Memory chips are the backbone of Samsung's semiconductor business, but with the slowdown in the consumer electronics market, the demand for memory products has dropped significantly. Weak sales of smartphones, PCs, and other electronic devices have led to a decrease in the demand for memory chips in the market. In addition, the uncertainty of the global economy has also made many companies more cautious in procurement, which in turn has affected the overall demand for semiconductors.

Citing information from Bloomberg, Samsung's profits fell as it struggled to keep up with its competitors, with Samsung's profits reportedly falling by more than 40% in the last quarter. It is reported that the performance of its profit pillar, the chip business, is particularly weak. Samsung's semiconductor business losses were mainly due to the continued decline in sales and prices of 3D NAND and DRAM. Despite the strong demand for chips for AI and data center servers, the weak demand for mobile chips, coupled with the increased supply of traditional chips in the Chinese market, has put a lot of pressure on Samsung.

In addition to declining demand, Samsung is also facing stiff competition from other semiconductor manufacturers. Competitors such as SK hynix and Micron continue to introduce new products in the market, increasing market share and intensifying price competition. Samsung has had to find a balance between maintaining its market position and profitability.

Industry insiders said Samsung's chip division's operating profit was much lower than market expectations, mainly due to its slow progress in the lucrative HBM (High Bandwidth Memory) market. Compared to its competitor SK hynix, Samsung is one step behind in the certification and mass production of HBM3E chips. SK hynix reported record results last week, highlighting Samsung's competitive disadvantages in this area.

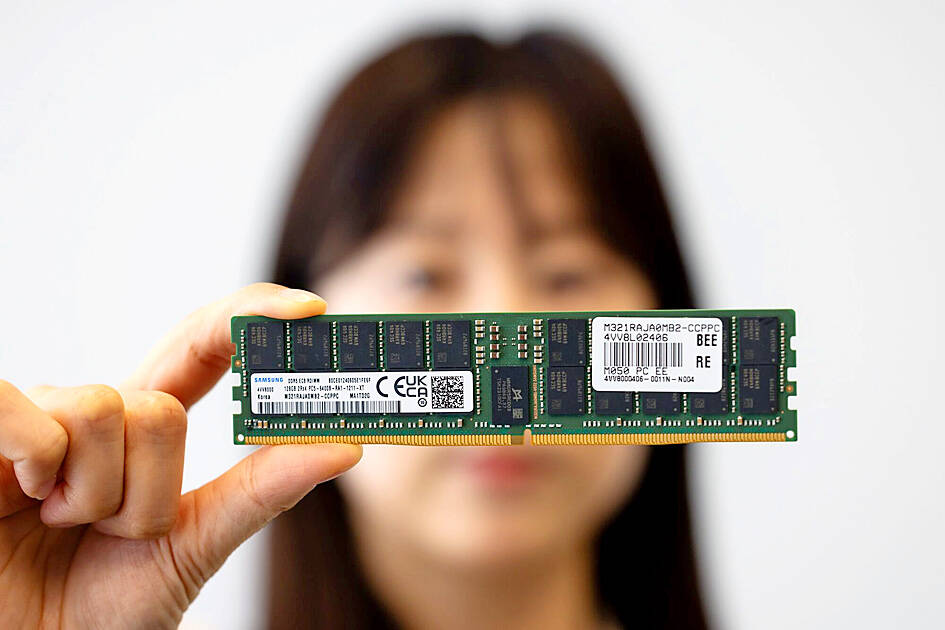

Figure: Samsung 32 GB DDR5 128GB RDIMM (Bloomberg)

In order to cope with the current challenges, Samsung plans to increase investment in high-end chips and expand sales of products such as HBM3E. However, Jeon Young-hyun, the head of the company's chip business, has previously admitted that the company has problems with its organizational culture and processes and needs to be fundamentally reformed.

Despite the poor performance of the chip business, Samsung's other businesses performed relatively solidly, so that the company's overall net profit was still higher than expected. However, Samsung's share price fell at one point after the earnings release, reflecting investors' concerns about the company's chip business prospects.

In the face of declining profits, Samsung did not sit still. The company has embarked on a number of strategies to address the current challenges. First, Samsung is actively investing in higher-end semiconductor technologies, such as artificial intelligence and automotive electronics. The growth potential in these areas is huge, which can help the company achieve a profitable recovery in the future.

Secondly, Samsung is also working to optimize the production process to reduce costs and improve efficiency. Through smart manufacturing and automation technology, Samsung hopes to maintain an edge over the competition by reducing production costs while maintaining product quality.

Finally, Samsung is also considering expanding its product portfolio to a wider range of applications, including emerging markets such as the Internet of Things (IoT) and 5G communications. The rapid development of these fields has provided new growth points for semiconductor demand.