The storage industry will embrace recovery in the second half of the year

Semiconductor industry includes integrated circuits, optoelectronic devices, discrete devices, sensors and other sub-industries, among which integrated circuits can be subdivided into memory, logic circuits, analog circuits, microprocessors and other fields according to their functions. Memory chip is one of the core components of semiconductor, which can be divided into different types according to its properties. According to whether the data can be stored in the device after power failure, the memory chips can be divided into two types: power failure volatile and power failure non-volatile, in which the volatile memory chips mainly include static random access memory (SRAM) and dynamic random access memory (DRAM); Non-volatile memory mainly includes programmable read-only memory (PROM), Flash memory (Flash) and erasable programmable read-only register (EPROM/EEPROM) and so on.

Figure 1: Memory chip type

According to the World Semiconductor Trade Statistics (WSTS), the global semiconductor industry reached US $555.9 billion in 2021, up 26% year-on-year. Among them, the memory accounts for 28%, and the market size is 153.8 billion US dollars, up 31% year-on-year, making it the largest sub-industry in the semiconductor market. In addition, in 2021, the global market size of optoelectronic devices, discrete devices and sensors was US $424.04, US $303.37 and US $19.149 billion respectively, accounting for 8%, 5% and 3% respectively. In the global semiconductor memory market, DRAM and NAND Flash are the main two kinds of memory chips, occupying a dominant position. Among them, DRAM accounts for about 56% and NAND Flash accounts for about 41% in 2021. Other forms of storage products, such as small-capacity storage represented by NOR Flash, account for about 2%.

As the vane of semiconductor industry, memory chips show strong periodicity, and the prosperity of the industry is greatly affected by the relationship between supply and demand. When the prosperity is high, manufacturers expand production capacity to increase income, which easily leads to oversupply, while when the prosperity is declining, they shrink production capacity and cut prices to clean up inventory, which eventually leads to the market in short supply. In addition, the storage market has long-term growth. With the rapid development of artificial intelligence, Internet of Things, cloud computing and other industries, the long-term market scale of the whole storage industry continues to expand.

In 2022, under the influence of macroeconomic environment deterioration and geographical factors, the global consumer electronics market demand declined significantly, and the inventory of terminals, channels and original factories was high, which further inhibited the demand for storage products. According to CFM flash memory market forecast, the size of 2023Q2 storage market is expected to grow quarter by quarter. In terms of storage capacity, the market capacity of NAND Flash will increase by 6% in 2022, reaching 610 B GB; DRAM storage capacity will increase by 4% to 194 B Gb. With the gradual improvement of demand in 2023, NAND and DRAM storage capacity are expected to increase by 20% and 10% respectively.

For demand side: The storage industry rebounded, and AI servers promoted demand growth

At present, smart phones, servers, PCs and so on account for a large proportion of the downstream market of the storage industry. According to CFM flash memory market data, in DRAM downstream applications in 2021, smartphones, PCs and servers accounted for 35%, 16% and 33% respectively; Among the downstream applications of NAND, mobile phones, cSSD, eSSD and memory card/UFD account for 34%, 22%, 26% and 9% respectively.

Figure 2: Application proportion of global NAND rain market in 2021

Mobile phone: It is expected to usher in a slight rebound in the second half

From 2019 to 2022, the overall fluctuation of global smartphone shipments is generally peace, stable at around 1.2-1.4 billion units: Domestic smartphone shipments have been decreasing continuously since 2016, and achieved a sharp rebound of 15.93% in 2021. However, due to unfavorable factors such as the impact of epidemic situation and prolonged replacement cycle, the domestic mobile phone market continued to shrink in 2022. In 2023, with the increasing penetration rate of low-end 5G mobile phones overseas, good inflation and relaxation of epidemic control in China, global and domestic smartphone shipments are expected to rebound.

