With the continuous development of new energy technology, energy storage technology has received more and more attention. In recent years, the development of new energy storage technology has become one of my country's important strategic development directions. China Overseas Semiconductor will interpret for you the 2023 "New Energy Storage Supports Energy Transformation" report jointly released by KPMG China and the Electric Transportation and Energy Storage Branch of the China Electricity Council . Explore the trends of the entire industry from five aspects: "Energy Storage Market Overview", "Industrial Scale and Forecast", "Energy Storage Business Model Analysis", "Energy Storage Enterprise Layout", and "Future Outlook of the Energy Storage Industry".

Vigorously developing the energy storage industry is of great significance for improving the utilization rate of renewable energy, achieving the "double carbon" goal, and establishing a new power system. In January 2022, the "14th Five-Year Plan" New Energy Storage Development Implementation Plan jointly released by the National Development and Reform Commission and the National Energy Administration pointed out that new energy storage is an important technology and basic equipment for building a new power system, and is an important tool for achieving "carbon peak" , an important support for the "carbon neutrality" goal, and also an important area for spawning new domestic energy formats and seizing new international strategic heights. KPMG China and the Electric Transportation and Energy Storage Branch of the China Electricity Council jointly released the 2023 "New Energy Storage Facilitates Energy Transformation" report. This report starts from the definition and development background of energy storage, and analyzes various energy storage methods, global and Chinese The scale of the energy storage industry was compared, and the business model, corporate layout, industry investment and financing of energy storage in different application scenarios were deeply analyzed, and the opportunities and challenges faced by the industry in the future were prospected.

1. Overview of the energy storage market

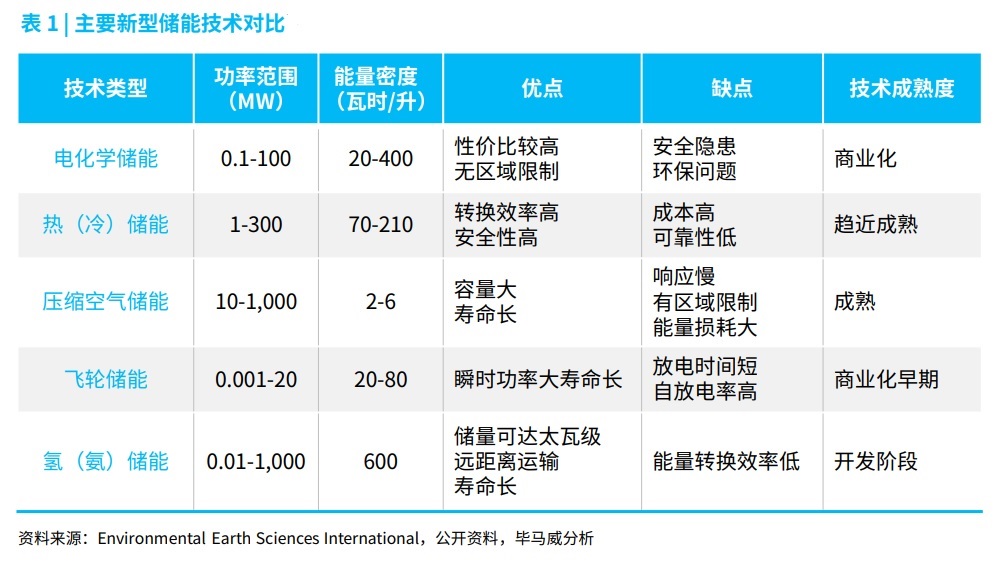

At present, in energy storage projects in power systems, pumped hydro storage is still the main method, but a variety of new energy storage methods represented by electrochemical energy storage are developing rapidly and have broad prospects. Table 1: Comparison of new energy storage technologies

- Pumped hydro energy storage is still the mainstream but its future development space may be limited. Pumped storage has the advantages of mature technology, large energy storage capacity, high system efficiency, long operating life, and high safety performance. It is currently a mainstream energy storage technology with a high degree of commercialization and a wide range of applications. From the perspective of the international market, pumped hydro energy storage occupies an absolute leading position. As of the end of 2020, the installed scale of pumped hydro energy storage accounted for 94% of the total scale of power energy storage projects. However, the construction of pumped storage power stations is greatly restricted by terrain factors, and the construction period is long, usually taking about 7 years. In the future, as the cost of new energy storage such as electrochemical energy storage decreases, the development of pumped storage in the power system will Space may be limited.

