Currently, the hottest semiconductor market belongs to the automobile market. With the rapid pace of electrification, networking, intelligence and sharing of automobiles (hereinafter referred to as the "new four modernizations"), more and more chips are needed in automobiles, among which MCU is the most striking one. Since 2020, MCU demand continues to outpace supply. nowadays, many manufacturers continue to actively expand production, has the lack of core been alleviated?

Difficulties faced by automotive MCU chips

There are four kinds of chips used in automotive electronics: main control chip (MCU/SoC), power chip (IGBT), image sensor chip (CIS) and memory chip (Flash). As the core chip of motion control, MCU is widely used in automotive electronics and is an indispensable core component of automotive electronics.

With the rise of the "new four modernizations" of automobiles, MCU, as a key chip for the development of automobiles from electrification to intelligence, has become more and more abundant in its application fields, such as window controller, on-board diagnosis system, radar application, lamp application, automobile central control, vehicle power and safety, etc. On average, about 100 MCUs will be used in one vehicle. The total market of MCU for automobiles in China is about 2 billion, and the market scale is as high as tens of billions of yuan.

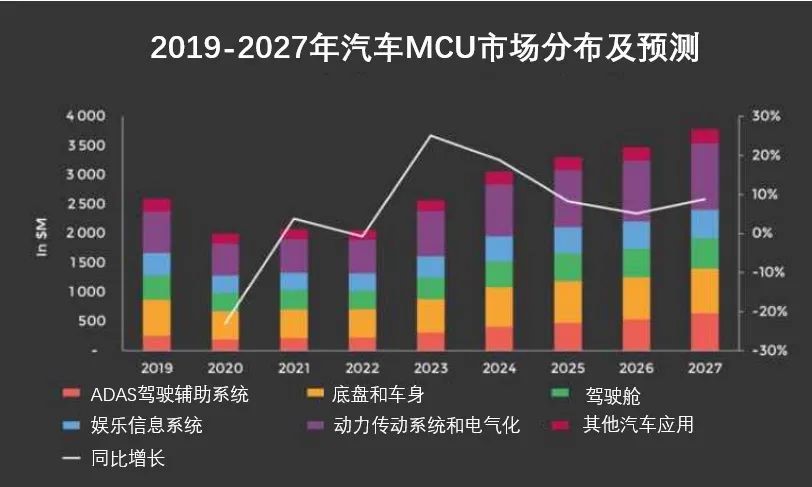

2019-2027 Distributed and forecast of automotive MCU market

Faced with such a vast market, more and more MCU chip manufacturers began to transform into automotive chips. However, automotive grade MCU has the characteristics of customer certification is difficult, long supply cycle, large investment scale and difficult entry. After completing the certification, the downstream car factory of MCU for vehicles will not easily change suppliers, which makes it difficult for many MCU enterprises to cut into the automotive grade track in a short time.

In addition, during the evolution of automobiles to intelligent systems, not only higher and higher requirements to ensure security, stability and consistency of MCU, but also MCU is required to have higher computing power, stronger network interface and lower power consumption. This leads to the need for longer detection and experiment time and higher investment for automotive grade MCU to get on the bus and go to mass production.

Head manufacturers have increased their efforts to increase capital and expand production

The global automotive MCU market has been monopolized by leading enterprises for a long time. RENESAS, NXP, MICROCHIP, INFINEON, STMICROELECTRONICS and TEXAS Instruments have a market share of over 90%, and all of them are IDM models. Therefore, the expansion of production by six major manufacturers is the key factor to solve the core shortage problem of automotive grade MCU.

2021 global MCU manufactures rankings

Structural shortages will continue

At present, the core shortage of automotive grade MCU has improved, from the overall shortage in the previous two years to the structural shortage. Automotive grade MCU can be divided into 8 bits, 16 bits and 32 bits. The higher the number, the stronger the performance, and the difficulty of research and development and the unit price will also increase. Among them, the performance of 8-bit MCU can meet the needs of most scenes, and is widely used in basic functions, such as fan, wiper, skylight, seat control and so on. The 32-bit MCU is used in high-end fields such as intelligent cockpit, body control, auxiliary driving and driving safety system.

Benefiting from the characteristics of small size, excellent performance and the trend of intelligent automobiles, at present, the global MCU chip products are mainly 32 bits. According to McClean report, in 2021, more than three quarters of automobile MCU sales came from 32-bit MCU. With the further development of automobile intelligence and electrification, the proportion of 32-bit MCU chips is expected to further increase.

Has the "lack of core" of automotive MCU been alleviated? -exportsemi.com