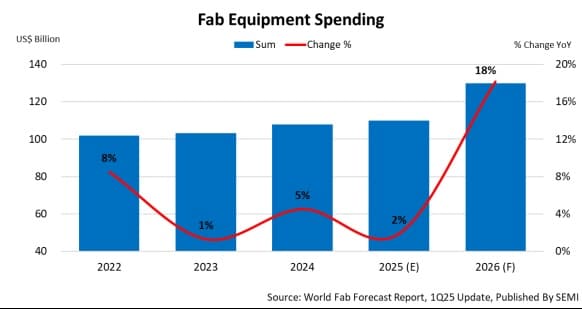

According to the latest quarterly "Global Fab Forecast Report" released by the International Semiconductor Industry Association (SEMI), global front-end fab equipment spending is expected to increase by 2% year-on-year to $110 billion in 2025, marking the sixth consecutive year of growth since 2020. In addition, investment is expected to climb by a further 18% to $130 billion in 2026.

There are multiple drivers behind this investment growth. The increasing demand for data center expansion in high-performance computing (HPC) and storage, coupled with the growing adoption of artificial intelligence (AI) technology, has significantly increased the demand for chips in edge devices, which in turn is driving the continued growth of semiconductor equipment investment.

Ajit Manocha, President and CEO of SEMI, said, "The global semiconductor industry's investment in fab equipment has risen steadily for the sixth year in a row. Investment spending is expected to grow strongly by 18% in 2026 as production scales up to meet AI-related chip demand. This investment growth trend indicates that in 2025 and 2026, there is an urgent need to strengthen workforce development programs to meet the demand for skilled workers at the approximately 50 new fabs expected to come online during this period.”

From the perspective of segments, the logic and microchip sectors are expected to become a key force driving the growth of fab investment. The growth of this segment is mainly driven by investments in cutting-edge technologies, such as 2nm process technology and backside power technology, which are expected to be in production by 2026. In 2025, investment in the logic and microchip sector is expected to grow by 11% to $52 billion; By 2026, this figure will grow by a further 14% to $59 billion.

Figure: Global fab equipment investment is expected to reach $110 billion in 2025

Overall spending in the storage sector is expected to grow steadily over the next two years. In 2025, investment in the storage sector is expected to grow by 2% to $32 billion; Growth is expected to be even more significant in 2026, reaching 27%. Among them, investment in dynamic random-access memory (DRAM) is expected to decline by 6% year-on-year in 2025 to a total of $21 billion, but is expected to recover in 2026, increasing by 19% to $25 billion. In contrast, spending in the flash memory (NAND) sector is expected to rebound sharply, growing 54% year-over-year to $10 billion in 2025 and continuing to grow 47% to $15 billion in 2026.

In terms of regional investment, although China's semiconductor equipment spending has declined from a peak of US$50 billion in 2024, it is still expected to rank first in the world with US$38 billion in investment in 2025, although this figure will be down 24% from 2024. By 2026, China's spending is expected to fall by a further 5% to $36 billion.

As the widespread adoption of AI technology drives an increase in demand for memory chips, South Korean chipmakers plan to increase equipment investment for capacity expansion and technology upgrades. South Korea is expected to become the world's second-largest semiconductor equipment investment region by 2026. In 2025, investment in South Korea is expected to grow by 29% to $21.5 billion; It will grow by 26% to $27 billion in 2026.

Taiwan, China, is expected to rank third in the world in terms of investment scale due to chipmakers' goals to improve advanced technology and production capacity. Investment in Taiwan is expected to reach $21 billion in 2025 and $24.5 billion in 2026 to meet the growing demand for AI applications for cloud services and edge devices.

The Americas region ranks fourth, with an estimated investment of $14 billion in 2025 and $20 billion in 2026. Japan, Europe and the Middle East, and Southeast Asia are expected to invest US$14 billion, US$9 billion, and US$4 billion, respectively, in 2025. In 2026, it is expected to invest $11 billion, $7 billion and $4 billion, respectively.

The latest update to SEMI's Global Fab Forecast Report, released in March, lists more than 1,500 facilities and production lines worldwide, including 156 that are expected to begin operations in 2025 or later, with varying possibilities for production.