Research from various industry reports in recent years has found that the development of China's energy storage companies and basic energy storage research have entered the fast lane. In the next few years, it is expected to usher in an era of full-scale explosion. From a global perspective, China has become the most active country in basic research on energy storage technology in the world. Batteries are still the hottest track in the energy storage industry, and upstream material companies are also favored by the capital market.

The number of newly established energy storage companies in China surges

Before 2021, there will be three to four thousand new energy storage-related companies established every year. In the context of achieving the "double carbon" goal and policy support for new energy storage, the development of China's energy storage industry has entered a fast lane. 38,294 energy storage-related companies will be established in 2022, 5.8 times that in 2021 (Figure 25). The surge in the number of new companies also reflects the popularity of the energy storage track to a certain extent. China Renaissance's report pointed out that the energy storage track will be the hot spot that investors pay most attention to in the second and third quarters of 2022, ranking first for two consecutive quarters. 163 .

Figure 25 : Number of newly established energy storage companies from 2018 to 2022

From the perspective of geographical distribution, the industrial agglomeration effect of Guangdong Province and Jiangsu Province is obvious. In 2022, the number of newly established energy storage-related companies in Guangdong Province (including Shenzhen) and Jiangsu Province will be 4,044 and 3,225 respectively, accounting for 10% and 8% (Figure 26). Guangdong and Jiangsu provinces have developed economies and have a large demand for electricity. They have complete supporting industries such as batteries, power dispatching, and energy storage systems, and a concentration of technical talents. The enterprises are close to end demand and talent gathering places, which is conducive to the agglomeration effect of the energy storage industry.

Figure 26 : Distribution of newly established energy storage companies in provinces (municipalities) in 2022

China has become the most active country in the world in basic research on energy storage technology

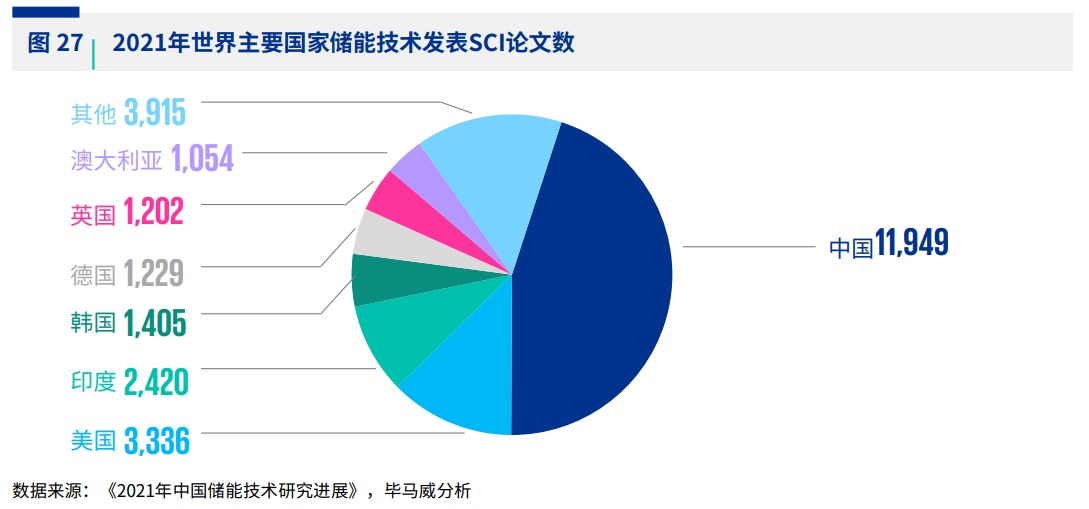

The academic community also pays attention to energy storage, and research related to energy storage such as batteries and energy storage has increased. Countries with advanced basic research on energy storage technology in the world are divided into two categories: the first category is Western developed countries represented by the United States, Germany, the United Kingdom and Australia; the second category is emerging countries represented by China, India and South Korea. According to the number of SCI papers in the Web of Science database with the subject term "Energy Storage", Chinese institutions and scholars published a total of 11,949 papers on energy storage technology in 2021, ranking first in the world and far ahead of the second-place United States with 3,336 papers. and India, the third place, with 2,420 papers, and more than the total number of papers published by the second to seventh countries. China has become the most active country in basic research on energy storage technology in the world (Figure 27).

