First, there are many categories of power semiconductors and the market scale is huge

Power semiconductor devices, also known as power electronic devices, are the foundation of power electronic technology and the core devices of power electronic conversion devices.

From the perspective of development, in the 1950s, power diodes and power triodes roll out and were applied to industrial and power systems; From 1960s to 1970s, semiconductor power devices such as thyristors developed rapidly. In the late 1970s, planar power MOSFET developed. In the late 1980 s, trench power MOSFET and IGBT gradually appeared, and semiconductor power devices officially entered the electronic application era; In 1990s, super-junction MOSFET gradually appeared, breaking the traditional "silicon limit" to meet the application requirements of high power and high frequency.

Development history of power semiconductor device

In terms of technology evolution, with the continuous improvement of social electrification, power semiconductor devices have gradually developed from simple diodes to high performance and integration. From the perspective of structure and equivalent circuit diagram, in order to meet the wider application requirements and complex application environment, the difficulty of device design and manufacturing is gradually increasing.

Taking power MOSFET as an example, the performance improvement driven by technology mainly includes three aspects: higher switching frequency, higher power density and lower power consumption. In order to achieve higher performance, MOSFET devices have experienced the process progress, device structure improvement and the use of wide band gap materials. In the manufacturing process, the line width process is reduced from 10 microns to 0.15-0.35 microns, which improves the density, quality factor (FOM) and switching efficiency of power devices; In the aspect of device structure improvement, the power device has experienced structural changes such as plane, trench and super junction, which further improves the power density and working frequency of the device; In terms of materials, the emerging third-generation semiconductor power devices use silicon carbide (SiC) and gallium nitride (GaN) materials, which further improve the switching characteristics of devices, reduce power consumption and improve their high temperature characteristics.

Evolution featured

Up to now, according to different categories, power semiconductors have gradually formed two categories: power IC and power devices. Among them, MOSFET and IGBT are voltage-controlled switching devices. Compared with current-controlled switching devices such as power triodes and thyristors, they have the characteristics of easy driving, fast switching speed and low loss, and have gradually become the mainstream products of power devices. At present, their total proportion is about 71%.

In terms of market size, according to Omdia data, the global power semiconductor market will reach 45.2 billion US dollars in 2020, including 24.3 billion US dollars for power IC and 20.9 billion US dollars for power devices. Among power devices, the market size of diode, thyristor, BJT, power MOS and IGBT is 3.87 billion US dollars, 470 million US dollars, 1.81 billion US dollars, 8.1 billion US dollars and 6.65 billion US dollars respectively. With the gradual advancement of the carbon peak and carbon neutrality policy, it is predicted that the global power semiconductor market will reach 52.2 billion US dollars by 2024.

As the world's largest consumer of power semiconductors, China's power semiconductor market will reach US $17.2 billion in 2020, accounting for 38% of the global market. It is predicted that China's power semiconductors will continue to maintain steady growth in the future, and the market size is expected to reach 20.6 billion US dollars in 2024.

Second, domestic semiconductors break through low-end products and break through monopoly to achieve partial import substitution

As the core of power conversion and circuit control of power electronic devices, power semiconductor can realize the functions of frequency conversion, phase transformation, voltage transformation, inverter, etc. It plays an irreplaceable key role in the current application fields such as high power, high current, high frequency and high speed, and many semiconductor manufacturers at home and abroad regard it as the focus of business layout.

