General situation of energy storage market

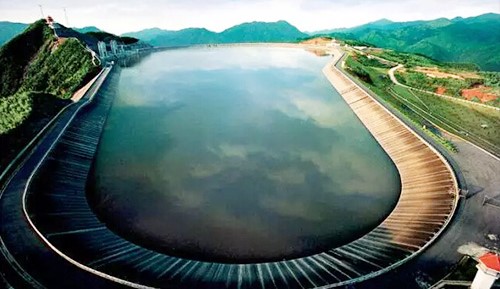

Pumped storage is still the mainstream, but the future development space may be limited

It is known that pumped storage has the advantages of mature technology, large energy storage capacity, high system efficiency, long operation life and high safety performance, and is the mainstream energy storage technology with high commercialization and wide application range. From the international market, pumped energy storage occupies an absolute leading position. By the end of 2020, the installed capacity of pumped storage accounts for 94% of the total scale of electric energy storage projects. However, the construction of pumped storage power station is greatly limited by topographic factors, and the construction period is long, which usually takes about 7 years. In the future, with the decrease of the cost of new energy storage such as electrochemical energy storage, the development space of pumped storage in power system may be limited.

New energy storage, mainly electrochemical energy storage, has grown rapidly and become the main force in the development of energy storage industry

Electrochemical energy storage has wide power range and high energy density, and has higher maturity than other new energy storage technologies, so it is more applicable to a wide range of scenarios. In addition, compared with pumped storage, electrochemical energy storage is more convenient to install and is not limited by location, which is becoming a new driving force for the development of energy storage industry. By the end of 2022, a total of 772 electrochemical energy storage power stations with a total energy of 43.08 GWh had been submitted by 19 enterprise member units of the National Electric Power Safety Committee. Lithium-ion batteries dominate electrochemical energy storage, but the potential safety hazard of ternary lithium batteries is more prominent, which means that lithium iron phosphate batteries and flow batteries with higher safety are expected to further open up market space in the future.

Figure 1: New energy storage based on electrochemical energy storage has become the main force in the development of energy storage industry

The application scenarios of new energy storage technologies are different, focusing on three major cost reduction ideas to promote large-scale application

In the process of promoting the large-scale application of new energy storage technologies, energy storage technologies that meet the needs of high security, long life, low cost and high efficiency of power grid should be matched according to different application scenarios. Besides the market prospect of electrochemical energy storage technology, the commercialization potential of compressed air energy storage, flywheel energy storage and hydrogen (ammonia) energy storage should not be underestimated. At present, the industry mainly focuses on three types of cost reduction ideas to help the new energy storage technology represented by electrochemical energy storage achieve large-scale application: First, pay attention to improving the cycle life of battery packs; The second is to reasonably reduce supply chain costs, such as realizing low-cost material substitution; The third is to optimize technologies such as energy storage cooling and integration methods to improve the overall efficiency of the energy storage system.

With a combination of policy guidance and market mechanism optimization, both aspects are working together to ensure the long-term stable development of new energy storage technologies.

In addition to achieving technological progress and improving cost competitiveness, a favorable policy environment and market mechanism are also essential for the development of new energy storage. Since the "14th Five-Year Plan", the state has actively promoted the transformation of new energy storage from the initial stage of commercialization to large-scale development by 2025, and to achieve comprehensive market-oriented development by 2030. In the medium and long term, China's energy storage industry needs to rely on a stable and efficient market mechanism to establish a sustainable profit model and achieve high-quality development. We can learn from the experience of electricity marketization in the United States, Europe and Australia, give due consideration to liberalizing electricity price control and establishing a reasonable bidding mechanism, so that energy storage entities can obtain commercial benefits from electricity price fluctuations (i.e., the price difference between charging and discharging), and gradually optimize from two aspects: electricity marketization and new energy storage participation in the market in combination with the current situation of energy storage development in various parts of China.

Product Scale and Forecast

The improvement of renewable energy generation may bring about rapid growth in the global energy storage market

According to EIA forecast, by 2050, wind energy and solar power generation will account for 72% of renewable energy power generation, nearly double the proportion in 2020. The unique intermittence and instability of new energy sources such as wind energy and solar energy will promote the rapid development of the global energy storage market. Electrochemical energy storage, as a representative of new energy storage methods, holds vast prospects for future development. According to CNESA's forecast, by 2027, the installed capacity of the global electrochemical energy storage industry will reach 1,138.9 GWh, with a compound growth rate of 61% from 2021 to 27, which is about twice the compound annual growth rate of 31% of the total installed capacity of energy storage in the future.