- New energy storage, mainly electrochemical energy storage, is growing rapidly and has become the main force in the development of the energy storage industry. Electrochemical energy storage has a wide power range, high energy density, and is more mature than other new energy storage technologies, so it is applicable to a wider range of scenarios. In addition, compared with pumped hydro energy storage, electrochemical energy storage is more convenient to install and is not subject to location restrictions, and is becoming a new driving force for the development of the energy storage industry. As of the end of 2022, 19 corporate member units of the National Electric Power Safety Commission have submitted a total of 772 electrochemical energy storage power stations of various types above 500kW/500kWh, with a total energy of 43.08GWh. Electrochemical energy storage is dominated by lithium-ion batteries, but the safety hazards of ternary lithium batteries are more prominent, which means that safer lithium iron phosphate batteries, flow batteries, etc. are expected to further open up market space in the future.

- New energy storage technologies have different applicable scenarios, and we focus on three major cost reduction ideas to promote large-scale application. In the process of promoting the large-scale application of new energy storage technologies, energy storage technologies that meet the needs of high security, long life, low cost, and high efficiency of the power grid should be matched for different application scenarios. In addition to the market prospects of electrochemical energy storage technology In addition to being worthy of attention, the commercial potential of compressed air energy storage, flywheel energy storage, hydrogen (ammonia) energy storage, etc. cannot be underestimated. At present, the industry is mainly focusing on three types of cost reduction ideas to help new energy storage technologies represented by electrochemical energy storage achieve large-scale applications: first, focusing on improving the cycle life of battery packs; second, reasonably reducing supply chain costs, such as realizing low-cost materials Replacement; third, optimize technologies such as energy storage cooling and integration methods to improve the overall efficiency of the energy storage system.

- Policy guidance and market mechanism optimization are two-pronged approaches to ensure the long-term and stable development of new energy storage. In addition to achieving technological progress and improving cost competitiveness, the development of new energy storage requires a favorable policy environment and market mechanism. Since the "14th Five-Year Plan", the country is actively promoting new energy storage to achieve commercialization from the early stage by 2025. Transform to large-scale development and achieve comprehensive market-oriented development by 2030. In the medium to long term, China's energy storage industry needs to rely on robust and efficient market mechanisms to establish a sustainable profit model and achieve high-quality development. We can learn from the electricity marketization experience of the United States, Europe, Australia, etc., and appropriately consider deregulating electricity prices and establishing a reasonable bidding mechanism to allow energy storage entities to obtain commercial benefits from electricity price fluctuations (i.e., the price difference between charging and discharging). The current status of energy storage development is gradually optimized from the aspects of power marketization and new energy storage market participation methods.

2. Energy storage industry scale and forecast

- The increase in renewable energy power generation will bring about rapid growth in the global energy storage market. According to EIA forecasts, wind and solar power will account for 72% of renewable energy power generation by 2050, nearly doubling the proportion in 2020. The unique intermittency and instability of new energy sources such as wind and solar energy will drive the rapid development of the global energy storage market. As a representative of new energy storage methods, electrochemical energy storage has particularly broad prospects for future development. According to CNESA's forecast, by 2027, the installed capacity of the global electrochemical energy storage industry will reach 1,138.9GWh, with a compound growth rate of 61% from 2021 to 2027, which is approximately twice the annual compound growth rate of 31% for the total installed capacity of energy storage in the future.

