(Shenzhen, February 27, 2025) – At the 2025 International New Energy Industry Marketing Summit*, the keynote speech titled "New Trends and Opportunities in China's Lithium Battery Energy Storage Industry" by Mr. Jiang Weiliang, Senior Vice President of Yongtai Digital Energy, was a wake-up call for the global energy storage sector, providing a clear vision for its development. With over two decades of experience in the power and energy sector, this industry veteran used comprehensive data and sharp insights to highlight the strategic opportunities and evolutionary logic of energy storage under the "dual-carbon" strategy.

Figure: At the 2025 International New Energy Industry Marketing Summit, Mr. Jiang Weiliang, Senior Vice President of Yongtai Digital Energy, delivered a keynote speech

I. Multi-Dimensional Support in a Strategic Opportunity Period

"When lithium carbonate prices stabilize at 80,000 RMB per ton, and the cost of a two-hour energy storage system falls below 0.5 RMB/Wh, we must take a broader historical perspective to evaluate this industry." Jiang opened with this statement, emphasizing that despite current challenges such as overcapacity and price competition, the fundamental judgment that energy storage remains in a strategic opportunity period has not changed.

From a policy perspective, the "dual-carbon" goal has transitioned from a national commitment to institutional practice. The 2024 "National Unified Electricity Market Development Plan Bluebook" released by the National Energy Administration outlines a three-step market reform, targeting a unified electricity market by 2029—reshaping the fundamental value logic of energy storage. "The experience of mature electricity markets in Germany and the U.S. shows that every step forward in market mechanisms unlocks a new layer of energy storage value," Jiang stressed.

Technological and economic breakthroughs are another crucial driver. By 2024, the global installed energy storage capacity exceeded 300GWh—a staggering 3,000-fold increase over a decade. China leads with a 60% market share, and storage costs have dropped by 47% compared to 2020, bringing the cost per kWh close to coal power parity. This exponential technological advancement is pushing energy storage from "policy-driven" to "market-driven."

II. Industry Restructuring Amid Globalization

"Expand overseas, or be eliminated"—this statement resonated with the audience. Citing BloombergNEF's forecasts, Jiang noted that the global energy storage market is expected to grow at a compound annual rate of 28% over the next decade, with emerging markets becoming the new growth engines. In 2024 alone, the Middle East signed over 20GWh of storage projects, energy storage solutions in Africa saw a 300% increase in orders, and South America’s demand surged exponentially.

This wave of globalization is reshaping industry dynamics. Yongtai Digital Energy's 600kW liquid-cooled ultra-fast charging demonstration station in Longhua Industrial Park exemplifies China's technological exports. "Chinese energy storage enterprises are evolving from selling products to selling systems, moving beyond mere exports toward exporting standards," Jiang pointed out. However, challenges such as overseas factory deployment timing, geopolitical risks, and securing international orders require strategic foresight.

III. A Crossroads in Technological Revolution

From a technological standpoint, the industry faces critical choices. While lithium batteries still dominate with a 90% market share, technological iterations are accelerating. The rapid replacement of 280Ah cells by 314Ah models and the push for 500Ah+ ultra-large capacity cells signal imminent breakthroughs in energy density. "The commercialization of semi-solid-state batteries in electric vehicles is laying the technical groundwork for energy storage applications," Jiang emphasized.

Meanwhile, technological diversification is gaining momentum. Vanadium flow batteries are emerging in long-duration storage, sodium-ion battery commercialization is progressing, and grid-forming PCS technology is addressing challenges in integrating high proportions of renewable energy. These innovations are not simple substitutes but integral components of a multi-dimensional technological matrix.

IV. Breaking Market Barriers

Jiang addressed the widely criticized "built but not operational" phenomenon by proposing market-driven solutions. The revenue model for independent energy storage plants is becoming clearer: 45% from arbitrage in the electricity spot market, 30% from ancillary services, and the remaining balance covered by capacity pricing incentives. This structure is supported by expanded spot market trials and improved ancillary service regulations.

The explosive growth of industrial and commercial energy storage further validates market mechanisms. The Yangtze River Delta and Pearl River Delta regions, leveraging peak-valley price differences exceeding 0.7 RMB/kWh, have established mature business models. Meanwhile, advancements in virtual power plant technology are enhancing the value of aggregated distributed storage. "When the cost per stored kWh falls below peak electricity prices, the market will make its choice," Jiang asserted.

