Recently, the news of the postponement of the mass production of NVIDIA's flagship in-vehicle AI chip Thor has attracted widespread attention. Originally scheduled for mass production in mid-2024, the Thor chip has now been postponed to mid-2025 and will only be available in an entry-level version. This delay not only affected NVIDIA's own market layout, but also had a significant impact on the product planning and supply chain management of domestic car companies.

As an important computing power support in the field of intelligent driving, Thor chips have always been regarded as a key component of the next generation of intelligent vehicles. However, this postponement has undoubtedly disrupted the rhythm of some car companies that rely on NVIDIA chips, and even forced them to re-examine their technical routes and accelerate the pace of self-developed chips. China Exportsemi will analyze in detail the background of the postponement of mass production of NVIDIA Thor, the short-term and long-term impact on domestic car companies, and discuss future technology trends and industry response strategies.

1. Background and scope of impact

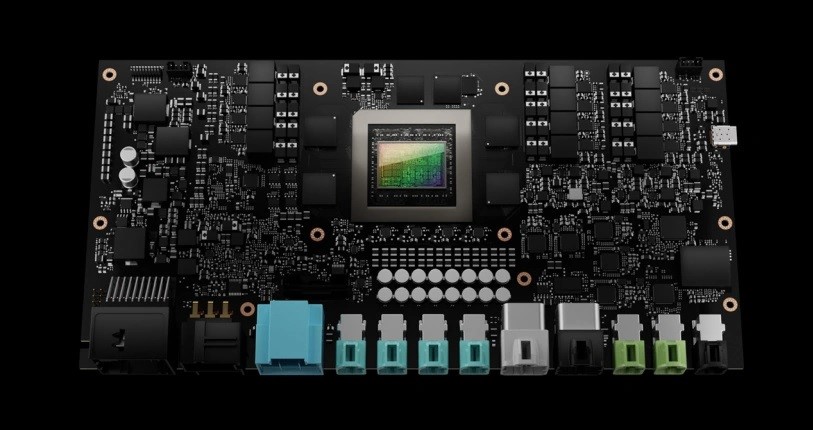

Nvidia's Thor chip was released in 2022 and is known as the "super brain" of AI-driven smart cars with its powerful computing power of up to 2000TFLOPS. Compared with the previous generation of Orin chips, Thor not only has higher computing power and integration, but also can support end-to-end intelligent driving systems, which is widely favored by domestic and foreign car companies.

However, due to supply chain issues, process maturity challenges, and market strategy adjustments, Nvidia announced that the Thor chip will not be ready for mass production until mid-2025. This postponement not only affects NVIDIA's own chip shipment rhythm, but also directly affects the technical decisions of car companies around the world, especially in the Chinese market.

The main areas of impact include:

1. New car release plans of domestic car companies: Restricted by the delay of the chip, car companies that rely on Thor chips may have to delay the release of models equipped with the chip.

2. Accelerating the process of self-developed chips: Some car companies have accelerated their self-developed chip projects to reduce their dependence on external supply chains.

3. Adjustment of the market competition pattern: domestic chip manufacturers have ushered in the opportunity of technological breakthrough, and localized alternatives have gradually become an important option for car companies.

Figure: In-depth analysis of the postponement of the mass production of Nvidia's Thor chip on domestic car companies

2. The response strategies of major car companies

1. Xpeng Motors: Accelerating the implementation of "Turing" self-developed chips

Xpeng Motors originally planned to equip NVIDIA Thor chips in its next-generation models, but in view of the delay in mass production, Xpeng quickly adjusted its strategy and switched to its self-developed chip "Turing".

The "Turing" chip has been taped out and has entered the performance testing stage, and the model equipped with the chip is expected to be mass-produced in 2025. Xpeng said that the full-stack NGP (Intelligent Navigation and Driving) function based on the Turing chip has been successfully operational, and the performance has met expectations. This measure not only ensures the progress of Xpeng's intelligent driving technology, but also greatly improves the autonomy and controllability of its supply chain.

2. NIO: Diversified chip strategy and "Shenji" self-development and promotion NIO

did not include NVIDIA Thor chips in its product plan in 2025, but carried out its technology layout through a multi-chip parallel strategy. NIO's intelligent driving system currently relies on NVIDIA's Orin chip and Horizon Journey series, and its self-developed chip "Shenji NX9031" has been taped out in July this year.

According to NIO executives, new cars equipped with Shenji chips will be launched in the next two years. Combined with NIO's independently developed full-stack software architecture, this chip is expected to significantly improve the iteration speed and efficiency of autonomous driving functions.

4. Li Auto: Self-developed chip "Schumacher" layout

In the future, Li Auto's self-developed chip project is codenamed "Schumacher", which is expected to be mass-produced in 2026. Different from traditional solutions, Ideal is developing a next-generation intelligent driving system based on an "end-to-end" visual language action model (VLA), which is matched with the "Schumacher" chip to achieve more efficient data processing and scenario decision-making.

According to insiders, the postponement of Thor's mass production has a relatively limited impact on Ideal, as its self-developed technology path has been steadily advanced. The ideal strategy suggests that car companies may become less reliant on Nvidia chips in the coming years.

3. In-depth analysis from the perspective of market and technology

1. The postponement of the acceleration of independent and controllable NVIDIA chips once again highlights the importance of independent and controllable technology. By accelerating the development of self-developed chips, Chinese automakers are expected to control core technologies and reduce their dependence on foreign suppliers, especially in the context of unstable global supply chains.

At the same time, domestic chip manufacturers such as Horizon, Black Sesame Intelligence, Cambrian, etc. have gradually risen and gradually launched competitive domestic automotive-grade chips, providing an alternative for domestic car companies. For example, the Horizon Journey 5 chip has been successfully applied in a number of mass-produced models, and its computing power and cost performance have been recognized by the market.

2. Changes in the market competition pattern, Thor's delay provides a market window for domestic chips. In order to ensure the progress of technology, some car companies have begun to choose localization solutions, which has promoted the rapid development of the domestic automotive chip industry chain.

In addition, with the advancement of intelligent driving technology, the demand for computing power continues to rise. Although NVIDIA occupies the first mover position in the market with its technological advantages, with the narrowing of the technology gap between domestic and foreign manufacturers, the market competition will be more fierce in the future.

5. Cost and BOM (Bill of Materials) Optimization

Although NVIDIA chips have a leading edge in technology, their high cost has always been a practical problem that car companies need to face. The chip delay provides an opportunity for automakers to rethink their cost structure and push them to choose more cost-effective solutions. Domestic chips are expected to occupy more market share in the future by virtue of their cost advantages.

4. Conclusions and future prospects

The postponement of the mass production of Nvidia's Thor chip has brought great challenges to domestic car companies that rely on the chip in the short term, but in the long run, this event will accelerate the technological autonomy and supply chain diversification of domestic car companies.

For car companies, improving their self-research capabilities and finding domestic alternatives have become inevitable choices to cope with uncertainty. The rapid response of leading automakers such as Xpeng, NIO, and Li shows the technological resilience and strategic flexibility of Chinese automakers in the face of external challenges.

At the same time, domestic automotive chip manufacturers have also ushered in new development opportunities. In the next few years, manufacturers such as Horizon and Black Sesame Intelligence are expected to further expand their market share and compete with international giants such as NVIDIA.

Overall, the delay of the Thor chip is not only a supply chain crisis, but also an opportunity for the domestic smart car industry to accelerate independent innovation and promote technological breakthroughs. In this process, Chinese car companies and chip manufacturers will work together to continuously improve their technical strength and market competitiveness, and help China's smart car industry move towards a broader global stage.