- China's electrochemical energy storage installed capacity will double year-on-year in 2022, and the installed capacity is expected to account for more than one-fifth of the world's total in 2026. By the end of 2022, 19 corporate member units of the National Electric Power Safety Commission have put into operation a total of 472 electrochemical energy storage stations with a total energy of 14.1GWh, a year-on-year increase of 127%; in 2022, 194 new electrochemical energy storage power stations will be put into operation, The total energy is 7.9GWh, accounting for 60.2% of the total energy of power stations in operation, a year-on-year increase of 176%. From an international comparison, according to the IEA's forecast, by 2026, China's total installed capacity of electrochemical energy storage will rank first among countries, accounting for 22%, which is almost the same as the total installed capacity in Europe and 7 higher than the United States. percentage point.

3. Analysis of business model of energy storage

The application scenarios of energy storage can be divided into three links : the power generation side, the grid side, and the user side . The business model of each link is also different. On the power generation side, it mainly plays the role of matching power production and consumption, and alleviating grid pressure; on the grid side, energy storage is mainly used to reduce or delay investment in grid equipment, alleviate grid congestion, and provide auxiliary services such as peak and frequency regulation for the power system; On the user side, it helps users implement modes such as peak shaving and valley filling or self-use of photovoltaics to reduce electricity bills.

Figure 1: Schematic diagram of energy storage downstream application scenarios

Figure 1: Schematic diagram of energy storage downstream application scenarios

- Power generation side:

At present, my country's electrochemical energy storage on the power generation side mainly includes thermal storage combined frequency regulation and new energy distribution and storage. The market scale of combined thermal storage frequency regulation is limited, and new energy distribution and storage has become the main application scenario of electrochemical energy storage on the power generation side. Due to factors such as the high cost of new energy distribution and storage, single revenue channels, and low utilization efficiency, which restrict the development of new energy power generation-side distribution and storage projects, policy is still the main driving factor for the current development of new energy distribution and storage.

1. New energy grid integration has become the main application scenario of electrochemical energy storage on the power generation side, but the total investment cost is high.

Many provinces have introduced policies requiring new energy stations to carry out distribution and storage. The proportion of energy storage allocated is 5%-20%, and the allocation hour is mostly 2 hours. However, the construction of energy storage power stations will increase the initial investment cost of the project. If a photovoltaic power station is equipped with an energy storage project with an installed capacity of 20% and a duration of 2 hours, its initial investment will increase by 8%-10%; while a wind farm equipped with the same capacity will For energy storage projects, the initial investment cost will increase by 15%-20%. At present, the distribution and storage costs of new energy enterprises are mainly borne by the enterprises themselves, and the increase in upstream costs such as lithium mines has put greater pressure on the enterprises.

2. The income from energy storage on the power generation side consists of reducing the amount of "abandoned wind and light" electricity, increasing electricity revenue and reducing assessment fees, but the current economics are still not significant.

my country's power marketization mechanism is still immature, new energy distribution and storage's participation in spot transactions in the power market is still being explored, the power generation side's participation in grid dispatching is unclear, and the conditions for participating in the ancillary service market are immature. Compared with the two-part electricity price policy for pumped hydro energy storage, due to the late start of new energy storage, both electricity price and capacity price need to be improved. At present, the cost of new energy distribution and storage is high and it is underused. According to a survey by China Electricity Council, the configuration time of energy storage projects in different application scenarios varies greatly. The configuration time of energy storage on the new energy side is 1.6 hours, which is higher than 0.6 hours for thermal storage, lower than 2.3 hours for grid-side energy storage, and 2.3 hours for user-side storage. It can take 5.3h. The operation strategies of new energy distribution and storage vary greatly. Most power stations adopt an operation strategy of charging and discharging when power is abandoned. In some projects, only some energy storage units are used, charging and discharging an average of 2 times per month, or even not using them at all. Condition. Judging from the equivalent utilization coefficient of the surveyed units, the equivalent utilization coefficient of new energy distribution and storage is only 6.1%, which is lower or much lower than thermal storage, grid side and user side.