Figure 2: The improvement of renewable energy generation will bring about rapid growth in the global energy storage market

In 2022, the installed capacity of electrochemical energy storage in China doubled year-on-year, and the installed capacity is expected to account for more than 1/5 of the world in 2026

By the end of 2022, 19 enterprise member units of the National Electric Power Safety Production Committee had put into operation 472 electrochemical energy storage stations with a total energy of 14.1 GWh, a year-on-year increase of 127%; In 2022, 194 new electrochemical energy storage power stations were put into operation, with a total energy of 7.9 GWh, accounting for 60.2% of the total energy of the power stations put into operation, with a year-on-year increase of 176%. From the international comparison, according to the forecast of IEA, by 2026, the total installed capacity of electrochemical energy storage in China will leap to the first place in all countries, accounting for 22%, which is almost equal to the total installed capacity in Europe and 7 percentage points higher than that in the United States.

Business model analysis of energy storage

The application scenarios of energy storage can be divided from three links: power generation side, power grid side and user side, and the business model of each link is also different. On the power generation side, it mainly plays the role of matching power production and consumption and reducing power grid pressure; Energy storage on the power grid side is mainly used to reduce or delay the investment in power grid equipment, alleviate power grid congestion, and provide auxiliary services such as peak shaving and frequency modulation for the power system; On the user side, it helps users to realize peak shaving and valley filling or photovoltaic spontaneous self-use, so as to reduce electricity expenses.

Generating side

At present, the electrochemical energy storage on the power generation side in China mainly includes fire-storage combined frequency modulation and new energy allocation and storage. The market scale of fire-storage combined frequency modulation is limited, and new energy allocation and storage has become the main application scenario of electrochemical energy storage on the power generation side. Due to the high cost of new energy allocation and storage, single income channel and low utilization efficiency, the development of new energy generation side allocation and storage projects is restricted, and policies are still the main driving factor for the development of new energy allocation and storage at present.

Grid-connected new energy has become the main application scenario of electrochemical energy storage on the power generation side, but the total investment cost is high.

Many provinces have issued policies requiring new energy stations to allocate and store energy. The allocation ratio of energy storage is 5%-20%, and the allocation hours are mostly 2 hours. However, the construction of energy storage power station will increase the initial investment cost of the project. The initial investment of an energy storage project with an installed capacity of 20% and a duration of 2 hours will increase by 8%-10%; However, if wind farms are equipped with energy storage projects with the same capacity, the initial investment cost will increase by 15%-20%. At present, the allocation and storage costs of new energy enterprises are mainly borne by the enterprises themselves, and the upstream costs such as lithium mines are rising, which brings great pressure to the enterprises.

Figure 3: New energy grid connection has become the main application scenario of electrochemical energy storage on the power generation side, but the total investment cost is high

The benefits of energy storage on the generation side come from reducing curtailed renewable energy and increasing revenue from electricity sales, as well as reducing penalties and charges. However, the economic viability of generation-side energy storage is currently not significant.

China's electricity marketization mechanism is still immature, the participation of new energy allocation and storage in spot transactions in the electricity market is still being explored, the participation of power generation side in power grid dispatching is unclear, and the conditions for participating in auxiliary service market are immature. Compared with the two-part electricity price policy of pumped storage, because the new energy storage started late, both electricity price and capacity price need to be improved. At present, the allocation and storage cost of new energy is high and the use is insufficient. According to the investigation of China Electricity Council, the allocation time of energy storage projects in different application scenarios is quite different. The allocation time of energy storage on the new energy side is 1.6 h, which is higher than 0.6 h on the fire side, lower than 2.3 h on the grid side and 5.3 h on the user side. The operation strategies of new energy distribution and storage are quite different. Most power stations adopt the operation strategy of one charging and one discharging when power is abandoned. In some projects, only some energy storage units are called, charging and discharging twice a month on average, or even basically not called. According to the equivalent utilization coefficient of the investigated units, the equivalent utilization coefficient of new energy allocation and storage is only 6.1%, which is lower or far lower than that of fire storage, power grid side and user side.

