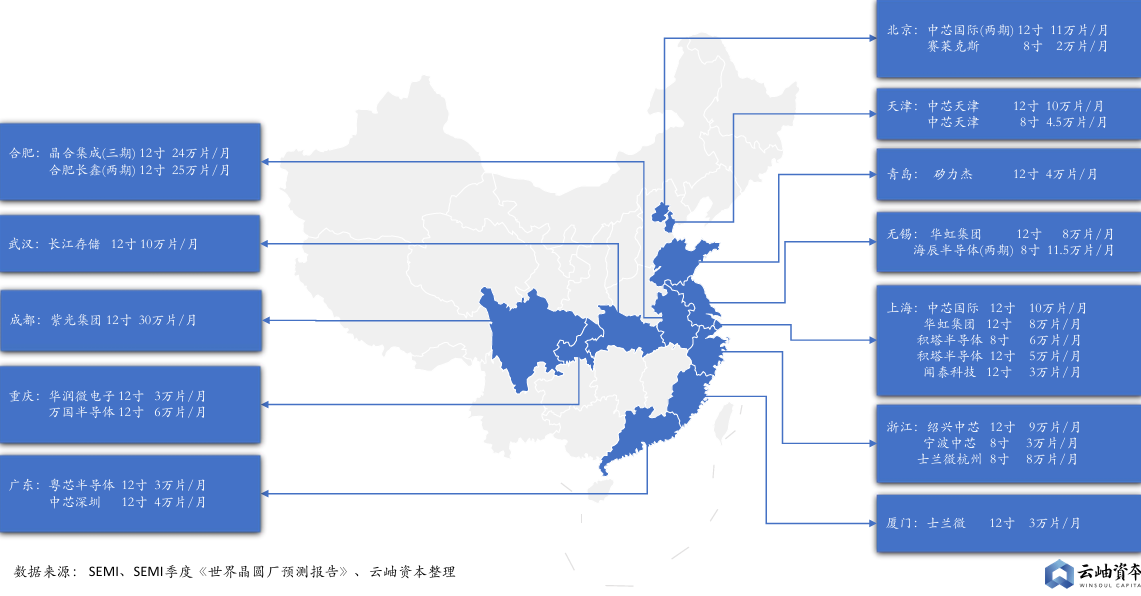

According to Winsoul Capital, the construction of semiconductor wafer factories in China is hot, and 12-inch wafer fabs will occupy the mainstream market. According to SEMI statistics, Chinese mainland will be the region with the highest growth rate of wafer production capacity in the world in 2024, accounting for more than 42%. Chinese mainland chipmakers will operate 18 projects in 2024, and wafer production capacity will rank first in the world with a growth rate of 13%, from 7.6 million wafers per month in 2023 to 8.6 million wafers. Winsoul Capital pointed out that 12-inch fabs are gradually becoming mainstream due to their higher production efficiency and cost-effectiveness. A number of 12-inch wafer fabs have been put into production in Chinese mainland, and it is expected that 24 new 12-inch wafer fabs will be added in the next five years, with a planned monthly production capacity of 2.223 million pieces.

There are 24 12-inch wafer factories in the country, of which only 4 are DDIC/PMIC manufacturing plants, and the production capacity is seriously insufficient

According to Winsoul Capital, at present, there are only four 12-inch wafer factories in China, including SMIC, Huahong Semiconductor, Nexchip, and Guangzhou CANSEMI, for the production of PMIC and DDIC products, and the total production capacity is low, and the production capacity is seriously scarce. Among them, there are only three advanced process production lines below 55nm, and the total production capacity is low, not exceeding 20,000 pieces per month. In general, there is a serious shortage of advanced process capacity. On the whole, the capital investment of 10,000 pieces of 12-inch Fab factory is not less than 1 billion US dollars, that is, more than 6.5 billion yuan, and the capital burden is extremely heavy.

Figure: Distribution areas of major wafer fabs in China

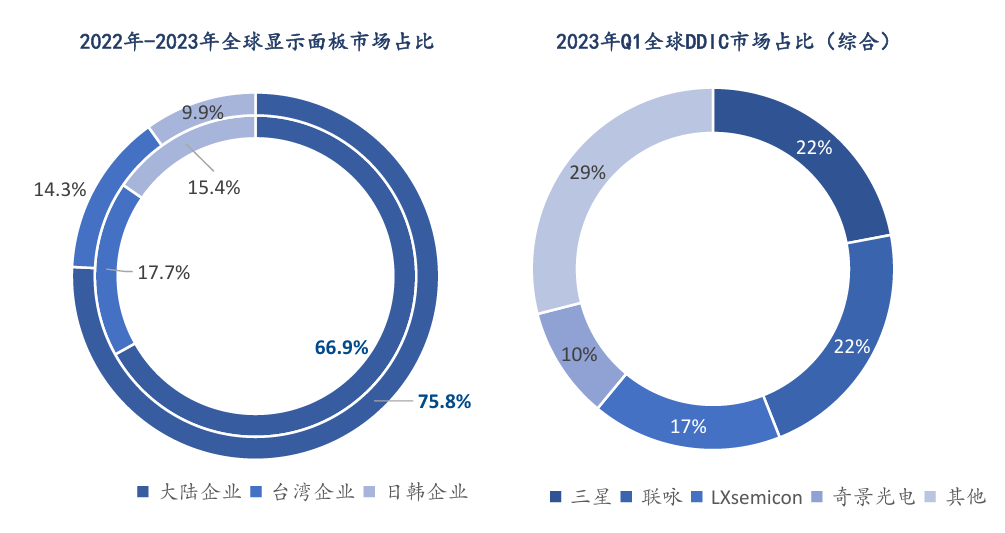

China's display panel market accounts for 76% of the world's market, but the DDIC market share is only 19%

