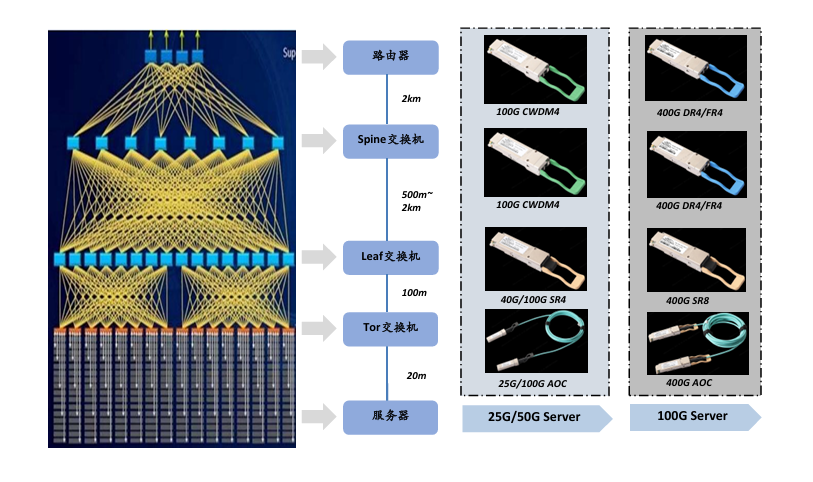

According to Winsoul Capital, the data center architecture has been upgraded, and 800G optical modules have gradually increased. With the continuous development of the digital environment, especially the emergence of new services such as AI, Internet of Things, and cloud computing, higher requirements are put forward for the bandwidth, concurrency, and real-time performance of data centers. Traditional three-tier architectures (access layer, aggregation layer, and core layer) are under tremendous pressure on aggregation and core switches in the face of large-scale data exchange. Data center network architectures are evolving to meet modern computing needs, with new Spine-Leaf topologies emerging. At present, the construction of ultra-large data centers around the world is accelerating, and existing optical modules are rapidly transitioning to 800G.

As a key component of high-speed data transmission, 800G optical modules have a transmission rate of 8 billion bits per second, which is significantly higher than that of 400G optical modules. This high-speed, high-capacity transmission capability can effectively reduce network congestion and improve network reliability and stability. In addition, 800G is widely used in ultra-large-scale data centers, cloud computing and artificial intelligence computing centers. In 2024, 800G optical modules will become the mainstream of the market, and 1.6T will also begin to increase in volume, and the overall market growth rate is expected to exceed 40%, among which the growth of data communication optical modules may be the most rapid. 800G optical modules will continue to be revised upwards on the basis of this year's high growth, and some institutions are expected to have an increase of more than 40%, and even revise the magnitude from 10 million to about 15 million. According to a report released by Valuates Reports, the global 800G optical transceiver market has demonstrated a value of $356 million in 2022 and is expected to reach $898.6 million by 2029.

Figure: The data center architecture is upgraded, and the 800G optical module is gradually increasing

The high computing power demand of AI has driven the rapid development of high-speed optical chips and electrical chips

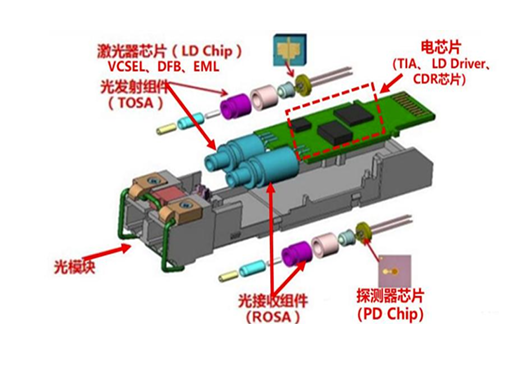

An optical chip is a chip with integrated optical components, which can realize optical transmission, modulation, monitoring, analysis and other functions on the chip. Compared with traditional optical components, optical chips have the advantages of small size, light weight, low power consumption and high integration, and can achieve high-speed, high-precision and high-reliability optical signal processing and transmission. Optical chips can be divided into laser chips and detector chips, in which laser chips are mainly used to transmit signals and convert electrical signals into optical signals, and detector chips are mainly used to receive signals and convert optical signals into electrical signals. The electrical chip is a chip responsible for electrical signal processing in the optical communication system, which is mainly used to drive optical signals, improve optical signal efficiency, and electrical signal processing. The electrical chips mainly include laser driver chip LD Driver, clock recovery chip CDR, transimpedance amplifier chip TIA, limiting amplifier chip LA, high-speed modulator driver chip, DSP PAM4 chip, serial/deserialization SerDes, MCU, temperature control TEC chip, etc.