V. The Perennial Challenge of Safety and Efficiency

Despite the industry's rapid progress, Jiang issued a strong warning about safety risks, citing recent energy storage accidents in the U.S. and U.K. "Safety is the '1' in front of all other zeros," he cautioned. Yongtai Digital Energy showcased a six-layer safety protection system—from intelligent early warning and explosion-proof designs to active fire suppression and flame-retardant materials—demonstrating evolving industry safety standards. AI-driven safety monitoring, trained on full-lifecycle data, is shifting accident prevention from reactive response to proactive prediction.

VI. The Future of Scenario-Based Solutions

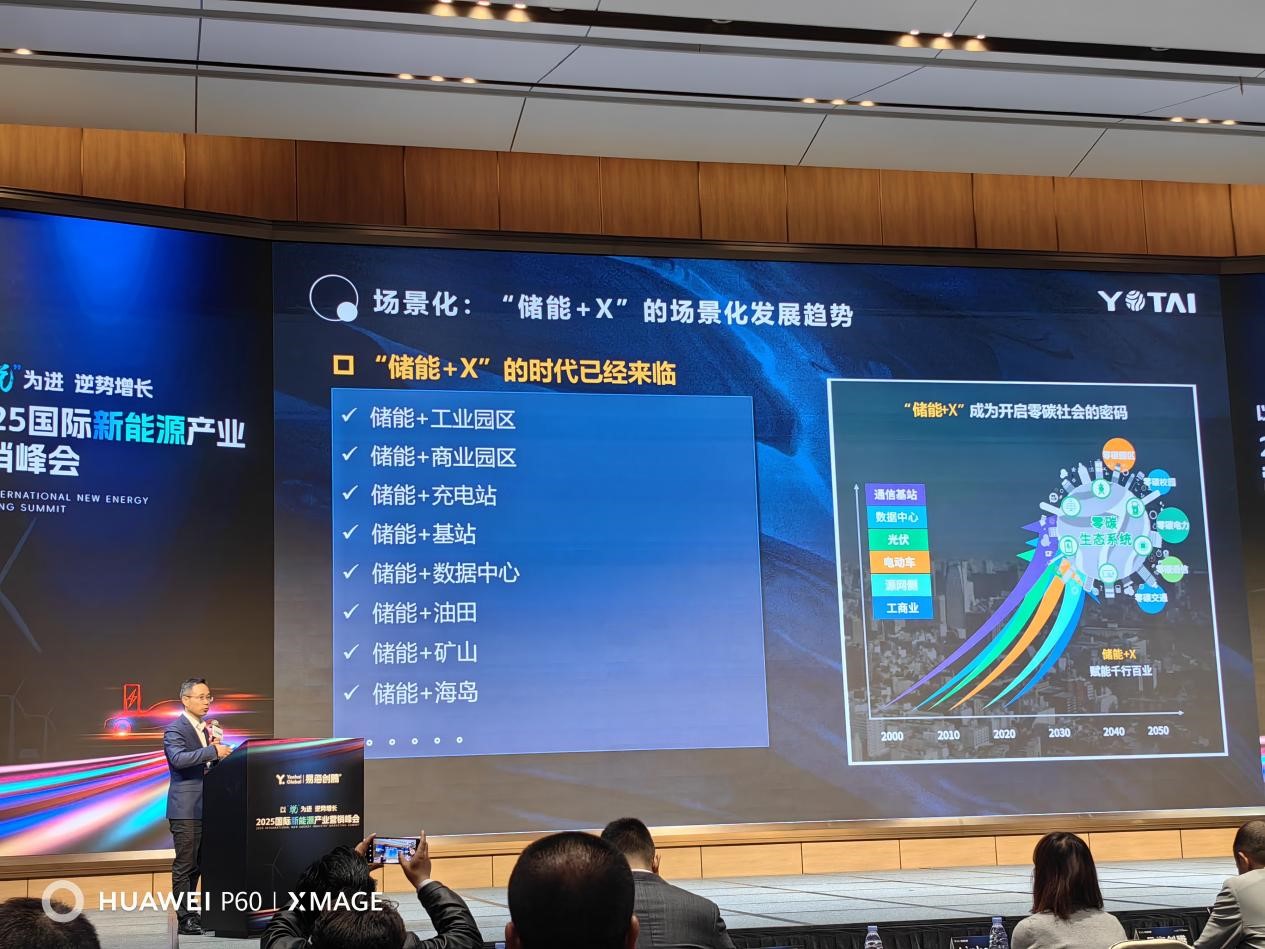

"Energy storage is not the endpoint but the connector in the energy revolution," Jiang concluded, unveiling scenario-based solutions that expand the industry's scope. Yongtai Digital Energy's "Energy Storage + X" model has spawned over 20 solutions, including integrated solar-storage-charging-inspection hubs, port microgrids, and backup power for data centers. This deep user-driven innovation is transforming energy storage providers into comprehensive energy service ecosystems.

