According to SEMI's Annual Semiconductor Equipment Sales Forecast – OEM Perspective, released today at SEMICON Japan 2024, sales in the global semiconductor manufacturing equipment market are expected to reach $113 billion in 2024, up 6.5% year-over-year and setting a new industry record. This growth momentum is expected to continue in the coming years, with sales expected to reach $121 billion in 2025 and climb further to $139 billion in 2026, driven by growth in front-end and back-end devices.

Ajit Manocha, President and CEO of SEMI, said, "The third consecutive year of growth in semiconductor manufacturing investment reflects the critical role of the semiconductor industry in supporting the global economy and driving technological innovation. From the July 2024 forecast to the present, the outlook for semiconductor equipment sales has become clearer, especially in the Chinese market and AI-related industries, where investment has exceeded expectations. This trend not only reflects the strong growth momentum of various segments, applications and regions, but also further demonstrates the importance of the semiconductor industry in the global economy.”

Semiconductor Equipment Market Segmentation: Front-end and back-end equipment growth is driven by two wheels

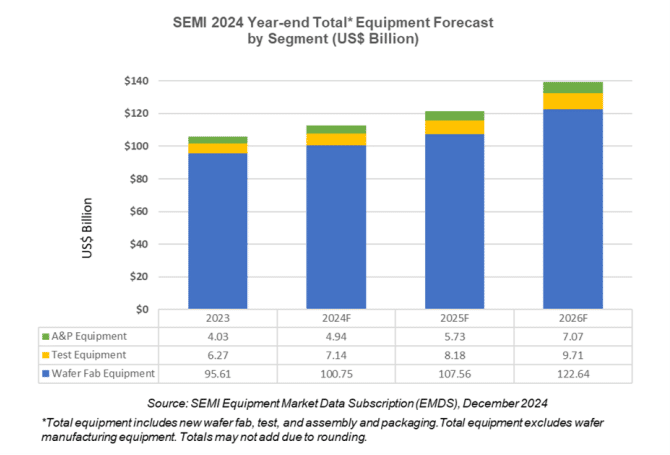

After setting a record $96 billion in sales in 2023, the wafer fabrication equipment (WFE) segment is expected to continue to grow, growing 5.4% to $101 billion in 2024. This growth was mainly supported by strong demand in the AI computing-driven DRAM (Dynamic Random Access Memory) and HBM markets. At the same time, China's equipment investment continues to play an important role in the expansion of the WFE market.

Looking ahead, the wafer fabrication equipment (WFE) market is expected to grow by 6.8% in 2025 and 14% in 2026, with sales reaching $123 billion, primarily driven by demand for advanced logic chips and memory applications.

Contrary to the continued growth of wafer fabrication equipment, the back-end equipment market is expected to rebound strongly in 2024, especially in the second half of the year, after two years of contraction. Specifically, sales of semiconductor test equipment are expected to grow by 13.8% in 2024 to $7.1 billion; Sales of packaging and assembly (A&P) equipment are expected to grow 22.6% to $4.9 billion. Growth in back-end equipment will continue to accelerate, with test equipment sales expected to grow by 14.7% in 2025, while packaging and assembly equipment sales are expected to grow by 16%. By 2026, test equipment sales will grow by 18.6%, and packaging and assembly equipment will grow by 23.5%.

Figure: Semiconductor equipment market forecast for 2024 by segment

Growth drivers for applications by segment

In the wafer fabrication equipment (WFE) application area, sales of foundry and logic chip applications are expected to remain flat at $58.6 billion in 2024, mainly due to continued investment in mature nodes. The market is expected to grow by 2.8% in 2025 and 15% by 2026 to reach $69.3 billion, driven by the demand for advanced technologies, including the application of Gate-A-Loop (GAA) technology, and the increasing need for capacity expansion.

In terms of memory devices, capital expenditures for HBM and DRAM are expected to grow significantly by 2026 as the demand for AI deployment increases and technology migration continues. NAND equipment sales are expected to remain flat in 2024, growing 0.7% to $9.3 billion, but are expected to grow significantly by 47.8% to $13.7 billion in 2025 and continue to grow 9.7% to $15.1 billion in 2026 as market supply and demand gradually recover. In comparison, sales of DRAM equipment are expected to grow by 35.3% to $18.8 billion in 2024, followed by 10.4% in 2025 and 6.2% in 2026.

Regional markets: China, Taiwan and South Korea continue to dominate equipment investment

In terms of regional distribution, China, Taiwan and South Korea are expected to continue to occupy the top three positions in equipment investment. China's equipment purchases are expected to hit another record level of $49 billion in 2024, firmly leading the world, although its growth rate may slow in 2025. Due to the huge investment in the past three years, equipment purchases in China are expected to see a correction in 2025, while equipment purchases in other regions are expected to pick up in 2025 after a slight decline in 2024. Equipment sales will continue to grow in all regions through 2026.

Looking ahead: The semiconductor industry continues to grow strongly

SEMI's forecast report is based on collective input from the world's major equipment vendors, SEMI's World Semiconductor Equipment Market Statistics (WWSEMS) data collection program, and the industry-recognized SEMI Global Fab Forecast Database. With the continuous progress of semiconductor technology and the diversification of market demand, the equipment market will continue to maintain a growth trend in the next few years, promoting global scientific and technological innovation and economic development.

The growth of the semiconductor industry is not only closely related to the development of cutting-edge technologies such as AI and 5G, but also closely related to the strategic layout of major economies around the world in technological innovation and industrial upgrading. The semiconductor equipment market is expected to continue to play a key role in driving technological advancements, improving energy efficiency, and accelerating manufacturing processes.