Industrial storage represents a high-margin market within semiconductor storage. Industrial applications demand higher stability in memory performance, necessitating memory manufacturers to possess cutting-edge technological capabilities as a foundation. With the development of automatic driving and telematics, the deepening of artificial intelligence application and the increase of complex sensor arrays. The demand for memory in automobile industry is increasing day by day, which will also become an important growth of storage industry in the future. According to the forecast, the global automotive storage market will rise from 2.2 billion US dollars in 2016 to 8.3 billion US dollars in 2025, with CAGR reaching 15.90%, and the proportion of automotive semiconductors will rise from 8% in 2019 to 12%.

Figure1: Source: auto sohu

Overview of Automotive Memory Chip Industry

Automotive chips can be divided into five categories: main control chips, memory chips, power chips, analog chips, sensor chips and so on. Among them, the memory chip is mainly used for data storage functions, including memory DRAM (DDR, LPDDR4 (x), etc.); FLASH (NAND FLASH, NOR FLASH); EEPROM, etc.

Specifically, DRAM and SRAM are most used in automobile scenes, such as car entertainment system, digital dashboard, ADAS, high-definition map application, driving recorder and so on. NAND is used together with DRAM, and the application scenarios are similar; NOR is mainly used in car entertainment system, ADAS and so on.

Figure2: automotive memory chip

Smart cars have higher requirements for instantaneous calculation, and vehicles need to process a large amount of data captured by sensors in real time, which puts forward higher requirements for bandwidth and space. Compared with consumer-grade devices, automotive grade memory has higher requirements in failure rate, reliability and environmental adaptability. According to the calculation, the automotive grade memory production cost has increased by about 20% compared with the consumer grade.

According to Semico Research data, there is little difference in storage capacity requirements for autonomous driving L1 and L2 levels, and 8GBDRAM and 8GBNAND are generally configured. The high-precision maps, data and algorithms of L3 and above self-driving need large-capacity storage to support: an L3 self-driving car will need 16GBDRAM and 256GB NAND; An L5-class fully autonomous car is estimated to require 74GB DRAM and 1TB NAND. According to MICRON Technology and China Flash, L2/L3 self-driving cars require about 100GB/s of memory bandwidth, and the average capacity requirements for DRAM and NAND FLASH are about 8GB and 25GB.

Figure3: smart car

Market Structure of Automotive Memory Chip

DRAM

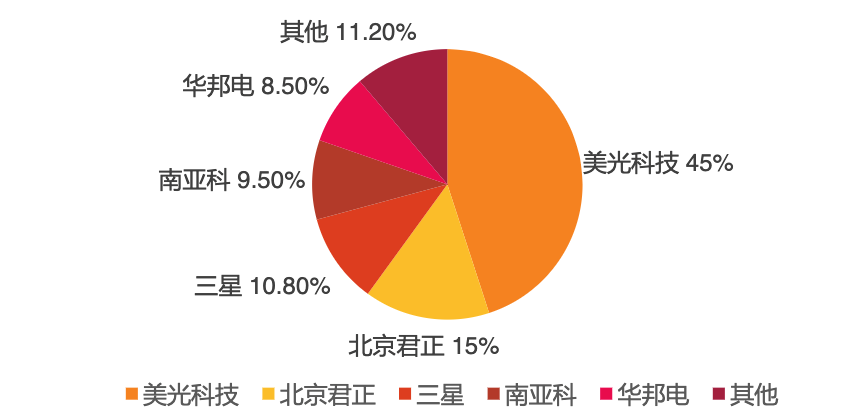

From the perspective of market structure, American and Korean enterprises are in the majority, and domestic enterprises have also developed in recent years. MICRON Technology, as the leading market, accounts for 45%. In 2021, it conducted LPDDR5 sampling test, leading the industry. INGENIC access the field of on-board memory chips after acquiring ISSI, and has reached close cooperation with downstream car companies such as BOSCH Automobile and CONTINENTAL Group.

Figure4: Global market share of automotive DRAM Storage

NAND Flash

The new four modernizations of electric vehicles drive NAND storage to evolve to large capacity and high reliability, and the demand capacity and value increase simultaneously. According to the Western Digital, the NAND capacity required by bicycles will increase from 1TB to 2TB in 2022 and 2025. With the integration of the Powertrain Domain (Safety), Chassis Domain (Vehicle Movement), Cockpit Domain/Intelligent Information Domain (Entertainment Information), Autonomous Driving Domain (Assisted Driving), and Body Domain (Body Electronics), the demand for NAND will be more than 2TB in 2025.

Source: Car2Cloud Data Driven Intelligent Drive

In terms of market structure, China, the United States, Japan and South Korea are highly competitive, and infotainment and ADAS systems have promoted the demand of the whole automobile industry for large-capacity and high-performance NAND. 256GB BGA SSD controller and firmware of SAMSUNG are independently developed by SAMSUNG, and have been evaluated by customers. At present, it has entered the mass production stage, which can achieve a sequential reading speed of 2,100 MB/s and a sequential writing speed of 300MB/s per second, which are seven times and twice that of the current eMMC respectively. Western Digital, has realized the application of UFS memory in navigation map, IVI system, remote communication, ADAS and data log.

NOR FLASH: The increasingly demands for vehicle-mounted systems, and Chinese companies occupy 70% of the market

The current automotive storage industry presents the following structural growth opportunities: On one hand, the increasing complexity of systems raises the demand for higher external storage. On the other hand, a growing number of applications are relying on high-performance processing units, driving the need for Microcontroller Units (MCU), Graphics Processing Units (GPU), Microprocessor Units (MPU), and System-on-Chip (SoC) for program and parameter storage, as well as Field-Programmable Gate Arrays (FPGA) for structured data storage. From the application scenario, the upgrade of automobile ADAS system, instrument system, cruise system and SOTA requires reliable NOR Flash storage.

Compared with DRAM and NAND Flash, NOR Flash is smaller in size. From the perspective of competition pattern, Macronix International, Winbond Electronics Corporation and Giga Device occupy the vast majority of market share. In 2016 and 2017, Micron Technology and Cypress successively announced their withdrawal from some NORFlash market competition and gradually faded out. The market share of NORFlash chips was gradually controlled by Macronix International, Windbond Electronics in Taiwan Province and Giga Device in Chinese mainland.

Analysis on the Market Structure of Automobile Memory Chip-China.exportsemi.com