Increasing demand of automotive grade chip

Recently, INFINEON, RENESAS, TEXAS, RAPIDUS and other enterprises have all started the plan to build factories, and the industry estimates that the investment amount of the four large factories in expanding production will exceed 25 billion US dollars. The expansion of the "Top Four", namely INFINEON, RENESAS, RAPIDUS and TEXAS. Automotive chip in the world is in sharp contrast to the layoffs of Micron, LAM Research, QUALCOMM and other companies that provide chips for consumer electronics products. The reason for this difference lies in the ever-changing market demand.

In past years, the consumer electronics market is sluggish, and the continuous expansion of production by various chip manufacturers, the final result is that the supply exceeds demand, thus the market chip price drops, resulting in miserable for various manufacturers. On the other hand, in the automobile industry, the value of chips in electric vehicles and driverless vehicles is rising, which makes the market demand for chips increase rapidly, and chip production cannot keep up with the demand of the automobile market. Especially for high-end micro-control unit (MCU) and SoC chips, the output is small and the verification cycle is long, which makes them more in short supply. In the future, as the pandemic stabilizes and the global automotive industry continues to recover, the situation of supply shortage is expected to persist due to high demand.

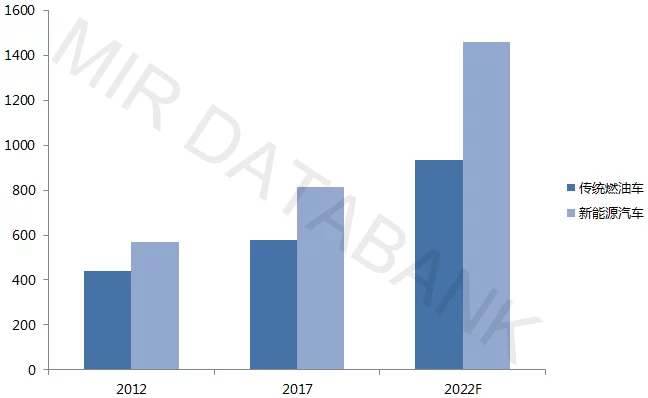

China, as a major automobile producer and market, is also significantly affected by the "chip shortage" in the automotive industry. According to the data of China Association of Automobile Manufacturers, in 2022, the production and sales of automobiles in China will be 27.021 million and 26.864 million respectively. On average, about 500 MCU chips will be used for traditional automobiles and bicycles, while 1,000-2,000 will be used for new energy vehicles. With the increasing number of chips carried by bicycles, the demand for on-board chips in China is also increasing.

Figure 1: Changes in the number of chips carried by bicycles in China

How can domestic manufacturers in China break through the lack of local brands in the automotive MCU chip market?

From the perspective of global competition pattern, the global automotive MCU market is monopolized by overseas manufacturers, and European, American and Japanese giants account for nearly 95% of automotive semiconductors. At present, the top five manufacturers in the global automotive chip market account for nearly 50%, and NXP will account for the largest share of the global automotive chip MCU market in 2020, which reaching 14%. Followed by INFINEON, RENESAS, STMICROELECTRONICS, TEXAS, BOSCH, ONSEMI and MICROCHIP, accounting for 11%, 10%, 8%, 7%, 6%, 4% and 3% respectively.

Compared with other products such as consumer electronics, automobile products require higher reliability and stability, and automotive grade MCU chips have higher requirements in the production process and longer production cycle. Therefore, automobile chip enterprises and automobile manufacturing enterprises often form a long-term and stable "binding" relationship, which makes it more difficult for Chinese rising chip manufacturers to squeeze into the global vehicle MCU market.

Figure 2: Market share of global vehicle MCU top enterprises in 2020

Secondly, from the research and development of automotive grade MCU technology, automotive grade MCU can be divided into 8 bits, 16 bits and 32 bits. The more bits of MCU, the more complex the corresponding structure, the stronger the processing capacity and the more functions that can be meet. At present, the production of MCU chips in China is mainly concentrated in low-end application fields such as automobile wipers, headlights and windows, most of which are 8-bit MCUs, while the coverage of high-end application scenarios such as electronic power steering system, electronic body stabilization system and anti-lock braking system is relatively weak.

In the short term, Chinese automobile enterprises are affected by the shortage of chips due to the epidemic situation and the market, but from a deep perspective, it is because China lacks independent chips, the domestic rate of chips is low, and it is highly dependent on the supply of foreign brand chips. In recent years, China's automotive chip market has maintained steady growth, and the market prospect is very broad. Chinese chip manufacturers are expected to seize the domestic automotive MCU market through this opportunity. "Lack of chip" is both a challenge and an opportunity for Chinese chip localization.

