In the third quarter of 2024, the semiconductor industry ushered in a historic moment: AMD's data center business surpassed long-time market leader Intel for the first time. This achievement not only marks AMD's strong growth in the high-performance computing space, but also reflects the profound changes in the competitive landscape of the data center market. At this turning point, AMD challenged Intel's dominance in the data center business with the success of its technological innovation and go-to-market strategy.

Historic transcendence

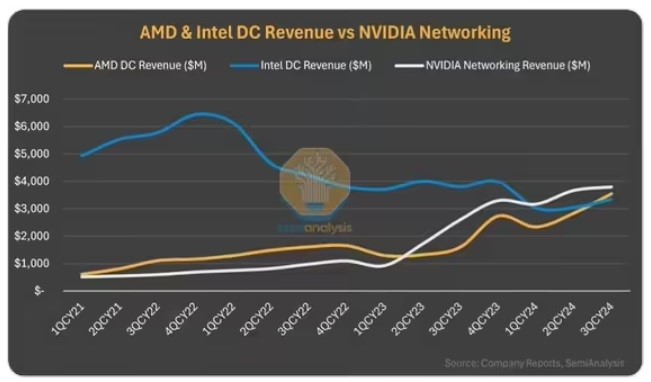

According to the latest financial report data, AMD's data center revenue in the third quarter of 2024 reached $3.549 billion, a year-on-year increase of 122%, while Intel's data center and AI business revenue was $3.349 billion in the same period, a year-on-year increase of 9%. This comparison marks the first time AMD has surpassed Intel as one of the leaders in the data center processor market. AMD's strong performance not only highlights its technological advancements, but also reflects the growing market interest in its products.

Figure: Comparison of data revenue from AMD and Intel

AMD's rise in the data center space, especially in the context of the dramatic growth in AI and big data processing demand, is driven by several factors. The increasing share of AI chips in the data center processor market has further fueled the rapid growth of AMD's data center business. In stark contrast, Intel's revenue growth has lagged far behind AMD's, even as it unveils its new Granite Rapids processors and tries to catch up with the market.

Technology and market advantages

AMD's ability to surpass Intel is inseparable from its technological breakthroughs, especially in the field of processors and acceleration cards. AMD's EPYC CPU family has surpassed Intel's Xeon series in the data center market, especially in cloud computing, high-performance computing (HPC), and AI acceleration. This shift illustrates a significant increase in market preference for AMD products. AMD's success is not only reflected in the growth in sales of EPYC CPUs, but also in the strong shipments of its Instinct GPUs.

AMD's Zen architecture has not only reached the industry's leading level in terms of performance, but also made significant breakthroughs in process technology. With TSMC's advanced process foundry, AMD's processors have achieved higher performance and energy efficiency, which has enabled it to rapidly grow its market share in server CPUs, further cementing its leading position in the data center market.

AMD's technology strength is reflected in its innovative Zen architecture and new Instinct accelerator cards, which are designed to efficiently handle AI and big data tasks. With the increasing demand for AI computing in data centers, AMD's technology is rapidly attracting more and more customers and gaining a foothold in the market.

Intel's challenge

Although Intel is still introducing Granite Rapids processors and claims that its new generation is expected to surpass AMD's EPYC in performance, the actual market performance is not as good as it could be. Not only is Intel under pressure to lose its CPU market share in the data center, but its performance in the AI space is also relatively weak. Intel's Gaudi series of AI accelerators lags far behind its competitors in the data center AI market, especially compared to NVIDIA and AMD, where Intel's AI chip sales and market awareness are far behind.

Intel's technology is constantly being updated, but its continued pace of innovation in data center processors has not kept pace with changes in market demand, especially in the fields of AI and HPC. Under pressure from competitors such as AMD and NVIDIA, Intel urgently needs to make significant adjustments in its technology and market strategy to return to the forefront of industry competition.

Industry Competitive Landscape

This historic moment for AMD to surpass Intel not only reflects AMD's continued technological breakthroughs, but also marks a profound change in the competitive landscape of the data center market. With the rapid development of cloud computing, low-latency, and high-bandwidth network interconnection technologies, data centers are entering a new stage. At this stage, resource pools across multiple data centers are consolidated into a single "virtual data center", resulting in more efficient resource allocation and lower latency. Such large-scale resource integration provides unprecedented market opportunities for companies such as AMD.

As enterprises' demand for data processing power and computing efficiency continues to rise, the data center market is no longer solely dependent on traditional computing and storage solutions, and emerging technologies such as AI, machine learning, and big data are becoming the main drivers of industry development. Against this backdrop, AMD's technology strengths, product portfolio and market expansion strategy have made it more competitive in the global data center market.

On the other hand, although Intel still occupies a certain share of the global data center field with its long-term accumulated technical strength, it is difficult to ignore the declining trend of its market share in the face of strong competition from emerging manufacturers such as AMD and NVIDIA. AMD's two-pronged approach in the field of AI accelerators and processors is putting significant market pressure on Intel, forcing it to accelerate its technology development and market response strategy.

Future outlook

Going forward, AMD's Zen 5 architecture and Intel's Arrow Lake architecture will be officially unveiled around 2025. AMD expects the Zen 5 architecture to deliver a 20% performance improvement over Zen 4, further cementing its leading position in the data center market. Intel, on the other hand, expects to achieve a 25 to 35 percent performance improvement with the Arrow Lake architecture, aiming to win back from the competition. While Intel is under pressure to lose market share, the competition between AMD and Intel will intensify in the coming years as technology continues to advance.

In particular, fields such as AI, machine learning, and big data processing will become the most critical battlegrounds for the semiconductor industry in the next few years. The growing demand for data centers will make this competition even more intense. How AMD and Intel respond quickly to changes in technological innovation, market strategy, and customer needs will determine their position in the future market.

Summary

AMD's data center business revenue surpassed Intel's in the third quarter of 2024, which is not only an affirmation of its technical strength, but also a reflection of market choice. This historic transcendence heralds a profound change in the competitive landscape of the data center market. With the continuous innovation of technology and the change of market demand, the competition between AMD and Intel will become more intense, and the entire semiconductor industry will also usher in new development opportunities and challenges. Although Intel is currently facing certain technical challenges, its heritage and technology accumulation in the data center market are still worth paying attention to. Whether it is the continued rise of AMD or Intel's counterattack, it will have a profound impact on the development pattern of the global semiconductor industry.