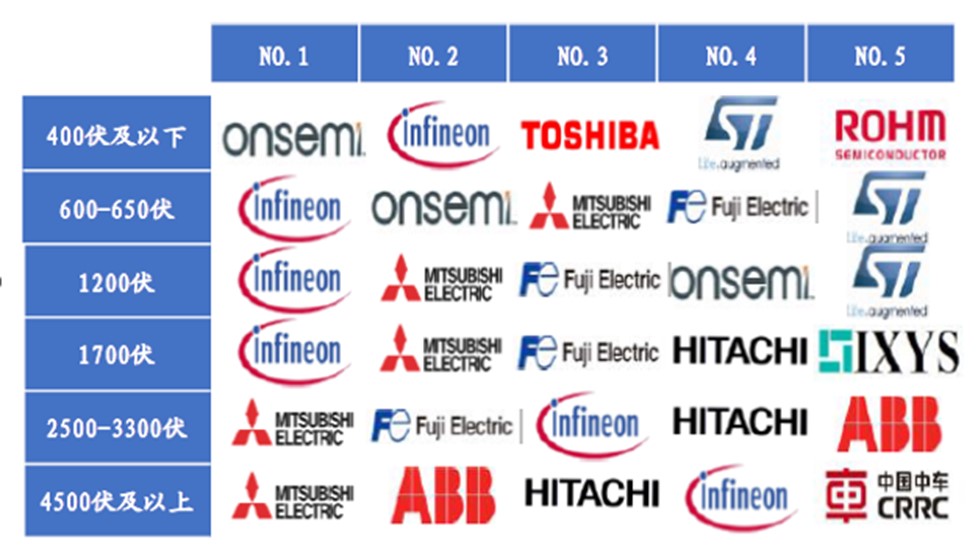

In the international market, the top ten high-power semiconductor manufacturers in 2021 are INFINEON, ONSEMI, STMICROELECTRONICS, MITSUBISHI, FUJI Electric, TOSHIBA, VISHAY, NEXPERIA Semiconductor, RENESAS and ROHM. Among them, INFINEON ranked first with sales of 4.869 billion US dollars, with a market share of about 20%. As an independent company in the semiconductor department of SIEMENS, with earlier technology accumulation, INFINEON occupies a dominant position in the power semiconductor fields such as IPM, frequency converter, medium voltage (wind power, subway), high voltage (high-speed rail, power grid), electric vehicle and photovoltaic; ONSEMI ranked second with sales of 2.051 billion US dollars, with a market share of about 9%; The total market share of the 3rd-10th place is about 30%, and the ranking changes slightly every year.

In addition, it is worth noting that half of the enterprises in the list are Japanese enterprises, namely MITSUBISHI, FUJI Electric, TOSHIBA, RENESAS and ROHM, and the revenues of the five enterprises have generally remained at about 32% ~ 33% of the total revenues in the list in the past three years. Among them, MITSUBISHI Electric, as the leader of Japanese power semiconductors, occupies a dominant position in the fields of medium and high voltage power semiconductors such as single tube, IPM, high-speed rail, power grid and electric vehicles.

top ten high-power semiconductor manufacturers in 2021

Compared with the strong market share of American, Japanese and European manufacturers, only NEXPERIA Semiconductor is selected as the top ten in the global power semiconductor list in China. It is understood that NEXPERIA Semiconductor used to be PHILIPS Semiconductor Standard Products Division, with a development history of about 60 years. It was acquired by WINGTECH in 2019. At present, it has more than 14,000 employees and 6 factories in the world. In its product line, diode products rank first in the world, and small MOSFET ranks second in the world.

In the domestic market, most of China's power devices such as power diodes, power triodes and thyristors have been localized, while power MOSFET, especially high-end power devices such as super junction MOSFET and IGBT, depend on imports to a large extent due to their technical and technological complexity.

Although major international manufacturers occupy the main market at present, due to the high price of their high-end products, they cannot meet the rapid outbreak of domestic market demand, resulting in an imbalance between supply and demand in the domestic market. In recent years, driven by multiple favorable factors, such as the encouragement of national industrial policies and the continuous improvement of industry technology level, some enterprises in the industry have continuously introduced international advanced technologies and gradually formed their own competitiveness through the independent innovation mode of "subdividing products + cost performance", and achieved rapid development.