- Grid side:

Grid-side energy storage refers to energy storage resources in the power system that can accept unified dispatching by power dispatching agencies, respond to the flexibility needs of the grid, and play a global and systemic role.

1. In terms of investment and operation models, the investment willingness of power grid enterprises still needs to be further strengthened, and existing non-independent energy storage projects face the problem of "difficulty in settlement".

After 2019, more new installed capacity of new energy storage will go to the power supply side, resulting in fewer existing new energy storage projects being connected to the grid side. Among them, energy storage projects that meet the conditions for direct power grid regulation or choose to settle with the power grid will generally adopt a contract energy management model. However, under this model, non-independent energy storage power stations often face delays or arrears of income from their owners. The fundamental reason is that such projects do not have the status of independent market entities such as independent measurement, dispatching, and settlement, and can only indirectly participate in power through power grid companies. market.

2. In terms of revenue pricing model, the blocking point is that the cost cannot be transmitted to the user side. There is an urgent need to develop a capacity cost recovery mechanism and a power spot market.

The income from grid-side energy storage mainly comes from compensation for ancillary services such as peak shaving and frequency modulation. According to incomplete statistics, at least 19 regions at or above the provincial level have clarified peak shaving and frequency modulation compensation standards. The problem is that according to the principle of "whoever provides, who benefits; whoever benefits, who bears", compensation for auxiliary services should be borne jointly by the power generation side and the user side. However, the cost of auxiliary services on the domestic grid side is currently difficult to transmit to the user side. To a certain extent, The extent may limit the development of the ancillary services market. Based on foreign market experience, China's grid-side energy storage urgently needs to develop a capacity cost recovery mechanism and a power spot market to improve the cost diversion mechanism and expand revenue sources.

- Independent energy storage power stations are the development trend on the source and grid side.

Independent energy storage refers to a new energy storage project that has technical conditions such as independent measurement and control, is connected to the dispatching automation system and can be monitored and dispatched by the power grid, complies with relevant standards and regulations and the requirements of power market operating agencies, and has legal person status. Shared energy storage power stations, that is, power station resources do not belong exclusively to a certain new energy station or power grid, but use the power grid as a link to integrate independent and dispersed grid-side, power-side, and user-side energy storage power station resources and provide unified and coordinated services to the grid. All new energy stations in the country will promote the full release of energy storage capabilities at all ends of the source, grid and load. Independent energy storage power station and shared energy storage power station commonly understood in the industry. In addition to meeting the energy storage needs of the power generation side, independent energy storage power stations can also meet the peak and frequency regulation needs of the grid side, broadening revenue channels and improving economics, which is the future development direction of energy storage power stations.

oThe identity of independent energy storage power station market entities is clear and the business model is evident. The National Development and Reform Commission and the Energy Bureau have repeatedly proposed to explore and promote the independent energy storage model, clarify the market dominant position of independent energy storage power stations, and continue to promote power auxiliary services and market-oriented reforms. After the country determined the development direction of independent energy storage, the Southern Region, East China Region, North China Region, etc. issued relevant detailed rules for new energy storage to participate in the power auxiliary service market.

o The revenue model of independent energy storage is still being explored, and details need to be further implemented. Generally speaking, the income channels of independent energy storage power stations include participating in spot transactions in the power market to obtain price difference arbitrage income, stable capacity market income, capacity leasing income and ancillary service income. Due to different market rules in different regions and the operating characteristics of energy storage itself, in most cases energy storage cannot obtain benefits from all channels, but can only obtain one or two of them at the same time.

o China's power market reform is gradually advancing. The possibility of independent energy storage power stations participating in power spot market transactions has increased. The overlay ancillary service market is gradually opening up to independent energy storage. Independent energy storage power stations can participate in peak shaving, frequency modulation and other power auxiliary services and capacity. Leasing to expand revenue channels. In the future, as the proportion of new energy power generation increases, the peak-to-trough price difference in the electricity spot market in some provinces is expected to continue to widen, thereby further increasing the profitability of energy storage projects and promoting the development of independent energy storage.