The increasing average capacity of mobile phones boosts the growth of storage demand. In recent years, the difference between old and new smart phones has gradually narrowed, and the change cycle of consumers has been continuously extended, so the demand for large-capacity models has become stronger. Based on brand positioning and sufficient profit margin, high-end mobile phones continuously improve product performance and storage capacity. The latest flagship mobile phones launched by major mobile phone manufacturers such as Xiaomi 13Pro, OPPO Find N2, vivo X90 Pro and Glory 80 Pro generally adopt UFS3.1/UFS4.0 and LPDDR5/LPDDR5X technologies, with storage capacity generally reaching 256GB and above, and the proportion of high-end smart phones equipped with storage capacity above 256GB gradually increases.

PC: Q1 Global PC shipments fell by 33% and are expected to recover in the second half of the year

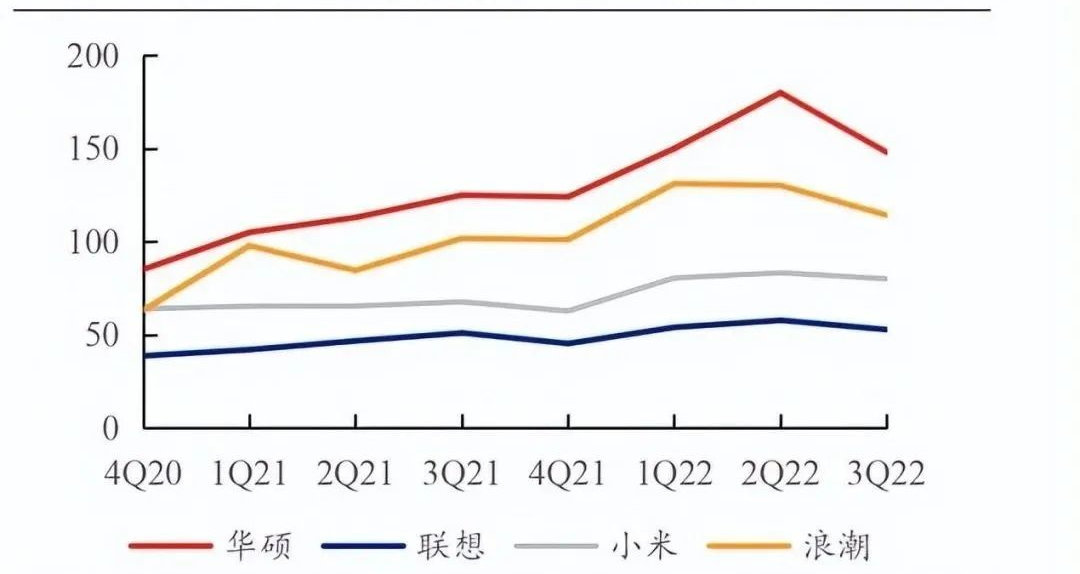

PC: Q1 Global PC shipments fell by 33% and are expected to recover in the second half of the year. According to Canalys data, the total shipments of personal computers in 2023Q1 decreased by 33% to 54 million units, reaching double-digit annual decline for four consecutive quarters. At present, PC demand is still weak. The sales volume of mainstream PC manufacturers represented by ASUS, LENOVO, and XIAOMI is declining, and the inventory level is rising. In 2022Q2, the inventory turnover days reached a new high, and the overall industry inventory has not returned to a healthy state. With the gradual recovery of demand in 2023, the inventory is expected to return to normal.

Figure 3: Change of inventory turnover days of each PC manufacturer

For server: Short-term demand is under pressure and shipments are expected to recover in the second half of the year

The growth rate of business revenue of AWS, Azure, Google and Meta, the major cloud service buyers of 2022H2, all slowed down, and the growth rate of AWS slowed down to 27.5% in 2022Q3, the lowest since 2014; Azure's growth slowed to 35%, and the server market began a round of inventory adjustment, which is expected to last until the end of 23Q2. However, due to the good overall growth prospects of AI and cloud computing, CFM flash memory market expects server shipments to be 13.3 million units in 2022, up 3% year-on-year, and is expected to return to 5% growth rate in 2023.