According to the data of China Semiconductor Industry Association, the top ten power semiconductor enterprises in China in 2021 are NEXPERIA Semiconductor, CHINA RESOURCES MICRO, YANGJIE Technology, SILAN MICROELECTRONICS, SINO MICROELETRONICS, JIEJIE MICROELECTRONICS, STARPOWER, NECPOWER, BYD and TIMES ELECTRIC. Among the top ten enterprises, NEXPERIA Semiconductor products have the most comprehensive coverage, basically covering major product lines such as diodes, MOS, IGBT and SiC; In addition, the products of established power device manufacturers such as SILAN MICROELECTRONICS, CHINA RESOURCES MICRO and YANGJIE Technology basically cover the mainstream MOS and IGBT products in the market; BYD Semiconductor and Times Electric, backed by their parent companies, have a strong terminal market. Besides their own use, related power devices have also dabble to the market and bulk shipping to other major customers.

Third, power devices are widely used, and there is huge incremental market space for new energy

As the core device of power conversion and circuit control, power semiconductors play the roles of power conversion, power amplification, power switch, line protection and rectification in electronic circuits, and are widely used in power electronic fields such as automobiles, industrial control, new energy power generation, consumer electronics, 5G communication, rail transit, etc., to help them achieve the power conversion goals of improving energy conversion rate and reducing power loss.

From the global downstream application distribution of power semiconductors, according to the data of TRENDFORCE, automobile, industry and consumer electronics are the main demand sources, accounting for more than 75% in total for many years. Specifically, the automotive sector accounts for 30%, the industrial sector accounts for 27%, consumer electronics accounts for 22%, and the rest account for about 21% in total.

1. The volume and price of automotive power semiconductors have risen, and they have been promoted to the largest application market of power devices

Automobile is the most important downstream application field of power semiconductor, and new energy vehicles drive its market to develop rapidly.

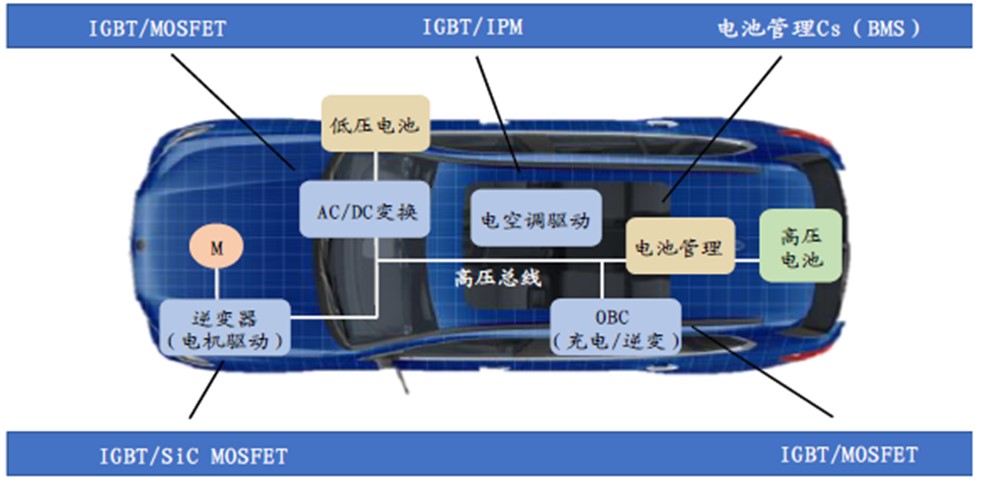

In terms of application scenarios, the electrification of automobiles brings about a rapid increase in the application scenarios of internal power semiconductors. Compared with fuel vehicles, electric vehicle power devices have higher requirements for working current and voltage, and the new requirements mainly come from the following aspects: IGBT module in inverter, high voltage MOSFET in DC/DC, IGBT discrete devices in auxiliary electrical appliances, and super junction MOSFET in OBC.