- user terminal:

The main body of energy storage is power users, mainly including industrial and commercial users and household users. The development of user-side energy storage can help save power costs and ensure the stability of power consumption.

1. Household energy storage (household energy storage) refers to the energy storage system used by home users. Household energy storage systems are usually installed in combination with household photovoltaic systems to provide electrical energy to home users. Household energy storage systems can improve the degree of self-use of household photovoltaics, reduce users' electricity bills, and ensure the stability of users' electricity consumption in extreme weather and other conditions. For users in areas with high electricity prices, peak-to-valley price differences, or old power grids, purchasing household storage systems is more economical, and household users have the motivation to purchase household storage systems.

o High electricity prices, cost reductions and policy support have boosted the overseas household storage market. Judging from the household electricity prices in major countries and regions in 2021, household electricity prices in European countries represented by Denmark, Germany, and the United Kingdom are all above US$0.3/KWh, which is double that of the United States and nearly three times that of China. Entering 2022, as the extreme drought weather in many European countries in the summer combined with the rise in natural gas prices caused by the Russia-Ukraine conflict, European electricity prices hit new highs. The application of household photovoltaic + energy storage systems can increase the level of self-consumption of electricity to delay and reduce the risks caused by rising electricity prices.

o The continued growth of photovoltaic penetration and the decline in installed costs will generate future market size. Due to the high degree of urbanization in European and American countries, housing is mainly detached or semi-detached houses, which are suitable for the development of household photovoltaics. At the same time, due to the accelerated pace of energy transformation, various countries have also introduced policies to encourage the spontaneous use of household photovoltaics. In 2021, the per capita household photovoltaic installed capacity in the 27 EU countries will be 355.3 watts per household, a 40% increase compared with 2019. From the perspective of penetration rate, the current household photovoltaic installed capacity in Australia, the United States, Germany, and Japan accounts for 66.5%, 25.3%, 34.4%, and 29.5% of the total photovoltaic installed capacity respectively, which is more than ten times that of China. It has good Household savings basis. In addition, the cost of household storage equipment accounts for the highest proportion, and the price of the most widely used lithium battery pack has dropped year by year from US$684/kWh in 2013 to US$132/kWh in 2021, a decrease of 81%, which is the same as in 2020. There was also a 6% drop from the previous year. Due to the increase in the price of upstream raw material lithium, BNEF has adjusted back the original forecast point of battery pack price falling by US$100/kWh in 2024 by two years to 2026.

o Take a family of four in Sydney with both working-class parents as an example. Assume that the daily electricity consumption of the family is 22kWh, and the installed home energy storage system is 7kW photovoltaic modules + 13.3kWh energy storage battery. According to estimates, due to the rapid decline in the cost of photovoltaic systems in recent years, the return on investment cycle for households installing only photovoltaic systems is the fastest, about 5.5 years; the payback cycle for installing photovoltaic + energy storage batteries is about 7.4 years. It is expected that if electricity prices rise further in the future, and as the cost of energy storage batteries decreases and their lifespan increases, their return cycle will be further shortened.

2. Industrial and commercial energy storage is another important component of user energy storage. For users who do not use photovoltaic, its economy is mainly reflected in the use of energy storage for peak and valley arbitrage; for photovoltaic users, they can save electricity through spontaneous self-use. cost, helping enterprises save energy and reduce emissions. Industrial and commercial energy storage mainly makes money through energy time shifting, peak-valley price difference arbitrage, capacity electricity fee reduction and demand response.

o Industrial and commercial energy storage is the main growth of China's energy storage market in the future. According to Wood Mackenzie's forecast, by 2031, industrial and commercial energy storage will account for 10% of China's energy storage market, with a total installed capacity of 442GWh, an increase of 4 percentage points from 2021, and will be the main growth market. The proportion of power generation/grid side remains unchanged, while the proportion of household energy storage will be only 4% by 2031, a decrease of 3 percentage points from 2021.

