Definition of satellite navigation and location service

Global satellite navigation system is a space-based radio navigation and positioning system that can provide all-weather positioning, navigation and timing for any place on the earth's surface or near-earth space. Satellite navigation system is an important space infrastructure, which provides all-weather accurate space-time information service for the production and life of human society and is an important information guarantee for economic and social development.

At present, the mature global satellite navigation systems in the world mainly include GPS system in the United States, GLONASS system in Russia, BEIDOU system in China and GALILEO system in Europe. In addition, there are two regional satellite navigation systems: Japan Quasi-Zenith System (QZSS) and India Regional Navigation Satellite System (IRNSS).

Global Positioning System (GPS)

In December 1973, the US Department of Defense approved the joint development of a new satellite navigation system-NAVSTART/GPS, or GPS for short. The first operational prototype satellite was launched in 1978. GPS has all-round, global, all-weather, continuous and real-time navigation, positioning and timing functions, and can provide users with precise three-dimensional coordinates, speed and time information. At present, GPS has 31 satellites working in orbit.

GLONASS Satellite Navigation System (GLONASS)

GLONASS is the second generations military satellite navigation system independently developed and controlled by the former Soviet Ministry of National Defense. It is the second global satellite navigation system with full operational capability after GPS. The emergence of GLONASS has broken the monopoly of the United States on satellite navigation systems, but its civilian and commercial users are still few. At present, there are 23 satellites in normal operation of GLONASS in orbit.

l BEIDOU Satellite Navigation System (BDS)

BEIDOU satellite navigation system, built in China, provides all-weather, all-day and high-precision positioning, speed measurement and timing services for global users. In July 2020, BEIDOU-3 system was opened. The space segment of BEIDOU-3 system consists of three orbiting satellites: geosynchronous and orbiting satellites (GEO), tilted geosynchronous orbit satellites (IGSO) and medium circular earth orbit satellites (MEO).

l Galileo Satellite Navigation System (Galileo)

Galileo satellite navigation system is a global satellite navigation and positioning system developed and established by the European Union, which was announced by the European Commission in February 1999. At present, Galileo has 22 available satellites in orbit, and the planned constellation consists of 24 satellites (Walker 24/3/1), including 6 standby satellites.

Industry development status

l Gross output value

In recent years, BEIDOU satellite navigation system has played an increasingly important role in China's economic and social development, and its application depth and breadth have continued to expand. The scale of China's satellite navigation and location service industry has maintained a steady growth trend. According to the White Paper on the Development of China's Satellite Navigation and Location Service Industry in 2023, the total output value of China's satellite navigation and location service industry will reach 500.7 billion yuan in 2022, an increase of 6.76% compared with 2021. It is estimated that the total output value of the industry will reach 573 billion yuan in 2023.

Figure 1: Forecast trend chart of total output value of China's satellite navigation and location service industry from 2017 to 2023 (* Data source: China Business Industry Research Institute)

l Core output value

In terms of core output value, in 2022, the core output value of industries including chips, devices, algorithms, software, navigation data, terminal equipment and infrastructure directly related to the research and development and application of satellite navigation technology increased by 5.05% year-on-year, reaching 152.7 billionyuan, accounting for 30.50% of the total output value. It is estimated that the core output value of China's satellite navigation and location service industry will reach 169.7 billion yuan in 2023.

Figure 2: Forecast of core output value of China's satellite navigation and location service industry from 2017 to 2023 (* Data source: China Business Industry Research Institute)

l Sales volume of terminal products (shipments)

In 2022, the domestic satellite navigation and location service market is generally stable. According to the research and analysis of China Satellite Navigation and Positioning Association, the total sales volume of domestic satellite navigation and positioning terminal products in 2022 is about 376 million units/set. Among them, the shipment of smart phones with satellite navigation and positioning functions reached 264 million units, and the sales volume of various positioning terminal devices including Internet of Things, wearable, vehicle-mounted and high-precision equipment was about 100 million units/set, and the sales volume of vehicle navigator market terminals was about 12 million units.

Figure 3: Sales volume of domestic satellite navigation and positioning terminal products in 2022 (* Data source: China Business Industry Research Institute)

l Regional development of industry

In 2022, the five major industrial regions and key industrial development cities with traditional development advantages actively combined with the development needs of major national strategic regions and their own characteristics, and further strengthened and comprehensively laid out the satellite navigation and location service industries, consolidating the characteristic advantages of regional development and maintaining steady growth as a whole. According to research statistics, in 2022, the comprehensive output value of the five regions will be about 377.8 billion yuan, accounting for 75.44% of the total output value of the whole country.

