The COVID-19 era is one of the most vicious black swan events the connector industry has ever experienced. Factory shutdowns, inventory backlogs, and market sales activities have undergone earth-shaking changes, which have had an extremely huge impact on the global supply chain. It has been more than three years since the outbreak of the epidemic. Although its impact has gradually stabilized, it has not fully recovered. Indicators are sending warning signals about industry conditions, but those signals are also tempered by some positive factors.

According to research for the first quarter of 2023 (1Q23), sales fell -0.1% from the same period last year. Although basically the same as in the past, this is still a signal that should not be underestimated for the connector industry as 1Q23 ends the industry 10 consecutive quarters of sales growth. Notably, it has achieved double-digit sales growth in seven of the past 10 quarters.

Percent change in industry sales (year-on-year) by quarter

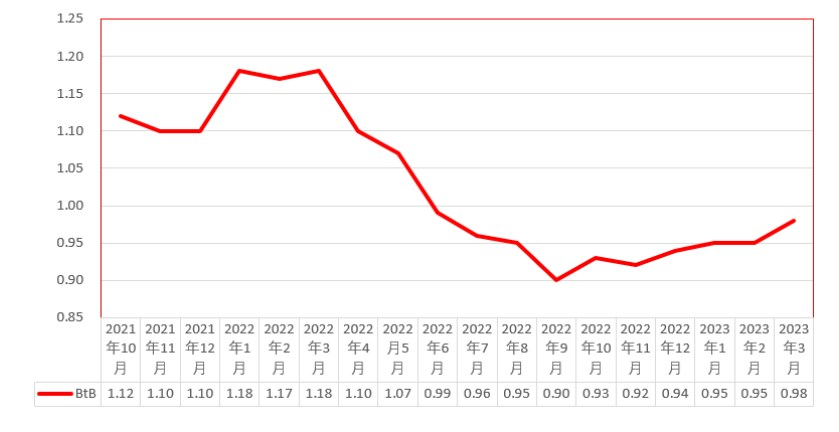

In addition to sales trending downward, orders are also falling. The connector industry has seen year-over-year order volume declines in 11 of the past 12 months, and declines have been in the double digits over the past six months. In addition, the order-to-bill ratio has been below 1.0 for 10 consecutive months.

Connector industry order-to-shipment ratio

May 2022 was the last month in which orders exceeded sales, and since then bookings have fallen by $4.1 billion without any customer cancellations or delayed delivery dates. These are not the only indicators that we are entering a downturn in the business cycle. The performance of the semiconductor industry during the same period also confirms this.

Historically, semiconductor sales lead connector sales by several months, and the chart below shows semiconductor sales versus connector sales over the past 17 months. Semiconductor sales can be seen declining for seven consecutive months, with four of those months falling below double digits.

Another clear sign that the connector industry is entering a downward business cycle are layoff announcements from technology companies. According to relevant sources, nearly 200,000 layoffs have been announced in 2023, while the number of layoffs in 2022 will be more than 160,000. Some large technology companies in the United States, including 3M, Meta, Dell, Boeing, IBM, Google, Microsoft, etc. There are layoffs. Based on these signs, the downward business cycle faced by the connector industry has been basically confirmed, but how long this cycle will last is another difficult question.

While orders have seen double-digit declines, sales have not yet experienced this. TE Connectivity and Amphenol, the two largest connector manufacturers, also performed well, with both companies achieving sales growth in Q1 2023 (TE = 3.8%; Amphenol 0.7%) and both forecasting Q2 sales There will be a slow decline. (TE -2.4% and Amphenol -1.0%).

Additionally, factors such as a $22 billion connector backlog unaffected by order cancellations or rollouts and a pause in expected rate hikes suggest the industry may not see double-digit sales declines. So, sales are more likely to be flat in 2023 compared to 2022. Bishop's forecast is more optimistic, with a projected growth rate of +1.9%. However, this growth will not be the same across all regions or market segments, with automotive and military markets expected to outperform other industries, while industries such as computers and peripherals, mobile phones and other data equipment, and consumer electronics are expected to experience declines.