In the fierce competition in the global semiconductor industry, TSMC continues to lead the development of the industry with its excellent technology and market strategy. On July 18, 2024, TSMC announced its financial report for the second quarter, once again proving its leading position in global chip manufacturing. China Exportsemi Web will try to deeply analyze TSMC's financial performance in the second quarter of 2024, and discuss its strong performance in advanced process technology and market demand.

Financial Performance Highlights

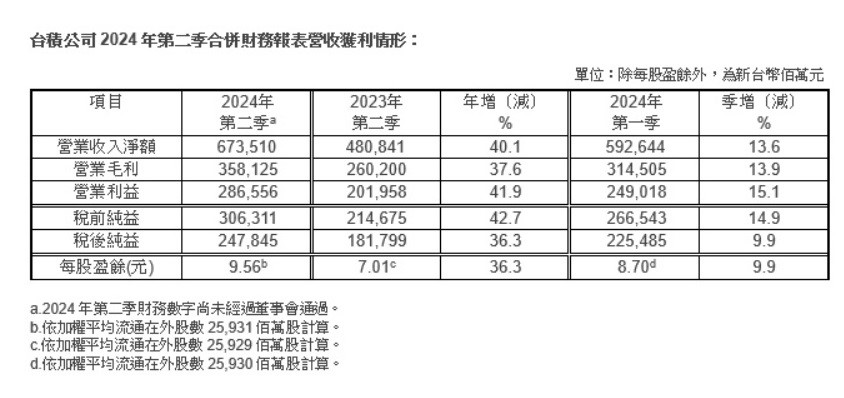

TSMC's consolidated revenue for the second quarter of 2024 reached NT$673.51 billion (approximately RMB150.462 billion), net profit of approximately NT$247.85 billion (approximately RMB55.37 billion), and earnings per share of NT$9.56 (equivalent to US$1.48 per unit of United States Depositary Receipts). Compared to the same period last year, revenue increased by 40.1%, and net income and earnings per share both increased by 36.3%. Compared to the previous quarter, revenue increased by 13.6% and net profit increased by 9.9%. These figures not only demonstrate TSMC's strong financial performance, but also reflect its competitiveness in the global market.

Chart: TSMC's consolidated financial statement revenue for the second quarter of 2024

Contribution of advanced process technology

TSMC's continued investment and innovation in advanced process technologies is key to its success. In the second quarter of 2024, 3nm process shipments accounted for 15% of TSMC's wafer sales, 5nm process shipments accounted for 35%, and 7nm process shipments accounted for 17%. Overall, the revenue of advanced processes (including 7nm and beyond) reached 67% of the total wafer sales value in the quarter. This data shows that TSMC's leading position in high-end process technology has not only consolidated its market share, but also brought significant economic benefits to it.

Specifically, TSMC's 3nm process technology accounted for 15% of total wafer revenue in the fourth quarter of 2023, while 5nm and 7nm accounted for 35% and 17%, respectively; Advanced processes (7nm and below) account for 67% of total wafer revenue. These data not only demonstrate TSMC's leading position in high-end process technology, but also reflect its accurate grasp of market demand and technological progress.

The need for AI and high-performance computing (HPC).

TSMC's customers include Apple Inc. and Nvidia Corp., whose revenue growth is driven by strong demand in artificial intelligence (AI) and high-performance computing (HPC). TSMC has benefited enormously from the AI wave, a trend that has helped the company withstand shrinking demand and pushed its stock price to record highs. It is expected that TSMC's revenue growth will fall in the range of 20%-25% in 2024, driven by the demand for AI and HPC.

TSMC's chief financial officer, Huang Renzhao, said that it is expected that the proportion of artificial intelligence revenue will increase to 11%-13% in the future. This shows that with the continuous advancement of technology and the popularization of artificial intelligence applications, artificial intelligence will become an important force to promote the future development of TSMC. In addition, TSMC's leadership in advanced manufacturing processes and packaging technologies will strengthen its position in the AI chip market.

Future outlook

TSMC expects third-quarter sales to be in the range of $22.4 billion to $23.2 billion, operating margin of 42.5% to 44.5%, and gross margin of 53.5% to 55.5%. In addition, TSMC expects full-year capital expenditures of $30 billion to $32 billion, an increase from previous expectations. This shows that TSMC is continuing to increase its investment to meet the growing market demand and technological advancements.

About 70% to 80% of TSMC's capital expenditure is spent on advanced process technologies, 10% to 20% on mature and special process technologies, and 10% on advanced packaging and testing and mask production. Among them, in terms of advanced processes, TSMC expects customer demand for 3nm technology to remain strong for many years; And the research and development of 2nm process technology is progressing smoothly, and mass production is planned to start in 2025, and 2nm process technology will help TSMC seize AI-related opportunities in the future.

In summary, TSMC's financial performance and market strategy in the second quarter of 2024 show its strong competitiveness in the global semiconductor industry. Through continuous technological innovation and accurate grasp of market demand, TSMC has not only achieved remarkable financial results, but also demonstrated its forward-looking and leadership in technology and market strategy. With the growing demand for artificial intelligence and high-performance computing, TSMC's future development prospects are worth looking forward to. TSMC's success lies not only in its outstanding financial data, but also in its keen insight and strategic layout in terms of technological progress and market demand.