The content shared in the last issue focused on Review and Prospect of Semiconductor Manufacturing Sector the summary of this issue of China exportsemi will focus on the review of semiconductor equipment/materials/EDA in 2023 and the prospect in 2024. The following will be described from the aspects of wafer manufacturing equipment, packaging test equipment and materials, semiconductor manufacturing materials and EDA design tools. The specific contents are as follows:

Review and prospect of semiconductor equipment/materials/EDA sector

Wafer manufacturing equipment: The demand for domestic equipment procurement is expected to increase significantly in 2024

Review of 2023 and Outlook of 2024; SEMI predicts that global semiconductor equipment sales are expected to reach 100 billion US dollars in 2023, down about 6.1% from 2022; Among them, the global sales of wafer manufacturing equipment in 2023 was US $90.6 billion, down about 3.7% compared with 2022. On the one hand, due to the downward impact of the semiconductor cycle, in 2023, various fabs around the world, especially storage plants, have lowered capital expenditures; On the other hand, wafer factories in Chinese mainland actively purchase equipment and machines to make up for it. According to the analysis, with the gradual recovery of the global semiconductor cycle in 2024, the global demand for semiconductor equipment and wafer manufacturing equipment is expected to increase. SEMI predicts that global semiconductor equipment sales are expected to reach 105.31 billion US dollars in 2024, a year-on-year increase of 4%; Among them, sales of wafer manufacturing equipment are expected to reach 93.16 billion US dollars, a year-on-year increase of 3%; Among them, storage customers will be an important driving force, and the year-on-year growth is expected to exceed 10%.

Figure 1: 2022-2025E Global Semiconductor Equipment Market segmentation; Figure 2: 2022-2025E Global Wafer Manufacturing Equipment Market segmentation

Capital expenditure of overseas FAB: Due to the high investment in advanced manufacturing processes and advanced packaging, it is estimated that TSMC is expected to continue to maintain capital expenditure of about 30 billion US dollars in 2024, and the capital expenditure of global logic plants in 2024 is expected to be basically the same as that in 2023; SAMSUNG and SK HYNIX actively expand HBM production capacity, which drives the demand for related process machines to increase. CICC predicts that the capital expenditure of global storage plants will increase in 2024 compared with 2023. As AIGC-driven, CoWoS and HBM production capacity have become the key bottleneck of high-performance GPU and the focus of FAB expansion, it is expected that the demand growth rate of related equipment will be significantly higher than the overall equipment demand growth rate, and the order and performance growth rate of manufacturers such as CAMTEK, SHIBAURA and OPTIMA will be higher than that of the industry as a whole.

Capital expenditure of domestic fab: According to the analysis, the capital expenditure of YANGTZE MEMORY and CXMT is expected to increase significantly in 2024 compared with 2023. At the same time, SMIC and HUAHONG are expected to maintain high capital expenditure close to 2023. In 2024, the capital expenditure of Chinese mainland fabs will increase significantly compared with 2023. At the same time, the localization rate of equipment is expected to further increase, CICC said Optimistic about the order and performance growth of domestic semiconductor equipment manufacturers, especially storage customers, which account for a relatively high proportion in 2024. Recommend AMEC, NAURA, TIOTECH, ACM Research, HWATSING, KINGSEMI, SKYVERSE-U and JINGCE ELECTRONIC; It is suggested to pay attention to SECOTE PRECISION ELECTRONIC shares.

