In terms of semiconductor equipment, Winsoul Capital pointed out that the performance of international equipment manufacturers in 2023 and 2024Q1 will be differentiated, and domestic manufacturers will buck the trend. In 2023, some international semiconductor manufacturers will show a recovery, such as ASML and other companies to achieve a significant year-on-year increase in revenue; In the first quarter of 2024, due to cyclical adjustments and uncertainty in the macro demand environment, the revenue of international semiconductor equipment manufacturers declined as a whole. On the other hand, the domestic semiconductor equipment market in 2023 and 2024Q1 has picked up as a whole, and the performance of manufacturers is optimistic. As the expansion of wafer factories has driven the demand for semiconductor equipment, the revenue of domestic semiconductor equipment manufacturers will generally increase significantly in 2023. For example, Piotech Technology, Hwatsing Technology, NAURA Technology and Crystal Growth and Energy Equipment have achieved growth of more than 50%. According to Winsoul Capital, starting from the fourth quarter of 2023, the semiconductor industry has shown a recovery trend, and it will continue to recover in the first quarter of 2024, with Guangli Micro and Crystal Growth and Energy Equipment doubling their revenue. Starting from the first quarter of 2024, some companies will increase R&D investment in order to make breakthroughs in the high-end market, with the cost ratio rising and net profit temporarily declining.

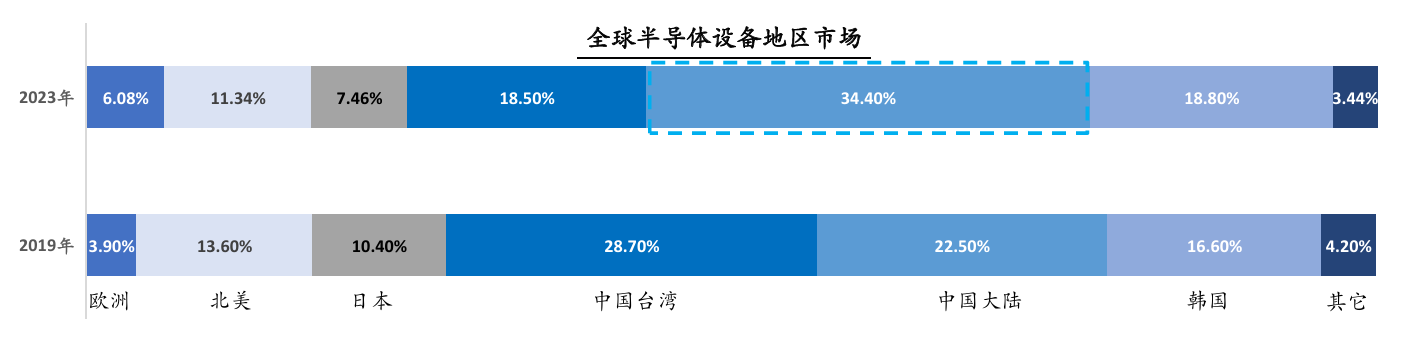

The proportion of Chinese mainland equipment in the global market has increased, the ban has been upgraded, and domestic substitution is urgent

With the escalation of restrictions on the semiconductor industry in the United States, China has also accelerated the pace of domestic substitution, according to SEMI data, the proportion of the Chinese mainland market has increased simultaneously, reaching 34.4% in 2023. Domestic semiconductor equipment has made remarkable progress in recent years, but there is still a certain gap compared with the international advanced level. At present, domestic equipment manufacturers have made great progress in core process links such as etching, deposition, cleaning, CMP, testing machines, sorting machines, and probe stations, and have formed preliminary technical benchmarks with overseas traditional manufacturers. However, there is still a significant gap in gluing and developing, ion implantation and lithography collars, and there is a long way to go for autonomy and controllability.

