In the future, with the continuous improvement of the level of automotive intelligence and electrification, as well as the continuous development of 5G, Internet of Things and other technologies, the automotive specification chip industry will usher in a broader market space and development opportunities. Enterprises need to continuously innovate and improve their technology to respond to market competition and meet customer needs. The following will continue to interpret the analysis of the automotive-grade chip report.

1. The process of "getting on the car" of automotive-grade chips

Generally speaking, it takes about 3.5-5.5 years for automotive chips to be put on the car from design to mass production, and it is expected to continue in batches for 5-10 years after being put on the car. Considering the vehicle project development process and chip design and development process, it takes 3.5 to 5.5 years for the chip to be put on the car from design to mass production, and the OTA (automotive remote upgrade technology) iteration requirements of the 5 to 10-year life cycle of the car product need to be met as much as possible after the chip is put on the car. Automotive-grade chips need to pass AEC-Q100, IATF16949 and other automotive certification standards to ensure product reliability, quality, and functional safety.

figure1:Vehicle project development and chip design and development cycle (Source: Grant Thornton )

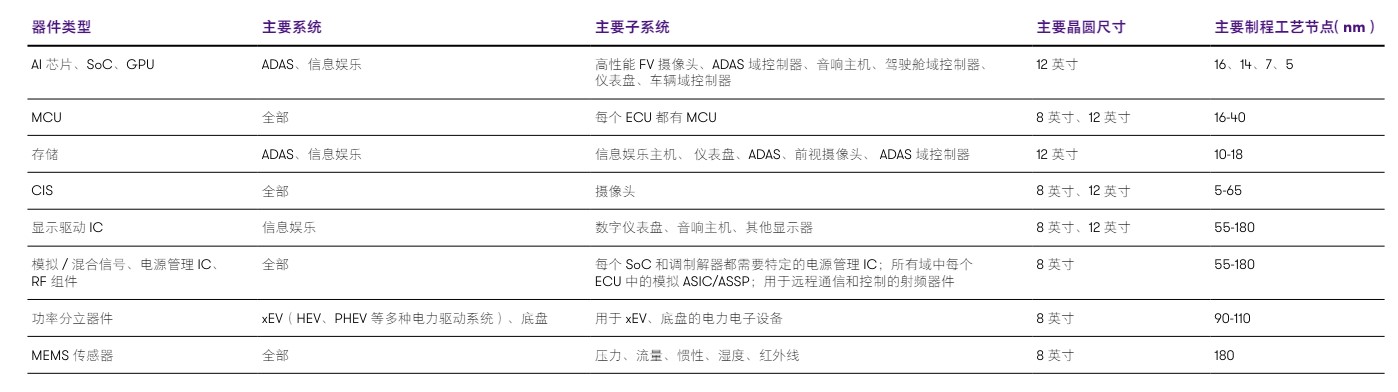

2. The demand for the wafer process for automotive-grade chips

Among the domestic automotive-grade chips, MCU, CIS, display driver IC, MEMS sensors, etc. mainly use mature processes (above 28nm), which have a high degree of overlap with the process selected by consumer electronics and other products; AI chips, SoCs, and GPUs are mainly made of advanced processes (below 28nm)

figure2:Demand for wafer manufacturing processes for automotive-grade chips (Source: Grant Thornton )

3. Analysis of major companies in automotive-grade chips

Breakthroughs have been made in the localization of vehicle-grade chips, especially in the fields of power semiconductors, computing chips, and control chips

According to Omdia data, the size of China's MCU market in 2022 will be about 8.34 billion US dollars, of which the market size of complex instruction set MCUs will be about 2 billion US dollars. In recent years, many Chinese manufacturers have started to develop high-end MCUs required for future automotive intelligence, such as intelligent cockpit and ADAS, from low-end automotive MCUs that have little relevance to safety performance, such as wipers, windows, remote controls, ambient light control, and dynamic flow lights. At present, the manufacturers in the industry that are advancing relatively rapidly include Auto chips Technology, BYD Semiconductor, Guoxin Technology, etc.

figure3:Major manufacturers of automotive smart cockpit chips at various price points (Source: Grant Thornton )

Almost all of the products of domestic MCU manufacturers for the automotive market are concentrated in 32 bits, and at present, ChipON Microelectronics, Auto chips Technology and Xiaohua Semiconductor have entered the automotive front-end market, and it takes 3-5 years for automotive-grade MCUs to be commercialized from R&D to commercial vehicles. It is understood that in the future of higher-level autonomous driving level cars, and under the general trend of multi-sensor fusion, 32-bit or even 64-bit high-computing power automotive-grade MCUs with bus width will become mainstream products.

figure4:Overview of key domestic IGBT manufacturers (Source: Grant Thornton )

The intelligent cockpit chips in the automotive-grade SoC chips have been supplied by domestic manufacturers, but the main suppliers are still foreign manufacturers, especially in the market of models with a unit price of more than 400,000 yuan, Nvidia, Intel, and Qualcomm occupy a large share.

China's automotive-grade power chips have been supplied in batches, and the main companies include Star Semiconductor, Times Electric, BYD Semiconductor, Silan Micro, etc.

With the continuous improvement of the level of intelligent and electrified vehicles, the technical requirements of automotive-grade chips are getting higher and higher, and the difficulty and cost of research and development are increasing. At the same time, the market competition is becoming increasingly fierce, and companies need to continuously innovate and improve their technology to maintain a competitive advantage. The development of intelligent and electrified automobiles has brought a huge market space to the automotive-grade chip industry. Especially in the fields of autonomous driving and new energy vehicles, the application of automotive-grade chips will be more extensive. In addition, with the continuous development of 5G, Internet of Things and other technologies, the application scenarios of automotive-grade chips will also continue to expand.

For more details, click here:Semiconductor Industry Research - Analysis of Automotive-grade Chip Report (Part I)

Semiconductor Industry Research - Automotive-grade Chip Report Analysis (Part II)