In the second quarter of 2022, the inventory problem in the field from end products to upstream chips in the electronic industry chain attracted the attention of the public. On August 23rd, Yong Hai, general manager of Xunwei Tech, Huawei's general agent in Taiwan Province, said that the laptop industry was still clearing inventory in the third quarter, and it was expected be better in the fourth quarter. According to IDC data, in the second quarter of 2022, the global shipments of traditional PCs were 71.3 million units, down 15.3% year-on-year, and the shipments declined for the second consecutive quarter. Statistics show that the PC finished product warehouses of mainstream manufacturers such as HP, Dell, Lenovo, Acer, Asus, MSI and Gigabyte reached a new high of US $14.8 billion in the first quarter of this year, up 56% year-on-year.

Smart phone industry, the latest financial report of Xiaomi, the third largest manufacturer in the world, shows that Xiaomi's book inventory exceeded 50 billion yuan for the first time at the end of 2021, and reached a new high of 57.8 billion yuan at the end of June 2022, accounting for 19.72% of the total assets. At the same time, Xiaomi's inventory and accounts receivable have increased significantly compared with the same period in 2021, and the total business cycle has reached the highest 104 days since its listing, which means that the cycle from production to collection of each mobile phone in Xiaomi has been extended by 25 days year-on-year.

What is the progress of 9 global games in 2022? This is not the first time that the inventory problem of chips has appeared. Why the situation suddenly intensified this year? What is the latest development of global 12-inch wafer capacity? Which terminal market applications can drive the future growth of semiconductors? The senior research director from SEMI brought the latest analysis and cutting-edge views at Nanjing Semiconductor Conference.

Executive director, Feng Li

The decline in terminal demand leads to the problem of chip inventory. Semiconductor growth needs the driving force of three major terminal industries

Feng Li said that from 2000 to 2021, the indicators of chip inventory can see the cycle of the whole semiconductor industry, from the bursting of the Internet bubble in 2000, to the financial crisis in 2008, and then to the epidemic era in 2020, which brought a hit to the whole semiconductor industry chain, and we can see the performance and changes of the corresponding indicators of chip production inventory.

In 2021, the impact of epidemic, disaster and geographical friction on the semiconductor industry chain also made the chip problem worse. According to the global chip inventory index released by Gartner, the inventory index of Q2 in 2021 is slightly higher than that of Q1, reaching 0.9, and the global production capacity has recovered but the demand has grown faster.

From the perspective of the terminal market in 2022, the demand of the whole consumer terminal is in a weak state. According to the statistics, the global mobile phone shipments decreased to 287 million units in the second quarter of 2022, down 7% year-on-year, which is the lowest point since the outbreak of the epidemic and after the second quarter of 2020. IDC's statistics show that PCs and tablets both fell by 10% in the second quarter.

According to public information, the supply of automobile and industrial chips is still inadequate, but the inventory of consumer chips is still accumulating in the whole supply chain. Sources expect that it will take half a year for consumer IC suppliers to complete inventory adjustment. Therefore, the prospect of consumer electronics demand in the second half of 2022 is pessimistic. Taiwan's wafer foundry Powerchip Semiconductor Manufacturing said that its operation slowed down in the second half of the year, and its capacity utilization rate declined by about 5%-10% in the third quarter. The market inventory correction will reach the first and second quarters of next year. For the huge pressure on the inventory of display drive chips, some customers have already paid liquidated damages rather than reducing the inventory pressure. South Korea's Samsung showed that its chip inventory surged by 53.4% in May compared with the same period of last year, and its chip inventory continued to show an increasing trend since October last year.

Opportunity of China semiconductor industry

Focus on the trend of future, Feng Li said that the forecast analysis released by Gartner in 2026 shows that the whole market will grow by 26.3%, of which 10% is due to the rebound of demand, including automobiles, smart phones and data centers, and 16% is due to the increase of prices, which leads to such a relatively strong trend.

The capacity of 12-inch wafer grows rapidly, and the proportion of wafer manufacturing in Chinese mainland expands

Feng Li introduced the key link of semiconductor industry investment. SEMI tracked about 1,000 semiconductor enterprises around the world. From the perspective of capacity distribution, in 2021, 300 mm accounted for 56%, 200 mm accounted for 24%, and less than 200 mm accounted for 20%. In 2022 alone, the investment increased by 14%, reaching nearly 26 billion US dollars, and 28 new batch wafers will start construction in 2022, including 23 300mm wafer and 5 200mm wafer.

Feng Li believes that the global layout of semiconductors is accelerating, and most of the production capacity will be reflected in 2023 and 2024. TSMC has started to build three new plants in America, Japan and China. Infineon accelerated the construction of Austria's 12-inch wafer factory in February 2021, and Bosch opened Germany's automotive semiconductor factory in June 2021, with mass production of 65mm-180mm process. SMIC has set up 12-inch wafer factories in Beijing, Shanghai and Shenzhen, and the Shenzhen chip factory is expected to produce 40,000 12-inch wafers per month.

Global landscape of wafer manufacture

Feng Li pointed out that the wafer manufacturing capacity in China mainland is growing rapidly, with a growth rate exceeding 10%, far exceeding the global average growth rate of 3% ~ 6%. In 2020, it has reached 17% of the global total, but 40% of them are below 8 inches.

