I. Industrial Dilemma: Dual Challenges of Homogeneous Competition and Technological Gaps

In recent years, the global new energy sector has achieved rapid growth driven by policy support and market demand. However, behind this prosperity lies intensifying internal competition, severe product homogenization, and escalating price wars, trapping many enterprises in a race to the bottom. How can China’s new energy industry break free from this cycle? How can it secure a dominant position in the new wave of industrial revolution? At the 2025 International New Energy Industry Marketing Summit, Dr. Du Guangdong, Chairman of Shenglu IoT and President of the Radio Association, addressed these critical issues. Below is an analysis of his insights by Semiconductor China’s editorial team.

China’s new energy sector currently exhibits a paradox of "global leadership in scale but lagging innovation." Market projections indicate that photovoltaic EPC costs have dropped to 2.8 yuan/W, with further reductions expected to 2.5 yuan/W in the long term, while energy storage EPC costs stand at 0.8 yuan/Wh, projected to decline to 0.6 yuan/Wh for long-duration storage. These price wars reflect a deeper crisis: insufficient investment in technological innovation has led to homogeneous competition.

Take Tesla’s Shanghai energy storage plant as an example: its systems command premiums 2–3 times higher than domestic counterparts. This disparity stems not only from brand value but also from generational gaps in core technologies. Dr. Du warned, "While China has built a complete industrial chain, it lacks an ecosystem for core technologies." Dependence on foreign chips persists—not due to an inability to manufacture chips, but because domestic alternatives struggle to match the stability and sophistication of imported intellectual property.

Photo: Dr. Du Guangdong delivered a keynote speech on "Thoughts on the Development Direction of New Energy Technology in the Next Decade"

II. Historical Lessons: Energy Revolutions and Industrial Transformation

Throughout industrial history, energy innovation has progressed in tandem with breakthroughs in communication technologies. The first Industrial Revolution harnessed steam power to drive mechanization and railways; the second leveraged centralized electricity to enable telephony and combustion engines. Today, we stand at the threshold of the third Industrial Revolution, characterized by:

IoT Infrastructure: As of 2023, China’s mobile network connects 4.059 billion terminals, including 2.332 billion cellular IoT devices, accounting for 57.5% of total connections. IoT integrates human-made and natural environments, enabling autonomous data generation and analysis across interconnected nodes.

Distributed Energy: Traditional centralized systems (coal, nuclear, hydropower) are giving way to distributed energy, which is driving down the cost of renewable energy generation, storage, and transmission—potentially approaching zero in the future.

Smart Transportation: By October 2024, China’s new energy vehicle penetration rate reached 52.9%, a 15-percentage-point increase from 37.9% in 2023.

These shifts demand reimagined energy systems. As Dr. Du noted, "Managing millions of distributed energy sources requires the precision of a symphony orchestra, not a solo performance."

Photo: The evolution of the energy revolution and industrial transformation

III. China’s Competitive Edge: Digital Infrastructure as a Foundation

In the third Industrial Revolution, China has built unparalleled infrastructure advantages:

Ultra-High Voltage (UHV) Transmission: With over 40,000 km of UHV lines—entirely self-developed—China leads globally in efficiency (1.5% power loss per 1,000 km for ±1100kV DC systems), stability, and scalability. This enables cross-continental transmission, such as delivering wind power from Xinjiang to the Yangtze River Delta.

Telecom Infrastructure: China’s base stations outnumber the U.S. by 5–6 times despite similar land area, achieving near-universal coverage. In contrast, U.S. networks prioritize profitability, leaving remote regions underserved.

These infrastructures form the "neural network" for digital transformation.

IV. Breakthrough Priorities: Energy Storage Revolution and Wireless BMS Innovation

Energy storage is hailed as the "crown jewel" of the energy transition. China aims to expand its new energy storage capacity to 30 GW by 2025, a 400% increase from 2022. Dr. Du emphasized that stability and cost-effectiveness in energy storage are critical.

