H and EyeQ Ultra chips, while still providing products that do not require self-development. Chip solution.

Domestic autonomous driving SoC chip manufacturers have always adhered to an open co-creation approach, and have continued to open up more cooperation models and development rights to car companies. "We will provide corresponding development kits, equivalent to a Tier 1.5 service system, which can quickly support Tier 1 to obtain quasi-mass production hardware." Horizon said.

According to reports, Horizon has built an efficient open technology platform with "chip + tool chain" as the core, including hardware reference design, tool chain, AIDI development platform, basic middleware and rich reference algorithms. Through open and easy-to-use AI development tools and infrastructure, ecosystem partners can complete the development of full-stack autonomous driving functions from hardware to software, from perception to control in a short time based on Horizon chips. For example, with the help of Horizon, the intelligence robot quickly achieved mass production-level requirements for various perception indicators of the entire system in less than 2 months.

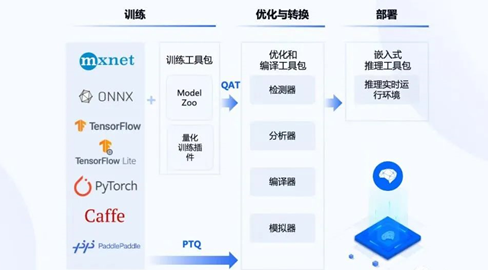

To support the launch of the Huashan series of autonomous driving computing chips, Heizhima has successively released the Shanhai artificial intelligence development platform and the Hanhai autonomous driving middleware platform, supporting car companies to quickly mass produce through a mature tool chain and middleware system.

It is reported that the Shanhai platform provides automatic optimization of AI compilers adapted to the chip architecture, supports TensorFlow, Pytorch, ONNX, etc., and also has more than 50 AI reference model library conversion use cases, supporting dynamic heterogeneous multi-core task allocation and customer-defined operators. Development; Hanhai autonomous driving middleware platform is an intelligent driving platform SDK development kit, including Target (SoC) SDK, X86 (Host host) SDK, Target (MCU) SDK, which can support vehicle terminals, road terminals and various intelligent Development of driving and vehicle-road collaborative scenarios.

Xinchi has made many localized designs in its chip research and development, providing an agile and open product development platform with good compatibility. In addition, Xinchi has also created a complete chip ecosystem, covering software, tool protocols, ecological vision and overall solutions, with a total of more than 200 ecological partners.

Four cost considerations for chip applications

From the perspective of car companies, when selecting autonomous driving SoC chips, they will not only compare the performance of the product itself, but also pay more attention to the overall cost. In fact, four aspects need to be considered to judge this indicator: the price of the chip itself, energy efficiency ratio, development cost and supply guarantee cost.

The first is the cost of the chip. How much will the system price be after using this chip.

The second is energy efficiency ratio, which represents the cost performance of the chip itself. "Good chips" can bring customers results beyond expectations. Horizon told Auto Byte that if a 100TOPS chip can achieve the autonomous driving experience that a 200TOPS chip can achieve, then it will be more cost-effective for both car companies and consumers. "Just like high horsepower does not mean good acceleration performance, high computing power does not mean good final autonomous driving experience." In terms of energy efficiency ratio, domestic chip manufacturers such as Black Sesame and Horizon have launched products that are no less powerful than Nvidia's Orin and Special Products such as SLA FSD, an internationally mainstream large computing power chip.

The third is the cost of chip development. For example, how many people and time are invested in the research and development of the chip, and how difficult it is to develop the chip. "When Tier 1 or a car company gets a chip, does it cost 500 people/month in time and labor costs to develop, or does it cost 5,000 people/month? If the chip is easy to use, easy to develop, and can be deployed quickly, then for car companies It is also a very cost-effective choice,” Horizon said. Black Sesame also took Huashan No. 2 A1000 and A1000L as examples. These two chips are pin2pin compatible, which allows car manufacturers to save more manpower and material resources during the product migration process of different solutions.

The fourth is the cost of supply security. Xinchi pointed out to Auto Byte that chips not specifically designed for automobiles have a short life cycle and may not be available in 3-5 years. However, the supply of car specifications is generally guaranteed for 10 years. If the subsequent supply cannot be guaranteed, the subsequent costs of the car manufacturer will become higher, and the chip system must be redesigned to meet the continued sales of the model.

Mass production status

Currently, Horizon Journey 2 has been mass-produced in front-loading of Changan UNI-T, Changan UNI-K, Chery Ant, SAIC Zhiji, GAC Aion Y and other models. However, only Chery Ant has applied the chip to autonomous driving, and the rest have Used in smart cockpits.

