According to TrendForce's latest report, the spot prices of DRAM and NAND flash memory are unlikely to rise in the short term for two reasons: first, the market has sufficient inventory; Second, the introduction of relevant policies has led to a further impact on DRAM prices.

The price dynamics of the NAND Flas market show that wafer prices have increased recently due to supply shortages. But this upward trend did not last. According to reports, the spot price of 5112Gb 3D TLC NAND wafers has dropped by 0.57% to $3.309 per piece in the latest week.

Similar to NAND, the DRAM market is under price pressure, in stark contrast to the contract price. The reason for this is that module factories have excess inventory, and module factories tend to buy DRAM in the spot market. In addition, the weakness of the consumer goods market has also led to a decline in prices. According to TrendForce, despite suppliers' efforts to limit supply to support prices, overall spot prices are expected to decline as more chips enter the market in the second quarter, especially DDR5 products. The average spot price of mainstream chips, such as DDR4 1Gx8 2666MT/s, fell 0.05% to $1.939 from $1.940 last week.

Another reason for the price drop is the market policy to crack down on product smuggling, which has led to a further decline in the price of DRAM chips that have been replanted. Reballing is the process of removing the graphics core chip (GPU) and then resoldering. Since the GPU is packaged in a BGA (or similar configuration) with no pins on the bottom and is made up of multiple solder dots (and no solder ports on the back of the PCB), specific techniques and tools are required for soldering.

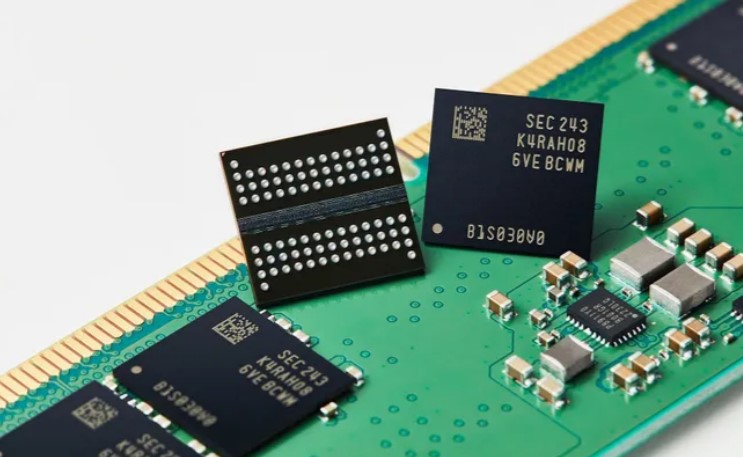

Figure: NAND and DRAM prices have fallen (Source: Samsung)

Market analysts pointed out that although the increase in contract prices has provided some support to the prices of NAND Flash wafers and other related products, the quotations in the spot market have not eased as a result. Supplier supply has not expanded significantly, and overall price dynamics are slightly better than in the DRAM spot market. However, further pressure on prices is expected as supply increases in the market.

In the storage market, manufacturers such as Samsung, SK hynix, Micron and other manufacturers are fiercely competitive, and in order to seize market share, these head manufacturers have reduced their prices and sales, which is also the reason for the price drop. In order to alleviate the pressure of falling prices, some memory chip manufacturers have begun to cut expenses and reduce production capacity in order to stabilize prices.

Similarly, the spot NAND flash market is trading weakly due to the abundance of stocks among SSD manufacturers, some of which produce the world's best SSDs, and demand has yet to recover despite price cuts from spot vendors. This has led to the persistence of the divergence between the spot price and the contract price. In addition, there is uncertainty about inventory replenishment needs in the third quarter of 2024.

Overall, both the DRAM and NAND flash markets face significant pricing challenges due to weak demand. TrendForce does not expect prices to recover in the near term due to external pressures such as market dynamics and government crackdowns.

Not long ago, Kioxia announced that it would stop reducing 3D NAND memory production and was ready to increase production, which could increase market share and could also have a significant impact on 3D NAND supply and price.