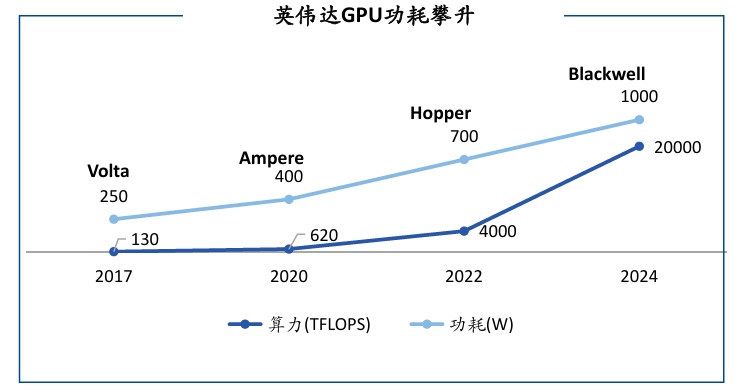

According to Winsol Capital, with the improvement of computing power, the energy contradiction has also become prominent. It is reported that at present, the low power consumption of a single computing power chip has increased from about 300W in the past to 1000W or even higher today. This increase in power consumption imposes higher power requirements and greater energy strain on infrastructure such as data centers. In 2023, data centers accounted for about 2% of global electricity consumption, and this figure is expected to grow to 4% by 2030. In 2019, the energy consumption of data centers in China was about 80 billion kWh, and by 2030, this figure will increase to 180 billion kWh. Musk has also predicted that by 2025 the electricity supply will not be enough to power more and more artificial intelligence chips.

In the context of energy shortage, improving the conversion efficiency of power semiconductors is the key to reducing energy consumption and alleviating energy pressure. At present, the industry has adopted advanced process technology and architecture improvements to improve the conversion efficiency of power semiconductors. For example, the 80Plus Platinum standard server power supply has achieved conversion efficiency of more than 89% at 20% light load and full load rated output, and 92% at 50% typical load. However, in the face of higher power consumption requirements, these conversion efficiencies still need to be further improved. In addition, higher operating temperatures reduce the energy costs of server cooling systems, which also requires power semiconductors to be stable at high temperatures.

Figure: With the improvement of computing power, the energy contradiction is prominent

Silicon-based power devices are developing to the limit, and the third generation of semiconductors will lead the innovation of data center power systems

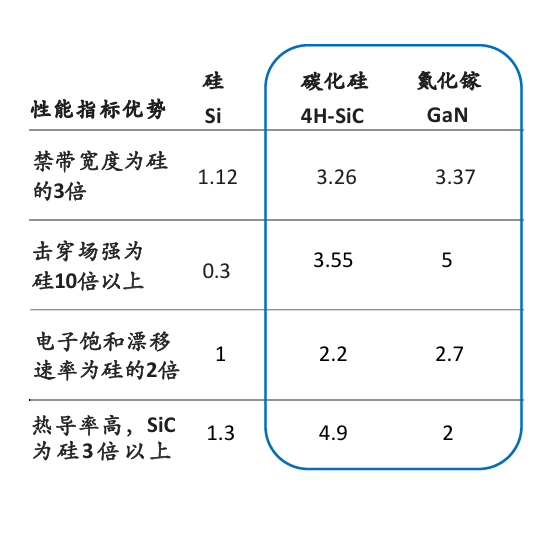

According to Winsoul Capital, SJ MOSFETs, SiC and GaN power chips are widely used in server PSUs, and the performance advantages of third-generation semiconductors make them better meet the application needs of data centers. The third generation of semiconductor materials, represented by compounds such as silicon carbide and gallium nitride, have the advantages of wider band gap, higher breakdown electric field, higher saturated electron drift rate, and higher thermal conductivity. These characteristics make the third-generation semiconductor materials have significant advantages in the fields of high frequency, high temperature, high power and high energy efficiency.

In data center power systems, the application of third-generation semiconductor materials can significantly improve power efficiency, reduce energy consumption, increase power density, and enhance system stability and reliability. For example, the application of silicon carbide diodes in power factor correction (PFC) circuits can significantly improve the efficiency of PFCs; GaN power devices can be used in server power supplies to achieve higher conversion efficiency and power density. Computing power in data centers is often constrained by power constraints. The high breakdown voltage of SiC and GaN allows them to withstand larger power inputs, allowing them to operate stably even under extreme conditions, effectively expanding computing power. In addition, third-generation semiconductors can increase the power conversion efficiency to more than 90%, far exceeding the efficiency of traditional silicon-based devices. Their superior heat dissipation performance allows the device to operate at higher loads without overheating, resulting in significant cost savings and improved overall economic benefits.

Figure: The core performance advantages of the material

Markets such as new energy vehicles, optical storage, charging piles, and data centers have accelerated the penetration of SiC

According to Winsoul Capital, through the current performance comparison of silicon carbide power devices and the analysis of downstream application working conditions, silicon carbide devices currently use silicon-based IGBTs with voltage levels of 600-1700V and power levels of 10kW-1MW as the main replacement objects. SiC power devices are mainly used in inverters, OBC (on-board chargers) and DC/DC converters in the field of new energy vehicles. Compared to silicon devices, SiC devices can reduce the weight and size of the device, reduce switching losses, and improve operating temperature and system efficiency. It is estimated that by 2027, the global market size of conductive SiC power devices are expected to reach US$6.3 billion, of which the market size of new energy vehicles is expected to reach US$5 billion, accounting for 79%. With the promotion of the national "dual carbon" strategy, the integrated photovoltaic storage and charging power station, as a new charging facility, is being put into operation in many places across the country. This type of power station combines photovoltaic power generation, energy storage and charging piles, which can provide green charging solutions and play an important role in the power system. According to market research and forecasts, the global SiC power semiconductor market is expected to continue to expand, and the market size is expected to exceed $8.9 billion by 2028, with a market penetration rate of 55%.

Related:

Outlook and Analysis of China Semiconductor Industry 2024 (1)

Outlook and Analysis of China Semiconductor Industry 2024 (2)

Outlook and Analysis of China Semiconductor Industry 2024 (3)

Outlook and Analysis of China Semiconductor Industry 2024 (4)

Outlook and Analysis of China Semiconductor Industry 2024 (5)

Outlook and Analysis of China Semiconductor industry 2024 (6)

Outlook and Analysis of China Semiconductor Industry 2024 (7)

Outlook and Analysis of China Semiconductor Industry 2024 (8)