It is reported that the Institute for Information Industry, III, recently released an analysis report titled " Global and Taiwan Semiconductor Industry Outlook 2024 ", which stated that in 2024, affected by many factors, the global semiconductor industry The industry prospects are not clear, and dark clouds are still gathering in many countries or regions around the world. However, the industry is still expected to get out of the bottom in 2024 and show a rebound trend. Among them, Sino-US confrontation, China's economic development and war risks are still the three most critical factors.

China exportsemi net will analyze this report for you in two parts. In the first half of the report, two major issues are mainly elaborated, namely: key issues in global semiconductor development; and eight major trends in semiconductor development in Taiwan under the influence of the global industry.

- Key issues in global semiconductor development:

1. Global economic growth has slowed down in the past three years, and global economy and trade may become fragmented.

Data from various research institutions show that the global GDP growth rate forecast for 2024 will be significantly lower than that of 2022, and will be slightly weaker than that of 2023. Looking at global economic and trade exchanges, whether it is the United States, China, Germany or Japan, they will all move towards regionalization.

Figure 1: Forecast of global GDP growth rate and regionalization of global economic and trade exchanges

2. The mainstream market is slowing down, and future growth depends on emerging applications.

Due to changes in the external environment and global popularity, the growth of mainstream product markets such as smartphones and personal computers will slow down in 2024; future growth momentum will mainly rely on emerging information services, energy and environmental protection, and technology integration and other application markets, such as Wi-Fi 6E /7. 6G commercialization, AI big data model, etc.

Figure 2: The growth of mainstream products such as smartphones is slowing down, and emerging application fields such as AI and energy will take up the growth banner.

3. Mainstream products hit the ceiling, and differentiation of specific products drives growth.

Products such as mobile phones and personal computers will recover in 2024, but because the penetration rate of these products is already high, the market growth momentum may mainly rely on replacement demand. On the other hand, AI applications continue the boom in cloud services, electric vehicles are combined with automated driving, and similar specific product differentiation may create business opportunities.

Figure 3: Mainstream products such as smartphones lack growth momentum, and differentiation of specific products drives growth.

4. AI, new energy and intelligent networking are key words to promote future growth

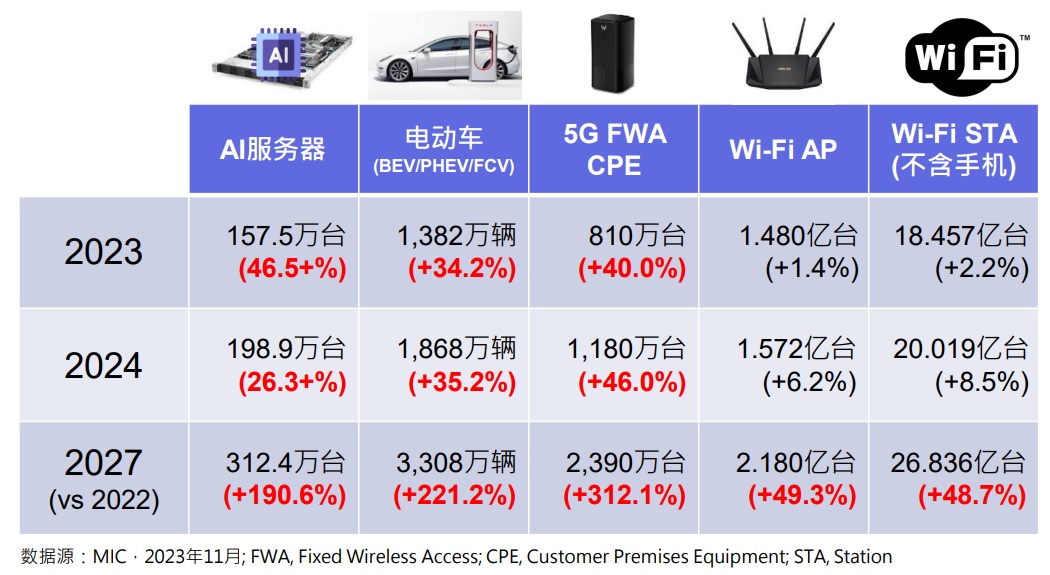

AI servers and new energy vehicles are expected to achieve multiple growth in 2027, and have become the main driving force for the development of the semiconductor market. AI servers are expected to reach 3.124 million units in 2027, a growth rate of 190% compared with 2022; new energy vehicles are expected to reach 33.08 million units in 2027, a growth rate of 221% compared with 2022. On the other hand, driven by digitalization and intelligence factors, wireless terminal equipment will expand from traditional product areas and develop towards vertical market applications.