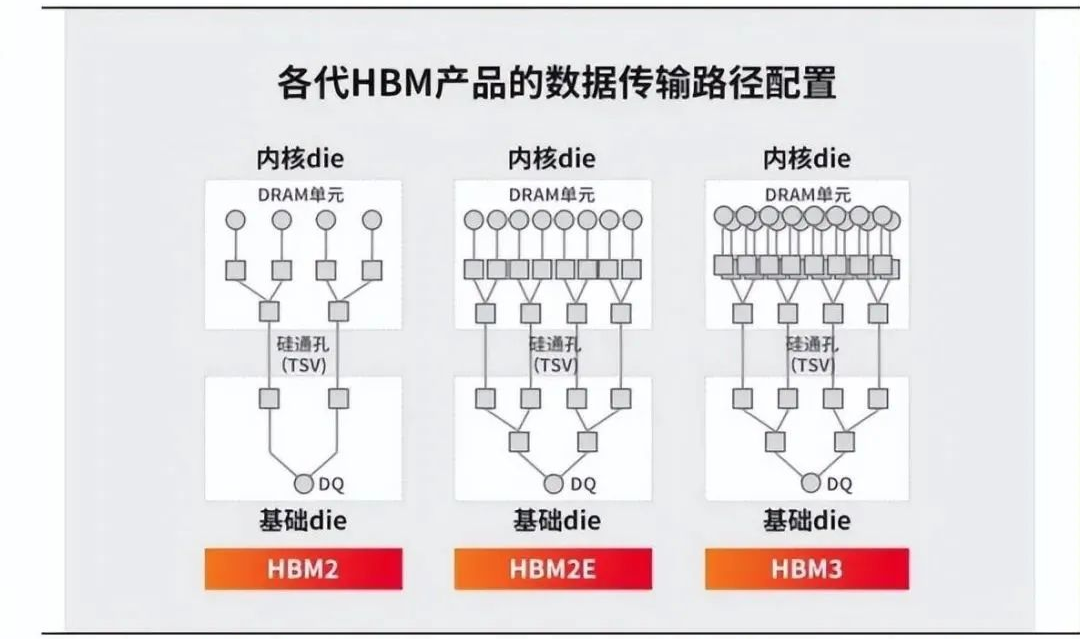

HBM (High Bandwidth Memory) is a new DRAM solution based on 3D stacking technology. HBM transforms DRAM from traditional 2D to stereo 3D, makes full use of space, reduces area, and breaks through the bottleneck of memory capacity and bandwidth. HBM mainly uses through-silicon hole (TSV) technology to stack chips, so as to increase throughput and overcome the limitation of bandwidth in a single package, and stack several DRAMs dies vertically. By increasing bandwidth and expanding memory capacity, the model and parameters are kept closer to the core calculation, thus reducing latency. In the future, application markets such as artificial intelligence, machine learning, high-performance computing and data center will put forward higher requirements for bandwidth, which will continue to drive the iterative development of HBM.

Benefiting from the outbreak of AI applications, the AI server market is expected to continue to expand. According to TRENDFORCE data, the compound growth rate of AI servers will reach 10.8% from 2022 to 2026, and the annual shipment of AI servers is expected to reach about 200,000 units by 2026. In addition, with the increasing demand of AI technology for high computing power, HBM chips are expected to be rapidly scaled up. According to Omida’s data, the market size of HBM is 500 million US dollars in 2019, and it is expected to reach 2.5 billion US dollars by 2025.

Figure 4: Data transmission path configuration of HBM products of each generation

Automotive electronics: Automotive electrification and intelligence are expected to increase the demand for on-board storage

According to the data of China Automobile Association, the domestic shipments of new energy vehicles increased from 517,000 in 2016 to 7.058 million in 2022, with CAGR reaching 54.6%. According to MICRON data, the demand growth of the new generation IVI system and more advanced driving assistance system will promote the strong growth of the automobile storage market in 2023. Specifically, with the development of automatic driving L1 to L5 level, the demand for local storage of automobiles such as on-board smart chips, T-BOX, GW, LCD dashboard, DVR and EDR is getting higher and higher, and the demand for sensors such as cameras, lidars and thermal imaging carried by vehicles will also increase to meet the needs of data collection, exchange and real-time information sharing, thus promoting the growth of the automobile storage market, which is expected to reach 20 billion US dollars in 2030, of which the biggest driving force comes from IVI infotainment system and ADAS

Supply side: Major storage factories reduce capital expenditure, and the relationship between supply and demand of memory chips is expected to improve

Due to the continuous downturn in downstream demand, major memory chip manufacturers such as HYNIX, MICRON, MACRONIX and WINBOND Electronics have reduced capital expenditure and reduced capacity utilization rate. In the future, as major memory manufacturers take the initiative to destocking and reduce production, the relationship between supply and demand is expected to continue to improve.