Figure: Components of an optical module

According to Winsoul Capital, in 2021, the localization rate of 25G optical chips will be about 20%, and the localization rate of optical chips above 25G will be about 5%, and overseas optical chip manufacturers will still dominate. The localization rate of electric chips is lower than that of optical chips, and only a few domestic suppliers are involved in electric chip products with a rate of 25G and below, and there are basically no domestic manufacturers above 25G. Among them, DSP is the most difficult, the domestic production is almost 0, and the localization rate of the rest of the electric chips is about 5%. With the continuous improvement of the speed of optical modules, the proportion of electrical chips in the overall cost will increase significantly.

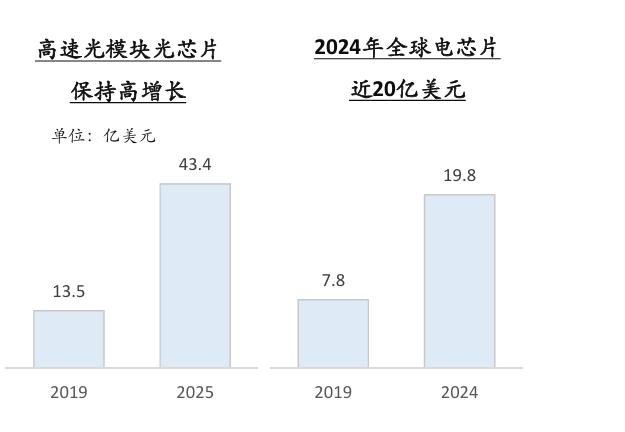

Winsoul Capital pointed out that the overall market space of optical chips with more than 25G rates will grow from US$1.36 billion to US$4.34 billion, and each module of the new generation of 50G network standards needs to be equipped with a DSP chip to process attenuated signals, and the electric chip market will reach US$2 billion in 2024.

Figure: The demand for high computing power for AI is driving the rapid development of high-speed optical chips and electrical chips

China's computing power demand is large, the localization rate is very low, and the substitution space is broad. It is estimated that from 2024 to 2025, the planned growth of China's computing power scale will exceed 100EFLOPS, corresponding to the market size of AI computing chips exceeding 260 billion yuan, of which intelligent computing power will become the main incremental part. According to LightCounting data, the global optical module market continues to grow, and the market share of optical chips, as the core component of optical modules, is also increasing year by year. It is expected that in the next few years, with the rapid growth of demand for high-performance optical modules in communications, AI and other industries, optical chips will show a growth trend of both volume and price.

The high computing power demand of AI has promoted the rapid development of high-speed optical chips and electrical chips. With its advantages in speed, power consumption, and integration, optical chips have become a key component in the construction of computing infrastructure. At the same time, domestic optical chip companies are also actively catching up with the international leading level, and the process of domestic substitution is accelerating. The electronic chip is also continuously improving performance and reducing power consumption to meet the demand for computing power of AI algorithms. In the future, with the continuous progress of AI technology and the expansion of application scenarios, high-speed optical chips and electrical chips will continue to maintain a rapid development trend.

Related:

Outlook and Analysis of China Semiconductor Industry 2024 (1)

Outlook and Analysis of China Semiconductor Industry 2024 (2)

Outlook and Analysis of China Semiconductor Industry 2024 (3)

Outlook and Analysis of China Semiconductor Industry 2024 (4)

Outlook and Analysis of China Semiconductor Industry 2024 (5)

Outlook and Analysis of China Semiconductor industry 2024 (6)

Outlook and Analysis of China Semiconductor Industry 2024 (7)