Figure 2: Industrial and commercial energy storage will be the main increase in China’s energy storage market in the future.

Figure 2: Industrial and commercial energy storage will be the main increase in China’s energy storage market in the future.

o With the further improvement of time-of-use electricity prices and the further increase of electricity prices for high-energy-consuming enterprises, the economics of energy storage for industrial and commercial users has significantly enhanced. At the same time, power cuts in some provinces and cities in my country in 2021, as well as tight power supply caused by drought and other extreme weather, have disrupted industrial and commercial production and operations and boosted energy storage demand.

o Industrial and commercial energy storage has a wide range of application scenarios, including industrial parks, data centers, communication base stations, government buildings, shopping malls, hospitals and other industries. Among them, the industrial park has the characteristics of large factory floor area, and the photovoltaic power generation time coincides with the peak power consumption. After configuring the combined photovoltaic and storage system, it can effectively reduce the cost of power purchase, reduce the impact of photovoltaic on the system, and reduce power deviation in the power market environment. The economic losses caused are more representative industrial and commercial energy storage scenario applications.

4. Energy storage enterprise layout and financing

The implementation of the national "dual carbon" strategy has greatly promoted the development of energy storage technology and industry. Energy storage has realized the transformation from the early stage of commercial development to large-scale development, and the development of energy storage has entered the fast lane.

1. Energy storage enterprise layout

o Newly established energy storage companies are growing rapidly. Before 2021, there will be approximately three to four thousand newly established energy storage-related companies in my country every year. However, as the energy storage industry heats up rapidly, 38,294 energy storage-related companies will be established in 2022, 5.8 times the number in 2021. In terms of geographical distribution, the industrial agglomeration effect of Guangdong and Jiangsu provinces is obvious. In 2022, the number of newly established energy storage-related companies in Guangdong Province and Jiangsu Province will be 4,044 and 3,225 respectively, accounting for 10% and 8%.

o China has become the most active country in basic research on energy storage technology in the world. According to the number of SCI papers counted in the Web of Science database with the subject term "Energy Storage", Chinese institutions and scholars published a total of 11,949 energy storage technology papers in 2021, ranking first in the world and surpassing the second to seventh countries. Total number of papers published.

o Central electric power enterprises are the main body of pumped hydro energy storage construction, and are also extending to electrochemical energy storage power stations; private enterprises focus on the electrochemical energy storage track, with the largest battery business layout. Pumped hydro storage still occupies a dominant position in energy storage in my country. The main investors are State Grid and China Southern Power Grid, which account for more than 90% of the market. The five major power generation groups, six small power generation groups, the two major power grids, and central enterprises such as PetroChina and Sinochem are all involved in the energy storage industry. As of now, a total of 78 listed private companies are engaged in the electrochemical energy storage industry. Batteries are the field with the largest number of listed private companies, reaching 45, while lithium battery materials and energy storage systems have 19 and 13 companies respectively.

2. Energy storage industry financing

o Global energy storage financing transactions continue to increase. According to the Pitchbook database, the amount of global energy storage financing increased by 30% year-on-year in 2021, and continued the previous high growth in 2022. Global energy storage financing for the whole year was US$6.3 billion, a year-on-year increase of 94%. China, the United States and Europe are the main entities in global energy storage financing transactions. Since 2020, the three countries (regions) have accounted for about 90% of the world's energy storage financing transactions.

