First, "co-construction and co-sharing" to create an asset-light strategy model and ease the pressure on capital investment in the early stage

Considering that charging pile construction is a heavy asset and long-term investment, in order to alleviate the pressure of capital investment in the early stage, some operators innovatively launched the "partner" mode. Operators recruit groups or individuals who have the resources (sites, equipment, funds, etc.) needed for the construction of charging stations to jointly carry out the construction and operation of charging stations, so as to realize the rational distribution of social resources and benefit sharing. Compared with independent pile construction operation, partner mode can reduce the proportion of self-owned funds invested in charging stations, change from heavy assets to asset-light strategy, and operators focus more on the operation and maintenance of charging stations.

Second, the software and hardware upgrades are superimposed on the time-sharing charging strategy, and the charging utilization rate is gradually improved

Soft charging stack solves the problem of single pile power solidification, flexibly distributes charging power and improves equipment utilization rate. In recent years, flexible charging stacks are regarded as an important technical upgrade of charging piles. According to the technical standard definition of Technical Requirements for Flexible Charging Stacks for Electric Vehicles issued by Shenzhen Municipal Market Supervision Administration in 2017, flexible charging stacks are "all or part of charging modules of electric vehicle charging stations are concentrated together, and charging modules are dynamically distributed according to the actual charging power of electric vehicles through power distribution units, and station-level monitoring systems can be integrated to centrally control charging equipment, distribution equipment and auxiliary equipment, which can charge multiple electric vehicles at the same time." The core advantages of flexible charging reactor are:

Solve the power solidification problem of single charging pile. The power of a single charging pile is fixed, which cannot meet the charging requirements of higher-power vehicles. With the fast charging battery and the upgrading of vehicles, it cannot be "upward compatible". Flexible charging stack is a power cluster, which can distribute charging power on demand to meet the charging demand of higher power. In addition, even if the fast charging technology of electric vehicles is iterated, the charging stack can be upgraded to meet the charging demand of higher power and solve the problem of "upward compatibility".

Flexible distribution of charging power to improve equipment utilization rate. The flexible charging pile can distribute the charging power according to the charging demand issued by the vehicle BMS, which is beneficial for the charging equipment to work in the best load rate range and improve the equipment utilization efficiency of the charging pile.

Significantly reduce the investment cost, and do not need to repeatedly increase the follow-up investment. For investors, flexible charging reactors solve the problem of "upward compatibility", without worrying that the charging piles invested in the early stage do not match the charging needs of subsequent higher-power vehicles, and do not need to repeatedly increase the subsequent investment, thus significantly reducing the investment cost and improving the willingness to build charging piles.

Figure 1: Flexible charging reactor is regarded as an important technical upgrade of charging pile

The related technologies of flexible power distribution and flexible charging of head operators are relatively mature. Taking the TELD New Energy, the leading in the industry as an example, its group charging products concentrate all the power modules in the charging box transformer, which can form a power pool with a maximum of 1600kW. The original PDU power distribution scheme is adopted to realize the granular power call of a single module. Under the current situation that the public station meets the same requirements of multiple vehicles and multiple powers, the group charging equipment improves the module utilization rate through power sharing. The BEIDOU second-generation 360Kw split DC charging system charged by Star Charge uniformly controls the whole pile power, and the maximum output power of a single gun reaches 360Kw. Through the principles of distribution according to needs, overall optimization and flexible customization, the overall charging efficiency is improved by 10%, and the operational efficiency is improved.

Time-sharing charging price charging strategy is expected to adjust user demand and improve the time utilization rate of charging piles. One of the important reasons for the low time utilization rate of public charging piles is that the charging demand of users is unevenly distributed in the time dimension under the condition of limited supply. Usually, the charging peak is at 10-15:00 and 18-21:00 during the day, and the charging trough is at 23:00-7:00 in the morning, and the charging demand is moderate in other time periods. Therefore, the phenomenon of waiting in line during the peak charging period and go begging during the low charging period often occurs, which makes the charging pile unable to make full use of.

To solve this problem, the mainstream charging operators have introduced the time-sharing charging price charging strategy, which charges higher electricity charges during peak charging hours and cheaper electricity charges during low charging hours. The low-price strategy is used to encourage users to charge during low charging hours, and the charging demand is adjusted across time, so that charging piles can be fully utilized. Taking special calls and star charging as examples, the price difference between peak and valley charges can reach 0.5794 yuan and 0.5502 yuan/kWh respectively. Therefore, compared with peak, a pure tram with 50kWh charged in off-peak can save about 28.97/27.51 yuan.

