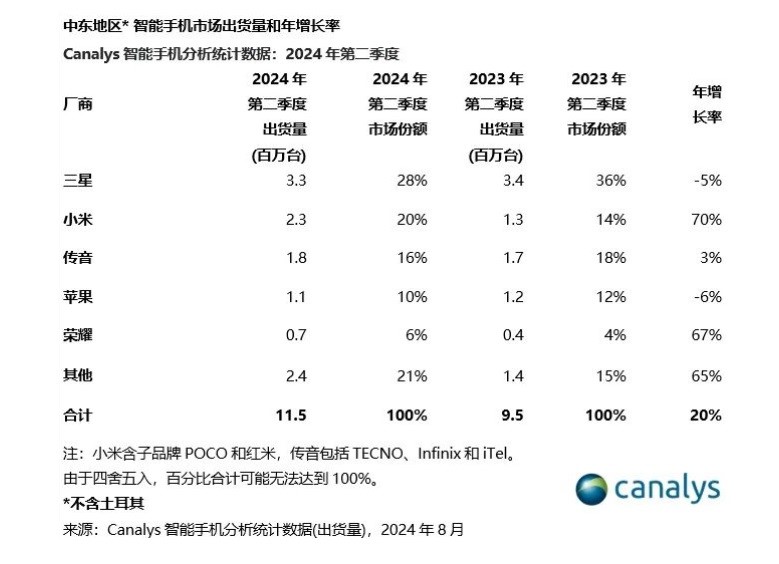

In today's ever-evolving global technology market, smartphones have become a bridge to connect the world. According to the latest report from Canalys, the smartphone market in the Middle East (excluding Turkey) shipped 11.5 million units in the second quarter of 2024, up 20% year-on-year, a significant increase that reflects not only the strong recovery of the regional economy, but also the positive effects of strategic investment in technology and economic diversification policies.

1. Market Overview and Growth Factors

The growth of the smartphone market in the Middle East is due to a number of factors. First, the smartphone market surged by 13% with strong growth in retail and catering in the region, especially in Saudi Arabia. Secondly, the U.A.E. market achieved a significant growth of 19%, mainly driven by the government-driven "World's Coolest Winter" campaign and Ramadan celebrations, which not only attracted tourists but also increased retail footfall. In addition, shipments in Iraq, Qatar and Kuwait increased by 22%, 14% and 17%, respectively, indicating that demand for smartphones is rising across the region.

2. Brand performance and market share

In terms of brand performance, Samsung continued to lead the Middle East market with 3.3 million units shipped and a 28% market share, albeit down 5% compared to the same period last year. This achievement was driven by Samsung's successful rollout of the mid-range Galaxy A series and the high-end Galaxy S24 series, especially the Galaxy AI feature of the S24 Ultra, which drove Samsung's average selling price (ASP) up by 19%.

Xiaomi followed with 2.3 million units shipped and a 20% market share, with a staggering 70% year-on-year growth. This growth was mainly due to Xiaomi's deep presence in the low-to-mid-end market, especially the launch of the Redmi Note 13 series, as well as the expansion of independent and chain retail channels.

Transsion ranked third with 1.8 million units shipped and a 16% market share, up 3% year-on-year. Transsion's growth was driven by strategic distributor partnerships for its Infinix brand in Saudi Arabia and Iraq, as well as its appeal to the mass market.

Apple ranked fourth with 1.1 million units shipped and a 10% market share, down 6% year-over-year. Despite the challenges, Apple's Pro series models contribute significantly to its product portfolio, and it is expected to recover its market share in the second half of the year with the introduction of new products.

Honor ranked fifth with 700,000 units shipped and a 6% market share, up 67% year-on-year, making it the fastest-growing brand in the quarter. Honor's growth was driven by active retail activities and new service centers in Saudi Arabia, which successfully attracted consumers in all price segments.

Figure: Canalys Smartphone Shipment Statistics in the Middle East - 2024Q2

3. Market trends and future prospects

Judging from the current market trends, the smartphone market in the Middle East is showing a diversified development trend. On the one hand, stable economic growth and government support policies provide a solid foundation for market expansion. On the other hand, with the growing consumer demand for new technologies and innovative products, smartphone manufacturers need to continuously introduce new products to meet market demand.

Looking ahead, the smartphone market in the Middle East is expected to continue its growth trend. Manufacturers need to continue to adapt to market changes and strengthen cooperation with local governments and retail channels to achieve long-term market development. At the same time, with the promotion and application of 5G technology, it is expected that the high-end smartphone market will usher in a new round of growth opportunities.

4. summary

The growth in smartphone shipments in the Middle East in the second quarter of 2024 is not only a reflection of the region's economic diversification and technology investment, but also the result of fierce competition among major brands. As the market matures and consumer needs diversify, we look forward to a more prosperous future for the smartphone market in the Middle East."