It is understood that the annual output of Chinese automobiles increased from 1.83 million in 1999 to 27.02 million in 2022, and the global proportion increased from 3% to nearly 50%. Among them, the development momentum of new energy vehicles in China is particularly rapid. According to the statistics of China Association of Automobile Manufacturers, the production and sales of new energy vehicles in China will be 7.058 million and 6.887 million respectively in 2022, up 96.9% and 93.4% respectively year-on-year. China's automobile industry has shown strong development resilience. For China's semiconductor industry, a new automobile era is opening, and a new automobile chip era has arrived. The industry predicts that it will become the key node of chip localization supply in 2025.

MCU: The Core of Automobile ECU

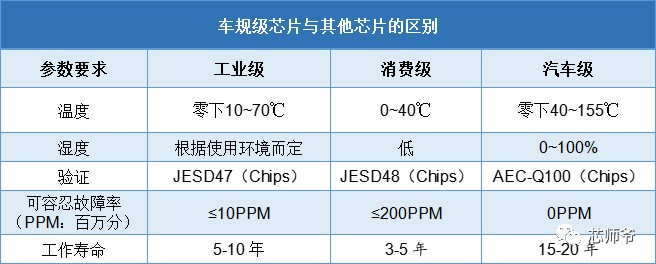

MCU is a micro-control unit that integrates CPU, memory, timer and input and output interfaces on the same chip, also called single chip microcomputer. MCU is mainly used for automatic control products and equipment, and can be applied to industry, automobile, communication and computer, consumer electronics fields. Compared with consumer-grade and industrial-grade chips, automotive-grade MCU has higher environmental requirements, reliability requirements and supply cycle requirements.

Difference between automotive grade chip and other chips

There is also a special certification process in the automobile market for automotive grade chips. In the automotive field, chip applications can be divided into factory-installed products and after-market. Factory-installed products refers to the parts installation completed in the car factory before leaving the factory, while after-market refers to the parts installation after leaving the factory. Some enterprises also call the front-loading market To B market and the rear-loading market To C market.

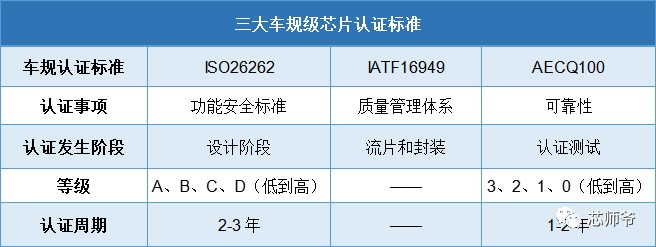

To dabble in factory-installed product market, chips need to pass the strict AEC-Q100, IATF16949 and ISO26262 certification systems, which are "automotive grade" in the strict sense; However, in the after-market, because the application scenarios have low requirements on the reliability and performance of chips, chips whose performance meets the requirements can get on the bus without passing the certification of automotive grade. Before 2019, most of the domestic MCU products were applied in the front-loading market. In recent years, with the maturity of the market and the original chip technology, the front-loading market has become the main battlefield of domestic MCU.

It is difficult and long for the automotive grade chip to pass the automotive grade certification, and it often takes 3-5 years from film streaming to mass production and shipment. In the core-deficient extreme environment of the previous two years, there is room for this period to be shortened. It should be noted that AEC-Q100 and ISO26262 certification are also divided into grades. Even if they are both automotive grade chips, the certification standards for automotive grade chips are different in different application scenarios.

Three major automotive-grade chip certification standards

During the long certification period ranging from one year to three to five years, chip suppliers can't get income from automobile manufacturers. However, once a certain chip successfully enters the supply chain of the vehicle factory-installed product market, it can enjoy a supply period of at least 10 years during the normal service life of the vehicle, with considerable long-term benefits.

In the field of automobile, automobile electronic control unit (ECU) is a special microcomputer controller for automobile, which is called "driving computer" and "vehicle-mounted computer". MCU chip is the core computing device of ECU, which undertakes the computing function of ECU. Each ECU unit on the automobile needs to be equipped with an MCU chip. With the improvement of intelligence and electrification of the automobile, the demand for single MCU chips can reach tens to hundreds.

Product performance is distributed from low to high, and the specifications of MCU applied in automotive field can be generally divided into 8-bit, 16-bit and 32-bit. The number of bits in MCU refers to the number of bits of binary numbers processed by CPU every time. The more bits, the more significant numbers of data, the higher the accuracy and the smaller the operation error. Under the same operation speed of CPU, the more bits, the faster the processing speed, which is an important index to measure the performance of MCU. MCU is involved in everything from simple control of windows, air conditioners and seats to body control, engine management and even intelligent driving. According to the difference of application environment and safety consideration standards, the MCU specifications selected by automotive electronic system schemes are different.