Application scenarios

In terms of value, compared with traditional fuel vehicles, the value of power semiconductors of new energy vehicles has been significantly improved. Generally speaking, the greater the power of new energy vehicles, the higher the degree of electrification, and the greater the value of single-vehicle power semiconductors. According to INFINEON data, the value of single-vehicle power semiconductor of new energy vehicles can reach 400 US dollars, which is about five times that of traditional fuel vehicles. Driven by the rising volume and price, the market share of power semiconductors in the automotive field has increased year by year, and now its proportion has surpassed that of industry, becoming the largest application market of power semiconductors.

2. The demand for power semiconductors in industrial control and automation is increasing

Power semiconductors are very important for the further automation of factories. With the continuous upgrading of manufacturing industry, the demand for high-performance power semiconductor devices is increasing in industrial manufacturing, logistics and other process transformations, which is expected to maintain a rapid growth rate in the future.

Taking IGBT as an example, as the most representative product of power electronics technology, IGBT is the core component in the field of industrial control and automation. It can adjust the voltage, current, frequency and phase in the circuit according to the signal instructions in industrial devices, so as to achieve the purpose of precise regulation. Its application scenarios include frequency converter, inverter welding machine, electromagnetic induction heating, industrial power supply and so on. It is reported that in 2021, the global industrial control IGBT market is about 15 billion yuan, of which China's industrial control IGBT market is about 3.5 billion yuan, accounting for about 1/4 of the global market. It is estimated that it will maintain a steady growth of 3%-5% in the next four years, and the global industrial control IGBT market will reach 17 billion yuan by 2025.

Taking the most commonly used frequency converter in the field of industrial control as an example, the frequency converter is a power control equipment that changes the power supply frequency, thus adjusting the load, reducing power consumption, reducing the loss of operating equipment and prolonging the use of equipment. Among them, IGBT module acts as an inverter switch in the braking and DC/AC parts of the frequency converter, which is the core device of the frequency converter and widely used in the industry.

3. New energy power generation has become the main incremental market for power semiconductors

In the field of new energy, there is a large demand for power semiconductors in photovoltaic, energy storage and wind power generation. Taking photovoltaic as an example, according to the data of the International Energy Agency (IEA), the cumulative installed capacity of photovoltaic power generation in the world in 2021 was 942GW, up 22.8% year-on-year. Among them, China's cumulative installed capacity is 308.5 GW, up 21.7% year-on-year, ranking first in the world. In the field of photovoltaic inverters, Chinese manufacturers continue to exert their strength, and SUNGROW, HUAWEI and GINLONG have ranked among the top three in global shipments, temporarily forming a "Tripartite balance" situation.

According to the announcement of GINLONG, IGBT-based semiconductor devices account for about 10% of the inverter cost, and play a role in rectifying and inverting electric energy, so as to realize the functions of AC grid connection of new energy power generation and charging and discharging of energy storage batteries. Therefore, IGBT and other power devices will fully receive the rapid development of light, storage and wind power. According to the calculation of TIANFENG Securities, the global demand value of IGBT for wind power, photovoltaic and energy storage will increase from 8.67 billion yuan in 2021 to 18.25 billion yuan in 2025.

Compared with foreign large manufacturers, there is a certain gap in product stability and technical indicators in domestic photovoltaic energy storage IGBT, which fails to fully meet the technical requirements of products. Therefore, there are few domestic manufacturers in this area at present, and the localization rate of domestic photovoltaic energy storage IGBT is close to zero in 2020. However, the good thing is that the promotion of optical storage and charging integration based on distributed photovoltaic is expected to change this situation. In 2021, Starr Semiconductor, SILANMICROELECTRONICS, TIMES Electric, YNGJIE Technology and NCE POWER Photovoltaic IGBT all made breakthroughs in revenue. In the future, with the popularization of optical storage and charging integration, related companies are expected to usher in rapid volume growth.

4. The increment of the consumer market comes from the fast charging and home appliance frequency conversion market

- The popularization of fast charging drives the rapid development of gallium nitride power chips

In recent years, with the gradual improvement of people's charging requirements, the "fast charging" mode has appeared in mobile phone charging. The fast charging charger made of GaN with lower cost, smaller volume and higher concentration has developed rapidly, which drives the demand for power semiconductors to rise.

