After several years of market downturn, China's smartphone market is finally showing signs of recovery. According to the latest report from Counterpoint Research, China's smartphone sales increased by 2.3% year-on-year in the third quarter of 2024, achieving positive year-on-year growth for four consecutive quarters and on track to achieve annual growth for the first time in five years. This shift not only marks the restoration of market confidence, but also heralds a new trend in the competitive landscape and technological innovation in the smartphone industry.

Ⅰ. the market recovery and brand competition

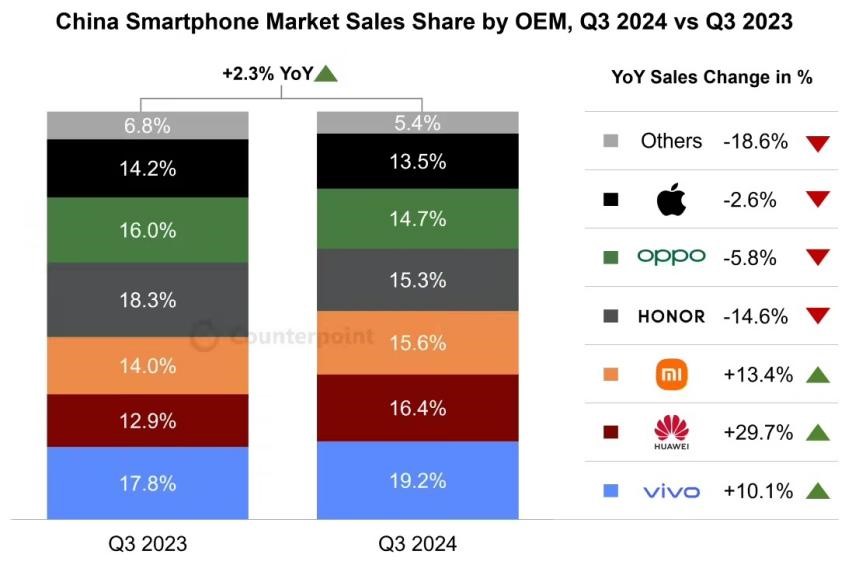

In terms of market share and shipments, vivo is in first place with a 19.2% market share, followed by Huawei with a 16.4% share, and Xiaomi in third place with a 15.6% share. This ranking reflects the success of each brand in terms of product strategy and market positioning. vivo maintains its leadership position with its diverse product portfolio and best-selling models across all price segments. Huawei, on the other hand, has demonstrated its strong presence in China's high-end market with the hot sales of the Pura 70 and Mate 60 series. Xiaomi's growth is due to the success of its mid-to-high-end Redmi K series and flagship Mi series.

According to IDC, in the third quarter of 2024, China's smartphone market shipped about 68.78 million units, a year-on-year increase of 3.2%. This data shows that the market demand is continuing to improve, and the arrival of a new round of replacement cycle provides a good environment for brand competition.

Figure: Counterpoint Research's latest report shows that China's smartphone sales increased by 2.3% year-on-year in the third quarter of 2024

Ⅱ. the role of technological innovation in promoting

Technological innovation, especially the application of AI technology, has become a new driving force for the growth of the smartphone market. Smartphone manufacturers have successively introduced AI-based control systems and applications, which not only improve the user experience, but also stimulate the demand for phone replacement. The development of AI technology has brought unprecedented impetus to the smartphone industry, supporting the improvement of product competitiveness and the technological innovation of key components.

For example, Huawei's Mate 60 series has demonstrated its competitiveness in the high-end market through its self-developed Kirin chip and HarmonyOS system. This series of products not only outperforms the competition in terms of performance, but also provides a smoother operation experience in terms of user experience. At the same time, Xiaomi's surging OS and vivo's Blue River operating system are also evolving, driving technological innovation across the industry.

Ⅲ. Market trends and future prospects

China's smartphone industry will show development trends such as industrial centralization, domestic market stability, and new technologies such as AI to promote product upgrades. It is estimated that by 2029, the market size of China's smartphone industry will reach 1,536.7 billion yuan, with an average annual compound growth rate of about 9.2%. With the recovery of the global economy and the rise of folding screen mobile phones and AI mobile phones, China's smartphones are expected to usher in a new wave of opportunities, driving shipments back to an upward trend.

It is worth noting that as the high-end market continues to expand, consumer demand for smartphones is also changing. According to the Q3 2023 mobile phone market report released by GfK China, the average price of China's mobile phone market has reached 3,480 yuan, and the shipment of high-end smartphones (priced at more than 3,500 yuan) has reached 33%. This indicates that consumers are willing to pay higher prices for higher-quality products, driving the growth of the high-end market.

Ⅳ. Editor's point of view

From a personal observation, the editor of China Exportsemi believes that the recovery of China's smartphone market is not accidental, but the result of years of technology accumulation and brand competition. The competition between brands has shifted from a simple price war to a competition of technology and innovation. The application of AI technology has not only changed the experience of using smartphones, but also brought new growth points to the industry. At the same time, with the further popularization of 5G technology and the research and development of 6G technology, the competition in the smartphone market will become more fierce in the future, and technological innovation will become the key for brands to remain competitive.

In addition, consumers' replacement cycles are also gradually extended, with data showing that Chinese consumers' mobile phone replacement cycles have been extended from 28 months to 43 months. This means that mobile phone manufacturers need to pay more attention to product innovation and user experience to attract consumers to replace their phones.

Conclusion

The recovery of China's smartphone market has brought new vitality and hope to the industry. The competition between brands, the application of technological innovation, and the change of market trends have jointly depicted a new development blueprint for the smartphone industry. With the continuous advancement of technology and the increasing diversification of consumer needs, China's smartphone market is expected to usher in a more prosperous future. The addition of AI technology will further drive the market, making the smartphone not just a communication tool, but an intelligent personal assistant that can provide support and services in more life and work scenarios.