The time utilization rate of charging operators is different, and it is expected that some head enterprises have crossed the break-even point. Based on the data of charging pile ownership, total power and charging capacity of each operator disclosed by China Charging Alliance in February 2023, we calculate the charging time benefit efficiency of some charging operators. According to the calculation results, the average charging time utilization rate of XIAOJU charging in February exceeded 10%, reaching 11.6%, which was at the highest level. The leading operator TELD, Star Charge utilization rate is 8.4% and 9.3%, respectively. The utilization rate of Yun Kuai Chong and China Southern Power Grid charging time is low, which is 5.7% and 3.2% respectively. According to our calculation of charging pile profit model above, we expect that head charging operators such as TELD, Star Charge and XIAOJU charging have crossed the break-even point in some months when charging demand is relatively strong this year.

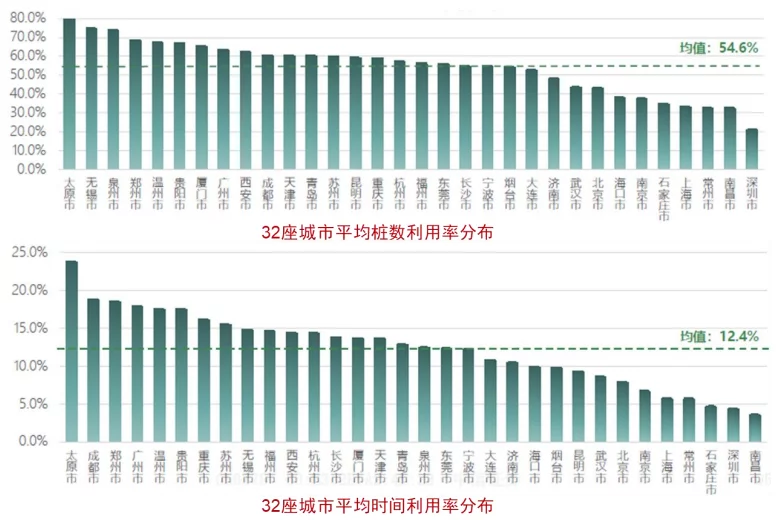

Fig. 2: Distribution of average pile number utilization rate and average time utilization rate of public piles in major cities of China in 2021

The average time utilization efficiency of public charging piles in China increased from 6.7% in 2020 to 12.4% in 2021. According to the data comparison of "Monitoring Report on Charging Infrastructure in Major Cities in China" released by China Urban Planning and Design Institute in recent two years, the utilization efficiency of public charging piles in China is gradually improving, mainly reflected in:

Average pile number utilization rate: the ratio of the number of piles providing charging services to the total number of public piles in the charging station increased by 19.7 pcts; from an average of 34.9% in 2020 to an average of 54.6% in 2021;

Average time utilization rate: The ratio of the charging working hours of all public piles in the charging station to the total service hours available in one day increased from an average of 6.7% in 2020 to an average of 12.4% in 2021, an increase of 5.7 pcts.

Third, the optical storage integration system has significant advantages, and peak-valley arbitrage improves the profitability of charging operators

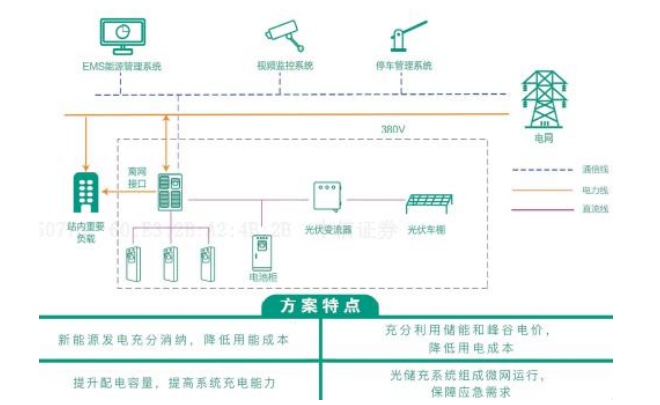

The integrated system of "optical storage and charging" has obvious advantages. The "optical storage and charging" integrated system is a green charging mode which integrates photovoltaic power generation, energy storage and charging and supports each other in coordination. Its working principle is to use photovoltaic power generation, and the surplus power is stored by energy storage equipment to jointly undertake the task of power supply and charging. The core advantages of the "optical storage and charging" integrated system are:

Peak-valley arbitrage can reduce the operating cost of enterprises: energy storage devices are used to store electric energy during the valley period with low electricity price, and stored electric energy is used during the peak period of electricity consumption, avoiding direct large-scale use of high-priced grid electric energy, which can reduce the operating cost of enterprises and realize peak-valley electricity price arbitrage.

Reduce the impact on the power grid: With the increase of the number of new energy vehicles and the popularization of superfast charging, high-power charging requires higher and higher power supply capacity of charging facilities, which brings great impact to the existing charging network system. The "optical storage and charging" system can use photovoltaic power generation for self-use, which becomes a beneficial supplement to the power grid.