Grid side

Grid-side energy storage refers to the energy storage resources in the power system that can accept the unified dispatching of power dispatching institutions, respond to the flexible needs of the power grid, and play a global and systematic role.

In terms of investment and operation mode, the investment willingness of power grid enterprises still needs to be further strengthened, and the existing non-independent energy storage projects are facing the problem of "difficult settlement".

After 2019, more new installations of new energy storage will enter the power supply side, resulting in less access to the power grid side for existing new energy storage projects that have been put into operation. Among them, the contract energy management mode is generally adopted for energy storage projects that have the conditions of direct adjustment of power grid or choose to settle accounts with power grid. However, under this mode, non-independent energy storage power stations often face the situation that the owner delays or defaults on income. The fundamental reason is that such projects do not have independent market subject status such as independent metering, dispatching and settlement, and can only indirectly participate in the power market through power grid enterprises.

In terms of revenue pricing model, the blocking point lies in the fact that the cost cannot be transmitted to the user side, so it is urgent to develop the capacity cost recovery mechanism and the spot power market.

The energy storage income on the power grid side mainly comes from the compensation of auxiliary services such as peak shaving and frequency modulation. According to incomplete statistics, at least 19 regions above the provincial level have defined the compensation standard for peak shaving and frequency modulation. The problem is that according to "who provides, who profits; According to the principle of" who benefits, who bears ", the compensation for auxiliary services should be shared by the power generation side and the user side, but the cost of auxiliary services on the domestic power grid side is still difficult to be transmitted to the user side, which may limit the development of the auxiliary service market to a certain extent. Combined with foreign market experience, China's grid-side energy storage urgently needs to develop capacity cost recovery mechanism and power spot market, so as to improve cost diversion mechanism and expand revenue sources.

Figure 4: The energy storage revenue on the grid side mainly comes from the compensation of auxiliary services such as peak shaving and frequency modulation

Client

The main body of energy storage is power users, mainly including industrial and commercial users and household users. Developing user-side energy storage can help in reducing electricity costs and ensuring the stability of power supply.

Behind-the-Meter Energy Storage

Refers to the energy storage system for home users. Residential energy storage systems are typically installed in combination with residential solar photovoltaic (PV) systems to provide electric power for household users. Residential energy storage system can improve the self-use degree of household photovoltaic, reduce the electricity expenditure of users, and ensure the stability of users' electricity consumption in extreme weather. For users in areas with high electricity prices, high peak/off-peak price differentials, or aging power grids, purchasing a residential energy storage system offers good economic viability. These factors provide motivation for homeowners to invest in such systems.

Industrial and commercial energy storage

It is another important part of user energy storage. For unused photovoltaic users, its economy is mainly reflected in peak-valley arbitrage by using energy storage; For photovoltaic users, they can save the cost of electricity purchase through spontaneous self-use, and help enterprises save energy and reduce emissions. Industrial and commercial energy storage mainly makes profits through energy time shift, peak-valley price difference arbitrage, capacity electricity fee reduction and demand response.

Layout and financing of energy storage enterprises

The implementation of the national "Dual Carbon" strategy has significantly promoted the development of energy storage technologies and industries. Energy storage has undergone a transition from the initial stage of commercial development to scale-up development, entering a fast lane of growth.

Layout of energy storage enterprises

Newly established energy storage enterprises are growing rapidly. Before 2021, there are about three or four thousand newly established energy storage related enterprises in China every year. However, with the rapid warming of the energy storage industry, 38,294 energy storage related enterprises were established in 2022, 5.8 times that of 2021. In terms of geographical distribution, the industrial agglomeration effect of Guangdong Province and Jiangsu Province is obvious. In 2022, there were 4,044 newly established energy storage related enterprises in Guangdong Province and 3,225 newly established enterprises in Jiangsu Province, accounting for 10% and 8% respectively.

China has become the most active country in basic research on energy storage technology in the world. According to the number of SCI papers counted by the Web of Science database with "Energy Storage" as the key word, Chinese institutions and scholars published 11,949 papers on Energy Storage technology in 2021, ranking first in the world and exceeding the total number of papers published by the second to seventh countries.

