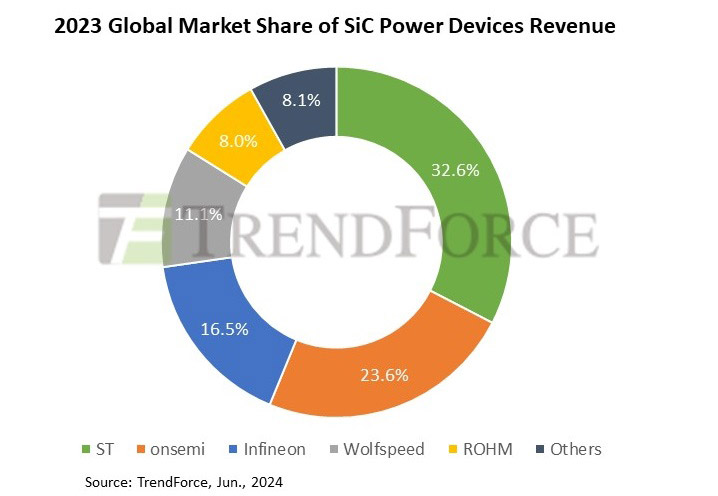

According to market research firm TrendForce, the silicon carbide power device industry continues to grow strongly, driven by the application of battery electric vehicles (BEVs). The top five suppliers account for about 91.9% of total revenue: European-based STMicroelectronics leads with a market share of 32.6%.

ST has invested significant resources in the research and development of silicon carbide power devices. The company has a strong R&D team composed of senior engineers and scientific researchers, who have made a number of major breakthroughs in the preparation of silicon carbide materials, device design, and manufacturing processes. These innovations not only improve the performance and reliability of SiC power devices, but also reduce production costs and promote the rapid development of the market.

The analysis points out that the demand for artificial intelligence servers and other fields will rise sharply in 2024, but the sales growth of pure electric vehicles will slow down significantly, and the weakening of industrial demand is affecting the SiC supply chain, and it is expected that the annual growth rate of SiC power device revenue in 2024 will slow down significantly compared with previous years.

As a major supplier of automotive SiC MOSFETs, ST is building a full-process SiC plant in Catania, Italy, which is expected to be operational in 2026. In addition, the 8-inch SiC joint venture plant between ST and Sanan Optoelectronics in China is expected to be completed and put into operation by the end of 2024, which will enable ST to achieve vertical integration by combining a local post-processing production line with a supporting substrate material plant provided by Sanan Optoelectronics.

Figure: Revenue share of the global SiC power device market in 2023 (Source: TrendForce)

onsemi's SiC business has grown rapidly in recent years, mainly due to its EliteSiC family of power devices for automotive. The company's SiC fab in Bucheon, South Korea, was expanded in 2023 and plans to transition to 8-inch production after completing relevant technical verification in 2025. Since the acquisition of GT Advanced Technologies Inc., a SiC material manufacturer based in Hudson, New Hampshire, USA, at the end of 2021, onsemi has achieved a self-sufficiency rate of more than 50% in SiC substrate materials. With the ramp-up of in-house material capacity, the company is on track to achieve its goal of 50% gross margin.

Nearly half of Infineon's SiC revenue comes from the industrial market, but its main customer (SolarEdge) at its Kulim plant in Malaysia is facing difficulties, impacting Infineon's operations. In contrast, Infineon's automotive business is growing stronger, as evidenced by the recent design bid for the Xiaomi SU7. Interestingly, Infineon is well positioned to face market headwinds, having previously lagged behind in capacity expansion. Unlike other leading manufacturers of SiC integrated devices (IDMs), Infineon lacks in-house production capacity for SiC crystalline materials and actively promotes a diverse supplier system to ensure a stable supply chain.

Overall, TrendForce said that the SiC industry is in a stage of rapid growth and fierce competition, and scale effect is more important than any other factor. Leading IDM manufacturers have changed their conservative and prudent strategies and actively invested in SiC expansion plans to establish a leading position. At present, more than 10 companies around the world have invested in the construction of 8-inch SiC wafer fabs. As the market continues to expand, the competition in the SiC field is expected to become more and more intense.