Figure 27 : Number of SCI papers published on energy storage technology in major countries in the world in 2021

In 2021, the number of SCI papers published by Chinese institutions and scholars on lithium-ion batteries, thermal storage (including cold storage), supercapacitors, and sodium-ion batteries exceeded 1,000, making them a popular area for basic research in the field of energy storage (Figure 28). In terms of sub-technologies, including pumped hydro energy storage, compressed air, heat storage, flywheels, lead batteries, lithium-ion batteries, sodium-ion batteries, flow batteries, supercapacitors, liquid metal, metal-ion batteries and aqueous batteries, Chinese institutions and The number of SCI papers published by scholars in 2021 ranks first in the world.

Figure 28 : SCI papers published on China’s major energy storage technologies in 2021

At present, China's in-depth advancement of basic research in the field of energy storage has provided theoretical support for the development of the energy storage industry. Combined with national policies to support the integration of industry, academia and research, and promote the transformation of theoretical research into industrial applications, the development of the energy storage industry has deep basic research support and is expected to have great development in the future.

Distribution of energy storage companies : Large central power enterprises are actively deploying energy storage business to drive industry development

Pumped hydro storage still occupies a dominant position in energy storage in China, and the main investors are State Grid and China Southern Power Grid, which account for more than 90% of the market64 . Up to now, the five major power generation groups, six small power generation groups, the two major power grids, and central enterprises such as PetroChina and Sinochem have all deployed in the energy storage industry (Table 19).

Table 19 : Energy storage layout of some state-owned enterprises

Multiple energy storage is included in the key tasks of production, operation, reform and development of state-owned central enterprises in 2022. While taking on the heavy responsibility of pumped hydro energy storage construction, central power enterprises are also extending their efforts to new energy storage such as electrochemical energy storage. According to Wind data, there are currently 11 listed state-owned enterprises in the lithium battery track, and 9 listed state-owned enterprises in the lithium battery material track. For example, Sinochem International relies on lithium batteries and materials to extend the upstream and downstream industrial chain, increase its lithium battery energy storage business layout, and plans to provide integrated solutions in the energy storage field. The products will be mainly used in large-scale energy storage on the power generation side, the grid side, and the user side. Scenes.

Distribution of energy storage companies : Private companies focus on electrochemical energy storage, with battery business being the largest