Figure 3: Forecast of China's automotive chip market size (US $100 million)

The global shortage of on-board chips makes some automakers have to broaden channels to purchase chips and increase suppliers, and Chinese MCU chip enterprises usher in a new interim period. At present, manufacturers including GIGA Device, shanghai Fudan Microelectronics, CHIPSEA Technology, SINO WEALTH Electronics, etc. are developing automotive grade MCU products and have successively passed AEC-Q100 (meeting device reliability standards) certification, among which GIGA Device automotive grade MCU is expected to achieve mass production in mid-2022.

GIGA Device

MCU products of Beijing GIGA Device Semiconductor Inc. are steadily entering the vehicle regulation market and actively expanding their application in the automotive field. At present, the company is actively promoting the mass production of 40nm car-level MCU products, which have been released and tested by customers. This product will mainly face the general body market, and gradually expand high-threshold applications such as ADAS and BMS in stages.

According to the latest news, GIGA Device has released the first GD32A503 series automotive grade microcontroller based on Cortex-M33 core, and officially entered the car-level MCU market. This series of products are mainly used in various electrified vehicle scenes such as body control, vehicle lighting, intelligent cockpit, auxiliary driving and motor power supply. Has passed the early user verification, and now officially opens the application for samples and development boards.

Figure 4: Zhaoyi Innovation Operation in the Third Quarter of 2017-2022

CHIPSEA

The main business of CHIPSEA (Shenzhen) Co., Ltd. is the research and development of high-precision ADC, high-performance MCU, measurement algorithm and one-stop solution for Internet of Things. CHIPSEA has complete signal chain chip design capability, and its core technologies are high-precision ADC technology and high-reliability MCU technology. CHIPSEA MCU is mainly divided into general MCU (including 32-bit and 8-bit MCU), PD fast charging MCU, computer and peripheral application MCU, vehicle-level MCU and so on. The automotive grade MCU chips being developed by the company are mainly divided into M series and R series.

The MCU of CHIPSEA. has been verified in many clients, and has begun to enter the stage of product testing and mass production introduction. At the same time, CHIPSEA has started the development and verification of the next generation of MCU products for automotive grade signal chain, which will form a series of platform products and continue to expand the intelligent cockpit and body electronics market. General MCU products based on ARMCortex-M0 core are undergoing AEC-Q100 test and certification, and will be gradually provided to automobile customers for testing and development in 2022. The target market is body electronics, car lights, seats and other applications. At the same time, CHIPSEA has officially started the design and development of MCU products that meet ISO26262 functional safety, and has launched strategic cooperation with TUV RHEINLAND Company of Germany to build an automotive electronic chip development system. All plans are being carried out in an orderly manner, and CHIPSEA will further expand its investment in automobile products and continue to expand its market territory.

Figure 5: Operation of CHIPSEA in the third quarter of 2017-2022

SINO WEALTH

SINO WEALTH. is mainly engaged in R&D, design and sales of integrated circuit chips of its own brand, and provides corresponding system solutions and after-sales technical support services. The main products are microcontroller chips and OLED display driver chips. The main products of SINO WEALTH include 8-bit 8051 core MCU, 32-bit ARM core MCU and 8051 + DSP dual-core MCU. At the end of last year, SINO WEALTH disclosed that its automotive lithium battery chips and automotive MCU chip companies were actively developing and deploying. Automotive grade MCU chips are in the stage of R&D and testing, and customers have contacted and planned to import them.

Figure 6: SINO WEALTH Operation in the Third Quarter of 2017-2022

Generally speaking, China's MCU industry started late, and its main sales are concentrated in consumer electronic products, so China's car regulation MCU is still at the low-end production level. China's "14 th Five-Year Plan" mentioned in speeding up the filling of bottlenecks such as basic components and components; The MCU chip is one of the shortcomings in the policy of improving the industrial level of communication equipment, core electronic components and key software.

With the growth of downstream demand for new energy vehicles, China's MCU market is entering a high-speed development stage, and this chip shortage is bound to stimulate Chinese manufacturers to accelerate the development of China's MCU market. With the changing market demand, the application scenarios of downstream products will become more and more complex in the future, which requires MCU to have higher integration and richer functions. Chinese MCU chip enterprises should seize the opportunity of shortage of foreign chips, increase technology research and development, and increase the proportion of R&D and production of 32-bit MCU chips to meet market demand, so as to promote the localization process of MCU chips.

Source: MIR DATABANK

In-depth analysis of China's vehicle MCU chip market-China .exportsemi.com