Figure 3: Principle of "Optical Storage and Charging" Integrated Charging Scheme

Cost-benefit calculation: We take the "storage and charging" system consisting of 10 60kW DC piles and 1.5 MWh lithium iron phosphate batteries as an example to calculate the cost-benefit without considering photovoltaics and only considering storage. According to our calculation, the initial investment cost is about 2.69 million yuan, the static investment payback period is about 5.3 years, the total income of energy storage and charging is 5.59 million yuan, and the net income of the whole cycle is about 2.9 million yuan.

The economy of "optical storage and charging" system gradually appears, and it is expected to accelerate its popularization and application in the future. The main factor limiting the large-scale popularization and application of the "optical storage and charging" system is the economic problem. In the early stage, due to the high battery cost, poor cycle performance, small peak-valley price difference and other factors, the "optical storage and charging" system has a large investment in the early stage and a poor profit model, so its economy is not high. In recent years, with the progress of battery technology, the number of cycles has gradually increased, and the cost of batteries has been continuously reduced. The promotion of the superimposed time-of-use electricity price policy has improved the peak-valley price difference of electricity prices for industry and commerce and large industries in various places, and the economy of the "optical storage and charging" system will be further improved, which is expected to be accelerated in the future.

Fourth, vehicle-to-network interaction, orderly charging, and V2G assistance empower charging operators to transform into roles as resource aggregators.

Vehicle to network interaction refers to the interaction of energy and information between electric vehicles and power grid through charging piles, which can be divided into orderly charging and bidirectional charging and discharging (V2G) according to energy flow direction.

Orderly charging can relieve the pressure of power grid and achieve peak cut. Disordered charging means charging at anytime, anywhere and randomly. When a large number of electric vehicles are charged centrally during peak load hours, it will bring great pressure to the power grid system. According to the forecast of State Grid Energy Research Institute, the disorderly charging of electric vehicles will lead to an increase of 12% ~ 13.1% in the peak load of power grid in 2030 and 2035. According to the definition in "White Paper 2019 on Ubiquitous Power Internet of Things" issued by State Grid in October 2019, orderly charging refers to full information exchange and hierarchical control among distribution network, users, charging piles and electric vehicles, fully perceiving the changing trend of distribution transformer load, dynamically adjusting charging time and power, optimizing distribution transformer load operation curve, and realizing peak cut. This not only meets the charging needs of users, but also improves the utilization rate of distribution network equipment and power generation equipment, and reduces the investment of power network and power generation equipment.

Fig. 4: Grid load curve under disordered and ordered charging conditions

V2G technology enables electric vehicles to have load management function. V2G (Vehicle to Grid), also known as bidirectional inverter charging technology, which is equivalent to using electric vehicle power battery as a distributed energy storage system, which can transmit power to power grid through bidirectional charging and discharging piles while meeting driving requirements. When the power grid load is too low, charge the electric vehicle and store the power grid. When the power grid load is too high, the charging operator integrates the power battery resources of electric vehicles through the digital system to form a virtual power plant, which discharges to the power grid through V2G charging piles, effectively improving the operation efficiency and regulation ability of the power system and reducing the power grid load.

Figure 5: Schematic diagram of V2G system

Charging operators are high-quality resource aggregators. Compared with load-side resources such as industrial parks and commercial buildings, the adjustment of charging behavior can be realized through orderly charging and V2G technology. Therefore, electric vehicles are a relatively high-quality load resource, so charging operators serving electric vehicle charging become natural load resource aggregators. In the future, charging operators are expected to integrate scattered electric vehicle load resources and flexibly participate in power spot market transactions and auxiliary services according to the demand of power market, so as to increase profit sources.

Flexible scheduling for different charging scenarios, participating in electricity market transactions to increase profit margins. By screening suitable types of electric vehicles and charging stations, charging operators aggregate dispatchable resources to participate in power spot market, demand response market and rotating standby market transactions, thus increasing their profit margins. Generally, the types of electric vehicles with regular vehicle behavior and large charging demand are relatively high-quality adjustable resources, and operators can obtain greater profit elasticity by optimizing charging time and charging amount.

Application side: In 2022, the penetration rate of interactive charging equipment supporting vehicle network is about 10%, and the market scale is developing rapidly. According to the data in the White Paper on Large-scale Application and Development of Vehicle-network Interaction issued by China Southern Power Grid and China Electric Power Enterprise Confederation, according to incomplete statistics, in 2022, there were about 535,000 charging devices supporting vehicle-network interaction nationwide, accounting for 10.3% of the total charging equipment. Among them, the number of TELD supporting vehicle-network interactive charging devices was the largest, reaching 370,000, followed by STATE GRID, China Southern Power Grid, NIO and other enterprises; By 2022, when the national vehicle-network interactive equipment has provided about 180 million peak shaving power, the scale of the vehicle-network interactive market is developing rapidly.

Figure 6: Interactive charging equipment supporting vehicle network nationwide in 2022 (10,000 units)

The Highlights of Charging operators in the era of rushing take a claim in new markets-China.exportsemi.com