According to Winsoul Capital, from 2022 to 2023, the market share of Chinese mainland manufacturers in the global display panel field will increase from 70% to 76%, and they are in a leading position; However, in the DDIC comprehensive market, including LCD, OLED and other products, the market share of mainland manufacturers is still less than 20%, and there is a huge gap between application and supply. Winsoul Capital pointed out that only SMIC and Crystal Integration can produce DDIC chips in mainland China, both of which are 12-inch wafer fabs, of which SMIC is oriented to advanced processes, and the current production capacity is small, mainly for advanced process products of leading design companies; Crystal Integration is currently the largest DDIC manufacturing enterprise in China, with a monthly production capacity of 70,000 pieces, but it is still not enough to meet customer demand, and is expected to continue to expand in 2024, but the process capacity of crystal integration is weak, at present, 55nm has been mass-produced, and 40nm is being tackled; The market demand for large production capacity and advanced manufacturing processes is huge.

Figure: China's global display panel and DDIC market share

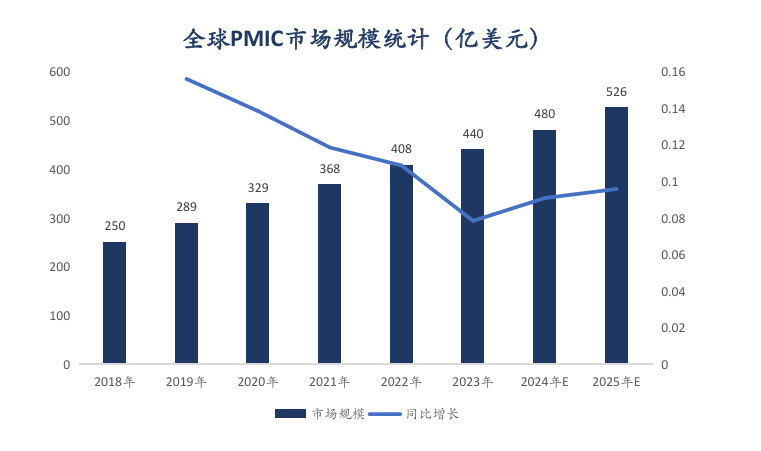

The market demand for PMIC is huge, and the market share of Chinese products is extremely low

In the context of the high popularity of electronic devices and the continuous development of emerging application fields such as the Internet of Things, new energy, and artificial intelligence, PMIC is becoming increasingly important as the power supply heart of electronic equipment. According to WSTS data, the global power management chip market size will be $40.8 billion in 2022, a year-on-year increase of 10.9%. The global power management chip market size is expected to reach $52.6 billion by 2025, with a CAGR of 8.8% from 2023 to 2025. From a global perspective, the PMIC market is dominated by a number of internationally renowned manufacturers, such as Infineon Technologies Corporation, Dialog Semiconductor PLC, Linear Technology, STMicroelectronics, Texas Instruments, etc. These companies have significant advantages in technology research and development, product quality, brand influence, etc., so they occupy a large share of the global market.

Figure Global PMIC Market Size Statistics (USD 100 million)

On the other hand, China's PMIC market has also achieved rapid development in the past few years. With the continuous progress of domestic PMIC manufacturers in technology research and development, production technology, market expansion, etc., the performance and quality of domestic PMIC products have been significantly improved. At the same time, domestic PMIC manufacturers are also actively exploring emerging markets, strengthening cooperation with downstream customers, and continuously increasing market share. However, the development of the PMIC industry needs the support of a complete industrial chain. Compared with international leading manufacturers, domestic PMIC manufacturers still have certain deficiencies in the industrial chain supporting, and need to strengthen the integration and coordinated development of the industrial chain. In the context of Sino-US trade frictions and the "CHIPS Act", China has begun to attach importance to chip research and development and independent production capacity, and the process of domestic substitution of PMIC has been rapidly promoted. Although most PMICs are still monopolized by European and American international manufacturers, there are also domestic manufacturers such as SG Micro Corp, Shanghai Bright Power, Silan Micro, Wuxi Etek Microelectronics.

Related:

Outlook and Analysis of China Semiconductor Industry 2024 (1)

Outlook and Analysis of China Semiconductor Industry 2024 (2)

Outlook and Analysis of China Semiconductor Industry 2024 (3)

Outlook and Analysis of China Semiconductor Industry 2024 (4)

Outlook and Analysis of China Semiconductor Industry 2024 (5)

Outlook and Analysis of China Semiconductor industry 2024 (6)

Outlook and Analysis of China Semiconductor Industry 2024 (7)

Outlook and Analysis of China Semiconductor Industry 2024 (8)

Outlook and Analysis of China Semiconductor Industry 2024 (9)

Outlook and Analysis of China Semiconductor Industry 2024 (10)

Outlook and Analysis of China Semiconductor Industry 2024 (11)