According to Winsoul Capital, switches, as key equipment for the interconnection of various types of network terminals, are widely used in the consumer market, enterprise market, industrial market and cloud service market, and the switch chip is one of the core components of the switch, which is responsible for the exchange and forwarding of the underlying data packets of the switch. In recent years, the scale of China's switch market has continued to expand. According to the latest market research, the domestic switch market is expected to reach 74.9 billion yuan in 2024, a year-on-year increase of 9%. This growth momentum is driven by the acceleration of digital transformation, the commercialization of 5G technology, and the advancement of Industry 4.0. In the long run, the scale of the domestic switch market has shown a steady upward trend. With the rapid development of big data, cloud computing, Internet of Things and other technologies, the demand for high-speed, high-bandwidth, and low-latency communication is increasing.

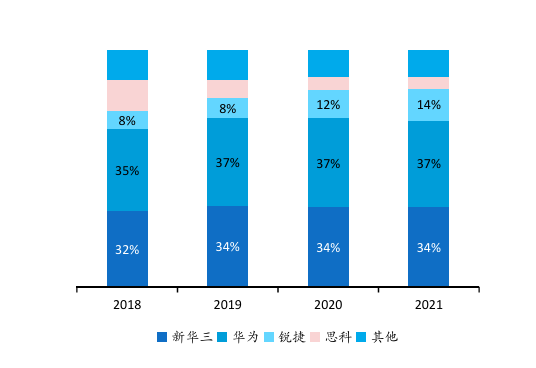

According to Winsoul Capital, the top three switch systems in China are all domestic manufacturers, and Cisco, the leading overseas switch manufacturer, continues to decline in China's domestic market share, and it is reported that the market share in 2021 will be less than 5%. It can be seen that China has basically been able to achieve domestic substitution in the whole machine of the switch. Winsoul Capital pointed out that the overall market of China's commercial Ethernet switching chips reached 9 billion yuan in 2020 and is expected to reach 17.1 billion yuan by 2025, with an average annual compound growth rate of 13.8% from 2020 to 2025. The cloud service provider market is the largest downstream market for switches, with the business revenue of the three major operators reaching 68.4 billion yuan in 2021, with an annual growth rate of more than 100%.

Figure: Share of domestic switch market

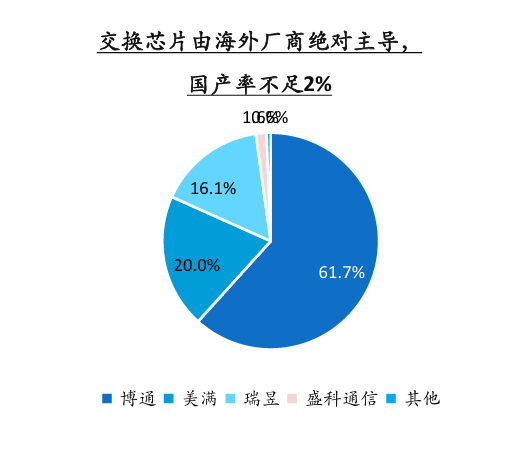

Domestic mid-to-high-end switching chips need to be supplemented urgently

In 2020, CR3 manufacturers (the top three in business scale) in China's commercial Ethernet switch chip market are all foreign brands, and the market share of mainland manufacturers Centec Communications is 1.6%. According to Winsoul Capital, domestic switching chips are still 2-3 generations behind overseas, and the domestic and foreign markets are basically dominated by overseas manufacturers. According to the official websites of each company, the switching capacity of major overseas manufacturers has been iterated to 25.6Tbps, Broadcom has released 51.2Tbps products in 2022, and the highest switching capacity of Centec's mass-produced products is only 2.4Tbps. On the other hand, domestic manufacturers such as Huawei, ZTE, and Centec Communications have successfully developed domestic Ethernet switching chips by overcoming technical difficulties. These chips are gradually approaching the international advanced level in terms of performance, meeting the needs of domestic data centers and network communication infrastructure.