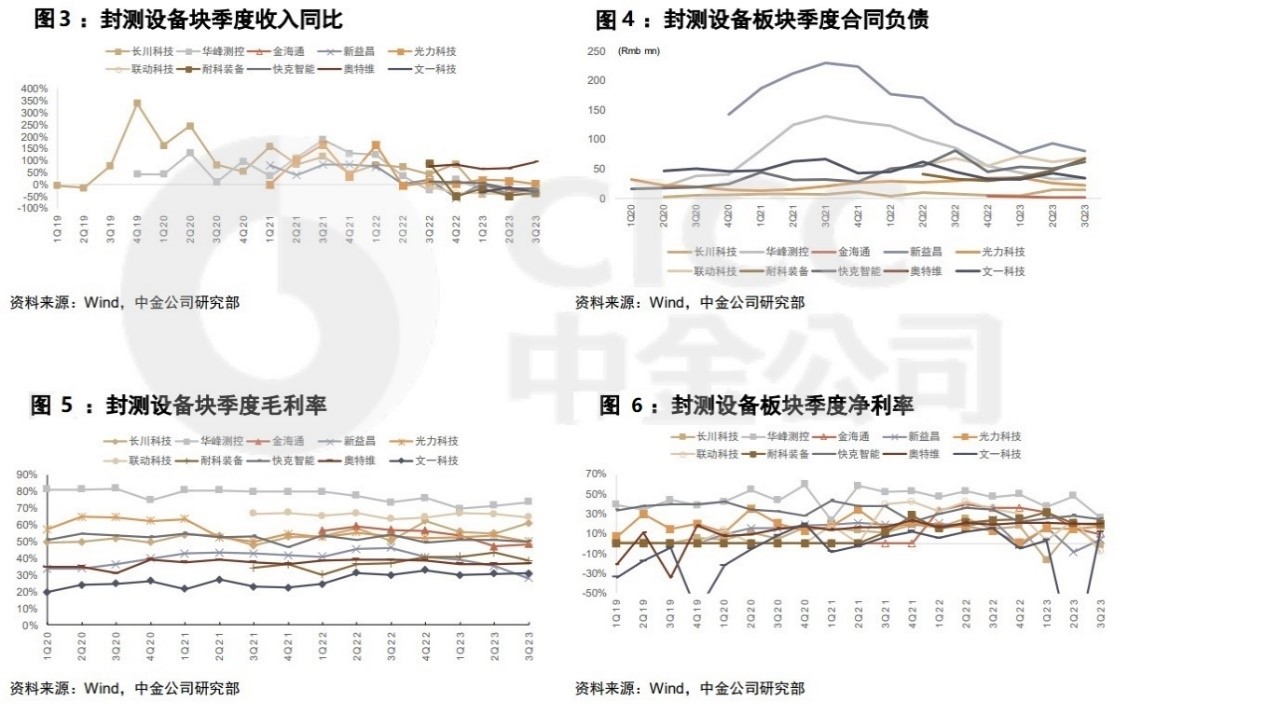

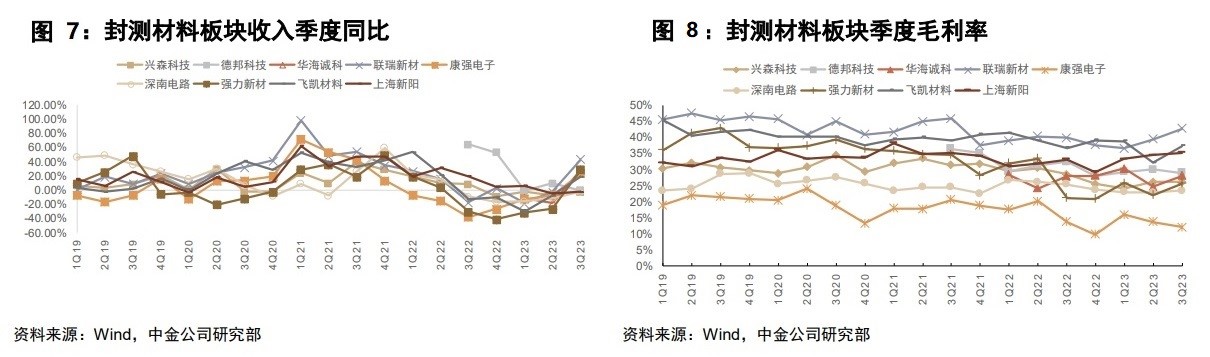

Packaging test equipment and materials: speeding up the localization process of advanced packaging industry and traditional equipment

Looking back at 2023: The packaging and testing equipment and materials sector is mainly affected by the utilization rate of packaging and testing capacity, and the overall revenue scale and contract liabilities have obviously declined in the past few quarters. Among them, the revenue still declined significantly year-on-year, but the amount of contract liabilities has basically stabilized. According to the analysis, with the gradual improvement of capacity utilization rate of packaging and testing plants, as well as the research and development of new downstream chip products and technological breakthroughs, the orders of domestic equipment manufacturers are expected to be gradually restored.