Figure 4: Regional output value of China's satellite navigation and location service industry in 2022(* Data source: China Business Industry Research Institute)

Number of listed enterprises in the industry

At present, the total number of enterprises and institutions in the field of satellite navigation and location services in China remains around 14,000, and the number of employees exceeds 500,000. By the end of 2022, there were 92 related enterprises (including the New Third Board) listed in China, and the related output value of listed companies related to satellite navigation and location services accounted for about 9.02% of the total output value of the whole country.

Figure 5: Statistics on the number of listed companies in domestic satellite navigation and location service industry from 2018 to 2022(* Data source: China Business Industry Research Institute)

Key enterprises in the industry

l Aerospace electronics

Aerospace Times Electronic Technology Co., Ltd. is mainly engaged in R&D, production and sales of aerospace electronics, unmanned systems, high-end intelligent equipment, wires and cables, etc. Its products mainly include integrated information systems, inertial navigation, integrated circuits, electromechanical components, etc. Aerospace Electronics is the earliest research unit engaged in measurement and control technology and satellite navigation technology in China, and its main product "Monitoring Receiver of Ground Operation Control System of BEIDOU Experimental Satellite Project" won the first prize of scientific and technological progress of China Satellite Navigation and Positioning Association. In 2022, Aerospace Electronics achieved operating income of 17.476 billion yuan and net profit attributable to its shareholder of 611 million yuan, up 9.30% and 11.17% respectively.

Figure 6: Aerospace Electronics Experience from 2018 to 2022 (* Data Source: China Business Industry Research Institute)

l Chinese satellite

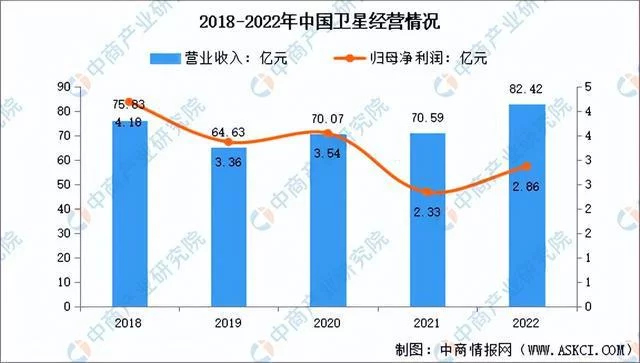

China SPACESAT Co., Ltd. focuses on the development of satellite communication, navigation and remote sensing integration industries, and relies on two national platforms, "National Engineering Research Center for Small Satellites and Their Applications" and "State Key Laboratory of Information Technology for Integration of Heaven and Earth", and has strong research and development strength in key core technology research and satellite and satellite application equipment manufacturing. In 2022, Chinese satellites successfully obtained the test pieces of commercial aircraft multi-mode navigation receivers, and the development tasks of navigation aircraft and unmanned aerial vehicle tracking and monitoring terminals. The further expansion of BEIDOU navigation application in aviation field achieved practical results. In 2022, China Satellite achieved operating income of 8.242 billion yuan and net profit attributable to its mother of 286 million yuan, up by 15.26% and 21.89% respectively over the previous year.

Figure 7: China's satellite operation from 2018 to 2022 (* Data source: China Business Industry Research Institute)

l Shanghai HUACE Navigation

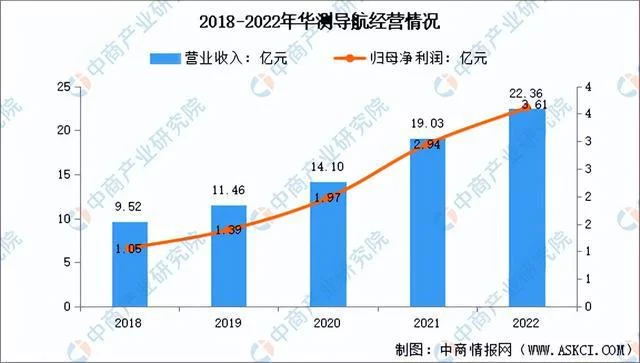

HUACE Navigation always focuses on the core technologies related to high-precision navigation and positioning applications and the development, manufacturing, integration and industrialization of its products. It has formed the core algorithm capability with technical barriers, and has complete algorithm technical capabilities such as high-precision GNSS algorithm, three-dimensional point cloud and aerial survey, GNSS signal processing and chip, automatic driving perception and decision control, etc. It is one of the leading enterprises in the domestic high-precision satellite navigation and positioning industry. In 2022, HUACE Navigation achieved operating income of 2.236 billion yuan, up 17.50% year-on-year, of which high-precision positioning equipment achieved income of 1.093 billion yuan.