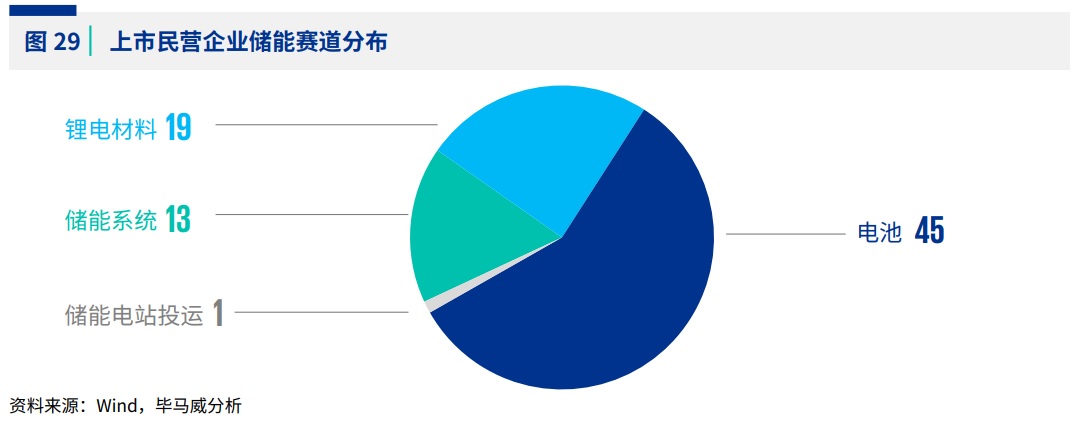

Electrochemical energy storage technology has the advantages of relative maturity, short construction period, and relatively low cost. It has become a hot spot on the energy storage track, attracting a large number of private companies to enter the energy storage track. After sorting out the Wind listed companies, there are currently 78 listed private companies in the electrochemical energy storage industry. Their business scope includes batteries (mainly lithium batteries), lithium battery materials (mainly cathode materials and anode materials), energy storage systems, etc. 61 . Batteries with lithium batteries as the main body have the largest number of listed private companies, reaching 45, while lithium battery materials and energy storage systems have 19 and 13 companies respectively (Figure 29). Energy storage has become a new growth pole for battery companies. For example, CATL listed energy storage as one of its three major businesses in its annual report. In addition to increasing the supply of energy storage cells, it also established a holding subsidiary to enter grid-side energy storage.

Figure 29 : Distribution of energy storage tracks of listed private enterprises

The popularity of the energy storage track has also attracted the entry of other industries such as high-end manufacturing. According to Gaogong Energy Storage Research, from 2021 to September 2022, the proportion of new energy storage businesses of listed companies will reach 30% 62 . Xiaomi, Huawei and other companies have added departments to focus on the development of the energy storage industry. Midea Group, Gree Group and others have entered the industry by acquiring new energy companies, and Sany Heavy Industry and other companies have established lithium battery companies to lay out the energy storage industry.

Financing status of global energy storage industry

In recent years, major countries and regions around the world have actively promoted green transformation and reduced carbon emissions. The installed capacity of new energy sources such as wind power and photovoltaics has increased, and energy storage subsidy policies have been introduced. Global energy storage financing transactions have continued to increase. The amount of global energy storage financing will increase by 30% year-on-year in 2021, and will continue the previous high growth in 2022. Energy storage financing for the year will be US$6.3 billion, a year-on-year increase of 94%; the number of financings will be 239, a year-on-year increase of 10% 67 (Figure 30).

Figure 30 : Global financing amount and quantity of energy storage from 2020 to 2022, quarterly

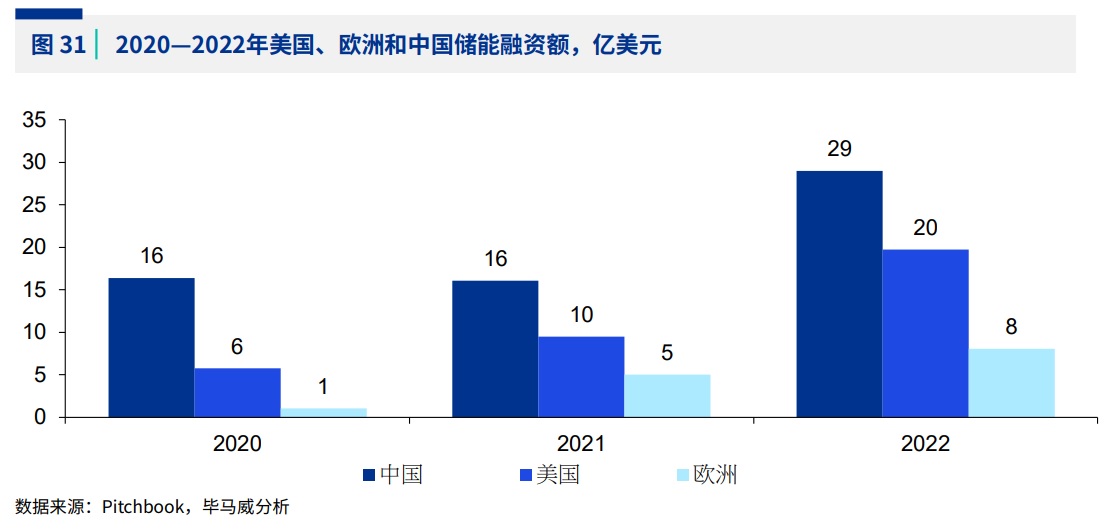

China, the United States, and Europe are the main players in global energy storage financing transactions. In 2022, energy storage financing transactions in three countries (regions) will account for 90% of the world. Among them, the energy storage financing amounts of China, the United States and Europe will be US$2.9 billion, US$2 billion, and US$800 million respectively, accounting for the global energy storage financing amount respectively. 46%, 31% and 13% (Figure 31).