Looking ahead to 2024: Domestic equipment and material manufacturers are expected to speed up the process of advanced packaging and localization of traditional equipment. It can be seen that major domestic chip design, wafer manufacturing and packaging and testing leaders have been involved in HBM and advanced packaging industries, so the requirements for high-end packaging equipment are rapidly increasing. In this process, the domestic front equipment quickly entered the fields of exposure, electroplating, CMP, etching, deposition, cleaning, quantity detection, etc., but the technical level of domestic equipment in the fields of bonding, temporary bonding, thinning and cutting still needs to be improved. At the same time, domestic equipment in traditional fields such as flip chip, molding and ATE is expected to gradually improve the localization rate.

Figure 3: Quarterly revenue of packaging and testing equipment block year on year;

Figure 4: Quarterly contract liabilities of packaging and testing equipment sector

Figure 5: Quarterly gross profit margin of packaging and testing equipment block;

Figure 6: Quarterly net interest rate of packaging and testing equipment sector

Figure 7: The revenue of the packaging and testing materials sector was quarter-on-quarter;

Figure 8: Quarterly gross profit margin of packaging and testing materials sector

Semiconductor manufacturing materials: optimistic about the demand for advanced packaging materials and the substantial increase in localization rate

Review of 2023 and Outlook of 2024; Since the second half of 2022, the global semiconductor cycle has entered the downward channel, and the demand for terminal mobile phones, PCs, servers, etc. has weakened, which has led to a downward trend in the demand for semiconductor materials. The capacity utilization rate of 3Q23 SMIC has reached 77.1%, a slight increase from the previous month. Analysis shows that the growth rate of wafer factories has shown a weak recovery trend. Among them, because the demand for semiconductor materials keeps a certain correlation with the crop rate of the wafer factory, and the shelf life of semiconductor materials is short, it is difficult to stock up on a large scale. Therefore, it is considered that with the gradual recovery of the growth rate of downstream fabs, the demand for semiconductor materials is expected to usher in the inflection point of demand at 1H24.

At present, the localization rate of domestic semiconductor materials is still low. In 2022, the total income of domestic materials enterprises is about 15 billion yuan, while the domestic demand for wafer manufacturing materials is about 50-60 billion yuan, and the overall localization rate is about 25%-30%. However, 6-inch and 8-inch semiconductor materials are the main ones, and the localization rate of 12-inch high-end semiconductor materials is still at a low level. Since 2019, geopolitics has been changing continuously. CICC has combed the overall supply chain of semiconductor materials, in which Japanese suppliers account for more than 50% in the fields of silicon wafers, photoresists and targets, while American suppliers have a higher share in the field of polishing pads. Domestic fab began to gradually replace domestic fab materials for the sake of supply chain security. Compared with semiconductor equipment, if domestic fab cannot purchase overseas equipment, the expansion of new production capacity may be blocked. However, if materials cannot be purchased, the manufacturing progress of most existing fab will be negatively affected. Therefore, according to the analysis, semiconductor materials are still expected to continue to accelerate domestic substitution in the future.

Advanced packaging brings investment opportunities in packaging materials; According to Yole Development, the global advanced packaging market has reached 30 billion US dollars in 2020, and is expected to reach 47.5 billion US dollars in 2026, with CAGR of 8%, and advanced packaging will exceed 50% of the total packaging market in 2026. According to the analysis, with the slowdown of Moore's Law and the limited domestic wafer manufacturing process, the development of advanced packaging market will be accelerated in the future, and the demand for advanced packaging materials and the localization rate will be greatly improved.

At the same time, with the accelerated landing of advanced packaging methods such as 2.5 D and Fanout, the analysis believes that related packaging materials are expected to usher in a large demand increase. According to SEMI data, the global semiconductor packaging material market will reach 24.8 billion US dollars in 2022. According to the analysis, in the future, it is expected to benefit from accelerating industrialization of advanced packaging capacity in Chinese mainland, and packaging consumables are expected to usher in great development opportunities. It is suggested to pay attention to: ANJI MICROELECTRONICS, DINGLONG Co., Ltd. (Joint Coverage of Chemical Group), JINHONG GAS (Joint Coverage of Chemical Group), HUATE GAS (Joint Coverage of Chemical Group), YOKE Technology (Joint Coverage of Chemical Group), FASTPRINT CIRCUIT Tech, etc.

