The results of the 2024 U.S. presidential election were announced, and Trump won a second term with 270 electoral votes. This political event has attracted widespread attention around the world, and at the same time has had a profound impact on the semiconductor industry and the technology stock market (Trump Wins the U.S. Election and What's the Impact on China's Semiconductor Industry) In this political gamble, it is not difficult to find that Musk seems to be one of the biggest winners, and Tesla's stock performance is particularly explosive.

The impact of Trump's policies on the semiconductor industry

During Trump's presidency, policy toward the semiconductor industry has focused on restricting Chinese investment in the United States, escalating export controls, and experimenting with multilateral sanctions. These policies have dealt a major blow to China's semiconductor industry, while also affecting the stability of the global semiconductor supply chain. These actions of the Trump administration have undoubtedly intensified competition and tensions in the global semiconductor industry.

Musk's political bets and business interests

Musk played an important role in this election. He reportedly poured at least $130 million into Trump's campaign, a move that shows his unwavering support for Trump's policies. Musk's political gamble seems to have paid off, with Trump specifically mentioning Musk in his victory speech, praising him as a "special person" and a "super genius" and hinting that Musk will play an important role in the future administration.

Tesla, as a leader in the electric vehicle industry, could gain a competitive advantage because of the Trump administration's tariffs on China. In addition, SpaceX may also receive more government contracts because of the Trump administration's defense policies. Musk's personal net worth surged by $33.5 billion overnight to $270.3 billion after Trump's victory, further cementing his position as the world's richest man.

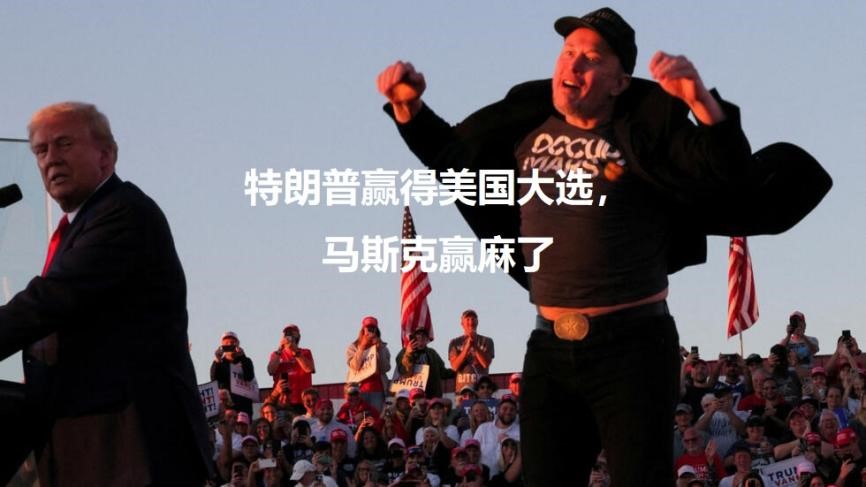

Pictured: Trump won the U.S. election, and Musk won hemp

Strong performance of Tesla stock

Tesla's stock performance was particularly strong after Trump's victory. According to the latest financial report data, Tesla achieved revenue of $25.182 billion in the third quarter of 2024, a year-on-year increase of 8%; net profit was US$2.167 billion, a year-on-year increase of 17%; gross profit margin increased to 19.8%, an increase of about 2 percentage points year-on-year; Excluding the profits from other businesses and carbon credits, its gross profit margin for automobiles is also as high as 17.1%. Its net profit and gross profit margin levels far exceeded market expectations.

In terms of sales, Tesla's global EV deliveries in the third quarter of 2024 were about 463,000 units, setting a new record for quarterly deliveries in 2024. At the same time, Tesla ushered in the world's 7 millionth vehicle off the assembly line on October 22.

Thanks to the better-than-expected earnings report, Tesla's stock price rose 12% after the U.S. stock market on Wednesday, and rose 21.92% in U.S. trading on Thursday, the highest single-day increase this year. The gain was the stock's biggest one-day gain since May 2013, closing the day at $260.48 a share. Its total market capitalization was $832.1 billion, up about $150 billion overnight, exceeding the combined market capitalization of General Motors, Ford Motor and Stellantis in a single day.

Conclusion

Trump's re-election is undoubtedly a victory for Musk. Musk's political bet has paid off, and his business empire is poised to reap the benefits of Trump's policies. Tesla's stock has been particularly strong, with a significant increase in market capitalization that reflects not only the market's recognition of Tesla's future growth potential, but also investors' confidence in the U.S. technology market under Trump's policies. For the semiconductor industry, the road ahead remains uncertain. Trump's policies are likely to continue to affect the stability of the global semiconductor supply chain, while also having a profound impact on the future development of the U.S. semiconductor industry. At this critical juncture, companies and policymakers in the semiconductor industry need to keep a close eye on policy developments to address possible challenges and opportunities.