Power central enterprises are the main body of pumped storage construction and extend to electrochemical energy storage power stations at the same time; Private enterprises focus on electrochemical energy storage track, with the largest layout of battery business. Pumped storage still occupies the dominant position of energy storage in China, and the main investors are State Grid and China Southern Power Grid, which occupy more than 90% of the market. Five major power generation groups, six small power generation groups, two major power grids and central enterprises such as PetroChina and Sinochem all lay out energy storage industries. Up to now, a total of 78 listed private enterprises have laid out the electrochemical energy storage industry. Batteries are the track with the largest layout of listed private enterprises, reaching 45, and lithium battery materials and energy storage systems are 19 and 13 respectively.

Figure 5: China has become the most active country in basic research of energy storage technology in the world

Financing of energy storage industry

Global energy storage financing transactions continue to increase. According to Pitchbook database, the amount of global energy storage financing increased by 30% year-on-year in 2021, and continued the previous high growth in 2022. The annual global energy storage financing was 6.3 billion US dollars, up 94% year-on-year. China, the United States and Europe are the main bodies of global energy storage financing transactions. Since 2020, energy storage financing transactions in three countries (regions) account for about 90% of the world.

The financing scale of China's energy storage industry has increased rapidly, and its regional distribution is relatively concentrated. According to the investment database, since the second half of 2020, the amount and scale of financing in the energy storage industry have greatly increased, and it has become a new energy track favored by the investment market after photovoltaic and electric vehicles. According to the investment data, the energy storage industry is still hot in 2022, with 249 financing transactions in the energy storage industry in the whole year, with a financing scale of 49.4 billion yuan and a financing amount 16 times that of 2019. As the energy storage industry is in its infancy, there are many new enterprises, and the financing demand for energy storage is mostly in the early stage. In 2022, the financing amount of Round A and Round B of energy storage industry was 32.5 billion yuan, accounting for 66%. From a regional perspective, in 2022, the top ten provinces raised a total of 45.3 billion yuan, accounting for 92% of the overall financing of the energy storage industry. There are 67 financing transactions in the energy storage industry in Guangdong Province, with a financing amount of 13.5 billion yuan, which exceeds that of other provinces in terms of financing amount and amount.

Batteries are still the hottest track in China's energy storage industry, and upstream material enterprises are also favored by the capital market, with frequent large-scale financing in the industry. In 2022, the financing amount of battery enterprises was 31.7 billion yuan, accounting for 64% of the total financing transaction amount of energy storage industry. There are 29 upstream financing transactions in the energy storage industry, including positive electrode materials and negative electrode materials, with a financing amount of 10.8 billion yuan. In 2022, Sunwoda Battery has the largest financing amount in the energy storage industry, with a financing amount of 8 billion yuan.

Future prospect of energy storage industry

With the acceleration of new energy development, new energy storage, as a solution to improve the safe and efficient utilization rate of new energy, is highly anticipated. At the same time, business economy, application security, policies and market competition mechanism need to be improved, which also brings many challenges to the development of the industry.

Figure 6: The development process of new energy is accelerating, and new energy storage is highly anticipated

On the user side, domestic industry and commerce and overseas household energy storage have developed rapidly

As far as domestic industry and commerce are concerned, the introduction of time-of-use electricity price and electricity premium of high energy-consuming enterprises improves the economy of peak shaving and valley filling on the user side, and the domestic lithium battery market has scale advantages compared with foreign countries, which is also an important driving force for market development. In the future, with the introduction of the virtual power plant policy, it will bring more new value to the market. As far as household energy storage is concerned, overseas markets have large market space and relatively guaranteed profit margins due to high electricity prices, increased proportion of new energy and weak power grids. Compared with local enterprises in Europe and America, Chinese enterprises occupy a relatively small share in the end product market. However, in the key links of the household energy storage industry chain, including energy storage lithium batteries and energy storage converters, domestic power battery enterprises and photovoltaic inverter enterprises have strong competitiveness and continue to exert their strength in overseas household storage markets.