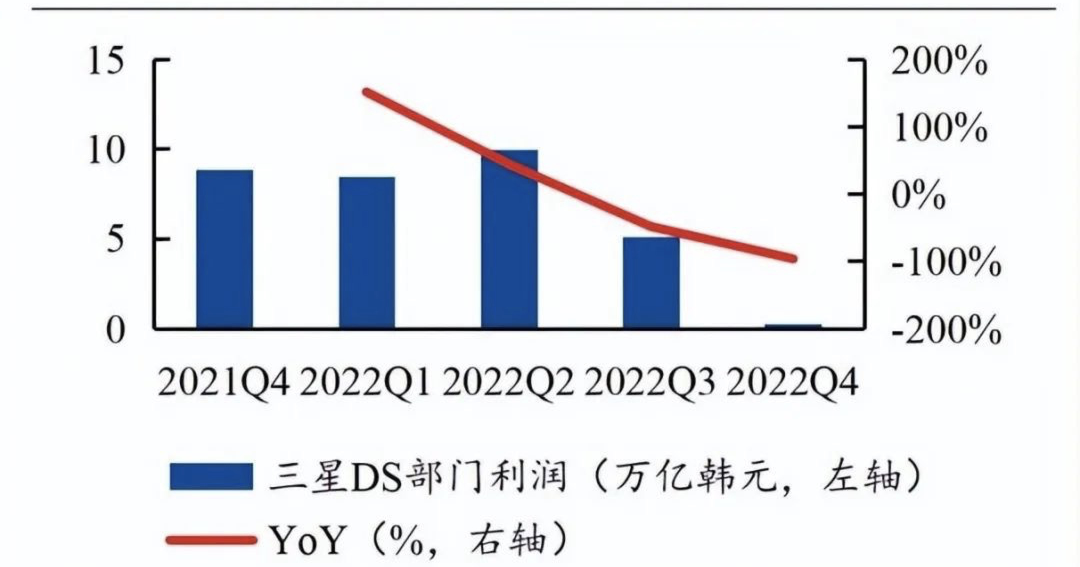

Sales side: 2022Q4 storage of SAMSUNG division revenue was 12.14 trillion won, down 38% year-on-year and 20% quarter-on-quarter. 2022Q4 The operating profit of SAMSUNG DS department was 0.27 trillion won, down 97% year-on-year and 95% quarter-on-quarter.

Figure 5: 2021Q4-2022Q4 SAMSUNG DS Division Profit

2023Q1 revenue of SKHYNIX was 5.09 trillion won, down 58% year-on-year and 34% quarter-on-quarter, of which NAND business revenue accounted for 33%, about 1.68 trillion won; DRAM business revenue accounted for 58%, about 2.95 trillion won. Operating profit was-3. 4 trillion won and net profit was-2. 59 trillion won.

MICRON FY2023Q2 quarterly revenue was US $3.693 billion, down 53% year-on-year and 10% quarter-on-quarter. Among them, DRAM revenue was USD 2.722 billion, accounting for 74% of revenue, down 52.4% year-on-year and 3.8% quarter-on-quarter. DRAM Bit shipments increased by about 15% month-on-month, while DRAM ASP decreased by about 20% month-on-month. NAND revenue was USD 885 million, accounting for 24% of the total revenue, down 54.8% year-on-year and 19.8% quarter-on-quarter. NAND Bit shipments increased by about 5% ~ 10% month-on-month, while NAND ASP decreased by about 25% month-on-month. MICRON company predicts that DRAM Bit demand growth will slow down to about 5% in 23 years, and NAND Bit demand growth will be in the low double-digit percentage range.

