With the acceleration of the global new energy transition, the ASEAN countries are becoming one of the key markets for the global new energy industry due to their fast-growing economies, abundant natural resources and policy support. For Chinese semiconductor companies, ASEAN's new energy market is not only an important opportunity to expand overseas, but also an important driving force to promote technological innovation and industrial transformation. In this context, China Exportsemi believes that analyzing the opportunities and challenges of Chinese semiconductor companies in the ASEAN new energy market, and proposing feasible strategies based on actual data and cases, is the focus of the current industry.

1. The Rise of ASEAN's New Energy Market: Opportunities Emerge

The regional characteristics of the new energy industry and favorable policies are favorable

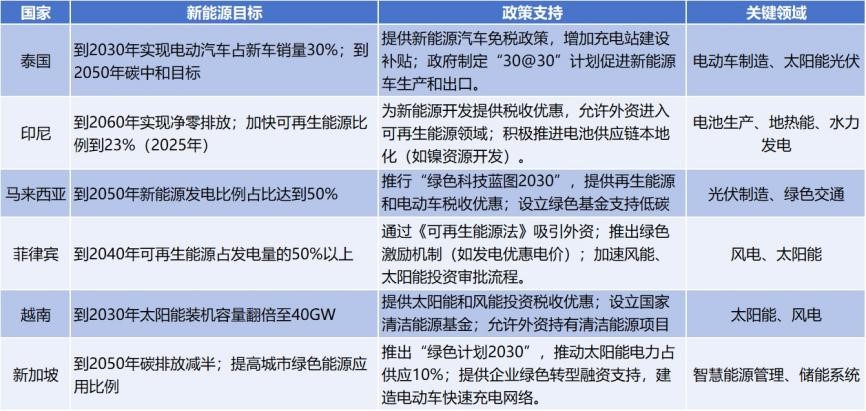

ASEAN countries have made frequent moves in the field of new energy in recent years, especially in the fields of solar energy, wind energy, electric vehicles (EVs) and energy storage systems. According to the International Energy Agency (IEA), new energy investment in the ASEAN region increased by 40% in 2022 to US$29 billion, and this figure is expected to further increase to US$50 billion by 2030. In addition, ASEAN countries have successively introduced supportive policies, such as the development goals of the electric vehicle industry in Indonesia and Thailand, and the incentives for solar production in Malaysia, which provide a good environment for the development of the new energy industry.

Vietnam, for example, adopted a new National Power Development Plan in 2023, which aims to increase the share of renewable energy to 30% by 2030. These policies not only promote the development of new energy for local enterprises, but also provide opportunities for Chinese semiconductor companies to enter these markets.

Chart: List of new energy policies of major ASEAN countries (compiled by China Exportsemi)

The huge market demand is driving the demand for semiconductor products

The development of the new energy industry requires the support of a large number of semiconductor components, such as power semiconductors for inverters, IGBT chips for electric vehicles, and control chips for photovoltaic energy storage systems. According to market research firm Statista, EV sales in ASEAN are expected to reach 1.2 million units in 2025, up 150% year-on-year. This demand growth has directly driven the expansion of the market size of power chips such as IGBTs, providing potential space for Chinese manufacturers to export and cooperate.

Chart: Growth Trend of ASEAN New Energy Market (2025-2050)

2. The advantages and transformation potential of Chinese semiconductor companies

Competitive advantage in technology and production costs

In recent years, Chinese semiconductor companies have made significant progress in the fields of power semiconductors and automotive electronic chips. For example, StarPower has achieved product technology independence in the field of IGBT, and its IGBT modules have been widely used in new energy vehicles at home and abroad. In terms of cost, Chinese companies benefit from large-scale production and a complete supply chain ecosystem, which can provide cost-effective products, which are competitive in the price-sensitive ASEAN market.

The dual support of policy and market resources

The close economic and trade relations between China and ASEAN countries, especially the implementation of the Regional Comprehensive Economic Partnership (RCEP), have provided tax incentives and facilitation measures for Chinese enterprises to invest and export in ASEAN. For example, LONGi, a leading PV company, has set up a production base in Malaysia, which not only reduces export tariffs, but also better serves the ASEAN market.