Figure 31 : Energy storage financing amount in the United States, Europe and China from 2020 to 2022, US$100 million

Equity financing in the European energy storage industry is mainly distributed in Germany, France, Sweden, the United Kingdom and Belgium. In 2022, the five countries will account for 91% of the European energy storage financing scale, with the proportions of the five countries being 38%, 30%, 11% and 7% respectively. , 4% (Figure 32).

Figure 32 : Proportion of energy storage financing in major European countries in 2022

Financing status of China’s energy storage industry

The implementation of the national "dual carbon" strategy has greatly promoted the development of energy storage technology and industry. Energy storage has realized the transformation from the early stage of commercial development to large-scale development, and the development of energy storage has entered the fast lane.

Energy storage financing: The amount of industry financing has grown rapidly since 2020, and energy storage companies in Guangdong Province are far ahead.

According to data from ChinaVenture, since the second half of 2020, the number and scale of financing in the energy storage industry have increased significantly, making it a new energy track that is highly favored by the investment market after photovoltaics and electric vehicles. In 2019, the financing scale of the energy storage industry was only 3 billion yuan, which increased to 49.4 billion yuan in 2022, 16 times the financing amount in 2019 (Figure 33). Due to the large financing of 11.59 billion yuan by China New Aviation (AVIC Lithium Battery) and 10.28 billion yuan by Honeycomb Energy, the third quarter of 2021 became the quarter with the largest scale of energy storage financing since 2019. In 2022, the energy storage industry continued to be hot since last year, with 249 financing transactions in the energy storage industry throughout the year, with a financing scale of 49.4 billion yuan. It is worth noting that the number and amount of energy storage financing in the second half of 2022 far exceeded that in the first half of the year, especially the large financing of Xinwanda, Rongtong Hi-Tech, Guoqing Technology, Haichen Energy Storage, Weilan New Energy, etc., which led to financing of 36.7 billion yuan in the second half of the year, accounting for 74% of the annual financing 68 .

Figure 33 : Number and amount of financing in the energy storage industry from 2019 to 2022, quarterly

Judging from the distribution of financing rounds, early-stage financing such as seed rounds, angel rounds, and Series A currently dominate69 . Since the energy storage industry is in its infancy and there are many new entrants, the financing demand for energy storage is mostly in its early stages. In 2022, the amount of Series A and Series B financing in the energy storage industry will reach 32.5 billion yuan, accounting for 66% (Figure 34). Enterprises that entered the energy storage industry earlier have improved their technical strength and market recognition after several years of tempering and precipitation, and are already in the mid-to-late stage of financing in the capital market, such as Series C and Series D. In 2022, the D round of financing and beyond will reach as high as 11.2 billion yuan. Some companies that have deployed energy storage earlier have successfully gone public after receiving multiple rounds of financing, such as C round and D round.

Figure 34 : Energy storage industry financing amount by round from 2019 to 2022, billion yuan