Generally speaking, the fast charging mode mainly achieves high current charging by increasing the voltage, but the high voltage is accompanied by potential safety hazards, which needs to be adjusted by adding synchronous rectifier MOS transistors. Later, a safer flash charging mode appeared, that is, high-speed charging was realized by low voltage and low current, which required higher synchronous rectifier MOS transistors. Up to now, GaN-mos tube is widely used in the industry, which can achieve the purpose of less heat and small volume.

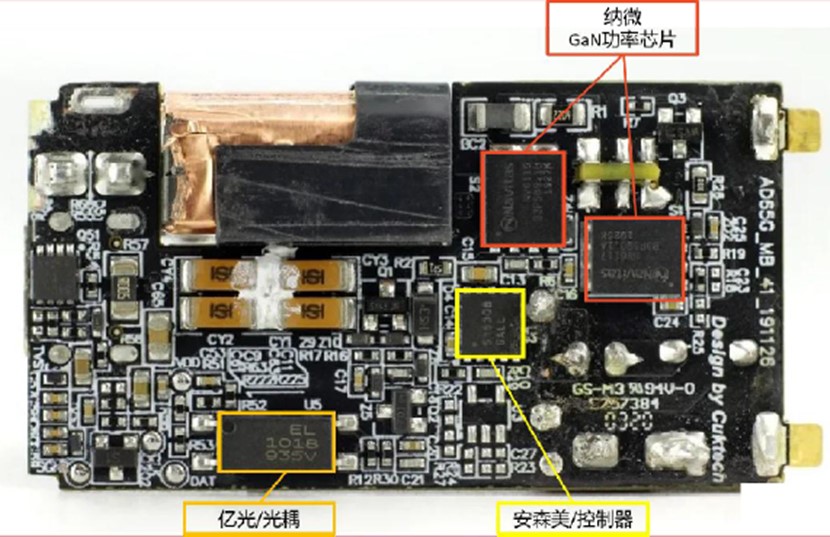

Taking XIAOMI 65W GaN PD fast charging charger as an example, compared with ordinary 65W PD fast charging and 45W PD fast charging, GaN effectively reduces the volume of fast charging head. According to Yale's forecast, the target market of GaN power supply will reach 240 million US dollars in 2022, among which GaN charger will become the biggest hot-selling product.

With the rapid expansion of GaN charger market, the demand for matching GaN power chips is expected to further increase. At present, NAVITAS is in a leading position in this field, and manufacturers such as XIAOMI, OPPO, BASEUS and ANKER all use NAVITAS gallium nitride power chips. According to NAVITAS, as early as May 2021, the company shipped more than 20 million gallium nitride power chips, and the company is actively expanding production to meet the growing demand of the industry.

- Traditional household appliances are gradually developing towards frequency conversion, and the demand for IPM modules is further increasing

In the field of home appliances, traditional home appliances are gradually developing towards frequency conversion, which can not only promote the continuous expansion of IPM market, but also provide stable market demand for IGBT and MOSFET.

In terms of penetration rate, according to the data of CMM, in 2020, the proportion of frequency conversion appliances in smart home appliances such as white electricity, kitchen electricity and household appliances will be 45%, 25% and 28%, respectively, and there is much room for upgrading in the future. From the overall consumption of MOSFET, IGBT and other power devices, according to INFINEON data, the value of single power semiconductor of variable frequency household appliances can reach 9.5 euros, which is nearly 13 times higher than that of non-variable frequency household appliances. Driven by the demand for frequency conversion of home appliances, the global scale of power semiconductors related to home appliances is expected to increase from 2.645 billion euros in 2017 to 5.779 billion euros in 2022, with a compound annual growth rate of 17%.

