Compound semiconductors are a class of materials composed of different or homogeneous elements, which have ushered in rapid development in recent years due to their excellent performance. As the global demand for electronics and mobile devices continues to rise, compound semiconductors occupy an increasingly important position in the market. To produce these materials, manufacturers employ a variety of advanced processes such as chemical vapor deposition, atomic layer deposition, etc., to ensure high performance and precision of the materials.

Compound semiconductors are favored because of their unique advantages. Compared to conventional semiconductors, compound semiconductors have stronger high-temperature performance, higher frequencies, larger bandgaps, and faster operating speeds. In the future, compound semiconductors are expected to remain in short supply due to the increasing demand for high-performance semiconductors. It is these distinctive features that drive the global demand for compound semiconductors, attracting a large number of suppliers to actively develop new technologies and strive to produce competitive compound semiconductor products.

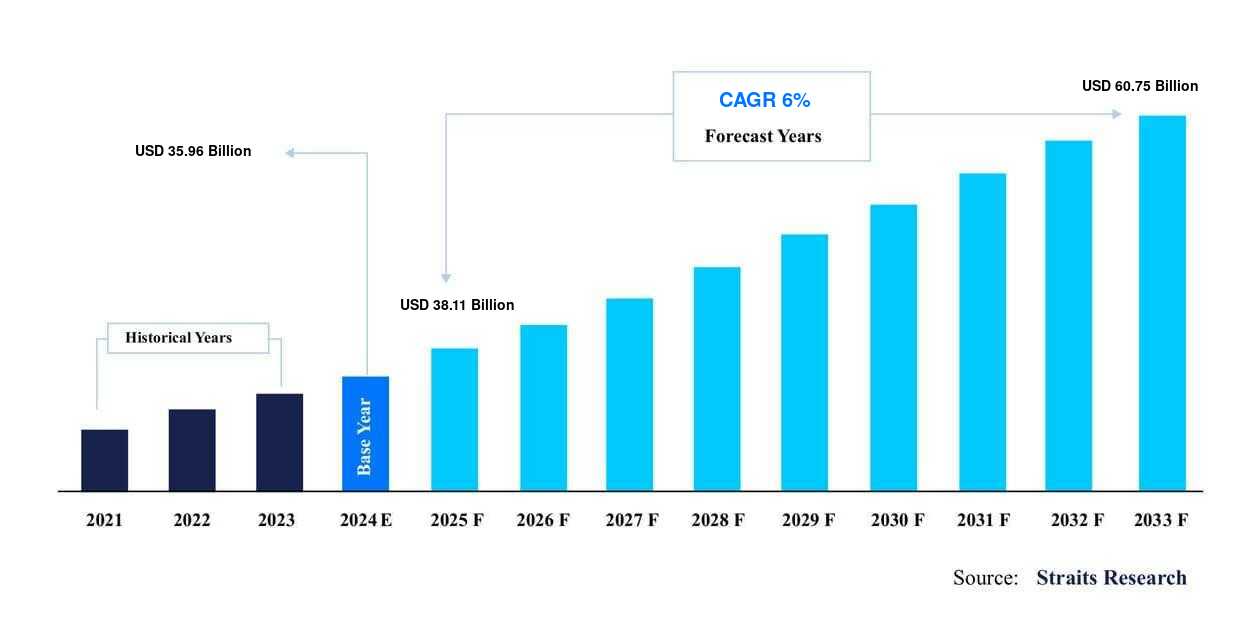

According to Straits Research, the global compound semiconductor materials market size is expected to be $35.96 billion in 2024 and will increase to $38.11 billion in 2025 and is expected to reach $60.75 billion by 2033, growing at a CAGR of 6% between 2025-2033. This growth is mainly driven by the expansion of global demand for electronic devices. Thin film deposition, prototyping, selective etching, and correction are critical in the manufacturing process to create microelectronic circuits containing hundreds of millions of functional components. Physical vapor deposition techniques, such as sputtering and evaporation, provide wear-resistant and durable coatings for semiconductors to meet the needs of end-user equipment.

The rapid expansion of the global semiconductor industry has also benefited from a number of key trends, notably the widespread adoption of artificial intelligence across industries, which has created additional market opportunities for compound semiconductor manufacturers and suppliers.

The potential of GaN in 5G infrastructure

In the construction of 5G wireless networks, base station equipment needs to meet the requirements of high efficiency, excellent performance and cost-effectiveness at the same time. Gallium nitride (GaN) solutions are ideal for 5G base stations because of these characteristics. Compared to traditional laterally diffused metal-oxide semiconductors (LDMOS), GaN-on-SiC (gallium carbide-on-on-silicon) can significantly improve the efficiency and performance of 5G base stations. In addition, GaN-on-SiC offers excellent thermal conductivity, durability, reliability, and high efficiency at high frequencies. These features make GaN suitable for use as power amplifiers in micro MIMO arrays, which is expected to have a profound impact on the full deployment of 5G.

Figure: Compound semiconductor market size forecast (Source: Straits Research)

Regional market analysis

Asia-Pacific holds a significant position in the global compound semiconductor materials market and is expected to grow at a steady CAGR of 4.6% during the forecast period. The consumer electronics market in the region, which includes countries such as China, India, Japan, Indonesia, and Malaysia, has a high penetration rate due to technologically advanced products. Rapid urbanization and rising disposable incomes have further boosted the adoption of consumer electronics, thereby expanding the use of compound semiconductor materials. In addition, the trend towards miniaturization of home appliances such as smartphones, TVs, laptops, and air conditioners is also driving the growth of the compound semiconductor industry. As the center of global home appliance production, the Indian government is actively promoting the manufacturing of home appliances, and the demand for compound semiconductor materials for refrigerators, washing machines, air conditioners, and other products is also growing. The region's low labor costs, abundant land supply and strong domestic demand have attracted a large number of foreign manufacturers to invest and build factories here.

The North American market is expected to grow at a steady CAGR of 3.3% during the forecast period. End-use markets in the United States, Canada, and Mexico are expanding the demand for compound semiconductor materials in the region. Foreign manufacturers are also accelerating their expansion into the North American market. For example, the Canadian company Solantro Semiconductor was acquired by Huada Semiconductor, a leader in China's industrial semiconductor market, and Solantro has developed advanced integrated circuits by combining silicon with compound semiconductor materials. The acquisition is intended to further increase the investment in Solantro, leverage technology resources in the region, and expand its market share in North America. In addition, production capacity in North America is increasing, such as the expansion of a new plant in Champaign, Illinois, with the goal of quadrupling production capacity with the goal of manufacturing epitaxial wafers for compound semiconductors.

The rapid development of compound semiconductors will drive progress in several industries, including 5G, artificial intelligence, and consumer electronics. With the continuous advancement of technology and the further expansion of regional markets, the application of compound semiconductors will be more extensive. In the coming years, compound semiconductors will occupy a significant position in the global semiconductor market, becoming an important pillar to drive innovation and improve device performance.