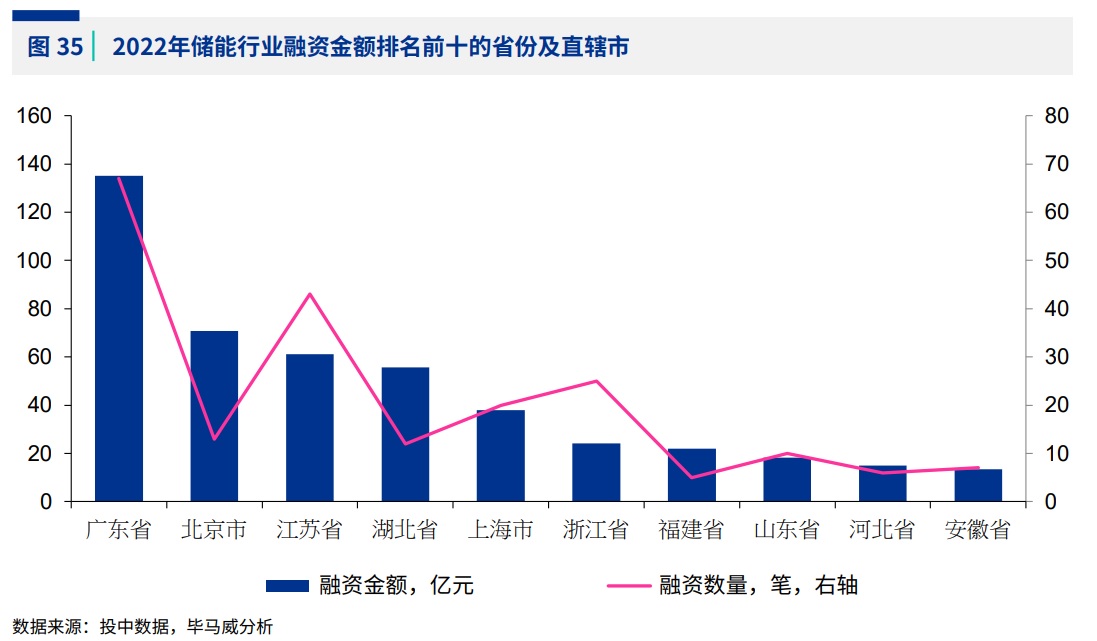

From the perspective of financing distribution area, Guangdong Province is far ahead in energy storage financing, and East China regions such as Beijing, Jiangsu Province, Shanghai, Zhejiang Province and Shandong Province also have more energy storage financing. The energy storage industry is relatively concentrated. In 2022, the top ten provinces in terms of financing amount for energy storage companies raised a total of 45.3 billion yuan, accounting for 92% of the overall financing in the energy storage industry. Among them, there were 67 financings in the energy storage industry in Guangdong Province, with a financing amount of 13.5 billion yuan. Both the number and amount of financing exceeded other provinces. This is also consistent with Guangdong Province having the largest number of newly established energy storage companies in 2022 (Figure 35).

The accumulation of energy storage in Guangdong Province is inseparable from the emphasis on clean energy and strong policy support. Guangdong leads the provinces in the installed capacity of clean energy sources such as photovoltaic power generation, with 10.2GW of photovoltaic installed capacity as of 2021. Guangdong Province plans to have approximately 195 million kilowatts of power installed capacity in 2025 and 246 million kilowatts in 2035, with clean energy accounting for 74% of the installed capacity. In the process of green transformation, Guangdong Province has introduced a number of policies to support the development of energy storage, which have been piloted on the power supply side and the grid side. For example, it has taken the lead in encouraging the inclusion of energy storage electricity prices into transmission and distribution prices, and has encouraged new electricity users to enter the market through direct participation. The market determines the price of electricity. The use of clean energy will further increase the demand for energy storage, and it is expected that the energy storage industry in Guangdong Province will further develop on the basis of existing advantages.

Figure 35 : Top ten provinces and municipalities by financing amount in the energy storage industry in 2022

Energy storage track: Batteries are the hottest track, and upstream materials are also favored by capital

Batteries remain the hottest track in the energy storage industry, and upstream material companies are also favored by the capital market. In 2022, battery companies raised 6470 financings , accounting for 52% of the total financing transactions in the energy storage industry, with a financing amount of 31.7 billion yuan, accounting for 64% of the total financing transaction amount in the energy storage industry (Figure 36). The upstream financing of the energy storage industry, including positive electrode materials and negative electrode materials, was 29, with a financing amount of 10.8 billion yuan. However, the financing distribution of batteries is more diversified. In addition to traditional lithium-ion batteries, new batteries such as sodium-ion batteries, solar cells, heterojunction batteries, hydrogen fuel cells, and aqueous zinc-based batteries have also received financing.

