With the continuous expansion of U.S. export controls on chips, chips that once met the requirements of sanctions are now pushed to a more stringent performance threshold. Still, chipmakers have not stopped there, but have adopted innovative strategies to adapt to the increasingly complex international trade environment.

U.S. controls on chips in the Chinese market are escalating

Last year, we reported that NVIDIA sold more than $1 billion of A800/H800 chips, which are designed to meet China's requirements, to major AI labs in China. However, the U.S. subsequently banned sales to China, forcing NVIDIA to reconsider its China business strategy.

U.S. Commerce Secretary Gina Raimondo warned: "If I redesign a chip around a specific technical standard to allow China to use in AI applications, I will control it the next day."

Although NVIDIA's new China-specific chip, the H20, is theoretically lower than high-end chips, it is optimized for large language model (LLM) inference tasks, making it 20% faster than the H100 in inference tasks. This allows NVIDIA to expect $12 billion in sales revenue from this chip family in the coming years.

The State of AI said the Chinese market is declining in importance to U.S. chipmakers. According to NVIDIA, the Chinese market, which used to account for 20% of its data center business, has now dropped to the "low to mid-single digits".

AI Development Assistant: From static code to dynamic products

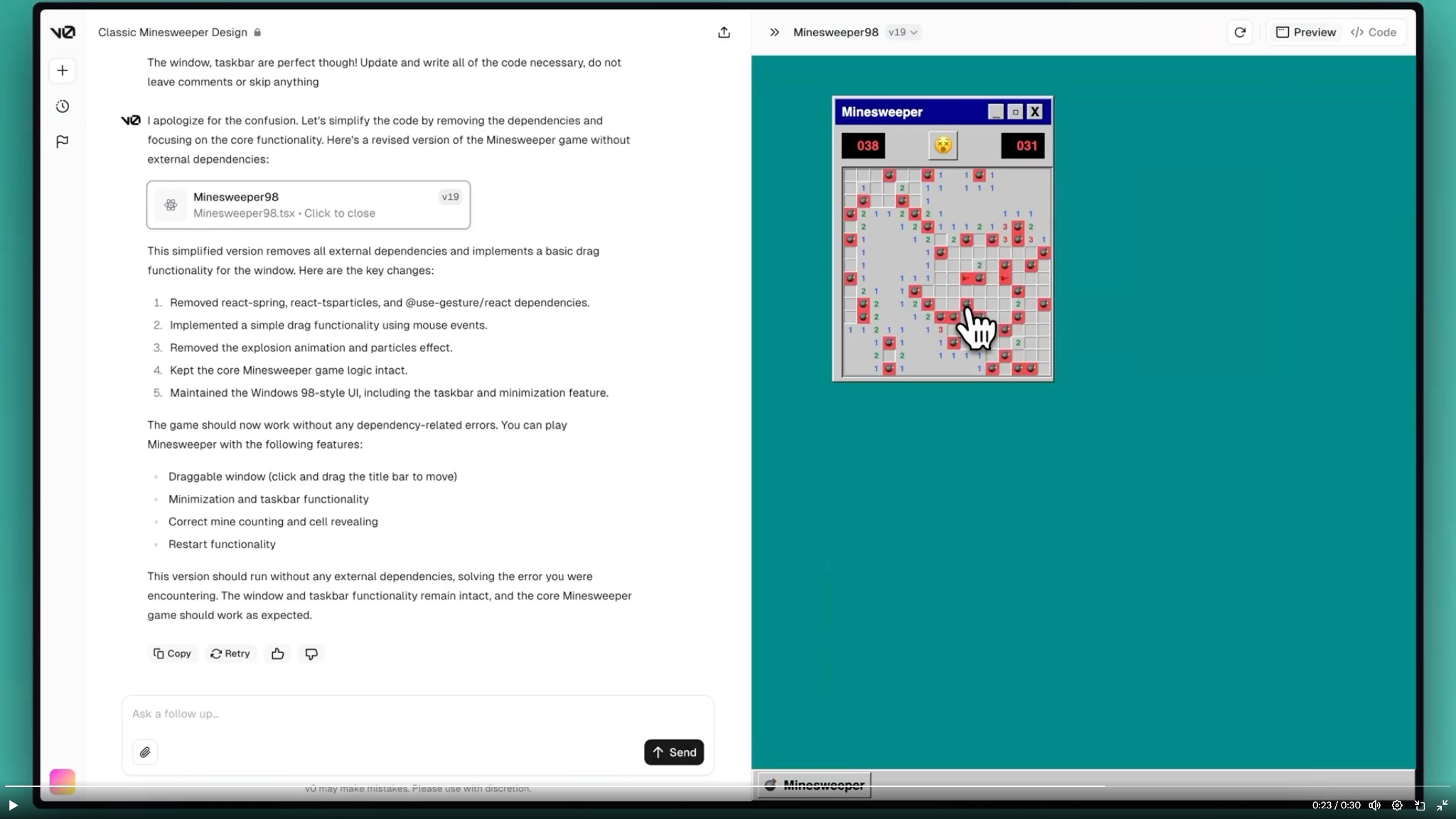

With the rapid development of AI technology, more and more companies are pushing their applications in the direction of interactive development assistants. This year, Anthropic and Vercel introduced chat agent-based Claude and V0 features that enable code to be written and run in the browser and respond to user needs in real time. This innovation brings otherwise static code snippets into the interactive world, allowing users to iterate with agents in real time, dramatically lowering the barrier to entry for software product creation.

For example, Claude and V0 can generate a playable Minesweeper game based on a simple prompt, proving that these AI agents can not only generate code, but also execute it and interact with users.

Figure: AI interactive development can be turned into a game

From Basic Model to Product Design: The Transformation of AI Developers

As the performance of the underlying model converges, leading technology companies such as Apple, Google, and TikTok are no longer focusing solely on building the underlying technologies and APIs, but are more focused on how to translate those technologies into concrete products. This product-driven mindset is also being widely adopted in the AI field. Companies like OpenAI, Anthropic, and Meta are starting to think more about the form and experience of their "products," whether it's Claude's Artifacts, OpenAI's advanced voice capabilities, or Meta's hardware collaboration and lip-syncing tools.

Figure: Advanced voice capabilities from Open AI

Europe Challengers:Mistral and Aleph Alpha