Figure 8: Operation of HUACE Navigation from 2018 to 2022 (* Data Source: China Business Industry Research Institute)

l HAIGE Communications Group Incorporated Company

Guangzhou HAIGE Communication Group Co., Ltd., whose main business covers four major fields: "wireless communication, BEIDOU navigation, aerospace and digital intelligence ecology", is an expert in developing BEIDOU navigation equipment with full frequency coverage and full industrial chain layout, a provider of electronic information system solutions, one of the key electronic information enterprises with the widest user coverage, the widest frequency coverage, the most complete product series and the most competitive in the industry, a leader in domestic institutional market simulation system, and a leading new generation of digital intelligence ecology builders in the industry. In 2022, HAIGE Communication's operating income was 5.616 billion yuan, of which BEIDOU Navigation's income was 439 million yuan, up 3.39% year-on-year.

Figure 9: HAIGE Communication Operation from 2018 to 2022 (* Data Source: China Business Industry Research Institute)

l BDSTAR Navigation Co., Ltd.

BDSTAR main business includes four sectors: chip and data service, satellite navigation, ceramic components and automotive electronics business. After more than 20 years of development, Big Dipper closely follows the construction and industrialization promotion of China's satellite navigation system and plays an important role in the process of domestic substitution. The basic products of navigation and positioning chips, modules, boards, antennas and other basic devices/components independently developed lead the industry in an all-round way, providing excellent products, solutions and services for global users, and making every effort to build a world-leading "position digital base" In 2022, BDSTAR achieved operating income of 3.816 billion yuan and net profit attributable to its mother of 145 million yuan.

Figure 10: Operation of BDSTAR from 2018 to 2022(* Data source: China Business Industry Research Institute)

Industry development prospect

l Remote sensing technology continues to break through, and satellite accuracy continues to improve

In recent years, remote sensing technology has been continuously broken through, the number of remote sensing satellites launched has increased rapidly, and the overall ability to observe ground objects and surface has been greatly improved, basically realizing a remote sensing satellite system with all-weather, all-day, full spectrum and full coverage. With the increasing number of commercial remote sensing satellites, the application scenarios and customized market of remote sensing data are gradually opening up. Satellite remote sensing data can be used for social, economic and national defense security such as natural resources investigation and monitoring, disaster early warning and assessment, ecological environment governance and protection, weather forecast and service, marine environment investigation, agricultural monitoring and yield estimation, environmental information guarantee in special areas, etc. Satellite remote sensing has become an indispensable technical means for government fine supervision, social collaborative governance and national security, and has played an irreplaceable role in major project construction and major tasks such as China's land and resources survey, West-East Gas Transmission Project, South-to-North Water Transfer Project and The Three Gorges Hydroelectric-Complex Project.

l The new generation of information technology has developed rapidly and the industrial ecosystem has been gradually improved

In recent years, with the rapid development of new technologies represented by 5G, cloud computing, big data, AR, artificial intelligence, Internet of Things, etc. and the completion of the global networking of BEIDOU three generations, the development of China's geographic information industry has entered a new historical period. The industrial ecosystem of "+ BEIDOU" has been further enriched and improved, which has spawned more new technologies, new products and new applications. These new technologies, new products and new applications together with the geographic information industry constitute an important foundation for the development of digital economy.

l Empowered by the data economy, there is a vast downstream application market.

With the implementation of major strategies such as new infrastructure construction and digital economy, spatiotemporal big data, urban and rural digital bases, unmanned systems and intelligent information services are booming, which further expands the broad market of BEIDOU spatiotemporal information application and service, and promotes the deepening application of satellite navigation and location services in various industries and fields. The market activity is expected to bottom out and rebound, and the overall economic benefits of the industry will also show a trend of stabilization and recovery.

2023 China Satellite Navigation and Location Services Market Research Report-China.exportsemi.com