Figure 36 : Distribution of energy storage financing companies in 2022, 100 million yuan

Energy storage is a capital- and technology-intensive industry, and the development of the industry requires a large amount of investment. With changes in the international environment and policy support, the energy storage industry has become a new growth pole, attracting the entry of different types of capital. There are not only the support of investment institutions such as PE/VC, but also the in-depth deployment of energy storage by companies such as CATL and BYD, as well as cross-border entry into the industry such as Gree Group and Xiaomi. The support of various market entities for the energy storage industry has promoted the rapid development of the energy storage industry, and large-scale financing in the industry has occurred frequently. Among them, Honeycomb Energy received a total of 6 rounds of financing from February 2021 to September 2022, with a total financing amount of approximately 21 billion yuan; China New Aviation (AVIC Lithium Battery) conducted a total of 5 rounds of financing before listing, with a financing amount of 20 billion yuan. .

In 2022, Sunwanda Battery will have the largest financing amount in the energy storage industry, with a financing amount of 8 billion yuan (Table 20). With the popularity of the energy storage track, Sunwanda Battery has accelerated its energy storage deployment. In February 2022, it signed a project investment agreement with the Shifang Municipal Government of Sichuan Province. It plans to invest a total of 8 billion yuan to build 20GWh power battery and energy storage battery production. Base 71 . The rising prices of upstream materials for energy storage have put greater pressure on battery companies. Against this background, upstream material companies have attracted the attention of the capital market. In 2022, upstream material companies for energy storage received a number of large financings. Rongtong Hi-Tech Advanced Materials, a developer and manufacturer of lithium battery cathode materials, received 5 billion yuan in financing in July 2022.

Table 20 : Large-scale financing transactions in the energy storage industry in 2022

63. China Renaissance , "The Third Market Temperature Report 2022", October 2022

65. This article only counts listed companies whose main business is related to the energy storage industry chain. It does not include listed companies that cross-border into energy storage, such as Midea Group, Gree, Xiaomi, etc., nor does it include lithium mines and other companies that provide raw materials for energy storage. listed companies.

66. The TOP100 total market value of listed energy storage companies in 2022 is released, Digital Energy Network, August 22, 2022

67. Equity investment transaction rounds in this section include seed rounds, incubators, crowdfunding, early and late-stage VC, PE growth stage, PIPE (Private Investment in Public Equity), strategic acquisitions (Buyout/LBO), and IPO, including undisclosed amounts transaction. Pitchbook and investment data have different definitions of the energy storage industry and financing rounds, which may lead to large differences in China's energy storage financing scale under the statistical caliber of Pitchbook and the statistical caliber of investment data.

68. Some energy storage financing transactions in the investment data did not disclose the specific amount . For transactions where the specific amount was not disclosed, we made an approximate treatment based on the transaction amount range. In addition, this part of the data analysis only includes financing transactions before the company goes public. For example, China New Aviation (AVIC Lithium Battery) will be listed in October 2022, and multiple rounds of financing before that are within the scope of analysis.

69. Early-stage financing includes Series A, Series A+, Series B, and Series B+, and mid- and late-stage financing includes Series C, Series D, and pre-IPO rounds.

70. In 2022 , a total of 249 financings occurred in the energy storage industry, of which 123 disclosed the transaction amount and 126 did not disclose the transaction amount. This part of the track analyzes financing transactions with disclosed amounts.

71. Xinwangda plans to invest 8 billion to build a power battery and energy storage battery production base, Tencent, March 17, 2022

Report source: KPMG analysis

How much do you know about the development background of the energy storage industry?

Energy storage market overview (Part 1): Main energy storage technologies

Energy Storage Industry Report: Energy Storage Business Model: Power Generation Side Energy Storage

Energy storage industry report: Grid-side energy storage in energy storage business model (Part 1)

Energy Storage Industry Report: Energy Storage Business Model: User-side Energy Storage

Energy Storage Industry Report: Multiple Challenges on China's New Energy Storage Fast Track