Figure: Switching chips are dominated by overseas manufacturers

The optical module market is broad, and the shipment volume and market size are growing steadily year by year

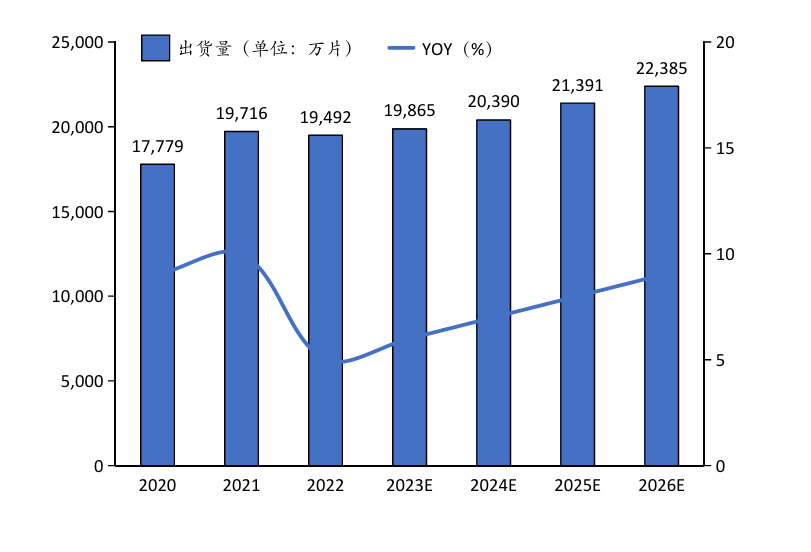

With the continuous penetration of the 5G industry and a new round of global data center construction, the global optical module market size will maintain rapid growth and is expected to exceed $17 billion in 2026. It is estimated that the size of China's optical module market will exceed 60 billion yuan in 2024, and the market size has reached 2.65 billion US dollars in the first half of 2024, and is expected to reach about 6.5 billion US dollars in 2029. The optical transceiver market is mainly divided into two application areas: data communication and telecommunications. Datacom optical modules are growing rapidly, mainly including Ethernet optical modules, connectors, Fibre Channel optical modules, etc.; Telecom optical modules maintained steady growth, mainly driven by factors such as the construction of 5G base stations and the acceleration of the construction of gigabit networks. Winsoul Capital pointed out that domestic optical module manufacturers occupy half of the country, and the market voice continues to increase. In 2023, a total of 7 Chinese manufacturers will be shortlisted in the list of the top 10 global optical module manufacturers, including Zhongji InnoLight (ranked 1st), Huawei (ranked 3rd), Accelink (ranked 5th), etc. These companies have a leading edge in the field of high-speed optical modules, and continue to increase the layout and R&D investment in overseas markets. The rapid development of the digital economy and the continuous increase in data traffic (5G Internet of Things, Eastern Data and Western Computing, Metaverse, and Chat GPT) have promoted the continuous and rapid growth of the demand for optical devices.

Figure: Global optical module shipments are increasing year by year (Source: Winsoul Capital).

Higher-speed, larger-capacity optical module products will gradually become the mainstream of the market. For example, 800G optical modules have attracted widespread attention due to their high bandwidth and high transmission rate, and have become the mainstream. At the same time, the layout and implementation of 1.6T optical modules are also accelerating. With the rapid development of artificial intelligence and Internet of Things technologies and the continuous advancement of 5G network construction, the demand for higher bandwidth and lower latency optical transmission will further increase. This brings huge opportunities to China's optical devices and optical transceiver industry, and the market size is expected to continue to grow in the next few years.

Related:

Outlook and Analysis of China Semiconductor Industry 2024 (1)

Outlook and Analysis of China Semiconductor Industry 2024 (2)

Outlook and Analysis of China Semiconductor Industry 2024 (3)

Outlook and Analysis of China Semiconductor Industry 2024 (4)

Outlook and Analysis of China Semiconductor Industry 2024 (5)

Outlook and Analysis of China Semiconductor industry 2024 (6)