Geopolitical tensions are having a profound impact on the global semiconductor supply chain. Reports at the end of July pointed out that the United States is considering introducing new trade rules to further restrict the development of China's chip industry. The intensification of the trade war between China and the United States has caused considerable disruption to the global electronic component supply chain.

In terms of the memory market, the spot price of DRAM has continued to rise recently, thanks to the market regulation of Samsung Electronics, the price has begun to stabilize. According to the latest data from TrendForce, DRAM spot prices have stabilized under the influence of Samsung Electronics. Spot prices for DDR4 products are expected to continue their upward trend in the coming weeks, possibly rising further than the existing increases. As module makers and other buyers prefer spot trading, spot prices are still lower than the contract prices for DDR4 and DDR5 products. The increase in mainstream chips reached 0.81%, of which the largest increase was DDR4 16Gb 2Gx8 2666Mbps, and the price rose from $3.74 to $3.82, an increase of 2.14%; This was followed by DDR4 8Gb 1Gx8 512Mx16 2666Mbps, with an overall increase of 2.05%, and the price increased from $1.95 to $1.99. This trend is undoubtedly a positive sign for the memory market, which has been frustrated by declining consumer demand.

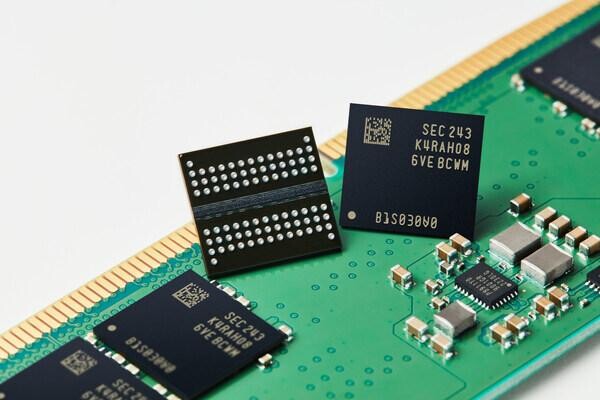

Figure: DRAM spot prices are rising

TrendForce's report also points out that NAND flash memory products are also gradually stabilizing and following the pace of DRAM. Spot prices have started to stabilize recently, mainly due to the reluctance of spot traders and module makers to cut production, and considering that the excessive decline in prices has dampened demand growth in the market.

Further analysis of the report shows that the spot market sales performance in the third quarter of 2024 is expected to be higher than that in the second quarter, and there may be a small amount of inventory replenishment demand. Overall, spot prices will initially remain stable and await further clarity on supplier contract prices and market conditions in Q3 2024.

Samsung announced an aggressive pricing strategy for server DRAM and enterprise SSDs at the end of June, which helped maintain the balance in the market. Although there are still signs of oversupply in the market, the price adjustment and the prioritization of HBM are helping to revive traditional DRAM. With the back-to-school season and holiday shopping season on the horizon, market conditions are expected to continue to improve as we enter the second half of the year.

The replenishment of inventories will help stabilize spot prices for DRAM and NAND flash, especially as smartphone makers and other consumer electronics companies launch new products in late Q3 and early Q4. Looking ahead to 2025, further inventory replenishment will help alleviate the ongoing oversupply seen in 2023.