In Shenzhen’s Yantian Port, the "solar + storage + shore power" system has achieved zero emissions during vessel docking. Meanwhile, in Xiong’an New Area’s digital industry park, energy storage coupled with waste heat recovery has raised overall energy efficiency to 85%. These case studies highlight a shift from single-use peak-shaving and frequency regulation toward integrated energy services.

Figure: The scenario-based development trend of "energy storage + X"

VII. Yongtai Digital Energy: Strategic Layout and Core Technology

As a leading global provider of new energy solutions, Yongtai Digital Energy’s core strengths lie in:

Comprehensive Product Portfolio Covering large-scale, commercial, and residential storage; 600kW liquid-cooled ultra-fast chargers; power distribution systems; and energy management software. Its flagship 125kW commercial storage cabinet, leveraging SiC third-generation semiconductors, achieves 99% conversion efficiency and integrates a proprietary EMS cloud platform.

Figure: Yongtai Digital Energy provides the world's leading new energy integrated solutions

Advanced Technology Ecosystem

Six-layer safety protection: Preventing thermal runaway with multi-tiered fire suppression, reducing accident rates by 50%.

Liquid cooling thermal management: Maintaining system temperature variation within ±2°C, extending cycle life to 8,000+.

Smart operations: 500-person R&D team self-developing BMS/EMS/PCS technologies, achieving 80% in-house production for key components.

Scenario-Based Deployment Capabilities

Longhua Industrial Park pilot integrates 2MWh storage, 1.2MW solar, and 600kW ultra-fast charging.

Green electricity consumption: 5,300kWh/day.

Battery health diagnostics add value-added services.

Model replicated in 17 countries.

Global Expansion

Four R&D centers (Shenzhen, Wuhan, Hangzhou, Munich) and seven factories (12GWh annual capacity).

Market-specific adaptations: 55°C heat-resistant cells in the Middle East, self-heating modules in Nordic regions.

Conclusion: Finding Certainty in Uncertainty

The energy storage sector’s every challenge breeds new opportunities. Overcapacity forces innovation, price wars drive business model evolution, and safety concerns accelerate standards upgrades. "Change is the only certainty in this industry," Jiang concluded.

As the global energy transition deepens, the strategic value of energy storage continues to rise. Companies excelling in technological innovation, business model adaptation, and global expansion will emerge victorious in this "Great Maritime Era."

Footnote:

The 2025 International New Energy Industry Marketing Summit and the inaugural release of the "2025 China New Energy Industry Chain Core Competitiveness White Paper" were successfully held on Thursday, February 27, 2025, at the Shenzhen Guangming Cloud Valley International Conference Center. Hosted by Yeehai Global—a client-renowned digital marketing agency specializing in overseas markets—and co-organized by its resource platform China Exportsemi, the summit aimed to provide Chinese new energy enterprises with global expansion guidance, foster business collaboration platforms, and facilitate discussions on cutting-edge trends and commercial opportunities in the global new energy industry.

Related:

The 2025 International New Energy Industry Marketing Summit Was Successfully Concluded

The Battle for Charging Station Core Technology: How Chinese Companies Overcame Western Barriers to Lead the Industry

Data-Driven Expansion of New Energy: Dun & Bradstreet Unveils a New Path for Global Business Decision-Making

Jiang Weiliang of Yongtai Digital Energy: "The 2025 Energy Storage Tri-Polar Battle"

Europe’s Electric Truck Revolution Spurs 1.2 Billion kWh Energy Storage Demand

CEO of the Global Decarbonization Expo Decodes the New Paradigm of China and EU Green Cooperation

China's New Energy Industry at a Crossroads: Challenges and Pathways to Global Leadership

China's State-Backed Energy Giants Decode The 'Lean Globalization' Playbook"

New Rules for New Energy Expansion: How to Break Out from an Overcrowded Market?