The competition pattern of downstream market puts forward different requirements for the core competitiveness of energy storage enterprises

For Chinese energy storage enterprises, the household storage market is mainly overseas at present, and it is concentrated on the to C end for mass consumers. Business expansion depends more on channels and brand promotion. Whether enterprises have localization ability is an important factor for their further development. On the power supply side/power grid side/industrial and commercial energy storage side, to B is concentrated for enterprises, and the main market is in China at present, so the resource channels of energy storage enterprises and the control of system security and cost are the key factors for their development.

The single income model leads to low-price competition, and safety and sustainable development deserve continuous attention

The driving force for the development of new energy storage mainly comes from the policy side, that is, the power generation side forcibly allocates storage. Under the condition that the energy storage cost is mainly borne by the power generation side and the energy storage income source is relatively single, power generation enterprises are more inclined to choose low-cost energy storage projects for economic reasons, ignoring performance and safety issues relatively, which will lead to low-price competition when transmitted to the energy storage supplier. According to KPMG's consulting research, the typical gross profit level of enterprises in all links of the new energy storage industry chain is mostly less than 30% (the gross margin of electrochemical energy storage battery diaphragm link is about 50%), and the gross profit margin level of many listed energy storage enterprises also shows a downward trend. In the long run, it will be difficult for the overall market to achieve healthy competition, and the low-cost and low-performance construction mode will also bury potential safety hazards for the energy storage industry, destroy the overall ecology of the industry, and even damage the safety of people's lives and property.

The long-term prospects of independent energy storage power stations are good, but the economy of project landing is unclear in the short term

With the continuous promotion of independent energy storage projects to participate in electricity market transactions, independent energy storage power stations are an important force to promote the large-scale application of new energy storage in China, and have broad development space in the future. According to CNESA data, the planned/under-construction scale of independent energy storage power stations in China in the first half of 2022 is 45.3 GW, accounting for more than 80% of all planned/under-construction new energy storage projects. However, in the first three quarters of 2022, the newly put-into-operation scale of China's independent energy storage power stations is about 345.5 MW, which is obviously lower than the planned/under-construction scale. The main reason may be that the investors have insufficient construction power. When calculating the return on investment of the project, they need to consider many factors, such as auxiliary service compensation cost, spot market price difference, new energy capacity rental cost, call times of energy storage power stations, effective utilization time and so on. However, under China's current power market mechanism, these considerations are affected by changes in policies and market rules, which fluctuate greatly and are difficult to quantify. As a result, investors fall into the dilemma of "unclear-afraid to invest-unable to calculate". To promote the landing of independent energy storage power station projects, it is necessary to rely on further optimization of the power market mechanism.

Figure 7: The long-term prospect of independent energy storage power station is good

Capital speculation urgently needs cold thinking, and it is necessary to carefully identify high-quality energy storage tracks and targets

It is predicted that China's energy storage industry may face the risk of insufficient growth momentum in the future as the domestic demand for strong distribution is gradually met, the European energy price returns to a stable state and its own supply capacity is strengthened. In terms of racetracks, popular racetracks such as electrochemical energy storage and supporting industries have been laid out in advance by many giant enterprises, making it difficult for external investors to enter. However, the track that is still in the stage of market cultivation has little income at present, and many venture capital institutions are forced to flock upstream. However, due to their own strength and unable to invest in large-scale mineral resources enterprises, they choose low-margin and high-turnover tracks such as lithium carbonate refining instead. Specific to the target, high-potential venture investors are relatively concentrated and have high valuations, but many energy storage enterprises have not yet formed a stable and reasonable business model, which leads to increased challenges for investors to identify high-quality projects.

Establishing a market-oriented mechanism for energy storage cost diversion is the key to the transformation of energy storage industry from the initial stage of commercialization to scale

The energy storage industry is in a critical period of transition from the initial stage of commercialization to large-scale development. Economy is the key to the success of the next stage of energy storage. It is necessary to improve the top-level design of energy storage cost diversion and run through economy through marketization. In April 2022, the Price and Cost Survey Center of the National Development and Reform Commission published an article entitled "Improving the Compensation Mechanism of Energy Storage Cost to Help Build a New Power System with New Energy as the Main Body", proposing to strengthen the top-level design of energy storage policy, explore ideas and methods to solve bottlenecks restricting energy storage development, and promote the vigorous development of various energy storage technologies.

New energy storage technologies are driving the energy transition -China exportsemi.com