8-bit MCU has low cost/power consumption, is easy to explore, and its performance can meet the needs of most low-order control scenarios. It is widely used in basic functions such as fans, wipers, skylights, seat control and other automotive fields; 16-bit MCU, with computing power between 8-bit and 32-bit MCU, is mainly used in power transmission systems, such as engine control, gear and clutch control and electronic turbine system; It is also suitable for chassis mechanism, such as

suspension system, electronic power steering wheel, torque decentralized control and electronic help, electronic brake, etc.; 32-bit MCU has stronger computing power, can meet the needs of high-speed processing, and is mostly used to solve complex scene problems, such as intelligent cockpit, body control, assisted driving, driving safety system and other fields.

In terms of price, the unit price of 8-bit MCU is generally less than US $1, the unit price of 16-bit MCU is between US $1 and US $5, the price of 32-bit MCU is between US $5 and US $10, and some high-end products are above US $10. However, in the extreme shortage of the market, the unit price of automobile MCU fluctuated greatly. MCF5282CVM66, a 32-bit MCU owned by TI, soared rapidly in September 2022, and once sold for 5,000 yuan. After that, the unit price of the chip once dropped to 2,000 yuan, and then rose to more than 4,000 yuan in March 2023.

In recent years, due to the rapid development of automotive intelligence and electrification, the application scenarios faced by automotive electronics are becoming more and more complex, and the consumption of 32-bit MCU is gradually increasing, which further reduces the unit price of 32-bit MCU. Driven by the improvement of performance requirements and the reduction of product unit price, 32-bit MCU currently accounts for the highest proportion of applications in the automotive field.

Tu Chaoping, senior product manager of AUTOCHIPS, said, "32-bit MCU accounts for nearly 80% in the automotive field and is the mainstream. From the perspective of product trends, the proportion of 32-bit products will continue to increase in the future, mainly replacing 16-bit products. With the increasing demand for refined control of automobiles, the proportion of 32-bit products will increase after a period of verification in transmission and safety. "

In the past two years, domestic MCU manufacturers generally choose 32-bit MCU as the first product of their vehicle product line. Besides product specifications, architecture choice is also a major factor affecting the application of MCU in automotive field. First, the architecture can save the memory space occupied by program application and reduce interrupt delay to a certain extent, which can affect the performance of MCU products; Second, due to the conflict of marginal politics and the consideration of supply chain security, some automobile manufacturers will consciously choose to adopt architecture chips with higher supply safety factor.

At present, in the fields of consumer electronics, industrial automotive control, medical care, etc., MCU is mainly based on ARM kernel architecture, and RISC-V architecture is gradually emerging; In the automotive field, Arm Cortex-M kernel follows its advantages in other fields. Most domestic MCU manufacturers adopt this series of architectures, which are only different in specific series; There are also a few MCU manufacturers who adopt open instruction set self-developed kernel in a different way, such as KungFu kernel R&D by CHIPON in 2012 and C*Core of Suzhou CCORE Technology PowerPC architecture established in 2001. The advantage of self-developed architecture lies in independent property rights, but it also faces the challenge of ecological construction, which requires enterprises to invest a lot of energy in construction.

Domestic chip original factory gaol oriented to automotive grade MCU

For a long time, due to the high market entry threshold of automotive MCU and the fact that the automotive market is dominated by overseas brands in the world, the global supply of automotive MCU is mainly controlled by overseas manufacturers, and the pattern is relatively stable; Domestic semiconductor manufacturers mainly compete in the fields of consumption and low-end industrial control, and the market share of automotive MCU products is low.

According to Omdia statistics, the top five MCU manufacturers in the world in 2021 are NXP, RENESAS Electronics, STMICROELECTRONICS, INFINEON and MICROCHIP Technology. Earlier data show that the top ten suppliers in the global MCU market account for more than 95%, and all of them are overseas enterprises, in other words, the domestic MCU market accounts for less than 5%.

On the whole, the domestic automotive grade chip is still in its infancy at present. In 2021, the trend of automobile core shortage once accelerated the application progress of MCU in China: at that time, the price of chips soared, and the prices of various types of automobile chips generally increased by 5 times to 20 times. However, it is still "hard to find a core", among which MCU chips are the most scarce. During this period, MCU of the original domestic chip factory won the favor of many automobile manufacturers and won many opportunities for certification in parking lots. However, due to the insufficient selection of MCU products in China, not many enterprises can share the dividend.