Figure 3: Quarterly global financing amount and quantity of energy storage from 2020 to 2022

Figure 3: Quarterly global financing amount and quantity of energy storage from 2020 to 2022

o The financing scale of China’s energy storage industry is increasing rapidly, and its regional distribution is relatively concentrated. According to the investment database, since the second half of 2020, the number and scale of financing in the energy storage industry have increased significantly, making it a new energy track that is highly favored by the investment market after photovoltaics and electric vehicles. According to investment data, the energy storage industry will still be hot in 2022. There were 249 financing transactions in the energy storage industry throughout the year, with a financing scale of 49.4 billion yuan, and the financing amount was 16 times that of 2019. Since the energy storage industry is in its infancy and there are many new entrants, the financing demand for energy storage is mostly in its early stages. The amount of Series A and Series B financing in the energy storage industry in 2022 is 32.5 billion yuan, accounting for 66%. From a regional perspective, the top ten provinces in terms of financing amount for energy storage companies will raise a total of 45.3 billion yuan in 2022, accounting for 92% of the overall financing in the energy storage industry. There were 67 financings in the energy storage industry in Guangdong Province, with a financing amount of 13.5 billion yuan, exceeding other provinces in both quantity and amount.

o Batteries are still the hottest field in China’s energy storage industry, and upstream material companies are also favored by the capital market, with large-scale financings occurring frequently in the industry. In 2022, the financing amount of battery companies will be 31.7 billion yuan, accounting for 64% of the overall financing transaction amount in the energy storage industry. There were 29 upstream financings in the energy storage industry including cathode materials, anode materials, etc., with a financing amount of 10.8 billion yuan. The largest financing amount in the energy storage industry in 2022 is Sunwanda Battery, with a financing amount of 8 billion yuan.

5. Future Prospects of the Energy Storage Industry

As the development of new energy accelerates, new energy storage has high hopes as a solution to improve the safe and efficient utilization of new energy. At the same time, business economics, application security, policies and market competition mechanisms that need to be improved have also brought many challenges to the development of the industry.

- On the user side, domestic industrial and commercial and overseas household energy storage are developing rapidly. As far as domestic industry and commerce is concerned, the introduction of time-of-use electricity prices and electricity premiums for high-energy-consuming enterprises has improved the economics of peak-shaving and valley-filling on the user side. The domestic lithium battery market has a scale advantage compared with foreign countries, which is also an important driver of market development. force. In the future, with the introduction of virtual power plant policies, more new values will be brought to the market. As for household energy storage, overseas markets have a large market space due to high electricity prices, increasing proportion of new energy, weak power grids and other reasons, and profit margins are relatively guaranteed. Compared with local companies in Europe and the United States, Chinese companies occupy a relatively small share of the terminal product market. However, in the key links of the household energy storage industry chain, including energy storage lithium batteries and energy storage converters, domestic power battery companies, Photovoltaic inverter companies have strong competitiveness and continue to make efforts in the overseas home storage market.

- The competitive landscape of the downstream market places different requirements on the core competitiveness of energy storage companies. For Chinese energy storage companies, the household storage market is currently mainly overseas, and is focused on the consumer side for mass consumers. Business expansion relies more on channels and brand promotion. Whether the company has localization capabilities determines whether it can further develop. Key factor. On the power supply side/grid side/industrial and commercial energy storage side, the focus is on to B facing enterprises, and the current main market is domestic. Therefore, the resource channels of energy storage enterprises and the control of system security and cost are key factors for their development.

- A single revenue model triggers low-price competition, and safety and sustainable development deserve attention. The driving force for the development of new energy storage mainly comes from the policy side, that is, mandatory allocation of storage on the power generation side. When the cost of energy storage is mainly borne by the power generation side and the source of energy storage revenue is relatively single, power generation companies will be more inclined to do so due to economic considerations. Choosing low-cost energy storage projects relatively ignores performance and safety issues, which will lead to low-price competition issues when transmitted to energy storage suppliers. According to KPMG consulting research, the current typical gross profit levels of companies in each link of the new energy storage industry chain do not exceed 30% (the gross profit margins of the electrochemical energy storage battery separator link are around 50%). The gross profit margins of many listed energy storage companies also show similar levels. a downward trend. In the long run, it will be difficult for the overall market to achieve healthy competition, and the low-cost and low-performance construction model will also pose safety risks to the energy storage industry, destroy the overall ecology of the industry, and even harm the safety of people's lives and property.