Figure: Global semiconductor equipment market by region

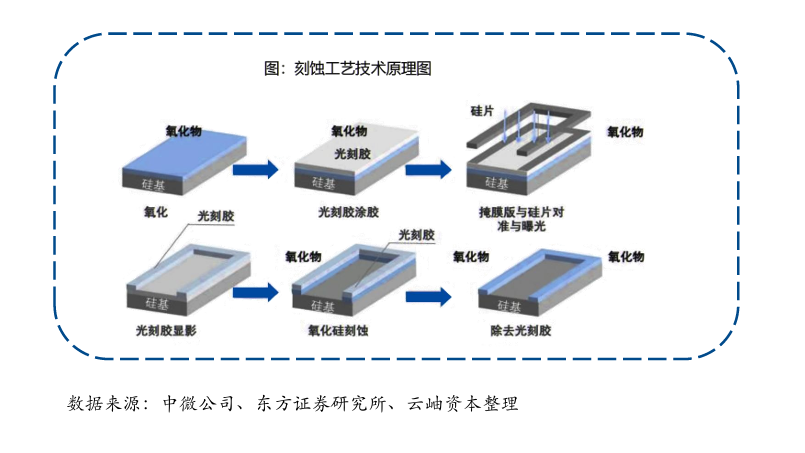

In recent years, the localization rate of China's semiconductor equipment has gradually increased. In 2023, the localization rate of domestic semiconductor equipment has reached 17.6%, of which the localization rate of etching equipment has reached about 20%. This shows that the localization rate of domestic etching equipment is increasing rapidly, and there is still a lot of room for development in the future. Compared with other semiconductor equipment, etching equipment has a relatively high localization rate. For example, the localization rate of degumming equipment is the highest, reaching 80%; The localization rate of lithography machines, ALD equipment, and ion implantation equipment is 0%, indicating that there is still a long way to go in the localization of these equipment. In etching equipment, dry etching occupies an absolute mainstream position, accounting for more than 90% of the market. Dry etching is further divided into capacitive plasma (CCP) etching equipment and inductive plasma (ICP) etching equipment. Among them, ICP etching equipment is mainly used for metal and silicon etching, and its market share in dry etching equipment is relatively high.

Figure: The technical principle of the etching process

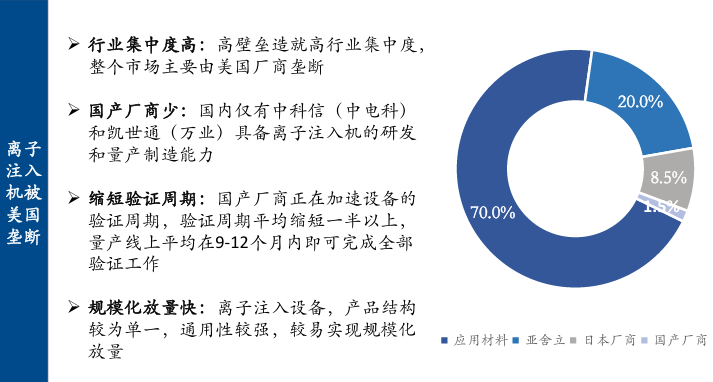

At present, the ion implanter market is highly dependent on imports. According to the statistics of the General Administration of Customs of China, in 2021, China's import volume of ion implanters will reach 384 units, a year-on-year increase of 67%; The export volume was only 157 units, a year-on-year increase of 20.8%. This shows that the self-sufficiency rate of domestic ion implanters is low, and most of them rely on imports. In order to get rid of the dependence on external technology, domestic manufacturers are actively developing ion implanters, and have achieved certain results. For example, Kaisteon, a subsidiary of Wanye Enterprise, has established a talent team covering multiple technical fields, and can independently complete the research and development and industrialization of advanced and multi-type ion implanters. In addition, Beijing Zhongkexin Electronic Equipment Co., Ltd. and Core-arrow Semiconductor (Shanghai) Co., Ltd. are also actively deploying the ion implanter market. The domestic ion implanter has been applied in a number of key 12-inch wafer fabs, and has received batch repeat orders from many key customers. This shows that the domestic ion implanter has reached a certain level in terms of performance and quality, and has been recognized by the market.

Figure: The ion implanter market is monopolized by the United States

With the rapid development of the semiconductor industry in Chinese mainland, wafer fabs are actively expanding production. According to incomplete statistics from Global Semiconductor Observation, there are currently 44 wafer factories in the mainland, including 25 12-inch wafer fabs. In addition, there are 22 fabs under construction and 10 fabs planned for the future. The expansion of these fabs will drive demand for semiconductor manufacturing equipment such as ion implanters. In order to reduce production costs and improve the security of the supply chain, fabs are accelerating the substitution process of domestic equipment. Ion implanters, as one of the key pieces of equipment in semiconductor manufacturing equipment, will also benefit from this trend. With the continuous progress of domestic ion implanter technology and the expansion of market share, wafer fabs will be more inclined to choose domestic equipment.

Related:

Outlook and Analysis of China Semiconductor Industry 2024 (1)

Outlook and Analysis of China Semiconductor Industry 2024 (2)

Outlook and Analysis of China Semiconductor Industry 2024 (3)

Outlook and Analysis of China Semiconductor Industry 2024 (4)

Outlook and Analysis of China Semiconductor Industry 2024 (5)

Outlook and Analysis of China Semiconductor industry 2024 (6)

Outlook and Analysis of China Semiconductor Industry 2024 (7)

Outlook and Analysis of China Semiconductor Industry 2024 (8)

Outlook and Analysis of China Semiconductor Industry 2024 (9)

Outlook and Analysis of China Semiconductor Industry 2024 (10)

Outlook and Analysis of China Semiconductor Industry 2024 (11)

Outlook and Analysis of China Semiconductor Industry 2024 (12)