Driven by policies and capacity, the sales of semiconductors in China are increasing. In 2021, it broke through the scale of trillions, among which IC design reached 451.9 billion yuan, IC manufacturing reached 317.6 billion yuan, and IC packaging testing industry also reached 276.3 billion yuan. It should be said that the development is balanced.

Demand for wafer is expands. China's equipment investment ranks first in the world in 2021

China is the world's largest manufacturing center of electronic products, which needs a large number of semiconductor devices, so it is the world's largest semiconductor market, and it is estimated that it will occupy 40% of the global semiconductor market by 2025.

From the perspective of semiconductor equipment, equipment firm expect the total sales to be US $117.5 billion in 2022 and US $120.8 billion in 2023. Wafer fabrication equipment includes wafer processing, wafer fabrication facilities, shade and mask equipment. In 2021, China's equipment investment ranks first in the world.

Feng Li, senior research director of SEMI, said that driven by the demand for cutting-edge and mature process nodes, foundry and Logic are expected to increase by 20.6% year-on-year to reach 55.2 billion US dollars in 2022 and 7.9% to reach 59.5 billion US dollars in 2023, which account for more than half of the total sales of wafer equipment.

Strong demand for Memory and storage drives this year's expenditure on DRAM and NAND devices, and the DRAM device market will take the lead in expanding in 2022, with an expected growth rate of 8%. At $17.1 billion, the NAND device market is expected to grow 6.8% this year to $21.1 billion, with spending on DRAM and NAND devices.

SEMI 2022 Mid-Year Wafer Fab Equipment Forecast by Application (US$Billion)

SEMI predicts that Taiwan, China and South Korea will remain the top three equipment buyers in 2023, and Taiwan is expected to regain the top position in 2022 and 2023.

Positive policies promote the development of semiconductor enterprises R&D investment need to enhance in future

The first phase of the national large fund was 138.72 billion yuan, and the second phase of the large fund was 204.15 billion yuan, which was invested in Integrated circuit each industrial chain. Coupled with the opening of SSE STAR market, it issued a total of 185 listed enterprises, including 27 semiconductor enterprises, accounting for about 14.6%.

See star market

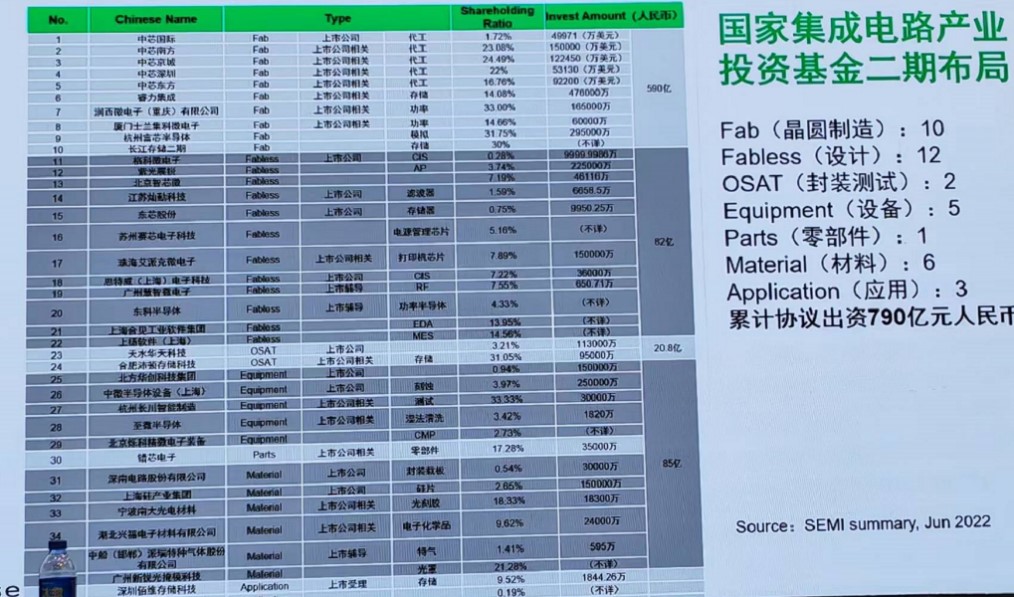

In the first phase of the large fund, 67% of the proportion is invested in chip manufacturing industry, 17% is invested in design industry, 10% is invested in packaging and testing industry, and 6% is invested in equipment and materials. The second phase of the large fund was invested in October 2019, with a volume of 204.1 billion yuan. Up to now, the agreed investment has reached 79 billion yuan, of which 10 Fab factories have invested, reaching 59 billion yuan, and the design industry is 8.2 billion yuan (including Ziguang Zhanrui, Galaxy Core, Beijing SmartChip Microelectronics, Dosilicon Co., Ltd., Suzhou XySemi Electronics Technology, Geehy Microelectronics, Smartsens Technology, Guangzhou Smarter Microelectronics, Dongke Semiconductor, etc.) invest on device and material, involve machinery parts reached 8.5 billion.

ICF investment found

Feng Li suggested that China should increase investment in semiconductor research and development for a long time. In 2021, the total R&D expenditure of American semiconductor companies (including wafer) reached 44 billion US dollars, with a compound growth rate of about 7.2% from 2000 to 2020. The proportion of R&D expenditure in China to total sales was only one third of that in the United States.

Chip Inventory Attracts Attention and Need to Increase Investment in Chip Research and Development in Future-China exportsemi. (exportsemi.com)