Inventory side: Inventory is close to historical high, and 2023Q2 is expected to gradually decline. As of 2023Q1, the inventory pressure of overseas storage plants is generally high. From the inventory water level, average inventory of MICRON turnover days are 235 days, and after inventory write-down, it is 153 days. It is estimated that the inventory turnover days have reached the peak in this quarter, and it is expected that the inventory will gradually decline after Q2.

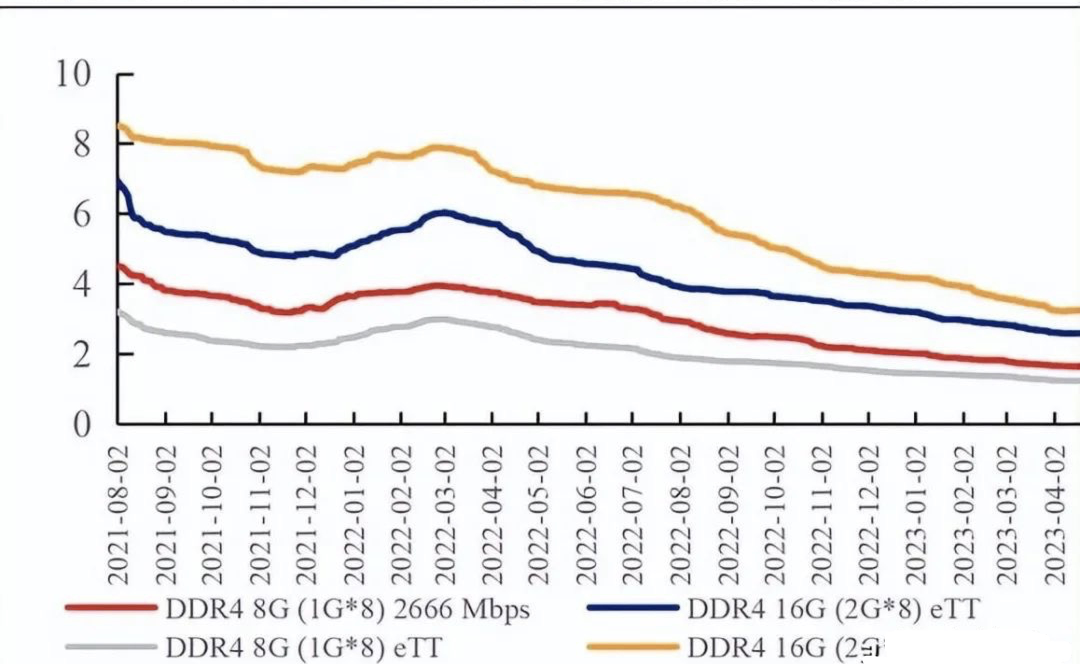

Price side: The relationship between supply and demand improves and accelerates the arrival of price turning point

DRAM: At present, the market is still in a weak situation of consumer demand, and the inventory pressure of memory manufacturers continues. As many overseas suppliers have begun to actively reduce production, it is expected that the price decline will converge. TRENDFORCE predicts that the price decline of DRAM in Q2 2023 is expected to converge to 10-15%.

Figure 6: Average spot price trend of mainstream DDR4 (USD)

NAND Flash: At present, the market demand for PC and mobile phone is still shrinking. Under the influence of market demand, inflation and other uncertain factors, it is predicted that NAND will still be in an oversupply situation in the first half of 2023, and the price may continue to fall. TRENDFORCE predicts that the price decline of 2023Q2 NAND Flash is expected to converge to 5 ~ 10%.

To sum up, from the demand side, the demand for memory chips remains at a low level, while from the supply side, the relationship between supply and demand is expected to continue to improve as major manufacturers take the initiative to destocking and reduce production. Based on the current relationship between supply and demand, the prosperity of the industry is sluggish, and the demand for 23H2 is expected to bottom out.

This article Source: GAGE finance

The Turning Point for Storage Chips has Arrived, and the Demand for AI Technology is Accelerating with the Revolution-China.eportsemi.com