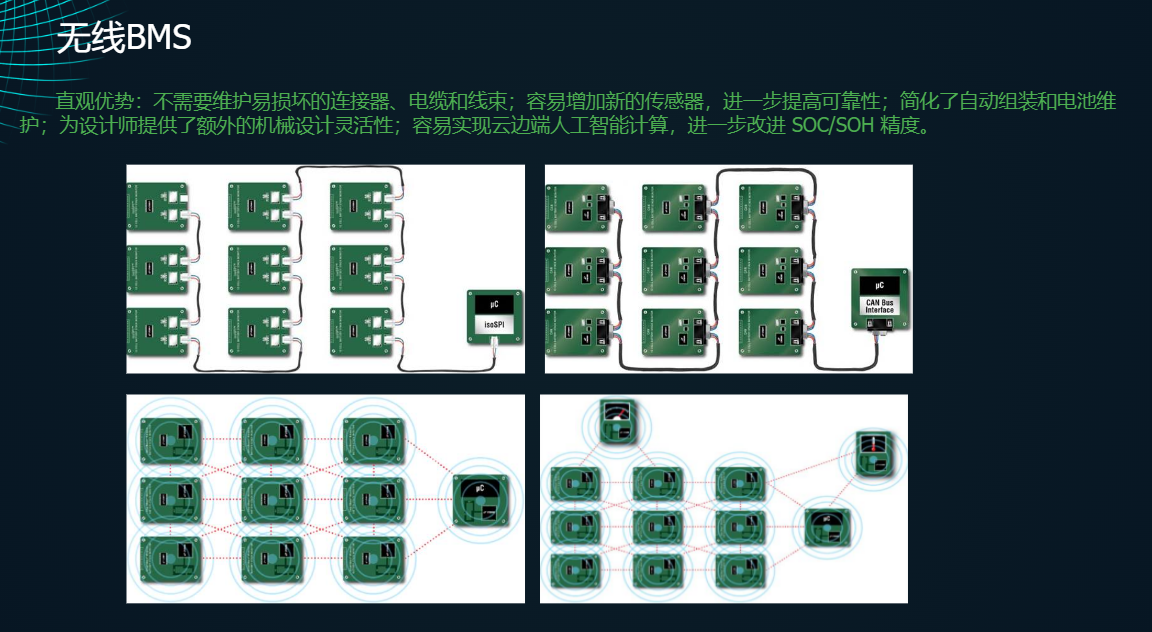

He highlighted wireless Battery Management System (BMS) technology, developed in partnership with Shenzhen Energy Group, which offers transformative benefits:

Operational Efficiency: Eliminates fragile connectors and cables, simplifies assembly/maintenance, and enables flexible design.

Enhanced Safety: Reduces physical risks via wireless architecture and ensures rapid response through multi-channel communication.

Cost Reduction: Streamlines system architecture, cuts equipment needs, and enables modular fault detection.

"Future energy systems will be digital twins," Dr. Du asserted. "When every battery and solar panel becomes an intelligent terminal, we can manage watts with bits and optimize efficiency with algorithms."

Photo:Advantages of wireless BMS

V. The Road Ahead: From Scale to Ecosystem Leadership

Historically, China’s new energy sector has prioritized scale. Now, it must transition to quality-driven growth. The success of UHV technology—achieved through a "new-type national system"—proves China’s capacity to overcome technical barriers. To sustain this momentum, the sector must increase R&D investment, establish national innovation platforms, and strengthen industry-academia collaboration.

As Dr. Du urged: "Our generation inherited infrastructure built by predecessors. We must ask what technological legacy we will leave. Only when companies invest in technologies for the next decade can China evolve from a follower to a global leader in new energy."

Footnote:

The 2025 International New Energy Industry Marketing Summit and the inaugural release of the "2025 China New Energy Industry Chain Core Competitiveness White Paper" were successfully held on Thursday, February 27, 2025, at the Shenzhen Guangming Cloud Valley International Conference Center. Hosted by Yeehai Global—a client-renowned digital marketing agency specializing in overseas markets—and co-organized by its resource platform China Exportsemi, the summit aimed to provide Chinese new energy enterprises with global expansion guidance, foster business collaboration platforms, and facilitate discussions on cutting-edge trends and commercial opportunities in the global new energy industry.

Related:

The 2025 International New Energy Industry Marketing Summit Was Successfully Concluded

The Battle for Charging Station Core Technology: How Chinese Companies Overcame Western Barriers to Lead the Industry

Data-Driven Expansion of New Energy: Dun & Bradstreet Unveils a New Path for Global Business Decision-Making

Europe’s Electric Truck Revolution Spurs 1.2 Billion kWh Energy Storage Demand

CEO of the Global Decarbonization Expo Decodes the New Paradigm of China and EU Green Cooperation

China's New Energy Industry at a Crossroads: Challenges and Pathways to Global Leadership

New Rules for New Energy Expansion: How to Break Out from an Overcrowded Market?