Differentiated competition driven by innovation

In the face of fierce competition in the ASEAN market, Chinese enterprises are gradually building differentiated competitive advantages through technological innovation. For example, Silan Micro has opened up the demand for high-end applications in the Southeast Asian market by improving the efficiency and durability of GaN (gallium nitride) power devices. Similar technological innovations have enabled Chinese companies to meet the increasingly complex semiconductor needs in the new energy sector.

3. Challenges and solutions

Challenge 1: Competitive pressure in regional markets

Although the ASEAN market has huge opportunities, it also faces competition from traditional powers such as Japan, South Korea, Europe and the United States. For example, Japanese power semiconductor giants such as ROHM and Fuji Electric have long established themselves in the ASEAN market, and their products are known for their high reliability and technological leadership. In the face of these strong competitors, Chinese companies need to further improve their quality and brand trust.

Countermeasures: Strengthen local cooperation and technological breakthroughs

By establishing joint ventures or cooperative relations with local enterprises in ASEAN countries, Chinese enterprises can integrate into the local market more quickly. For example, the joint development of new energy system chips adapted to ASEAN's climate characteristics to improve the pertinence of products. In addition, increasing R&D investment and making breakthroughs in emerging technologies such as silicon carbide (SiC) and gallium nitride (GaN) will help stand out from the competition.

Challenge 2: Supply chain and logistics issues

The complexity of the semiconductor supply chain and the uneven infrastructure in the ASEAN region may hinder the market expansion of Chinese companies. In particular, some emerging markets such as Cambodia and Laos have not yet developed a complete infrastructure, and logistics costs and delivery efficiency have become important challenges.

Solution: Establish a regional supply chain system

Chinese enterprises can learn from the experience of photovoltaic companies and optimize the supply chain layout by setting up production or storage bases in ASEAN countries. For example, some companies have begun to build chip packaging and testing factories in Vietnam and Malaysia to shorten the supply chain cycle and reduce logistics costs.

Challenge 3: Policy and trade barriers

Despite the convenience offered by RCEP, differences in policies and regulations between ASEAN countries can still be an obstacle to market expansion. For example, Indonesia imposes higher tariffs on imported electronic components, while Thailand provides subsidies for the new energy vehicle industry, and these differences make it necessary for companies to adjust their strategies flexibly.

Countermeasures: Flexibly adjust market strategies

for different countries, and Chinese enterprises need to adopt differentiated market strategies. For example, in countries with more favorable policies, such as Thailand and Vietnam, investment can be increased; For markets with large policy barriers, such as Indonesia, they can enter the market through cooperation with local companies or technology export.

4. Data case studies

PV market case:

LONGi has invested and built a PV module factory in Malaysia since 2020, with an annual production capacity of 7GW, accounting for more than 30% of Malaysia's solar export market. Through localized production, LONGi successfully avoided some trade barriers and won market share by stabilizing the supply chain.

New energy vehicle chip case:

Star Semiconductor's shipments of new energy vehicle IGBT chips exported to Thailand in 2024 increased by 200% year-on-year. By providing technical support and service solutions, Star Semiconductors has not only won the trust of customers, but also established long-term cooperation with local new energy vehicle manufacturers.

Regional supply chain layout case:

CR Micro has set up a packaging and testing base in Vietnam to quickly respond to the demand of the ASEAN market. According to the data, the capacity utilization rate of the base in 2023 has reached 85%, bringing the company a 10% increase in overseas revenue.

5. Conclusion: Seize the opportunity to achieve a win-win situation

In 2025, opportunities and challenges for Chinese semiconductor companies in the ASEAN new energy market coexist. By giving full play to technological innovation and cost advantages, and actively responding to regional competition and supply chain challenges, Chinese enterprises can not only occupy an important position in the ASEAN market, but also achieve their own industrial upgrading and globalization goals through this process.

Driven by policy dividends, market demand and technological innovation, Chinese enterprises need to strategically deploy the ASEAN market, flexibly adjust their business models, and achieve win-win development with the ASEAN new energy industry. For the entire semiconductor industry, the ASEAN market is not only a blue ocean, but also an important engine for the global new energy transformation in the next decade.