Currently, a new wave of AI is sweeping the world, and optical communication networks are an important foundation and solid foundation for AI computing power networks. The development of computing power networks has put forward higher requirements for backbone networks and large data centers. The optical base for building computing power networks urgently needs the support of new optical communication products. Its specific scenarios and business requirements include two aspects: first, backbone network transmission; The second is optical connections within large data centers. China's optical communications market is expected to reach 175 billion yuan in 2025, corresponding to a CAGR of 12% from 2022 to 2025.

Optical communication industry

Optical communication is a communication method that uses optical signals as information carriers and is developed on the basis of electrical communications. Compared with traditional electrical communication, optical communication has the advantages of huge transmission bandwidth, extremely low transmission loss, lower cost and high fidelity. As an information infrastructure, optical communication systems have been fully developed and widely used in the world.

The essential driver of optical communication network construction is the rapid and continuously growing demand for data traffic. After decades of updates and iterations, the market size has been in a state of continuous growth. As data traffic continues to grow, data transmission and bandwidth pressure on traditional bearer networks continue to increase, and the transmission rate of the backbone network will continue to upgrade from 100G to higher rates such as 200G/400G. The optical communication network technology industry chain is the supply side, and traffic growth is the demand side.

Figure 1: Current status of China’s optoelectronic communications development (* Data source: Ministry of Industry and Information Technology, Finisar )

Optical communication industry chain

Optical communication technology has been widely used for more than 20 years and has formed a relatively mature industrial chain system in the world. The most upstream are component suppliers, including PCBs, optical chips, optical active components, optical passive components, etc. The midstream includes optoelectronic devices with complete independent functions, including optical transceiver modules, optical amplifiers, optical transmission subsystems, etc. After assembly and integration, the optoelectronic devices form a communication equipment link and are ultimately delivered to network operators for use.

Figure 2: Optical communication industry chain

1. Optical chip

Optical chips are the basic components for photoelectric signal conversion. They can be further assembled and processed into optoelectronic devices, and then integrated into transceiver modules of optical communication equipment for wide application. Its performance directly determines the transmission efficiency of the optical communication system. Optical chips can be divided into laser chips and detector chips according to their functions. The laser chip is mainly used to emit signals and convert electrical signals into optical signals. The detector chip is mainly used to receive signals and convert optical signals into electrical signals.

Figure 3: Application position of optical chips in optical communication systems

Looking at the global optical chip market structure, overseas optical chip manufacturers have first-mover advantages, and there is huge room for domestic substitution of mid- to high-end optical chips. my country's optical chip companies have basically mastered the core technologies of 2.5G and 10G optical chips, but there are still some models of products with high performance requirements and high difficulty. The number of domestic manufacturers that achieve batch supply is relatively small, and there is broad room for domestic substitution in the industrial chain. Domestic manufacturers mainly include Yuanjie Technology, Wuhan Minxin, Zhongke Optical Core, Guanglong Technology, Guanganlun, Shijia Photonics, Yuanjie Technology, Elite Optoelectronics, China Electronics 13th Institute, etc.

2. Optical devices

In mid-range optical modules, optical components account for 73% of the cost, and circuit chips account for 18%. The high cost of optical components in optical modules is the core factor that determines the price of optical modules. The passive optical device market and the mid- and low-end fields of active optical devices are in a stage of perfect competition, while the field of high-end active optical devices is in a state of relatively complete competition.

There are many domestic optical device manufacturers, and the overall competitive landscape is relatively fragmented. Due to the small size of individual market segments, most optical device manufacturers have small revenue scales. Mainly because optical devices are highly customized and require a lot of labor for production, making it difficult to achieve economies of scale. Most manufacturers focus on individual categories, and there are very few companies with revenue exceeding 1 billion yuan. In addition, the production and manufacturing of different optical devices requires different equipment, and technology research and development also needs to be reorganized. Therefore, most companies focus on several subdivisions.

The characteristics of high process barriers determine that if a company wants to grow bigger in the short term, acquisitions and mergers are a relatively quick way. In recent years, acquisitions in the optical device field have occurred frequently. Guangku Technology acquires Lumentum lithium niobate high-speed modulator product line; Cisco acquires Acacia; Marvell acquires Inphi; Nokia acquires silicon photonics startup Elenion; Zhongji InnoLight acquires Chuhan Technology; Tianfu Communications acquires Northern Lights. Representative manufacturers in this link mainly include Tianfu Communications, Guangxun Technology, Shijia Photonics, Bochuang Technology, Taichenguang, Cambridge Technology, Guangku Technology and Huagong Technology.

3. Optical module

Optical modules are located in the middle reaches of the industrial chain and have relatively high profit margins in the entire optical communications industry chain. It undertakes the task of signal conversion and can realize functions such as optical signal generation, signal modulation, detection, optical path conversion, and photoelectric conversion. According to data from Yole, my country's optical module manufacturers account for more than 40% of the global market share. Among the listed companies, Zhongji InnoLight, Optics Technology and Xinyi Sheng are at the forefront.