Most domestic MCU chip manufacturers still stay in the field of body control, and a few have moved their product layout to the field of power integration with higher requirements for safety and performance, and have the ability of domestic substitution. This is directly related to the late development of MCU manufacturers in the automobile market. According to incomplete statistics, at present, 23 chip enterprises in China have laid out MCU product lines.

In addition, many chip design companies are accelerating the research and development of automotive grade MCU. For example, Wuhan P&S Information revealed through the interactive platform in early 2023 that the company's self-developed MCU chip is expected to complete the AECQ100 professional organization certification in the first half of 2023. After the above certification is completed, import it into customers for client certification; SINOWEALTH Electronics also said that its first 32-bit MCU engineering product has been sent samples for testing at multiple clients.

It is not unreasonable for domestic manufacturers to focus on MCU track. From the perspective of market demand, on the one hand, automotive MCU is welcoming a period of rapid development with rising volume and price. Traditional cars and bicycles use about 70 MCUs on average, while more than 300 MCUs are needed to realize electrification and intelligence of cars. The application fields of MCUs include ADAS, body, chassis and safety, infotainment, power system, etc., which are almost ubiquitous in body systems.

On the other hand, due to the development of geopolitics, in order to ensure the safety of supply chain, the policy has already encouraged the development of local chip supply chain, and in the automotive MCU, there is a huge space for local substitution. An engineer from a well-known Tier 1 manufacturer said, "There will be a guide to localization in policy. The specific performance is that the cost of local chips should account for a certain proportion of the supply chain for the OEMs in the whole industry."

From the supply point of view, automotive grade MCU is a famous category with high technical threshold and long return period. However, after years of experience and technical accumulation in consumer electronics, domestic chip enterprises that have launched the automotive grade MCU track for the first time in recent years have the strength to make automotive grade MCU that can meet the needs of most automobile scenes. Xu Xuexun, director of the Electronic Chip Division of GEEHY MICROELECTRONICS, said: "At present, the technical layout and product planning of GEEHY automotive grade chips fully consider different levels of electronic architectures to meet the needs of automotive electronic products and meet challenges, while paying attention to iterative upgrades and scalability."

Another kind of enterprises that have been making automobile chips since their inception have accumulated automobile market and technology for more than ten years, and have made small achievements in the automobile field. Tu Chaoping of AUTOCHIPS revealed: "Many domestic MCU manufacturers have begun to upgrade and transform, develop high-performance MCU chips, and the acceptance of domestic customers is also improving simultaneously."

In the external market environment, domestic new energy vehicle brands, such as BYD, XPENG, LI AUTO, NIO, etc., are booming and the semiconductor industry is maturing day by day, which also has the strength to nourish the growth of automotive grade MCU. "From the perspective of design capability, the technical parameters of domestic automotive grade MCU can be on par with international manufacturers in some fields, which is an opportunity to improve the chip self-sufficiency rate. From the perspective of process manufacturing, MCU process nodes are concentrated in mature processes of 40nm and above, and advanced automotive MCU products may partially adopt 28nm processes, and domestic foundries already have corresponding manufacturing capabilities. With the continuous optimization of foundry technology at 28nm, domestic automotive grade MCU manufacturers and upstream foundry have strengthened cooperation, which is expected to jointly push the domestic semiconductor industry to a higher level. " Tu Chaoping added.

Generally speaking, it is a good thing for the whole domestic automobile ecosystem that domestic chip manufacturers are rushing into the automobile MCU market. Because the local supply market is large enough, the addition of more enterprises has brought more talents to the automobile MCU field, which is conducive to improving technical capabilities, enriching the MCU product matrix of domestic automobile regulations, realizing healthy competition in the industry, and making concerted efforts to grab more market share from overseas manufacturers.

However, in terms of progress, the research and development and market development of domestic automotive MCU need to be further accelerated. In 2023, the shortage of automotive MCU has been basically alleviated, and domestic MCU manufacturers will face the counterattack of major international manufacturers, and the market pressure is not small. In the past few years, China has made certain achievements in the development of automotive grade MCU, and its products have certain competitiveness. In the future, driven by the wave of local supply and the continuous growth of China's new energy vehicle brands and markets, it is expected that the domestic vehicle regulation MCU will continue to accelerate its growth.

Analysis on the current situation of domestic MCU boarding-China exportsemi.com

![Hot news-[Event Preview] Registration Open for the 2025 International New Energy Industry Marketing Summit](https://bandaoti.oss-rg-china-mainland.aliyuncs.com/uploads/20241219/6fb4f075d1bd126de113312b3f1ff596apgwZt567SmoqfCW.jpg?x-oss-process=image/resize,m_fill,h_210,w_370,limit_0)