While U.S. labs are leading the development of global AI technology, European AI companies are also trying to find breakthroughs. Mistral has become one of Europe's leading success stories, with more than 1 billion euros in funding, excellent computing efficiency, and multilingual processing capabilities. Mistral's flagship model, Au Large, has been launched on the Azure platform through a partnership with Microsoft, and has begun to work with companies such as France's BNP Paribas, while increasing its presence in the US market.

However, Germany's Aleph Alpha faces more challenges. Although the company raised $500 million through equity financing, grants and licensing agreements, its closed-ended model did not perform as well as its open-ended model. knot

The Future of Custom Models: The Game Between Open Source and Commercialization

With the support of more and more open-source cutting-edge models, it has become a question worth pondering whether enterprises are still willing to invest in custom models. While companies like Databricks and Snowflake are trying to compete for the enterprise market by launching their own models, the widespread adoption of open source and low-code/no-code tools may significantly reduce the incentive for companies to invest in custom models.

With the gradual maturity of large models and the popularization of open-source models, the commercialization path of AI technology is changing. For enterprises, choosing how to leverage these powerful off-the-shelf models, or whether to customize them more deeply, will be key to the future of AI.

Innovation and Profitability: Challenges and Opportunities in AI

While many AI startups have set record levels of funding and doubled revenue, many are currently not profitable. However, for some large model providers, revenues are starting to grow significantly.

OpenAI expects to triple its revenue in a year, although training, inference and personnel costs still put it at a loss. Other AI giants are also looking for sustainable profit models.

The Competitive AI Market: Who Controls the Future?

Meta has successfully attracted market attention by completely switching to open-source AI and giving up huge metaverse investments. Zuckerberg became the epitome of open-source AI, in opposition to OpenAI, Anthropic, and Google DeepMind.

At the same time, with the continuous advancement of AI inference technology, the inference cost of powerful models is decreasing. Google's Gemini series, for example, has reduced its price by 64-86% just a few months after its launch, while maintaining strong performance, especially the Gemini 1.5 Flash, which is 50% cheaper than the 1.5 Pro.

Looking to the future

With the continuous progress of technology and the change of market demand, the international competition of chips and AI technology will continue to deepen. U.S. export controls, chip smuggling, the rapid development of AI technology, and the changing influence of the Chinese market on U.S. chipmakers are all important factors to watch in the coming years.

Related: