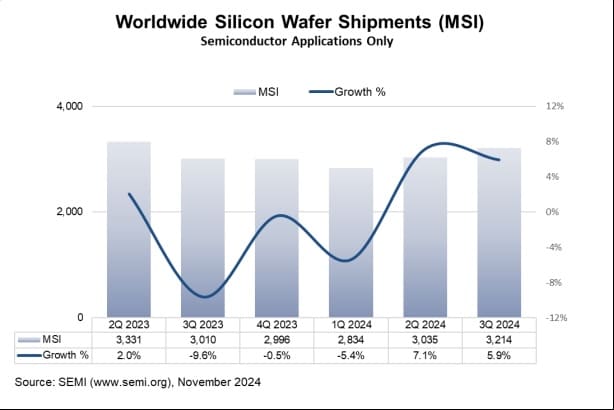

According to the latest report from the Semiconductor Equipment and Materials International (SEMI) Silicon Wafer Manufacturers Group (SMG) for the third quarter of 2024, global silicon wafer shipments showed a significant growth trend, increasing by 5.9% quarter-on-quarter to 3,214 million square inches (MSI). That's up 6.8% year-over-year compared to 3,010 million square inches in the same quarter of 2023. This growth marks a gradual recovery in the silicon wafer market after an upfront period of volatility.

The market is picking up, and the demand for AI is driving growth

SMG Chairman Lee Chungwei pointed out in the report that the demand for silicon wafers picked up in the third quarter, continuing the upward trend that began in the second quarter of 2024. While inventory levels in the supply chain remain high, overall demand is improving, especially for advanced silicon wafers used in artificial intelligence (AI). With the continuous development of AI technology, especially in areas such as deep learning, machine learning, and data processing, the demand for AI-related chips continues to grow, driving the demand for high-performance silicon wafers.

Demand from the automotive and industrial sectors remains weak

However, Li Chongwei also mentioned that despite the recovery of the overall market, the demand for silicon wafers in the automotive and industrial sectors is still weak. Demand recovery in both sectors has been slower, mainly due to global supply chain constraints and market uncertainty. In particular, in the automotive sector, despite the increasing trend of digitalization and intelligence, the demand for silicon wafers for automotive and industrial applications has not shown the same strong growth momentum compared to the explosive growth in the field of AI.

Figure: Global silicon wafer shipments

The consumer electronics market is showing signs of improvement

Unlike the weakness in the automotive and industrial sectors, demand in smartphones and other consumer electronics sectors has seen some improvement. With the gradual recovery of the global consumer market, especially in China and other Asia-Pacific regions, the demand for silicon wafers for consumer electronics such as smartphones and tablets has rebounded significantly. Despite this, overall demand has not fully recovered to pre-pandemic levels, and competition in the market remains fierce.

Outlook for 2025: Steady growth, but failure to recover to 2022 peaks

Looking ahead to 2025, Li Chongwei said that the growth momentum of the silicon wafer market is expected to continue, but the total shipment volume is not expected to recover to the peak level of 2022. 2022 was a peak year for the silicon wafer market, driven by the explosion of global demand for semiconductors. Although the growth trend is expected to continue in 2025, global economic uncertainties, industry demand differences, and supply chain fluctuations are still likely to have some impact on market growth.

Overall, the silicon wafer market is showing signs of steady recovery in the third quarter of 2024, especially driven by demand in the AI sector, and the market outlook is promising. However, demand in automotive, industrial, and consumer electronics has recovered more slowly, and overall shipments have yet to reach their all-time peak in 2022. With the arrival of 2025, the silicon wafer market is likely to continue to grow, but there are still many challenges and uncertainties.

As a basic material in the semiconductor industry, silicon wafers play a vital role in supporting the production of various electronic devices and chips. As technology continues to advance, especially in the fields of AI, automation and high-performance computing, the demand for silicon wafers will continue to grow, which means that the silicon wafer industry will continue to play a key role in the global semiconductor ecosystem.