In recent days, the news that BYD has asked suppliers to cut prices by 10% has caused an uproar inside and outside the industry. The incident not only exposed the business game between BYD and its suppliers, but also reflected the common challenges of supply chain management and cost control for Chinese new energy vehicle companies. Below, China Exportsemi will try to conduct an in-depth analysis of the incident from three aspects: event background, industry ecology and supply chain issues. Welcome readers and friends to contact and communicate.

1. Background of the event and industry shocks

In November 2024, BYD proposed to suppliers through an internal email that it would cut the prices of its supplied products by 10% from January 1, 2025. As soon as the news was exposed, it quickly spread in the media and the industry. BYD responded that the price reduction target is part of the annual price negotiation and is not mandatory, but it still provokes a strong reaction from suppliers. Some suppliers are questioning whether this will further squeeze their already slim profit margins or even jeopardize their survival.

This requirement is of great significance to BYD. As a global leader in the field of new energy vehicles, BYD needs to maintain its competitive advantage through cost optimization under the dual pressure of domestic and foreign markets. However, this undoubtedly increases the burden on suppliers and exacerbates the conflict between OEMs and supply chain partners.

Pictured: BYD's email asking its suppliers to cut prices by 10% and Li Yunfei's response to the matter

2. Global competition and supply chain cost pressures

Competition in domestic and foreign markets: driving the demand for cost reduction

As the global new energy vehicle market competition intensifies, Chinese automakers are accelerating their globalization layout. BYD's expansion in Europe and Southeast Asia in 2024 will undoubtedly increase cost pressures, especially in pricing-sensitive international markets, where how to maintain price advantage has become a key issue.

However, international automakers have taken a different approach. Tesla, for example, not only reduces costs through economies of scale, but also uses its own supply chain to improve efficiency and reduce pressure on suppliers. In their external expansion, Chinese companies rely more on supplier cost concessions to achieve price competitiveness. BYD's price reduction request is a direct manifestation of this strategy.

Supplier Survival Dilemma: Business Ethics and Right to Exist

From the supplier's point of view, this price reduction requirement can be described as "worse". In recent years, new energy vehicle companies have continued to increase their price wars, resulting in the continuous compression of profit margins in the supply chain. According to industry data, the average profit margin of Chinese auto parts suppliers is less than 5%, and BYD's 10% price cut could put some suppliers at risk of bankruptcy.

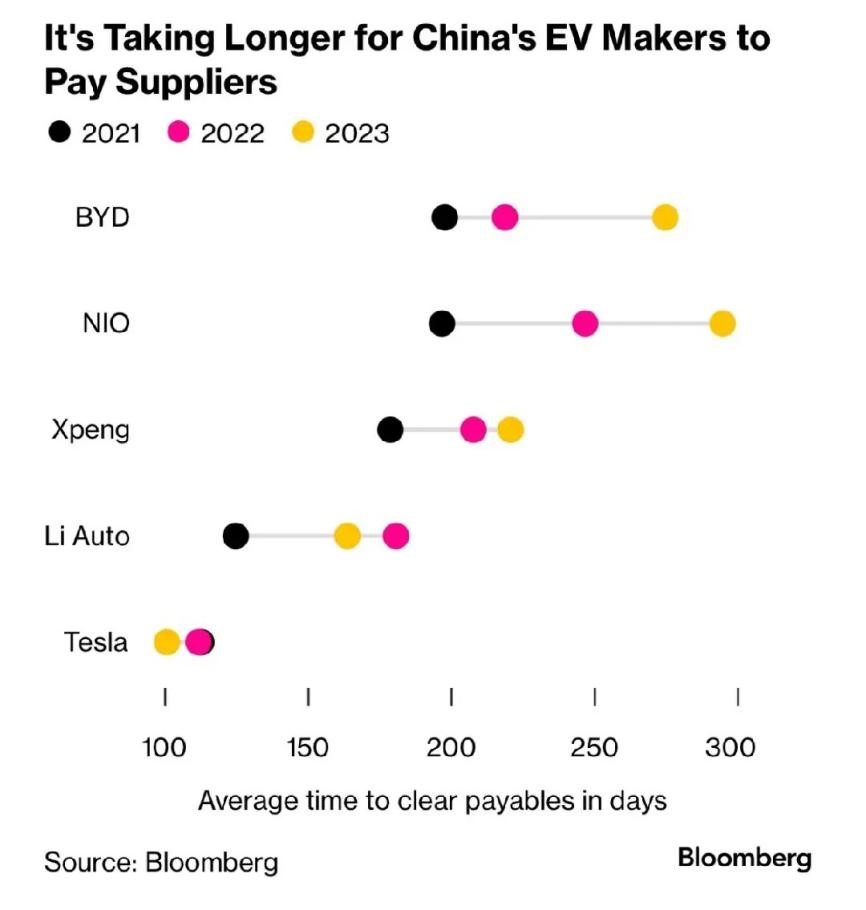

The chart below from Bloomberg reflects the challenges faced by Chinese NEV automakers in paying suppliers in recent years, with many automakers' payment cycles increasing year by year, with the longest being 200+ days. In contrast, international manufacturers (such as Tesla) have more advantages in the payment cycle, which further exposes the shortcomings of Chinese automakers in supply chain management.

Figure: Bloomberg data shows that Chinese EV manufacturers are likely to have longer payment cycles for their suppliers

3. A common problem in the supply chain of new energy vehicles

Bargaining mechanism and "strong dominant" model

Chinese OEMs generally adopt the "strong dominant" model, and have an absolute advantage when negotiating with suppliers. BYD's request for price cuts is a reflection of this model, and suppliers are often in a position of passive acceptance. While this mechanism can help OEMs control costs, it could affect the health of the supply chain in the long run and reduce their ability to invest in innovation and high-quality products.

Technological innovation and supply chain upgrading are lagging behind

With the increasing complexity of new energy vehicle technology, the importance of supply chain collaborative innovation capabilities has become increasingly prominent. Compared with Tesla's vertical integration model to achieve in-depth collaboration between software and hardware, Chinese automakers are still mainly outsourcing. The lack of technical voice among suppliers has led to China's supply chain relying on imports in key areas such as chips and intelligent systems.

"Supply Chain Going Global Together": Feasibility and Challenges

In the face of cost pressure and market competition, Chinese enterprises need to explore the "supply chain to go overseas" model, that is, to participate in international market competition with suppliers. In recent years, BYD has gradually increased its support for suppliers, and provided support for technology research and development and overseas channel development. However, this model still needs to be agreed by both parties in terms of profit distribution and market expansion, otherwise it may lead to a "zero-sum game".

4. The far-reaching impact and enlightenment of the BYD incident

The impact of BYD's price reduction request goes far beyond a simple commercial bargaining, and it touches on the core issues of the industry:

Redefining the relationship between OEMs and suppliers: In the future, the supply chain needs to develop in the direction of collaborative innovation, and OEMs need to allocate profit margins reasonably to ensure supply chain stability and long-term competitiveness.

Policy support and industry standards: China's new energy vehicle industry can learn from international experience and introduce more supportive policies in terms of supply chain payment cycles and technical standard formulation.

Cost and value balance: Companies should find a balance between price wars and technological innovation, and avoid over-reliance on supply chain price reductions at the expense of long-term value creation.

Summary:

BYD's 10% price cut for suppliers is a mirror of the supply chain management dilemma faced by China's new energy vehicle industry in its rapid development. This is not only a challenge for OEMs, but also an opportunity for supplier transformation. By improving supply chain relationships and promoting collaborative innovation, China's new energy vehicle industry is expected to occupy a more favorable competitive position in the global market.