Figure 9: Carding of equipment and materials in advanced packaging process

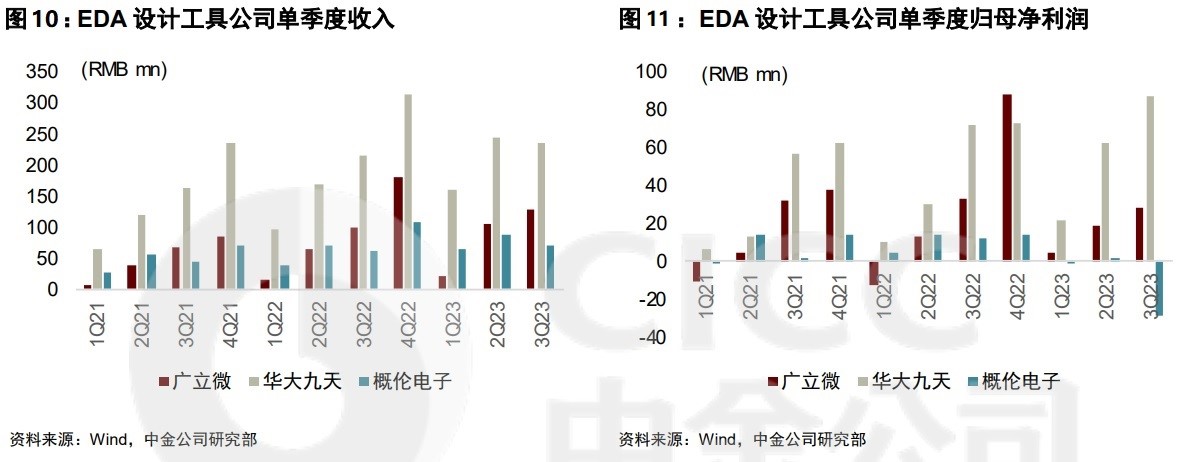

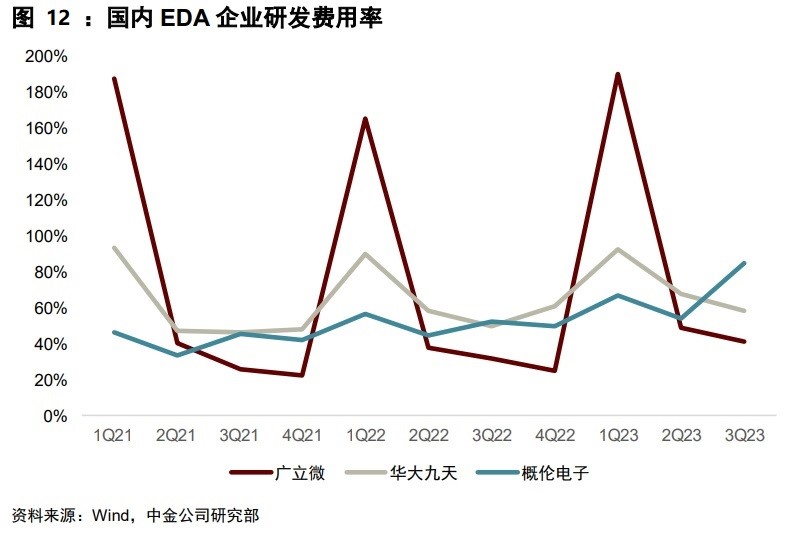

EDA design tools: The semiconductor industry is going down, and the cost control of chip design wafer manufacturing has cause negative impacts, waiting for the industry pattern to improve

Looking back at 2023: The downturn in the prosperity of the semiconductor industry in 2023 has also make a negative impact on the upstream EDA design tools. Generally speaking, the analysis shows that the income of EDA design tools has a low correlation with the overall prosperity of the semiconductor industry, mainly because the charging mode of EDA design tools is mainly "License". However, if the downturn of the industry leads to the slowdown of R&D and personnel cutting, it will have negative impact on the revenue of EDA Tools Company.

Looking ahead to 2024: According to the analysis, in 2024, the normal expansion and R&D of chip enterprises and fab will push the revenue of EDA design tool industry back to the right track of growth. At the same time, we can see that there are a large number of EDA design tools enterprises in mainland China. in the future, it is expected that there will be a peak period of industry clearing and mergers and acquisitions, and the market structure is expected to be improved.

Figure 10: Single-quarter revenue of EDA Design Tools Company;

Figure 11: Net profit attributable to the parent of EDA Design Tools Company in a single quarter

Figure 12: R&D expense rate of domestic EDA enterprises