Zhongji InnoLight's 400G series of related products have gradually been used by domestic mainstream equipment manufacturers and Internet cloud manufacturers, and will effectively assist my country's 5G and "Eastern Digital and Western Computing" construction. Guangxun Technology is one of the optical device companies with the most comprehensive product coverage in the industry. The high-end optical modules it produces include 400G and 800G series data communication modules, 400G coherent optical modules, etc. Xinyisheng provides 100G, 200G, 400G and 800G products for cloud data center customers; provides 5G fronthaul, midhaul and backhaul optical modules for telecom equipment vendors, as well as optical modules for metropolitan area network, backbone network and core network transmission. Module; provides optical module solutions for smart grid and security monitoring network service providers.

Figure 4: Distribution proportion of global optical module manufacturers (*Data source: Xingxingcha)

According to Lightcounting data, it is expected that after 2022, although 100G optical modules will still be the mainstream model in demand, with the continuous increase in capital expenditures of overseas cloud manufacturers, 200G/400G/800G silicon optical modules are expected to continue to undergo industry iterations. Module shipments may increase significantly. In the context of continuous growth in traffic, the demand for optical modules in the electronics market and data communication market will continue to exist, and it will continue to be updated and iterated at the technical level, thereby driving the upstream optical device market demand to maintain steady growth.

4. Optical fiber cable

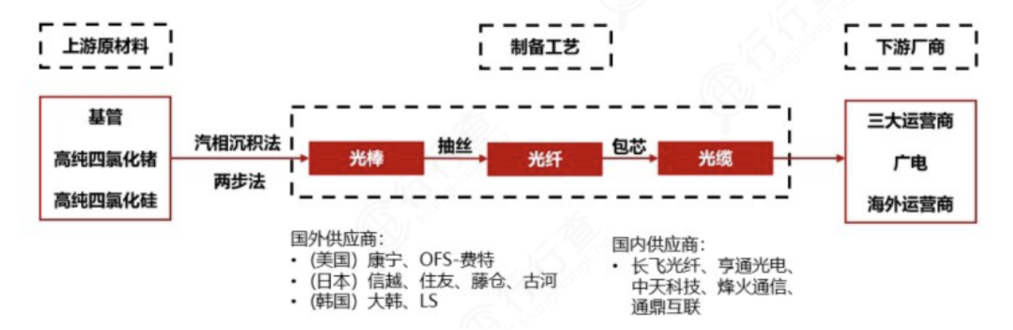

Optical fiber and cable are located in the lower reaches of the industrial chain, benefiting from the centralized procurement of operators and the high demand for 5G, experiencing both volume and price increases. The upstream fiber optic cable manufacturers make core rods and outsource the raw materials to make fiber optic rods. The downstream fiber optic cable manufacturers make fiber optic fibers from fiber optic cables through wire drawing and other processes, and then produce one-core or multi-core fiber optic cables according to demand.

It is reported that optical fiber preforms account for 70% of the profits of the industry chain due to high production technical barriers, while optical fiber drawing and optical fiber cabling processes account for 20% of the industry chain profits respectively due to relatively low technical and financial barriers and sufficient market competition. % and 10%. According to the CRU report, there are only about 20 manufacturers in the world who master the optical fiber preform preparation process. Domestic optical rod production capacity is mainly concentrated in YOFC, Zhongtian Technology, Hengtong Optoelectronics, Futong Information, Fiberhome Communications, Yongding Co., Ltd., and Tongding Internet Waiting for several leading manufacturers.

Figure 5: Optical fiber and cable industry chain ( *Data source: Xingxingcha)

As the volume of traffic increases, the disadvantages of electronic devices such as bandwidth limitations, insufficient capacity, and high power consumption are highlighted, and the phenomenon of "electronic bottlenecks" appears in communication networks. In order to solve this bottleneck, operators' backbone network lines first adopted optical communications, and gradually extended to metropolitan area networks, access networks and base stations. After the fiber optic lines were completed, the concept of all-optical network was further proposed. Data only undergoes electro-optical and photoelectric conversion when entering and exiting the network. All transmission and exchange processes in the network always exist in the form of light. The equipment in the network consists of Circuit switching is upgraded to optical cross-connect data switching with high reliability, large capacity and high flexibility.

At the key decision-making point for operators to deploy 400G, different modulation formats, optical modules, optical fibers, chips, WSS devices, etc. in future deployment plans require different consideration standards, and there are investment opportunities in related fields. Mainly including high-speed optical module light sources: Yuanjie Technology, etc.; high-speed, long-distance telecommunications optical modules: Dekeli, Xinyisheng, Zhongji InnoLight, Tianfu Communications, FiberXun Technology, etc.; OTN equipment: ZTE Communications, Fiberhome Communications ; G654.E optical fiber: YOFC, Zhongtian Technology, Hengtong Optoelectronics, Yongding Co., Ltd., etc.; WSS devices: Guangxun Technology, Tengjing Technology, etc.

However, optical networks also have disadvantages. First, the installation cost is relatively high, because the installation requirements for optical fiber are stricter, and the installation work of the optical fiber network is relatively large. Secondly, the maintenance cost of the optical fiber network is high, because the maintenance work of the optical fiber network is relatively high. The volume is large, and fiber optic network equipment is more expensive.

In an all-optical network, since there is no photoelectric conversion link, various protocols and encoding forms are supported, information transmission is transparent, and data transmission efficiency is further improved. At present, the backbone networks and metropolitan area networks of global operators have realized fiber optics, the fiber opticization of access networks in some areas has been completed, and the evolution to all-optical networks has begun.