Figure 4: AI servers, new energy vehicles, 5G FEA CPE, Wi-Fi AP, Wi-Fi STA, etc. have grown significantly

- Under the influence of the global industry, 8 major trends in semiconductor development in Taiwan:

1. Implement from the cloud to promote medium and long-term huge demand for AI applications

In 2024, major manufacturers will lead the deployment of AI servers, in the mid-term they will promote the AI-based operations of enterprises, and in the long-term they will promote the networking of AI in all walks of life. It is expected that by 2023, the number of global AI edge servers/connected terminal devices will reach hundreds of millions; and The demand for AI chips will move from data centers to enterprise and marginalization, leading chip manufacturers to invest in diversified application solutions. At the same time, more manufacturers will invest in AI chip research and development.

Figure 5: It is expected that by 2023, the number of global AI edge servers/networked terminal devices will reach hundreds of millions.

2. The huge number of AI applications drives chip demand and intensifies competition among new innovations

In 2024, more AI applications will be launched, which will promote the diversification of terminal equipment and create a huge demand for chips with emerging specifications to adapt to diverse scenarios. For example, AI training servers, AI inference servers, Gaming PC/Edge AI, Edge AI CPE and other chips will all see massive growth.

Figure 6: The explosion of AI applications drives competition in AI chips

3. From AI cloud services to built-in AI chips, PC users still need to be convinced

AI cloud services and AI chip functions are separately stimulating the development of AI PCs. However, it still takes time to convince business users or consumers to change existing user habits and adopt AI PCs. In the short term, the functions of AI chips still emphasize the general daily needs of users, such as improving efficiency, enhancing images, and reducing voice noise.

Figure 7: AI cloud to AI chip, stimulating the development of AI PC

4. Satellite plus 5G, integrating WAN and MAN to achieve Ubiquitous

In the future, satellite communications will make up for the coverage problems of mobile communications, achieve true Ubiquitous, realize ubiquitous communication signals, and eliminate borders.

Figure 8: Satellite communications will make up for the coverage problems of mobile communications

5. AI/smart scene application demand stimulates 5G+Wi-Fi integration

Personal information products have become the basic application base of 5G and Wi-Fi, and multiple AI/intelligent scenarios will stimulate communication integration applications. Wi-Fi applications have become popular in large numbers, and it is estimated that the total number of new application devices will reach 4 billion units in 2025, becoming the cornerstone of intelligence.

Figure 9: AI/intelligent scenario application requirements stimulate 5G+Wi-Fi integration

6. Function and usage requirements drive the transformation of automotive semiconductor usage models

In the field of automotive semiconductors, the increase in electronic control components will greatly increase the complexity of electronic systems and promote the development of regionalization and even centralization trends. The trend of regionalization and centralization will promote the improvement of processor performance requirements and promote value-added The development of emerging information applications, such as in-vehicle instrument systems, entertainment systems, and other systems that enhance the driving experience.![]()

Figure 10: Function and usage requirements drive the transformation of automotive semiconductor usage models

7. Driven by electrification and computing demand, the proportion of automotive semiconductors will increase

In the field of automotive semiconductors, electrification will stimulate a further increase in the proportion of semiconductor chips. The demand for power assembly chips will become the main stimulus for growth. Computing performance and autonomous driving will drive the demand for HPC processors, significantly increasing the proportion of semiconductor chips. The cost of electric vehicle semiconductors is expected to be approximately US$1,030 in 2025, and by 2030, the cost of electric vehicle semiconductors integrated with autonomous driving systems will reach US$3,000.![]()

Figure 11: Increased demands for electrification and computing efficiency drive the proportion of semiconductors in automotive products

8. The third -generation semiconductor 1 component market is expected to grow

Due to zero carbon emissions, product electrification, and B5G/6G demand, the development trend of third-generation semiconductors (silicon carbide, gallium nitride) is promising.![]()

Figure 12: The growth of third -generation semiconductors ( silicon carbide, gallium nitride ) is expected

1. What are third-generation semiconductors? This refers to the development process of semiconductor materials. The first generation of semiconductor materials: germanium and silicon are currently the largest semiconductor materials. They are relatively cheap and have the most mature process technology. Their application fields are in the information industry and microelectronics industry. Second-generation semiconductor materials: gallium arsenide and indium phosphide, are mainly used in the communications industry and lighting industry. Third-generation semiconductor materials: Represented by silicon carbide and gallium nitride, they can be used in higher-end high-voltage power components and high-frequency communication components. They are the main materials in the 5G era.

Outlook for Taiwan’s Semiconductor Industry in 2024 (Part 1)

Outlook for Taiwan’s Semiconductor Industry in 2024 (Part 2)