- The long-term prospects of independent energy storage power stations are promising, but the economics of project implementation in the short term are unclear. As policies continue to promote independent energy storage projects to participate in power market transactions, independent energy storage power stations are an important force in promoting the large-scale application of new energy storage in China, and there is broad room for future development. According to CNESA data, the planned/under construction scale of China's independent energy storage power stations in the first half of 2022 was 45.3GW, accounting for more than 80% of all planned/under construction new energy storage projects. However, the newly put into operation scale of China's independent energy storage power stations in the first three quarters of 2022 is about 345.5MW, which is significantly lower than the planned/under construction scale. The main reason may be that investors lack motivation for construction. When calculating the project investment return rate , many factors need to be considered, such as ancillary service compensation fees, spot market price differences, new energy capacity rental fees, number of energy storage power station calls, effective utilization time, etc. Under China's current power market mechanism, these considerations are affected by changes in policies and market rules, are highly volatile, and are difficult to quantify. This has caused investors to fall into the dilemma of "can't figure it out - don't dare to invest in construction - can't figure it out". Promoting the implementation of independent energy storage power station projects requires further optimization of the power market mechanism.

- Capital speculation urgently calls for cold thinking, and high-quality energy storage tracks and targets need to be carefully screened. It is expected that as domestic demand for strong distribution is gradually met, European energy prices stabilize and its own supply capacity is strengthened, China's energy storage industry may face the risk of insufficient growth momentum in the future. In terms of tracks, many popular tracks such as electrochemical energy storage and supporting industries have already been laid out by giant companies in advance, making it difficult for external investors to enter. The tracks that are still in the market cultivation stage currently have relatively small profits. Many venture capital institutions are forced to rush upstream. They are limited by their own strength and unable to invest in large-scale mineral resource enterprises. Instead, they choose low-margin, low-margin, lithium carbonate refining, etc. High turnover track. Specific to the targets, high-potential entrepreneurial investors are relatively concentrated and valuations are relatively high. However, many energy storage companies have not yet formed a stable and reasonable business model, which makes it more challenging for investors to identify high-quality projects.

- Establishing a market-oriented mechanism to ease energy storage costs is the key to the transformation of the energy storage industry from the early stage of commercialization to large-scale development. The energy storage industry is in a critical period of transformation from the early stage of commercialization to large-scale development. Economics is the key to whether the next step of energy storage goes smoothly. It is necessary to improve the top-level design of energy storage cost management and run through the economy through market-oriented methods. sex. In April 2022, the Price and Cost Investigation Center of the National Development and Reform Commission published an article titled "Improving the Energy Storage Cost Compensation Mechanism to Help Build a New Power System with New Energy as the Main Body", proposing to strengthen the top-level design of energy storage policies and explore solutions to the constraints that restrict energy storage development. Bottleneck ideas and methods promote the vigorous development of various energy storage technologies.

Report source: KPMG analysis

Data source: Environmental Earth Sciences International, Wood Mackenzie, pitchbook

How much do you know about the development background of the energy storage industry?

Energy storage market overview (Part 1): Main energy storage technologies

Energy Storage Industry Report: Energy Storage Business Model: Power Generation Side Energy Storage

Energy storage industry report: Grid-side energy storage in energy storage business model (Part 1)

Energy Storage Industry Report: Energy Storage Business Model: User-side Energy Storage

Energy Storage Industry Report: Multiple Tests on China’s New Energy Storage Fast Track