The Journey 3 is already on board the 2021 Ideal ONE, which is used to achieve L2 autonomous driving and NOA navigation-assisted driving functions. Journey 5 will be mass-produced for the first time in Ideal L8 Pro. In addition to Ideal, this chip has also received many designations from BYD, SAIC, FAW-Hongqi, etc.

Black Sesame’s Huashan No. 2 A1000 has also completed full mass production certification after two years of software and hardware polishing and verification. In May 2022, Black Sesame and Jiangxi Automobile Group reached a platform-level strategic cooperation. The Huashan No. 2 A1000 chip will be installed on a number of Sihao brand mass-produced models.

As early as September 2022, Cambrian Song announced that it was developing three autonomous driving chips, and there was also news of mass production. It is reported that its first autonomous driving chip has been taped out and has reached cooperation with FAW, and will later be installed on a model of one of FAW's own brands.

According to Xinchi, its V9 series chips have also obtained multiple mass production appointments, but the specific car companies for cooperation have not been officially announced yet. In addition, Xinchi mentioned that they are cooperating with Zongmu Technology to develop a designated project for a certain OEM.

Development strategies of chip manufacturers based on local advantages

It is undeniable that domestic local autonomous driving chip manufacturers are gaining momentum and have already opened up a corner of the market. But in the face of years of technology and customer reserves from international chip giants such as NVIDIA, Mobileye, and Qualcomm, how can domestic manufacturers maintain the current "corner of security" and continue to open up market space?

common advantages

For a long time, because Nvidia and Qualcomm have a complete development tool chain and good upstream and downstream cooperation relationships, their technology iteration speed is very fast. In order to maintain such a competitive advantage, the chips they launch will be more general-purpose in design and have a wider range of applications, rather than being specifically developed for autonomous driving.

Therefore, domestic chip manufacturers have the opportunity to catch up in overall performance by focusing more on specific algorithms in the field of autonomous driving. Moreover, domestic manufacturers also have the advantage of localized service capabilities, which allows them to communicate better with local OEMs and define products that can be better mass-produced after understanding the real needs of the domestic market. In addition, domestic chip manufacturers such as Horizon Robotics and Black Sesame generally provide a relatively open ecosystem to meet the customization needs of car companies and improve their software algorithm self-development capabilities.

For autonomous driving technology, a closed ecosystem is obviously not conducive to its rapid iteration. Take Mobileye as an example. In the past, it mainly focused on black box delivery and was too closed. Although it can achieve rapid mass production, in the long run, it is difficult to meet the customized needs of OEMs, and its computing power upgrade is relatively conservative. , The iteration speed is slow, and Mobileye also lost some customers because of this.

Positioning of each manufacturer

In addition to their common localization advantages, domestic autonomous driving chip manufacturers are also gradually establishing their own market positioning. Each manufacturer chooses different product routes, and the final target models and applications are also different.

Currently, Horizon has three self-driving SoC chips, namely Journey 2, Journey 3 and Journey 5, which have achieved pre-installation and mass production. Horizon said that Zhengcheng 5 is a high-performance, large-computing power car-grade chip designed for high-level autonomous driving applications. The price of the models equipped with Zhengcheng 2 is mostly around 100,000-200,000 yuan, the price of the models equipped with Zhengcheng 3 is about 350,000 yuan, and the price of the models equipped with Zhengcheng 5 is 350,000-400,000 yuan.

It is reported that Black Sesame's product positioning is a general-purpose computing chip for autonomous driving. It has two self-developed core IPs and is committed to achieving a balance in the functions, costs and power consumption of chip hardware design. Black Sesame also revealed to Auto Byte the benchmark models of the Huashan No. 2 series chips. It said that the Huashan No. 2 A1000L and A1000 can support integrated parking solutions from low-end 5V5R to high-end 10V5R with a single chip, covering Entry-level models and high value-added models.

Xinchi introduced that its product positioning is automotive-grade chips suitable for large-scale mass production. Its V9 series chips comprehensively consider the combination and optimization of user experience, algorithms and chips, and integrate high-performance CPUs, 3D GPUs, and AI engines. , using a highly reliable dual-core lock-step mechanism to implement the APA/ADAS solution with a single-chip solution, aiming to balance performance and cost.

Although China's self-driving SOC chip manufacturers started late, judging from the product information and mass production currently announced, domestic chips have gradually shown the potential to replace overseas chip products in cars, and have even been installed in products like Ideal A luxury SUV model like the L8 Pro costs around 400,000 yuan.

However, most domestic self-driving SOC chips are still in the stage of obtaining the designated points, and their mass-produced models have not yet been launched. It is still unclear whether they can withstand the test of the market. If you want to gain a foothold in the country and even gradually go overseas, it will not be achieved overnight.