According to a report by TrendForce, China has made significant progress in photoresist R&D in 2024.

Photoresists are classified into various types based on different exposure wavelengths, among which KrF (248nm), ArF (193nm), and EUV (13.5nm) photoresists are essential materials for manufacturing high-end process chips, such as 7nm and below. The production of these high-purity photoresists involves complex chemical synthesis and material optimization, especially for extreme ultraviolet (EUV) lithography applications, where the technical threshold is very high.

Currently, the global photoresist market is dominated by several giants in Japan and the United States, such as JSR, Shin-Etsu Chemical, DuPont, and other companies that control most of the high-end photoresist technology. However, under the pressure of the technology blockade of the United States and Japan, China's semiconductor industry has become more and more dependent on the R&D and manufacturing of local photoresists to break the monopoly of foreign technology and reduce its dependence on foreign countries.

Breakthroughs and progress of domestic enterprises

Despite its late start, China's breakthrough in the field of photoresist has begun to bear fruit. For example, Chinese companies such as Shanghai Xinyang, Ruikai, and Baichuan Pharmaceutical have made progress in entry-level photoresists, but due to technical difficulties and late starts, they are struggling to compete in the high-end market. At present, the penetration rate of photoresists in China is still low: about 20% for g- and i-line photoresists, less than 5% for KrF, and less than 1% for ArF. However, Chinese companies are making progress in high-end photoresists.

Hubei Dinglong: a key breakthrough in localization

Hubei Dinglong is a new star in China's photoresist industry. The company recently announced that its ArF and KrF photoresists have passed customer evaluation and successfully secured orders from domestic fabs worth more than $1.37 million. This achievement marks an important breakthrough in the field of high-end photoresist in China, demonstrating the ability of domestic companies to achieve complete localization of photoresist through innovative processes such as customized monomer and resin structures, improved purification and mixing processes.

Hubei Dinglong's successful case not only strengthens the confidence of Chinese enterprises in the field of photoresist, but also provides a technical reference for more Chinese semiconductor companies. This progress has laid the foundation for China to realize the independent and controllable semiconductor industry chain, and is expected to continue to promote the localization process of domestic photoresist in the next few years.

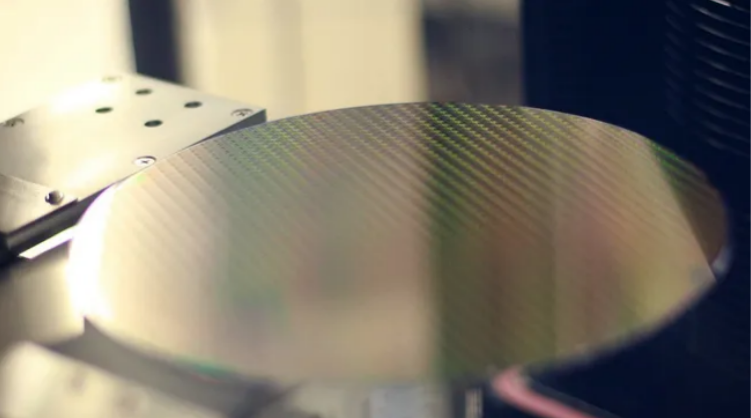

Figure: A photoresist ecosystem for ArF and KrF lasers is emerging in China (Source: SMIC)

ShenZhen Rongda Photosensitive's financial support and market expansion

Rongda Photosensitive is another up-and-coming company in the field of photoresists. The company recently received RMB 244 million in funding, which will be used to promote the research and development of its high-end photoresist products, as well as the production of other semiconductor-related materials. The funds will focus on R&D and production of high-performance photoresists and greater market share in the PCB and semiconductor industries.

With the improvement of China's semiconductor manufacturing capacity, the demand for high-quality photoresist is also growing, and ShenZhen Rongda Photosensitive's photoresist products will have the opportunity to fill this market gap. In addition, Rongda Photosensitive also plans to promote its dry film products to more electronic manufacturing fields to further enhance market competitiveness.

The future prospects of China's photoresist industry

China's breakthrough in the photoresist industry is not only a technological progress, but also closely related to the huge domestic semiconductor manufacturing demand. With the rapid development of emerging industries such as 5G, artificial intelligence and automotive electronics, China's semiconductor industry has ushered in unprecedented growth opportunities.

Continued support from government policies:

The Chinese government has been committed to supporting the development of the local semiconductor industry, and policy support is an important force to promote the self-sufficiency of the photoresist industry. Through various forms of funding, policy incentives and industrial cooperation, the government helps local enterprises accelerate technology research and development and market application. In addition, China's independent R&D capabilities in semiconductor raw materials, equipment and key technologies are constantly increasing, and the localization process of the photoresist industry is also accelerating.

Technology & Market Competition:

Although China has made a lot of progress in the field of photoresist, the global market is still dominated by Japanese and American companies, which have significant advantages in technology accumulation, R&D investment, and supply chain management. China's photoresist companies still face high technical thresholds and fierce international competition.

Gradually catching up, the future of the photoresist market can be expected

China's R&D breakthrough in the field of photoresist marks the gradual realization of its semiconductor industry chain independent and controllable, especially in the localization of high-end photoresists. With the continuous improvement of the technical level of domestic enterprises, the market share of China's photoresist market is expected to gradually increase in the future, and gradually narrow the gap with the international advanced level.