The demand for power semiconductor devices in 5G communication has increased fourfold

In terms of communication, with the acceleration of the construction of 5G communication base stations, there will be a huge demand for power semiconductors. The main driving force comes from the density and power requirements of base stations, and the demand for Massive MIMO RF antennas, fog computing and cloud computing will increase. According to the data released by Huawei official website, the power required by 4G base stations is 6.877 kW, while that required by 5G base stations is 11.577 kW, with an increase of 68%. For multi-channel base stations, the power requirement may even reach 20kW. Higher coverage density and greater power demand have produced greater demand for power devices such as MOSFET.

Impact of 5G antenna evolution on power semiconductor usage

In addition, 5G networks are mainly deployed in high frequency bands, that is, millimeter wave bands (mm Wave). Because the received power is proportional to the square of wavelength, the signal attenuation of millimeter wave is serious, and the transmission power is limited, so the deployment of 5G network needs to use Massive MIMO technology to increase the number of transmitting antennas and receiving antennas. According to INFINEON statistics, the value of power semiconductors required by traditional MIMO antennas is about US $25, but after the transition to Massvie MIMO antenna arrays, the value of power semiconductors such as MOSFET required has increased to US $100, which is four times that of the original.

Compared with traditional MOSFET technology, super junction MOSFET power devices based on charge balance theory can significantly reduce the on-resistance per unit area of MOSFET at high voltage. At the same time, super junction MOSFET has extremely low FOM value, so it has extremely low switching energy loss and driving energy loss. Therefore, super-junction MOSFET is expected to achieve rapid growth in the future under the "double-click of quantity and price" of the number of base stations and the value of single unit. It is estimated that by 2025, the global market size of super-junction MOS of 5G communication base stations is expected to reach 199 million yuan, of which the market size in China is 140 million yuan.

6. There is more possible for domestic replacement of IGBT in rail transit

In addition to being widely used in new energy vehicles, power semiconductors are gradually increasing in the field of rail transit. Taking high-speed rail as an example, high-voltage alternating current is converted into three-phase alternating current with adjustable amplitude and frequency through traction converter, which is input into three-phase asynchronous/synchronous traction motor, and drives wheels to run through transmission system, while IGBT is the core of traction electric rotation. By April 2021, the national railway mileage had increased from 98,000 kilometers in 2012 to 146,300 kilometers, with a growth rate of 49.29%. In addition, there are a series of rail transit application scenarios such as subway and light rail, and IGBT still has great room for growth in this field.

It is worth noting that although China has become the country with the most complete high-speed rail system technology, the strongest integration capability, the longest operating mileage, the highest running speed and the largest scale under construction in the world, at present, IGBT devices in this field in China mainly use the products of ABB, MITSUBISHI, INFINEON, TOSHIBA and other large manufacturers, and only a few domestic manufacturers such as Time Electric can have the technology and product reserves in this field. However, this is both a challenge and an opportunity. With the gradual development of the technology of power device manufacturers in China, there will be a broad space for domestic substitution in the future.

IGBT device

Semiconductor power devices originated in Europe and America, but Japan climbing up from behind and occupying for half of the country. Compared with foreign manufacturers, there is still a big gap in product structure, technical level and innovation ability in domestic power device industry, and some high-end MOSFET and IGBT products still rely heavily on imports. However, power devices are different from digital chips in that their technology iteration speed is slow and their service life is long. Moreover, customers mainly pursue the stability and reliability of products, and their willingness to pursue new technologies is not high. Therefore, although there is a big gap at present, the industry has left enough time for local power device manufacturers to develop and catch up.

Through the continuous introduction of international advanced technology and independent innovation, domestic high-quality enterprises have made great breakthroughs in technical level, production technology and product quality, and gradually realized import substitution of related products by virtue of their cost and regional advantages. In the future, with the improvement of technical level and the accumulation of management experience, domestic related enterprises are expected to further form competitive advantages over foreign enterprises and occupy a larger market space.

Analysis of Market Situation and Industry Opportunity of Semiconductor Power Devices-China exportsemi.com